Conquest Resources Limited (TSXV: CQR) ("Conquest") is pleased to announce today that it has entered into a Purchase and Sale Agreement with Stevens Geophysics Inc. (SGI), whereby Conquest will acquire a 100% interest in the Nipigon Rift Property located south of Black Sturgeon Lake, Nipigon, Ontario.

Conquest can earn a 100% interest in the Nipigon Rift Property, comprised of 100 contiguous cells by issuing 200,000 shares per year over 4 years, and spending $400,000 on exploration of the Property, subject to a 2% NSR with a buy-back of 1% at any time for $1,000,000.

This news release should be read in conjunction with the Company's unaudited interim consolidated financial statements and the associated management's discussion and analysis (MD&A) for the three and nine month periods ended September 30, 2021 which are available on the Company's website at www.conquestresources.com or under the Company's profile at www.sedar.com.

Nipigon Rift Uranium/Ni-Cu-PGE Property, Lake Nipigon, Ontario

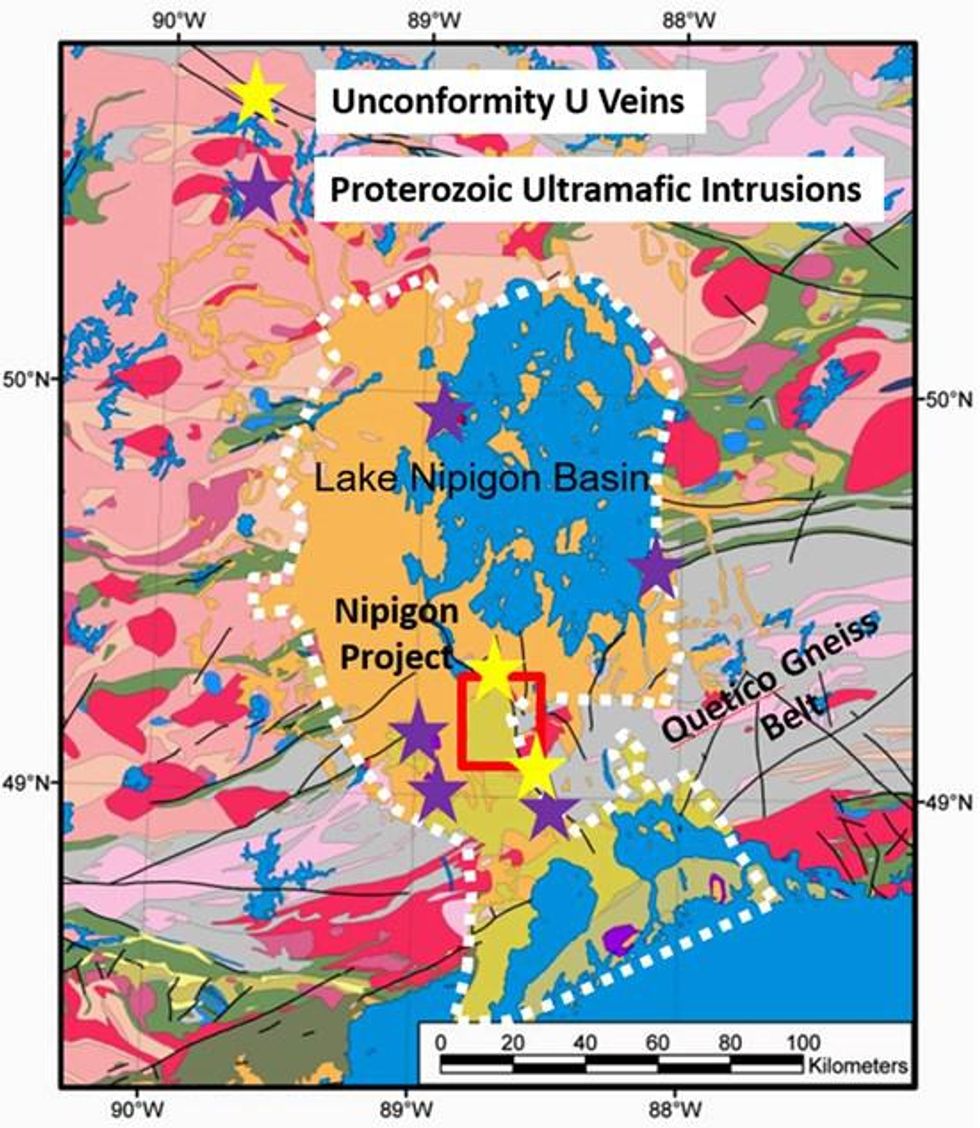

Conquest Resources is targeting high-grade Uranium deposits associated with veins and faults at or near the Archean-Proterozoic unconformity, and Proterozoic rift mafic intrusive Ni-Cu-PGE deposits near the unconformity south of Black Sturgeon Lake, in the Lake Nipigon Basin (LNB). As exemplified in the Athabasca Basin, unconformity related Uranium deposits are all associated with faults and fracture systems proximal to the regional unconformity. The Sibley Group of continental sedimentary rocks have been identified above the unconformity with the pre-Cambrian basement in the Lake Nipigon area. Uraniferous veins of the unconformity type are found at the Split Rapids Dam and Canyon occurrences, both located to the north of the Property. Historical intersections at Split Rapids Dam range from 0.012% U3O8 over a core length of 0.30 m in drill hole BS05-13, to 2.99% U3O8 over a core length of 1.5 m in drill hole BS05-30. Other occurrences, such as Greenwich Lake occur regionally, resemble the Athabasca unconformity type and have the best potential for the presence of uranium deposits. In the Lake Nipigon Basin, the most probable source area for uranium deposits associated with veins and faults that are proximal to the Proterozoic/Archean unconformity is the granitoid and associated meta-sedimentary rocks of the Quetico Gneiss Belt (Figure 1). The Quetico Gneiss Belt's signature is one of anomalously high uranium background levels, as identified from Ontario Geological Survey (Scott,1987), highlighting the similarities of the Athabasca basin and the Sibley Basin geological and structural histories.

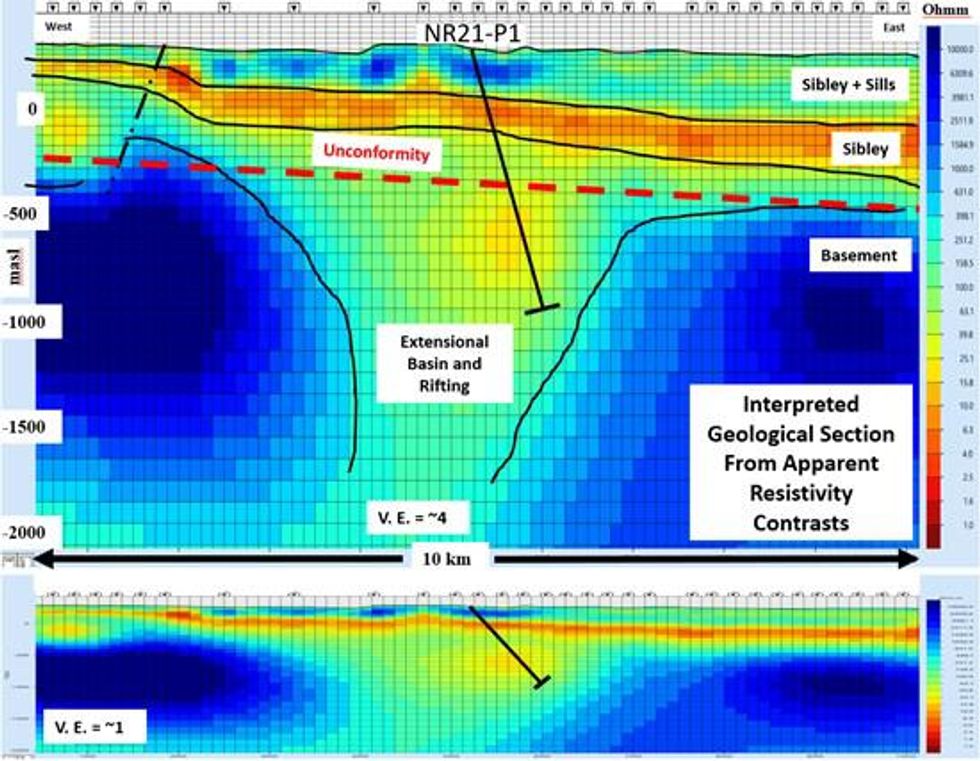

Early Proterozoic rift related mafic and ultramafic intrusive rocks are prospective for PGE-Ni-Cu deposits in the Lake Nipigon region as exemplified by the many occurrences or deposits discovered ie. Seagull, Disreali, and more recently, Thunder Bay North and Sunday Lake. Conquest believes the continental basement rocks have been subjected to intense regional faulting related to extensional basin style deformation or rifting southwest of Lake Nipigon, possibly representing a part of the Nipigon Rift system itself and consequently revealing a large extensional rift below the unconformity. In 2000-2001, 31 magnetotelluric (MT) data sites were collected across a regional northwest to southeast mapped fault system, south of Black Sturgeon Lake, and within the Nipigon project area (Figure 1). These data have recently been reprocessed and used to generate an estimate of the resistivity distribution below the profile of sites. The interpreted results are shown in Figure 2. The 31 MT site positions along the west to east profile are plotted above the color contoured resistivity estimate. Within the top 0-500m depth a low resistivity layered geologic sequence has been interpreted, reflecting a combination of Sibley sediment horizons are variably intruded by the high resistivity Nipigon diabase sills on/in the near surface layer, as observed in outcropping geology. Below 500m to greater than 2000m the resistivity increases significantly on the west and eastern parts of the profile (interpreted as resistive basement) while a large central region, 3-4 km wide, indicates lower resistivity rocks continuing to depth. Conquest interprets this to be a probable area of basin extension and/or intensive north to south fracturing/deformation on a multi-kilometre scale that may be permissive for the presence of a variety of deposit types including fault and unconformity related uranium veins and PGE-Ni-Cu bearing Proterozoic mafic and ultramafic intrusions.

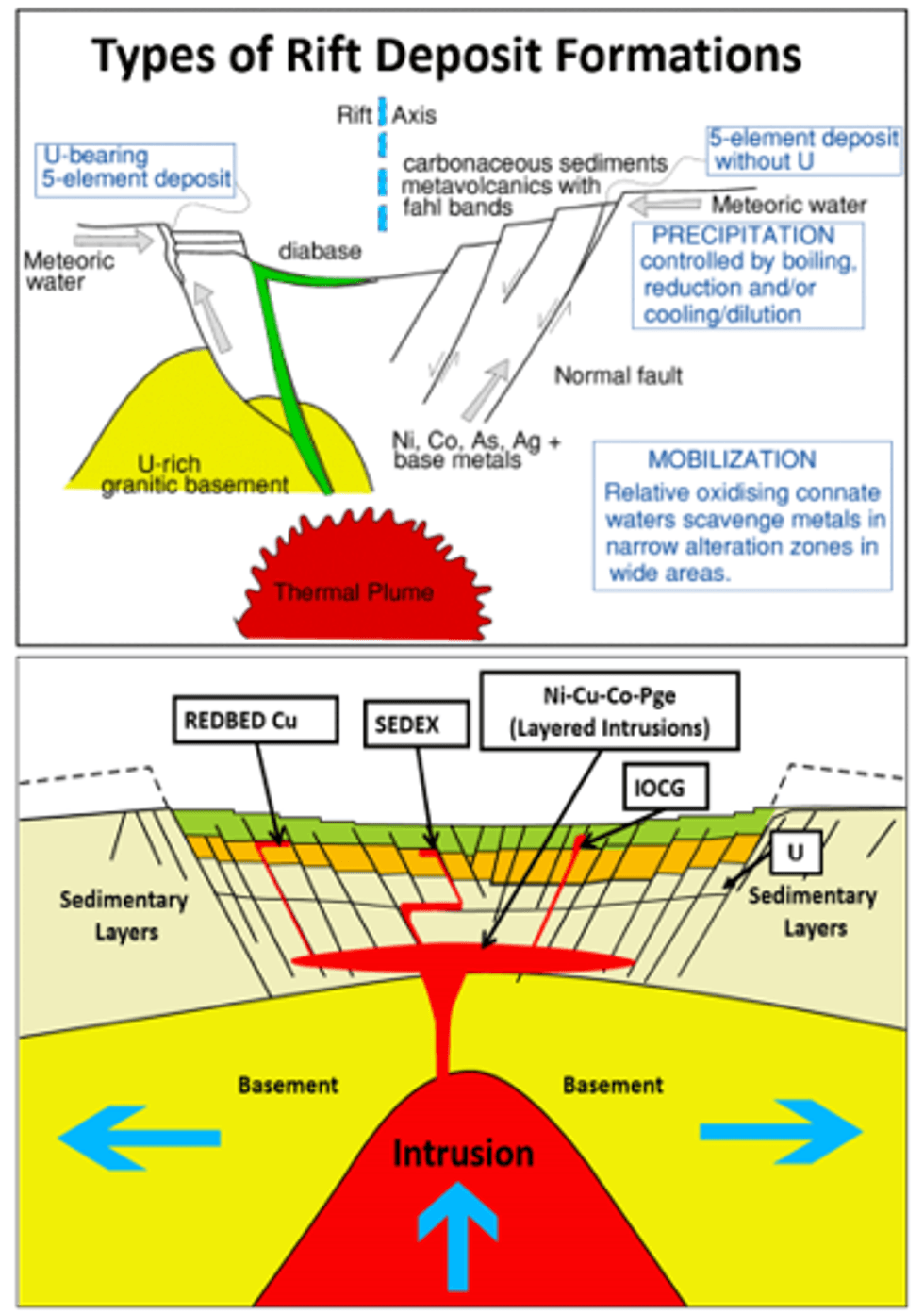

Building on the Athabasca Uranium exploration and early Proterozoic rift related PGE-Ni-Cu deposits exploration models, Conquest is exploring the SW Lake Nipigon region in search for economic minerals deposits of the type formed in rifted or extensional environments (Figure 3), and employing extensive use of deep-penetrating geophysical techniques including natural field magnetotellurics and ground time domain electromagnetic geophysics. Other field work will include structural mapping as a thick cover of Sibley Group sediments, intruded by Nipigon sills, blankets the area.

Conquest intends to commence a Phase 1 drill program in the first half of 2022 aimed to confirm the presence of the Nipigon Rift on the Property. The program will also target a discrete, very low resistivity region just below the interpreted unconformity (Figure 2). Conquest recently staked an additional 351 cells on strong evidence of an interpreted north-south deformation zone.

References:

Bowbridge, C. 2006: Report on 2005 Diamond Drilling, Black Sturgeon East Block, prepared for Rampart Ventures Ltd., New Shoshoni Ventures Ltd.

Scott, J.F. 1987: Uranium Occurrences of the Thunder Bay-Nipigon-Marathon Area; Ontario Geological Survey, Open File Report 5634, 158p.

Figure 1: The location of the Nipigon Rift Property

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/7183/104964_73b3233804680966_002full.jpg

Figure 2 - Interpreted apparent resistivity section Nipigon Rift Property

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/7183/104964_73b3233804680966_003full.jpg

Figure 3 - Vertical sections showing conceptual formation of deposit types of extensional basin/rift deposits (U, Ni-Cu-Co-PGE)

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/7183/104964_conquestfig3.png

Q3 & RECENT HIGHLIGHTS

- Conquest has completed 23 drill holes and an aggregate of 7,376 meters of its planned 10,000-meter Phase 1 diamond drilling program as of the date of the MD&A. The program remains on budget and is expected to complete by the end of Q4 2021.

- Assay results were received for holes BC-02 to BC-13. Three of the drill holes have encountered significant sulfide mineralization.

- Drill hole BC21-05 intersected sections of disseminated to semi-massive pyrrhotite, pyrite, and chalcopyrite mineralization in the form of disseminations, sulphidic horizons, and breccia units over a core length of 26 meters. Drill hole BC21-11 intersected numerous zones of pyrrhotite, pyrite, and chalcopyrite within chlorite-altered metasediments, in the form of sulphidic horizons, and disseminations. Drill hole BC21-02 intersected sections of semi-massive to massive sulphides over a core length of 5 meters.

- Drill holes BC21-21 through to BC21-22 tested BHEM anomalies proximal to drill hole BC21-05. Sulphides consisting of pyrrhotite with lesser amounts of chalcopyrite and pyrite have been intersected in the holes. Logging and sampling is currently in progress on these holes.

- In July 2021, Conquest completed a 155-line kilometer airborne MobileMT survey west of Emerald Lake. The results from the survey revealed a large area of low resistivity south of the TeckMag leases and away from the main IF trend and is encouraging for exploration for both Archean VMS and mafic intrusive related deposits.

- On September 22, 2021 Conquest entered into an agreement to purchase the LNB property that is considered to be prospective for uranium mineralization associated with veins and faults at or near the Archean-Proterozoic unconformity, Ni-Cu-PGE mineralization associated with Proterozoic rift mafic intrusive rocks located at the unconformity south of Black Sturgeon Lake in the Lake Nipigon Basin.

RESULTS OF OPERATIONS

For the three-month period ended September 30, 2021, the Company recorded a net loss of $1,169,011 or $0.009 per share. The operating expenses included exploration expenditures of $863,346 and stock-based compensation expense of $164,200. The increased exploration costs incurred in Q3 of 2021, in comparison with previous quarters, are resulted from the ramp-up of the Phase 1 diamond drilling program at the Company's Belfast-TeckMag Project that commenced in June 2021.

For the nine-month period ended September 30, 2021, the Company recorded a net loss of $3,003,293 or $0.023 per share. The operating expenses included net acquisition cost of $107,100, exploration expenditures of $2,013,715 and stock-based compensation expense of $503,885. A gain of $10,915 were included in the nine months ended September 30, 2021, as the result of the disposal of all the marketable securities held by the Company in May 2021.

The increase in the operating loss in the nine months ended September 30, 2021, in comparison with that of 2020, is mainly resulted from the increased exploration activities and expenditures on the Belfast-TeckMag Project and the acquisition of mineral rights associated with the DGC and JPC properties in March 2021.

At September 30, 2021, the Company had total current assets of $2,955,864, including cash and cash equivalents of $2,777,135 to settle accounts payable and accrued liabilities of $342,675.

During the nine months ended September 30, 2021, the Company had no proceeds or expenditures from financing or investing activities. The proceeds from its previous flow-through share financing were fully expended on qualifying Canadian Exploration Expenditures at the end of June 2021. Cash used in operating activities amounted to $2,076,275 for the nine months ended September 30, 2021.

As of the date hereof, the total number of Conquest shares outstanding is 134,837,106.

Qualified Person

The technical content of this News Release has been reviewed and approved by Joerg Kleinboeck, P.Geo., a qualified person as defined in NI 43-101.

ABOUT CONQUEST

Conquest Resources Limited, incorporated in 1945, is a mineral exploration company that is exploring for base metals and gold on mineral properties in Ontario.

Conquest holds a 100% interest in the Belfast - Teck Mag Project, located in the Temagami Mining Camp at Emerald Lake, approximately 65 kilometers northeast of Sudbury, Ontario, which hosts the former Golden Rose Gold Mine and is underlain by highly prospective Abitibi greenstone geology along a strike length of seventeen (17) kilometers.

In October 2020, Conquest completed the acquisition of Canadian Continental Exploration Corp. which holds an extensive package of mining claims which surround Conquest's Golden Rose Mine, and subsequently doubled its land holdings in the Temagami Mining Camp through the staking of 588 mining cells, encompassing approximately 93 sq km., centered on Belfast Township, on the edge of the Temagami Magnetic Anomaly.

Conquest now controls over 300 sq km of underexplored territory, including the past producing Golden Rose Mine at Emerald Lake, situated in the Temagami Mining Camp.

Conquest also holds a 100% interest in the Alexander Gold Property located immediately east of the Red Lake and Campbell mines in the heart of the Red Lake Gold Camp on the important "Mine Trend" regional structure. Conquest's property is almost entirely surrounded by Evolution Mining land holdings.

In addition, Conquest owns a 100% interest in the Smith Lake Gold Property of six patented claims and 181 staked mining claims to the north, west and south of the former Renabie Gold Mine in Rennie Township in northern Ontario, operated by Corona and Barrick that had reported gold production of over 1,000,000 ounces between 1947 and 1991 (Northern Miner March 4, 1991).

FOR FURTHER INFORMATION CONTACT:

general@conquestresources.com

www.conquestresources.com

Tom Obradovich

President & Chief Executive

416-985-7140

Forward-looking statements. This news release may include certain "forward-looking statements". All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the completion of the Acquisition and the Consolidation, the release of escrowed funds, future cash on hand, potential mineralization, resources and reserves, exploration results, and future plans and objectives of Conquest, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Conquest's expectations are exploration risks detailed herein and from time to time in the filings made by Conquest with securities regulators. Neither the TSXV nor its Regulation Services Provider (as defined in the policies of TSXV) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/104964