Understanding the strategy of companies involved in shale projects is fundamental for investors in order to determine their own investing strategy.

By Robert Sullivan – Exclusive to Oil Investing News

The emerging shale oil and gas boom in the US is quickly becoming one of the industries worst kept secrets, and what only a few years ago was an insignificant offshoot of the exploration business, little known to anyone but industry insiders, is now being heralded as a ‘game changer’ that is set to revolutionize the US energy outlook in the foreseeable future.Overshadowed in all of the hype, however, is the reality that despite some of the eye-popping estimates of reserves being bandied around by drillers, bankers, and the media, the shale sector is still an unknown quantity in the broader energy picture. There is certainly a tremendous upside to many shale plays in the US, but concerns from some analysts and industry players have also started to emerge over the rationale behind the scale of investment flowing into an industry that hasn’t yet had a chance to prove itself over the long-term.

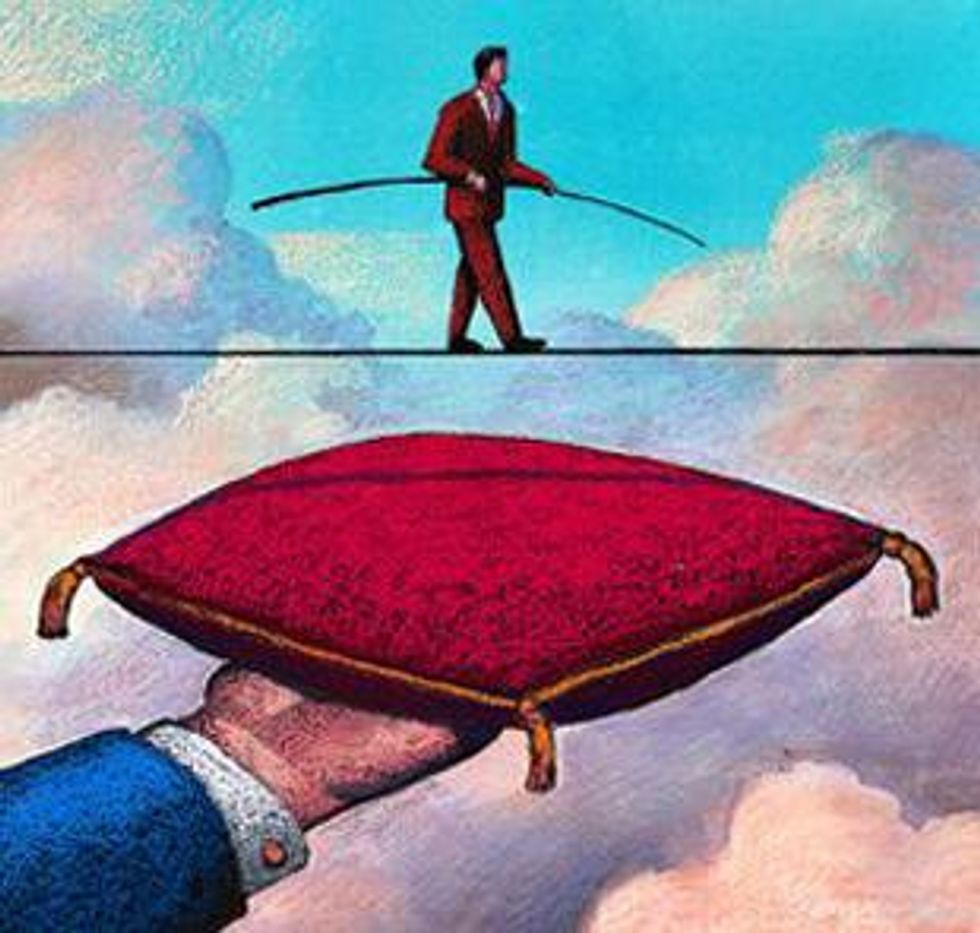

On the other hand, a certain measure of risk is assumed in commodities investing, and completely passing on the opportunities presented by shale plays in the US could mean missing out on a significant amount of value.

Understanding the strategy of companies involved in shale projects is fundamental for investors in order to determine their own investing strategy, and two approaches among some of the key US shale players are examined below.

Early entry/high value

Identifying promising shale plays and moving quickly to snap up acreage for exploration has been the model employed by EOG Resources (NYSE:EOG) in recent years, and one that has so far brought them success in the shale sector. Early entry not only means access to better land but also lower initial costs – less paid for the acreage and more favorable royalty rates.

Devon Energy Corp. (NYSE:DVN) is looking to pursue a similar strategy. On June 28 Devon CEO John Richels and vice president of exploration and production David Hager announced a capital spending plan of an additional $1 billion on promising shale plays this year after earning more than $10 billion from selling off their international and offshore assets to focus exclusively on North American onshore projects.

“…[W]hat we’re trying to accomplish with these new venture plays is to get in early and to identify new plays that we think will be successful and to get in with very reasonable terms, with low acreage costs or low royalties so that when we have success, we can really have outstanding economics,” explained Hager.

These high value strategies in unproven fields, however, also run the risk of turning up finds that aren’t commercially viable when company geologists get it wrong. The problem is compounded by the need for companies to secure their leases by drilling new wells until they do strike a find they can produce, which can send costs spiraling.

Late entry/low risk

A slightly more cautious approach towards shale developments has been adopted by companies like Marathon Oil Corp. (NYSE:MRO) Marathon have favored ‘hot’ shale plays – fields that have turned up proven commercial reserves after the initial stages of exploration.

Although the initial success of early entrants doesn’t guarantee it for those that follow, there is certainly less risk involved in entering into a shale play that is already producing for other companies. The chances of coming up empty-handed are still possible but greatly reduced, and late entrants can benefit from seeing what went right and what went wrong for the pioneers.

The tradeoff of this strategy though is foregoing the advantage of low initial costs the early entrants enjoy. The cost of late entry into a hot shale play is steep, and only pursued by the larger companies with the bankroll to back it. Marathon for instance, paid through the nose for a promising piece of the Eagle Ford, parting with $3.5 billion in June for 144,000 acres at close to $25,000 an acre.

While this is a major acquisition for Marathon that should produce reliably for them for years to come, the massive outlay of funds upfront for a development that will only be producing 12,000 barrels of oil equivalent (boe) per day by the end of the year means there may not be the same immediate value in this particular deal for them, than if these assets had been acquired at a discount.