MGX Minerals Announces NI 51-101 Estimated Prospective Oil and Gas Resource for Paradox Basin Petrolithium Project

MGX Minerals Inc. (“MGX” or the “Company”) (CSE:XMG) (FKT:1MG) (OTC:MGXMF) is pleased to report estimated prospective resources (the “Estimate”) attributable to the Company’s Paradox Basin Petrolithium Project (the “Project”), consisting of leasehold and royalty interests in San Juan County, Utah and San Miguel County, Colorado.

MGX Minerals Inc. (“MGX” or the “Company”) (CSE:XMG) (FKT:1MG) (OTC:MGXMF) is pleased to report estimated prospective resources (the “Estimate”) attributable to the Company’s Paradox Basin Petrolithium Project (the “Project”), consisting of leasehold and royalty interests in San Juan County, Utah and San Miguel County, Colorado.

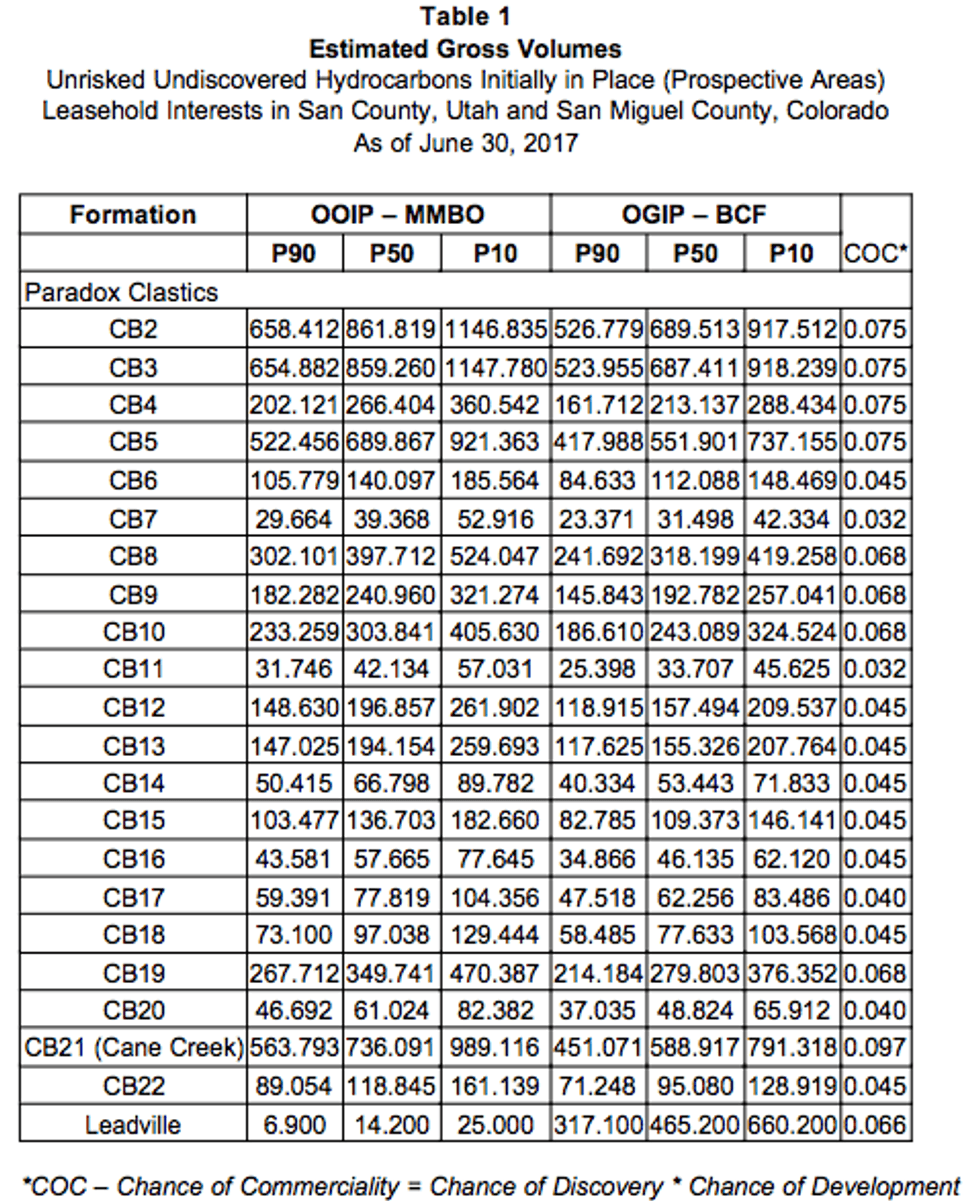

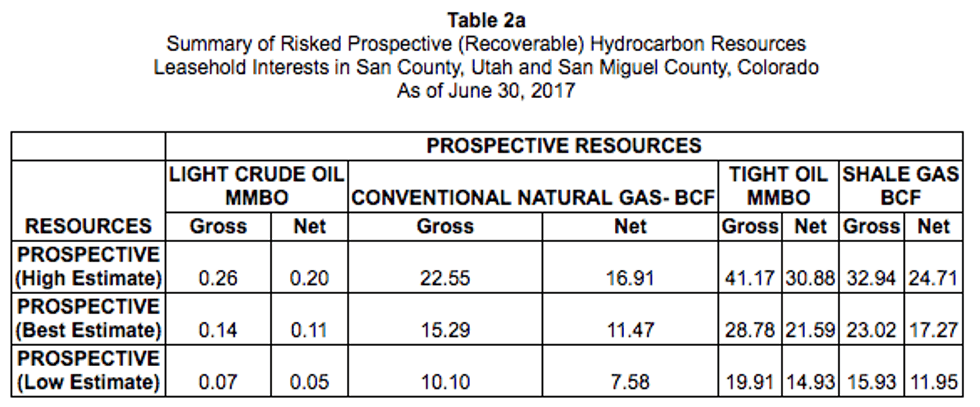

The Estimate was prepared by the Ryder Scott Company, L.P. (“Ryder Scott”), an independent qualified reserves evaluator within the meaning of National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities (“NI 51-101”), with an effective date of June 30, 2017. The Estimate was prepared in accordance with NI 51-101 and the Canadian Oil and Gas Evaluation Handbook. Although the salts may not perform well under stimulation or fracking, the Project contains many clastics and is highly pressurized. Management estimates the total cost required to achieve commercial production from the Project to be $8 million based on the expectation of completion of 3D seismic survey and one horizontal well being drilled. The timeline of the Project is five years, with the estimated first date of commercial production being 18 months from the commencement of drilling using vertical and horizontal drilling techniques along with proprietary patented water handling technology as the Project was conceived. Significant economic factors that may affect the Project relate primarily to operational costs, efficiencies and commodity pricing.

Notes:

1. There is no certainty that any portion of the resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the resources.

2. Summed volumes in this table are arithmetic summations of various individual reservoirs at the Project and are consequently not statistically correct representations of the range of resources.

3. Ryder Scott used probabilistic methods to conduct the Estimate from a technical standpoint and did not consider the expiration of the leases constituting the Project.

4. Light Crude Oil and Tight Oil are expressed in millions of standard 42-gallon barrels (“MMBO”).

5. Conventional Natural Gas and Shale Gas volumes are reported in billions of cubic feet (“BCF”).

Geologic Background

Various operators in the region have concluded that the presence of open natural fractures is the primary control on well productivity in the Paradox clastic breaks. Ryder Scott evaluated 21 prospective intervals corresponding to Clastic Breaks 2 through 22. All 21 clastic breaks displayed very consistent stratigraphy across the elevation area. Lithological correlation of the organic shale intervals, anhydrites and salts in and adjacent to the various clastic breaks are relatively even with the various vintages of wells and well log types ranging from gamma ray– neutron logs to sonic logs to modern lithodensity– neutron logs. The clastic breaks display only minor variations in thickness; in contrast, the intervening salt layers can vary significantly. Most of the clastic intervals in the area of interest are confined vertically by salt layers. The presence of salt may inhibit the creation of fractures in the thinner intervals both from natural forces and artificial simulation.

Ownership

MGX holds a 75% working interest in the Project with the remaining interest primarily controlled by a private Utah corporation (the “Paradox Partner”). The Paradox Partner has been engaged by MGX as subcontracted operator of the Project.

Qualified Person

The technical portions of this press release were prepared and reviewed by Andris Kikauka (P. Geo.), Vice President of Exploration for MGX Minerals. Mr. Kikauka is a non-independent Qualified Person within the meaning of National Instrument (N.I.) 43-101 Standards.

About MGX Minerals

MGX Minerals is a diversified Canadian resource company with interests in petrolithium, magnesium and silicon assets throughout North America. Learn more at www.mgxminerals.com.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This press release contains certain statements that constitute forward-looking statements or information (“forward-looking statements”) including the volume of resources. Although MGX believes that the expectations reflected in such forward-looking statements are reasonable, such forward-looking statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. Those factors and assumptions are based upon currently available information available to the Company. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. As such, readers are cautioned not to place undue reliance on the forward-looking information, as no assurance can be provided as to future results, levels of activity or achievements.

MGX believes that the material factors, expectations and assumptions reflected in the forward-looking statements are reasonable but no assurance can be given that these factors, expectations and assumptions will prove to be correct. The forward-looking statements included in this press release are not guarantees of future performance and should not be unduly relied upon. Such information and statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information or statements including, without limitation: inaccurate estimation of MGX’s prospective resources; risk associated with the Company having no history of operations or earnings including, but not limited to, any oil and gas operations; and certain other risks detailed from time to time in MGX’s public disclosure documents including, without limitation, those risks identified in this press release, and in MGX’s annual information form, copies of which are available on the Company’s SEDAR profile at www.sedar.com.

Furthermore, the forward-looking statements contained in this document are made as of the date of this document and, except as required by applicable law, MGX does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. The forward-looking statements contained in this document are expressly qualified by this cautionary statement.

Resource Definitions

Resources encompass all petroleum quantities that originally existed on or within the earth’s crust in naturally occurring accumulations, including Discovered and Undiscovered (recoverable and unrecoverable) plus quantities already produced. “Total Resources” is equivalent to “Total Petroleum Initially In-Place”. Resources are classified in the following categories:

Total Petroleum Initially In-Place (“TPIIP”) is that quantity of petroleum that is estimated to exist originally in naturally occurring accumulations. It includes that quantity of petroleum that is estimated, as of a given date, to be contained in known accumulations, prior to production, plus those estimated quantities in accumulations yet to be discovered.

Discovered Petroleum Initially In-Place (“DPIIP”) is that quantity of petroleum that is estimated, as of a given date, to be contained in known accumulations prior to production. The recoverable portion of DPIIP includes production, reserves, and Contingent Resources; the remainder is unrecoverable.

Contingent Resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations using established technology or technology under development but which are not currently considered to be commercially recoverable due to one or more contingencies. Economic Contingent Resources are those contingent resources that are currently economically recoverable. Sub-Economic Contingent Resources are those contingent resources that are not currently economically recoverable, provided that there should be a reasonable expectation of a change in economic conditions within the near future that will result in them becoming economically viable.

Undiscovered Petroleum Initially In Place (“UPIIP”) is that quantity of petroleum that is estimated, on a given date, to be contained in accumulations yet to be discovered. The recoverable portion of UPIIP is referred to as Prospective Resources and the remainder is unrecoverable.

Prospective Resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from undiscovered accumulations by application of future development projects. Prospective Resources have both an associated chance of discovery and a chance of development.

Unrecoverable is that portion of DPIIP or UPIIP quantities which is estimated, as of a given date, not to be recoverable by future development projects. A portion of these quantities may become recoverable in the future as commercial circumstances change or technological developments occur; the remaining portion may never be recovered due to the physical/chemical constraints represented by subsurface interaction of fluids and reservoir rocks.

The range of uncertainty of estimated recoverable volumes may be represented by either deterministic scenarios or by a probability distribution. Resources are provided as low, best and high estimates as follows:

Low Estimate: This is considered to be a conservative estimate of the quantity that will actually be recovered. It is likely that the actual remaining quantities recovered will exceed the low estimate. If probabilistic methods are used, there should be at least a 90 percent probability (P90) that the quantities actually recovered will equal or exceed the low estimate.

Best Estimate: This is considered to be the best estimate of the quantity that will actually be recovered. It is equally likely that the actual remaining quantities recovered will be greater than or less than the best estimate. If probabilistic methods are used, there should be at least a 50 percent probability (P50) that the quantities actually recovered will equal or exceed the best estimate.

High Estimate: This is considered to be an optimistic estimate of the quantity that will actually be recovered. It is unlikely that the actual remaining quantities recovered will exceed the high estimate. If probabilistic methods are used, there should be at least a 10 percent probability (P10) that the quantities actually recovered will equal or exceed the high estimate.

Certain resource estimate volumes disclosed herein are arithmetic sums of multiple estimates of DPIIP or UPIIP, which statistical principles indicate may be misleading as to volumes that may actually be recovered. Readers should give attention to the estimates of individual classes of resources and appreciate the differing probabilities of recovery associated with each class as explained under this Resource Definitions section.

Contact Information

Jared Lazerson

President and CEO

Telephone: 1.604.681.7735

Web: www.mgxminerals.com

Source: globenewswire.com