Danielle DiMartino Booth: “The Fed Has Overstepped its Bounds”

As the final stretch of election season begins, analyst and strategist Danielle DiMartino Booth wants voters to keep a few things in mind.

In what’s being considered the most important election in modern US history, Americans will head to the polls in November. The populace will choose a leader who will have to face the monumental task of fighting a global pandemic and addressing rampant domestic unrest.

Add to that a weakened global economy and a national economy whose future is up for debate, and it’s easy to understand why this will be the election of a lifetime.

There is no doubt the delayed response from the US government has made the spread of COVID-19 worse, and what happens from here will affect the lives of millions of citizens.

“We don’t really know what’s going to happen until after the election comes and goes in terms of the fate of millions of Americans and whether or not they’re going to be in worse or better shape,” said Danielle DiMartino Booth, CEO and chief strategist for Quill Intelligence.

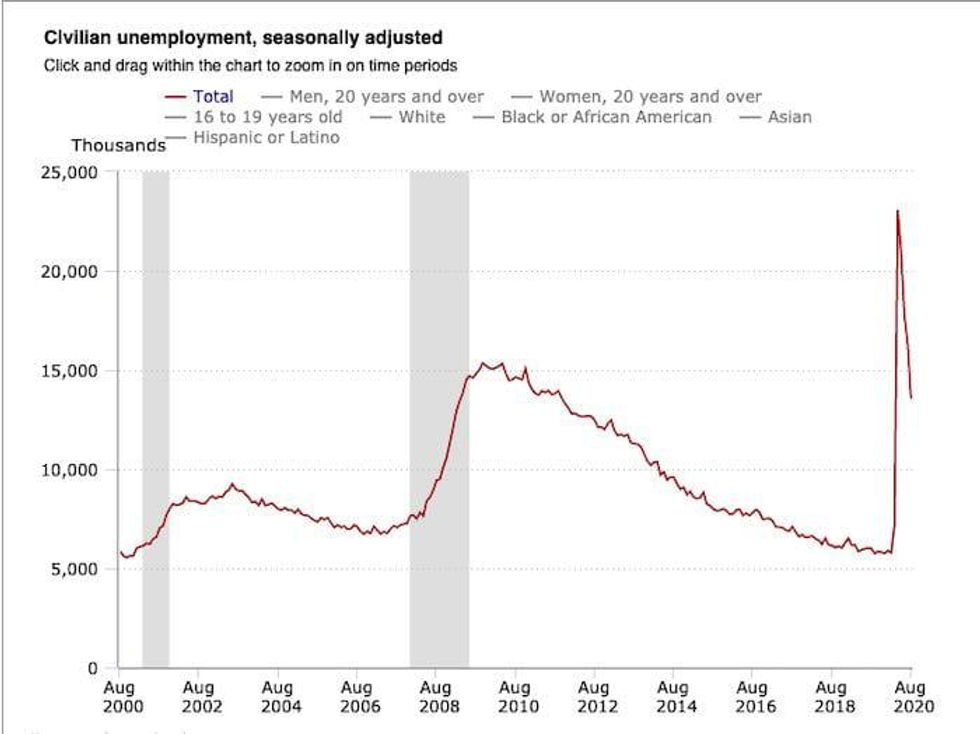

Chart via the US Bureau of Labor Statistics.

DiMartino Booth, an outspoken critic and former employee of the US Federal Reserve, sees the Fed’s current path as a problem, and would like whoever is elected to address it.

“The Fed has overstepped its bounds. It has inserted itself into price discovery, whether it is the stock market, or more recently the bond market by buying junk bonds,” she said. “I would like to think that future generations of leadership will come up with something along the lines of a 1951 (Treasury-Fed) Accord, that re-separated, if you will, the Treasury from the Federal Reserve. I think that that certainly needs to be done in the years to come.”

The accord DiMartino Booth mentioned was signed in March 1951 and separated government debt management and monetary policy. The agreement eliminated the Fed’s obligation to monetize the debt of the Treasury at a fixed rate.

The deal enforced the independence of the central banking system and established the Fed’s modern day monetary policy. However, DiMartino Booth doesn’t see Republicans or Democrats willingly taking on this issue in the current economic state.

“I don’t know any leader right now being considered to run the country that would have the strength given the (present) fiscal backdrop. Given how deep the recession is, and how prolonged it looks like it’s going to be — who would even begin to try and rein in the Fed right now, because they need the money printers, so to speak. Especially if we see continued gridlock,” she told the Investing News Network.

In terms of markets, DiMartino Booth explained how the Trump era has been considered friendly to riskier asset classes. “He certainly has not been very hard on antitrust matters,” she said.

“I think there’s a presupposition that (Joe) Biden would clamp down a little bit more on the monopolization of the US economy, which I’m sorry, but a blind person could see that,” she continued.

“It doesn’t take much to understand that we have become a nation that is worse than what it was back in the ‘robber baron’ era. So that would certainly come as a risk if Biden was to win, so I think (Donald) Trump is viewed as being friendlier.”

That said, as the day of the election nears uncertainty is mounting.

“You do see volatility priced out into the election becoming much, much more expensive. In other words, investors have already told the market by pricing in protection against declines in stock,” the strategist said. “That’s very expensive insurance to buy right now, if you will. So markets are definitely anticipating a lot of disruption around the election.”

DiMartino Booth also warned voters of false hope, especially around the suggestion that third quarter GDP growth equates to an end of the recession. “I think that’s a superficial take,” she said.

“We’ve had the shock recession that took its toll on service-oriented sectors that were directly exposed to the coronavirus. Now the US economy is settling into what we would consider to be a more conventional recession as we see white collar layoffs move up the income ladder, which is going to be very detrimental to the health of the US economy going forward.”

According to the head of Quill Intelligence, the Fed’s reaction to the COVID-19 pandemic has been overdone in some ways, and in some regards not enough.

“Depending on how the coronavirus proceeds, obviously we haven’t seen the kind of stimulus spending that was needed,” she added. “What the Fed can and cannot do to that end is, if stimulus legislation is passed by Congress, then they can actually print the money, they can do the quantitative easing in order to buy that up out of the market, so to speak.”

In closing, DiMartino Booth offered some non-partisan advice for American voters.

“It really is upon voters more than it ever has been in US history to do their own homework, and to rely less on Facebook (NASDAQ:FB) and social media and the opinions of others,” she said. “There’s never been a more critical time in US history for voters in America to seek out the unvarnished truth as opposed to what somebody with an agenda is trying to tell them.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.