Vanadium One Iron Reports an After Tax NPV of C$1.7 Billion and IRR of 33.8 Percent in Its Preliminary Economic Assessment for the Mont Sorcier Iron and Vanadium Project

Vanadium One Iron Corp. is pleased to announce the results of its PEA at its Mont Sorcier iron and vanadium project located near Chibougamau, Quebec.

Highlights:

- Annual production targeted at approx. 5.0 million tonnes of high grade, low impurity, iron concentrate grading ~65% iron with 0.6% V2O5 per tonne of concentrate

- Initial Capex C$457.5 million

- Payback period of 3.0 years

- Current Mineral Resource Estimate supports a potential mine life of 37 years

- Total Site Operating costs of C$52.38/t of concentrate over potential LOM

- Upside potential from resource expansion and the potential to expand production

Vanadium One Iron Corp. (“Vanadium One” or the “Company”) (TSXV:VONE), is pleased to announce the results of its Preliminary Economic Assessment (“PEA”) at its Mont Sorcier iron and vanadium project located near Chibougamau, Quebec. The PEA was completed by independent consulting group CSA Global Consultants Canada Ltd. (“CSA Global”) an ERM Group Company.

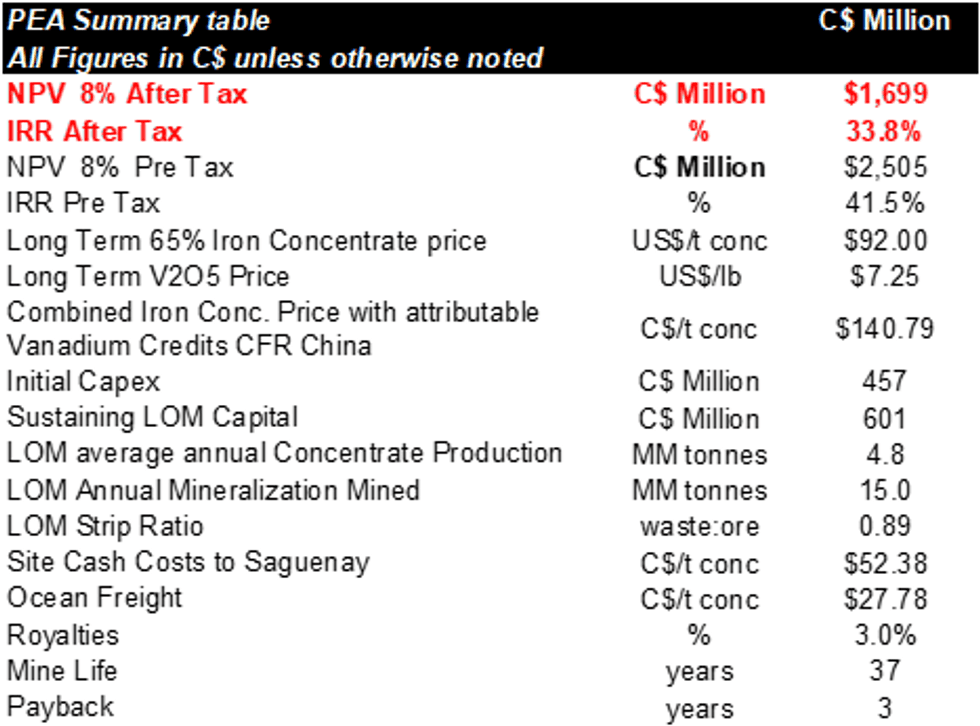

PEA Summary Results

The PEA for Mont Sorcier was based upon the Mineral Resource Estimate outlined in the company’s most recently released National Instrument 43-101 Technical Report dated April 23, 2019. The PEA outlines a robust economic assessment for Mont Sorcier, based on a traditional open pit mining scenario with magnetic separation processing to produce approximately 5.0 million tonnes per annum of vanadium rich iron concentrates, with low levels of impurities. Based on test work to date, this material is amenable for direct blast furnace route use.

Cliff Hale-Sanders, President and CEO of Vanadium One Iron commented “We are very pleased that the results of the PEA support our vision for the potential of the Mont Sorcier project to be a profitable, long-life operation. Located in an established mining region, Mont Sorcier has strong access to infrastructure already in place; which reduces upfront capital requirements, and with the production of premium 65% high grade iron concentrate with vanadium credits, we believe these characteristics position Mont Sorcier as one of the premier iron development projects in the world.

Based upon the results of the PEA, the Company is confident in its ability to improve the economics of this initial PEA through improved resource definition and growth, ongoing project optimization efforts and further metallurgical test work to enhance product quality even further. Going forward the company will now focus on developing strategic partnerships to complete a Feasibility Study to bring Mont Sorcier to a formal development decision as quickly as possible.”‘

The PEA was prepared by CSA Global incorporating contributions from Vulcan Technologies for the Iron and Vanadium Market Pricing Study. The PEA is preliminary in nature, as it includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the preliminary economic assessment will be realized.

Project Summary

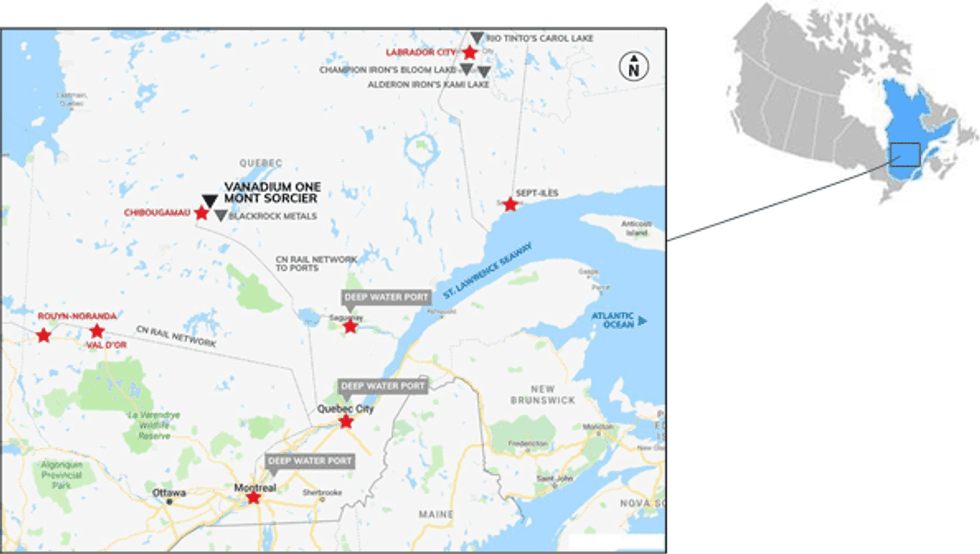

Mont Sorcier is located approximately 18 km east of Chibougamau, Quebec, in a region with a long history of mining and robust infrastructure in place to support future development. Mont Sorcier has access to all season roads, low cost provincial hydro power and is within 20km of the rail head connected to two all season, ocean going ports. The railway runs approximately 370 km to the Port of Saguenay and is currently underutilized, providing sufficient capacity for the project needs.

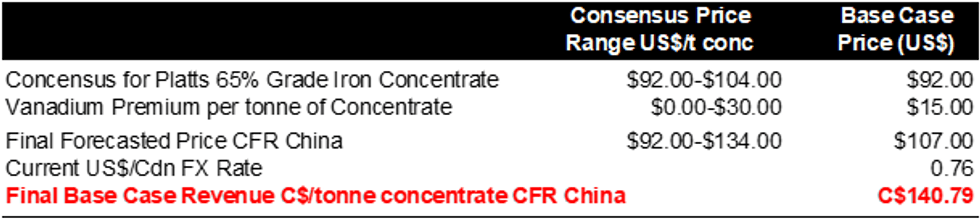

Iron and Vanadium Pricing Market Study

In preparation for the PEA, the Company commissioned an Independent Market Pricing Study to determine the potential value of the vanadium rich iron product produced by Mont Sorcier given the lack of available quoted market index prices. The study was completed by Paul Vermeulen of Vulcan Technologies in late October 2019. The study reviewed main iron index price forecasts as well as estimates of the applicable vanadium credits. The study reviewed a value in use methodology based upon a review of the grade and concentrate chemistry from Mont Sorcier relative to other similar iron products and the study concluded that the concentrate from Mont Sorcier should receive a US$15/t premium to the Platts 65 price iron Index for the contained vanadium credits (based on a net attributable value using a long term V2O5 price of $7.25/lb). The PEA used a concentrate selling price aligned with those in the Vulcan Market Study (October 2019) with an average value over the life of the project at C$140.79/t. An example of the pricing for 65% concentrate is provided in the table below.

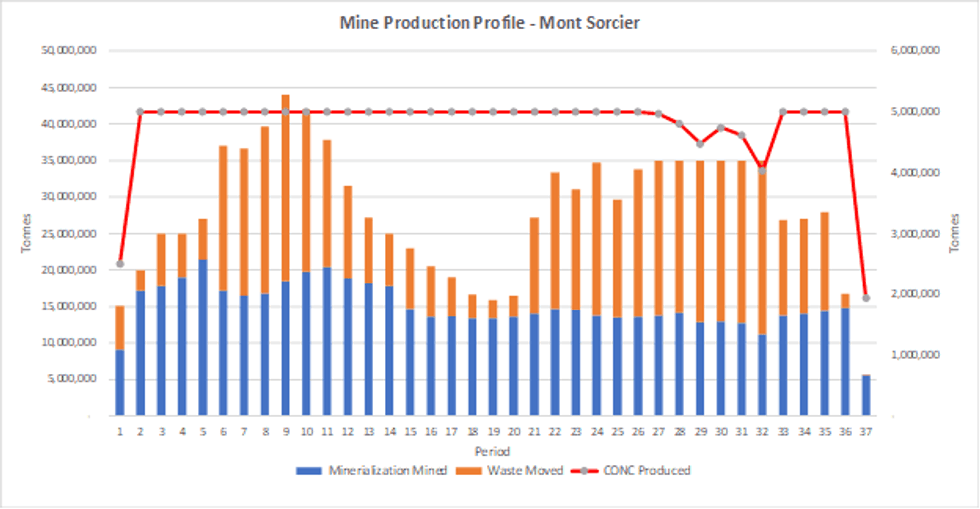

Mining

The mine design is based on the sequential mining of the South zone followed by the North zone using standard open pit mining techniques of drill, blast and haul. This will allow for the South pit to be used for waste disposition in future years. CSA Global has developed a mine plan which processes 555 million tonnes of the current resource base over a 37-year mine life at an average strip ratio of 0.89 to 1. Mining will reach a peak of material movement of approximately 44 million tonnes per annum. Mining costs are estimated at C$2.29/t of material moved. SiO2 content will be kept under 2.5% through pit grade-control practice to maintain above 65% Fe in concentrate.

Mont Sorcier Mine Production Profile

Source: CSA Global

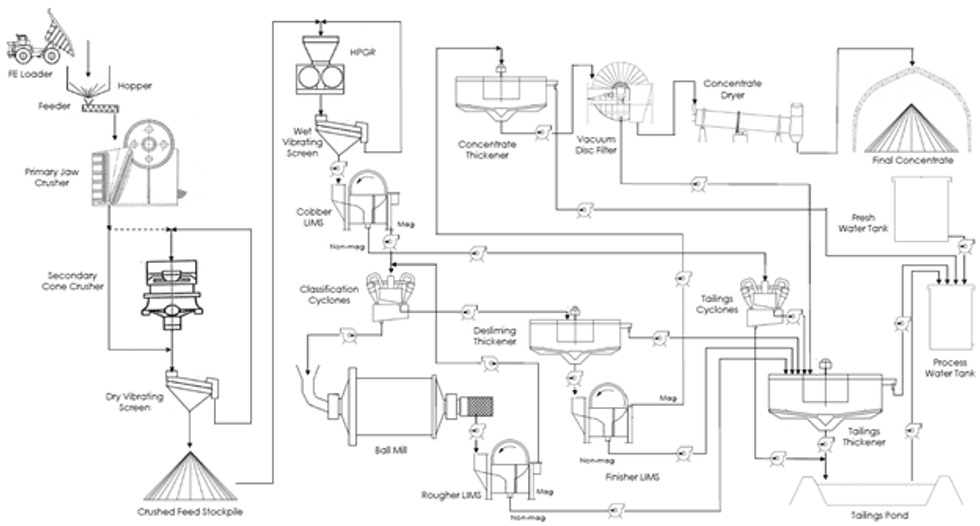

Metallurgy and Processing

As outlined in a press release dated February 10, 2020, Vanadium One Iron engaged COREM to undertake initial metallurgical test work to support the recoverability of the iron and vanadium into concentrates. The results of the test work confirmed the production of premium high grade 65.8% iron concentrate with 0.67% V2O5 expected at Mont Sorcier, averaged from 4 composite samples representing high and low grade drill core samples from the north and south deposits.

The processing plant designed for Mont Sorcier is in line with similar projects in production globally using standard equipment and technologies. The PEA has included crushing and grinding to a P95 of 45 microns to ensure the production of premium concentrate grades, with three stages of magnetic separation. Based upon the mine plan, Mont Sorcier is expected to produce a life of mine average concentrate grading 65% iron with 0.6% V2O5.

Mont Sorcier Plant Process Flowsheet

Infrastructure

The site is located with access to all weather roads, water, low cost grid hydro power and sufficient railway capacity to support project development with only modest infrastructure capital needs. The PEA incorporates expenditures required for additional infrastructure including auxiliary buildings, electrical grid connection, rail loading facilities at the mine site and unloading facilities at the port of Saguenay. This also includes a new rail loop at the mine to improve loading efficiencies. For the PEA it has been assumed all concentrate production will be rail hauled to the Port of Saguenay for international shipment to China. Given the proximity to Chibougamau no permanent camp is required for the anticipated permanent workforce.

In addition, the project will also include new tailing facilities in a location to be determined after consultation with local stakeholders and additional engineering and design.

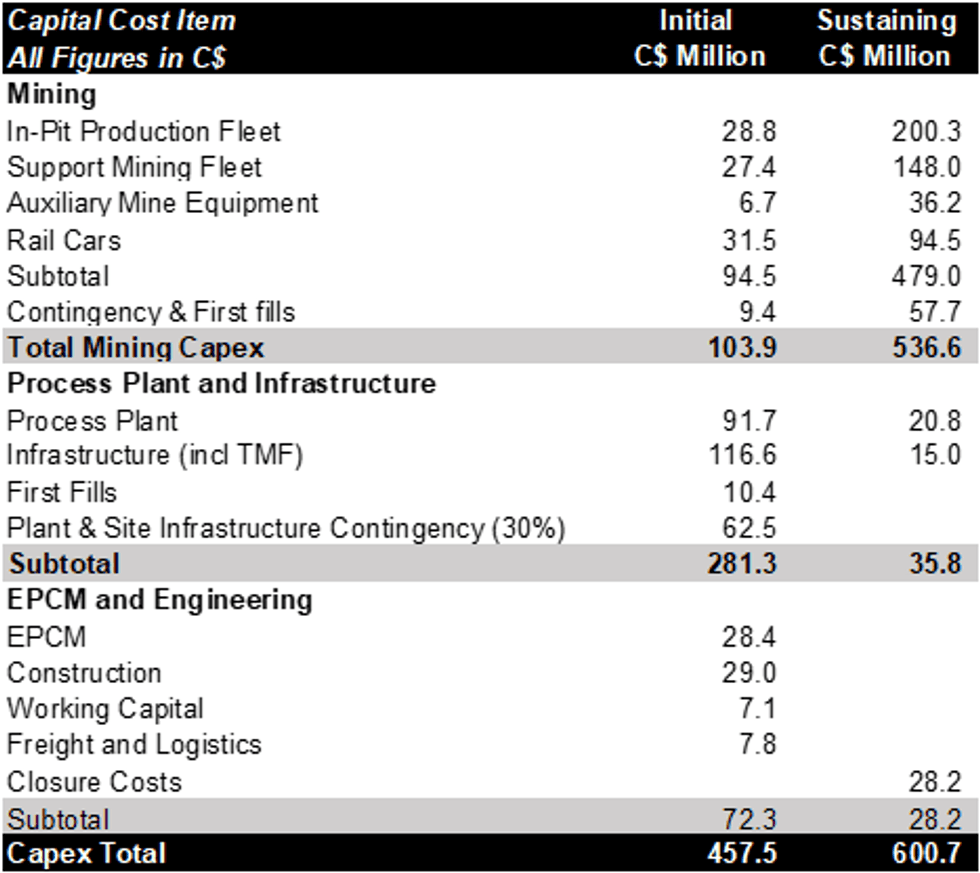

Capital Costs

Upfront capital costs are estimated at C$457.5 million with a pay back of 3.0 years with an after-tax IRR of 33.8%. Sustaining capital is estimated at C$600.7 million over the life of mine and is principally related to equipment replacement. Capital costs include a 15% continency for equipment and 30% for plant and infrastructure. It should be noted that included within mine capital costs is C$229.1 million (C$28.8 million initial capex) for the mining fleet and C$226 million (C$31.5 million initial capex) for rail cars for concentrate transport. Based upon expressions of interest from vendors, management is of the view these items can be readily leased to reduce initial capital needs with an increase in operating costs. This will be determined at a later date, based upon the receipt of more formal quotes, as will a review of the potential benefits of using contract mining.

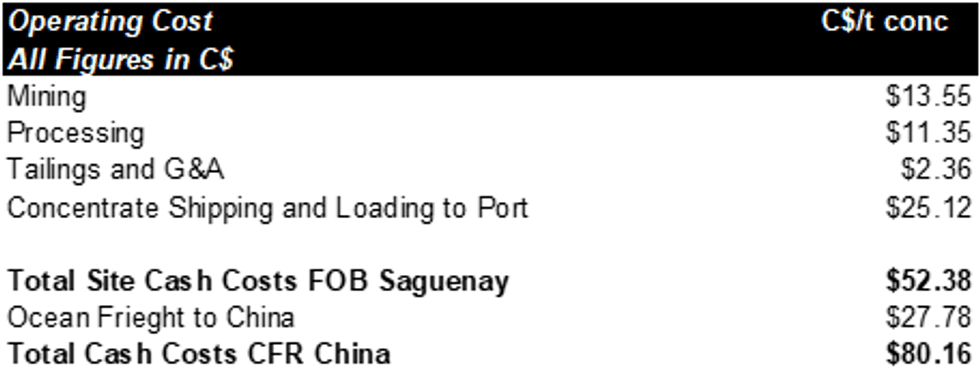

Operating Costs

The LOM operating costs are estimated at C$52.38/t of concentrate produced and delivered to the port of Saguenay and loaded onto a vessel. Additional selling costs related to ocean freight are expected to add C$27.78 per tonne of concentrate assuming delivery to China. Transport costs could be reduced significantly should the Company find a North American purchaser.

Note: Cash Costs is a non IFRS financial performance measure with no standard definition under IFRS. The Company provides them as supplementary information that management believes may be useful investors.

Tax Assumptions

For the PEA a simple after-tax model was developed for the Mont Sorcier Project pending a more detailed review in the future. All costs are in 2020 Canadian dollars with no allowance for inflation or escalation. The Mont Sorcier Project is subject to three levels of taxation, including federal income tax, provincial income tax and provincial mining taxes:

- Quebec mining tax rate of 16%;

- Income tax rate of 26.5% (federal and provincial combined).

The federal and provincial corporate tax rates currently applicable over the Project’s operating life are 15.0% and 11.5% of taxable income, respectively. The marginal tax rates applicable under the recently adopted mining tax regulations in Quebec are 16%, 22% and 28% of taxable income and depend on the profit margin. As the Project concerns the processing of iron concentrate at the mine site, a processing allowance rate of 10% was assumed. Actual taxes payable will be affected by corporate activities, profitability and current and future tax benefits that have not been considered.

The combined effect on the Project of the three levels of taxation, including the elements described above, is an appropriate cumulative effective tax rate of 30.3%, based on Project Earnings. It is anticipated, based on the current Project assumptions, that the Company will pay approximately C$2,715 million in direct tax payments to the provincial and federal governments over the life of mine based on the operating and commodity price assumptions used in the PEA.

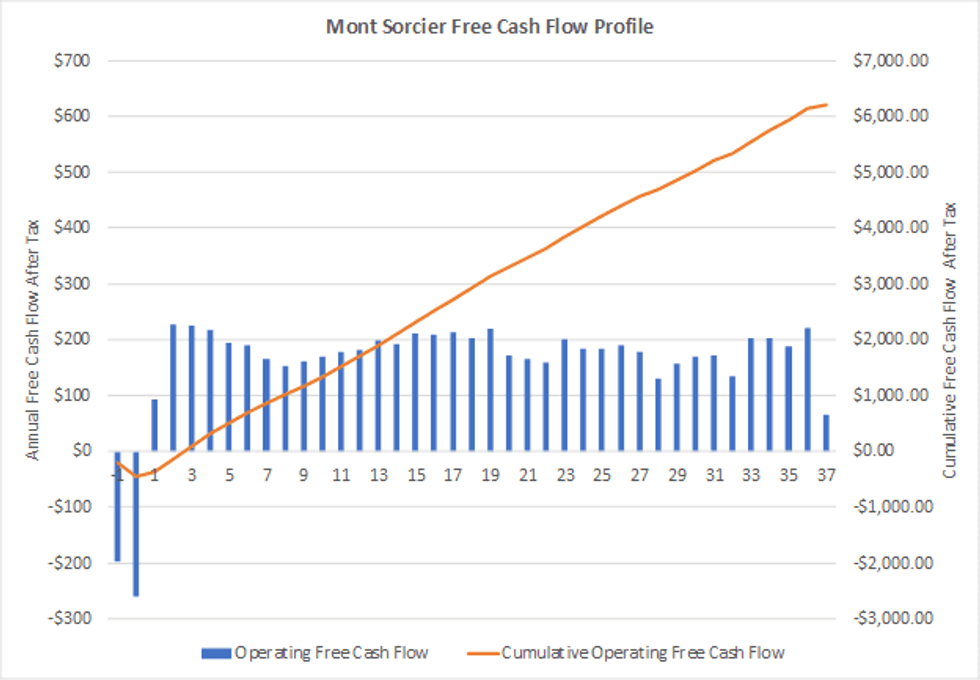

Overall Project Economics

The overall project shows potentially robust economic results with a an after tax NPV at 8% discount rate of C$1,699 million and IRR of 33.8%. Project economics are based on a potential 37-year mine life with a 3-year payback period, with positive after-tax cash flow commencing in Year 1. Total cumulative, after tax free cash flow over the life of mine is estimated at C$6,253 million.

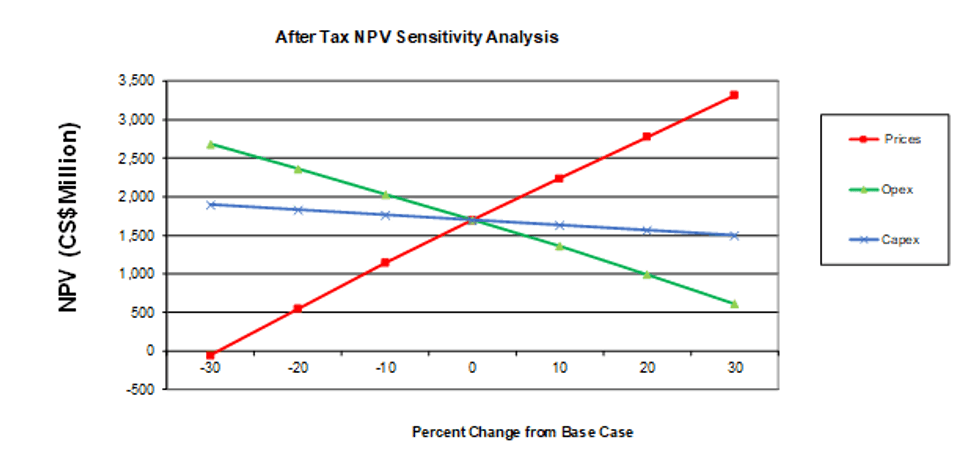

Sensitivities

The table below highlights the main project sensitivities:

Proposed Development Program

In light of the robust PEA results, the Company is in the process of developing a detailed development plan and budget to determine the requirements to bring Mont Sorcier to a development decision with the completion of a formal Feasibility Study. While details are still being finalized such a program would be expected to take approximately 24 months from commencement consisting of the following key components:

- Undertake a formal Strategic review of potential development partners and enter into an agreement to support project development and future funding requirements.

- Undertake additional drilling to improve resource confidence levels to support a Feasibility Study. A total of approximately 12,000 meters is recommended to complete this program.

- Undertake further metallurgical testing to determine final concentrate characteristics to optimize final product specifications and to enhance overall recovery based upon more detailed resource and mine sequencing details,

- Commence Environmental base line studies,

- Commence formal discussion with first nations and local community groups to negotiate an Impact and Benefits agreement,

- Commence and complete the required permitting process,

- Increased management and operational capacity with the addition of key specialists to bring the project to a final development decision,

- Commence and Complete project financing negotiations.

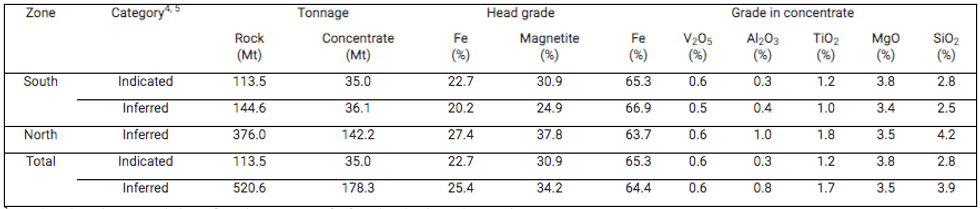

Mineral Resource Estimate

The PEA is based on a mine plan derived from the Mineral Resource Estimate dated April 23, 2019 outlined below.

Mineral Resource Estimate1 at Mont Sorcier Using a Cut-off Grade2 of 14% Fe.

1 Numbers have been rounded to reflect the precision of Inferred and Indicated Mineral Resource estimates.

2 The reporting cut-off was calculated for a saleable magnetite concentrate containing 65% Fe with price of $US 90/t of dry concentrate, 50% of the price of V2O5 contained in the concentrate, a V2O5 price of $US 14/lb, a minimum of 0.2 % of V2O5 contained in the concentrate, an open pit mining operation, a cost of mining and milling feed mineralization of USD 13.80/t, a cost of transporting concentrate of USD 40/t; and a cost of tailing disposal of USD 1.5/t.

3 Vanadium One is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing or political factors that might materially affect these mineral resource estimates.

4 Resource classification, as defined by the Canadian Institute of Mining, Metallurgy and Petroleum in their document “CIM Definition Standards for Mineral Resources and Mineral Reserves” of May 10, 2014.

5 Mineral Resources are not Mineral Reserves and by definition do not demonstrate economic viability. This MRE includes inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

Technical Disclosure

The reader is advised that the PEA summarized in this press release is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions and the use of Inferred Mineral Resources. Inferred Mineral Resources are considered to be too speculative to be used in an economic analysis except as allowed for by Canadian Securities Administrators’ National Instrument 43-101 in PEA studies. There is no guarantee the project economics described herein will be achieved.

Vanadium One Iron will within 45 days, publish a Technical Report prepared in accordance with NI 43-101 that documents the PEA study and supports the current disclosure.

Qualified Persons Statements

The PEA and other scientific and technical information contained in this news release were prepared by CSA Global, in accordance with the Canadian regulatory requirements set out in National Instrument 43-101, Standards of Disclosure for Mineral Projects (“NI 43-101”), and has been reviewed and approved by, as it relates to geology, sampling, drilling, exploration, QAQC and mineral resources: Dr. Luke Longridge, Ph.D., P.Geo, Senior Geologist (CSA Global); as it relates to metallurgy, processing and related infrastructure: Georgi Doundarov, M.Sc., P. Eng., PMP, CCP, Associate Metallurgical Engineer (CSA Global); as it relates to mining, related infrastructure, and mining costs: Karol Bartsch, BSc Mining (Hons), MAusIMM, Principal Mining Engineer (CSA Global); and as it relates to financial modelling and economic analysis: Bruce Pilcher, B.E. (Mining), Eur Ing, CEng, FIMMM, FAusIMM CP, Principal Mining Engineer (CSA Global). Dr. Luke Longridge, Georgi Doundarov, Karol Bartsch and Bruce Pilcher are all independent Qualified Persons (“QP”), as defined under NI 43-101.

The technical information contained in this news release has been reviewed and approved by Pierre-Jean Lafleur, P.Eng. (OIQ), who is a Qualified Person with respect to the Company’s Mont Sorcier Project as defined under National Instrument 43-101.

About Vanadium One Iron Corp.:

Vanadium One Iron Corp. is a mineral exploration company headquartered in Toronto, Canada. The Company is focused on advancing its Mont Sorcier vanadium-rich magnetite iron Project, near Chibougamau, Quebec.

ON BEHALF OF THE BOARD OF DIRECTORS OF VANADIUM ONE IRON CORP.

Cliff Hale-Sanders, President & CEO

Tel: 416-819-8558

csanders@vanadiumone.com

www.vanadiumone.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking information” including statements with respect to the future exploration performance of the Company. This forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements of the Company, expressed or implied by such forward-looking statements. These risks, as well as others, are disclosed within the Company’s filing on SEDAR, which investors are encouraged to review prior to any transaction involving the securities of the Company. Forward-looking information contained herein is provided as of the date of this news release and the Company disclaims any obligation, other than as required by law, to update any forward-looking information for any reason. There can be no assurance that forward-looking information will prove to be accurate and the reader is cautioned not to place undue reliance on such forward-looking information.

Click here to connect with Vanadium One Iron Corp. (TSXV:VONE) for an Investor Presentation.