An exciting period of growth has hit oil exploration and development in North Africa.

Over the last two decades, oil and gas discoveries in Northwestern Africa have climbed by 25 percent, including more than a 25-percent increase in the region’s oil reserves. With the continent’s oil production expected to grow by 6 percent annually for the foreseeable future, it’s no wonder that the region is a hot spot for oil.

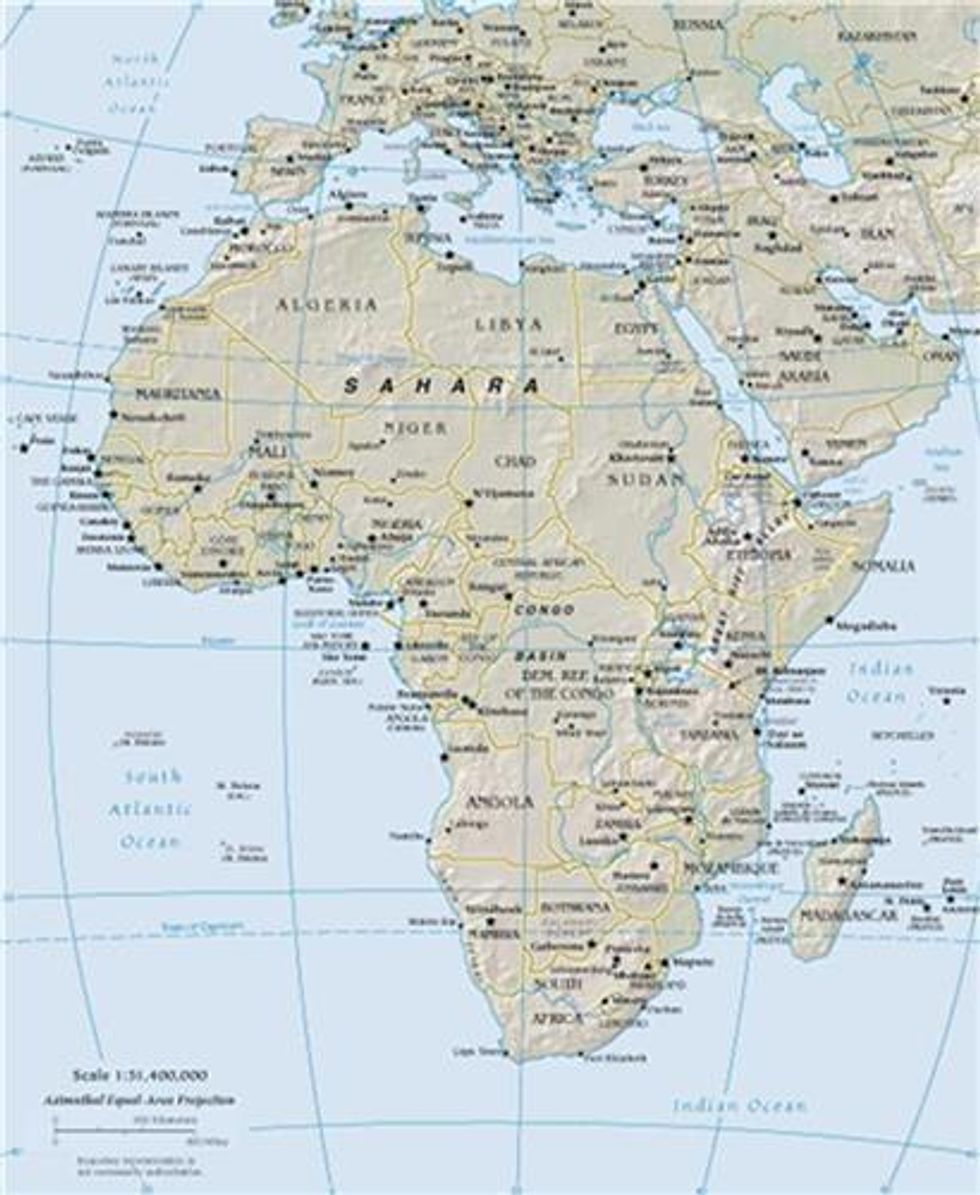

Northwest Africa, the region locally known as the Maghreb, is west of Egypt. It includes Morocco, Algeria, Tunisia, Libya, Mauritania and Western Sahara. In this region, Algeria and Libya are the biggest players on the oil scene, though Morocco has promise as well. Exploration, development and production in Libya have virtually ceased due to security concerns.

Here are some important features of the oil industry in the region, separated by country:

Algeria

The oil industry in Algeria has reported some exciting developments recently. On October 26, Energy Minister Youcef Yousfi said Algeria had discovered a field with an estimated 1.3 billion barrels of oil, according to The World Tribune. The field, discovered by state monopoly Sonatrach, is located in Hassi Messaoud. While the Algerian oil industry is widely regarded to be in decline, this new discovery has the potential to turn it around. It is expected to require some four years of exploration and development before production can begin.

Yousfi said he expects Algeria’s oil and natural gas output to be double its current amount within the next seven to 10 years as exploration and development continues in the southwestern region and the possibilities inherent in offshore drilling are considered.

“In the mature basins in the southeast of the country, under the existing fields of natural gas, condensates and oil, we have made significant discoveries,” Yousfi said, as reported in Bloomberg Businessweek.

Algeria continues to export its oil at unchanging rates despite a drop in European fuel consumption, according to Yousfi. Instead, it has been seeking new customers to absorb the production of oil in the country, which has not changed.

Morocco

Morocco, the only North African country whose political regime was not affected by the Arab Spring, is a promising market economically as well as geologically, according to Longreach Oil & Gas (TSXV:LOI). Its government takes the form of a constitutional monarchy, wherein elections of public officials are democratic. The political and security risks in the region are low, and the economic growth is rapid. The country is one of Africa’s largest energy consumers, with the demand having increased 54 percent over the past decade. It’s also Africa’s second-largest importer of oil. For this reason, the government provides exploration and development companies with significant incentives to attempt to find new oil reserves within the country’s borders, including royalties and a 10-year tax holiday on discovery. This has been a successful program at least in part, as there are 12 times more exploration permits currently in the country than there were in 1997.

Independent exploration and development companies have concentrated on offshore permits in the past, though they are now seeking inland acreage, competing in this market with major oil companies. Australia’s Pura Vida Energy (ASX:PVD) says companies will dig exploration wells off the Moroccan coast over the next year, representing an investment between $500 million and $1 billion. Damon Neaves, managing director of the company, told Reuters, “[i]t is still a frontier region and is under-explored compared to other parts of the world.”

Morocco is absorbing much of the exploration and development activity that has ceased in Libya due to disappointing finds and security concerns from nearby Algeria.

“North Africa and particularly Libya and Algeria are looking less appealing than they have done for five years,” Geoff Porter of North Africa Risk Consulting told Reuters. “Conversely, Morocco is a quiet hive of activity.”

According to The Global Post, Spain’s government is collaborating with Morocco on exploration and development near the Canary Islands, opening yet more opportunities for production companies to come. The maritime boundaries in the area between the two countries aren’t set, as territorial limits are established by an imaginary line halfway between the Moroccan coast and the Canary Islands, which Spain owns. This collaboration makes the issue moot, and the collaboration is expected to find up to 1.4 billion barrels of petroleum in the best-case scenario.