Tesla "Doesn't Have a Demand Problem," but What About Battery Metals Supply?

Car rental company Hertz recently ordered 100,000 Model 3 cars from Tesla, whose valuation hit US$1 trillion after the news.

Last week, news that US electric car maker Tesla (NASDAQ:TSLA) received a 100,000 Model 3 order from car rental company Hertz sent the valuation of Elon Musk's company to the roof — hitting US$1 trillion on October 25, with some predicting it could double that amount by as early as next year.

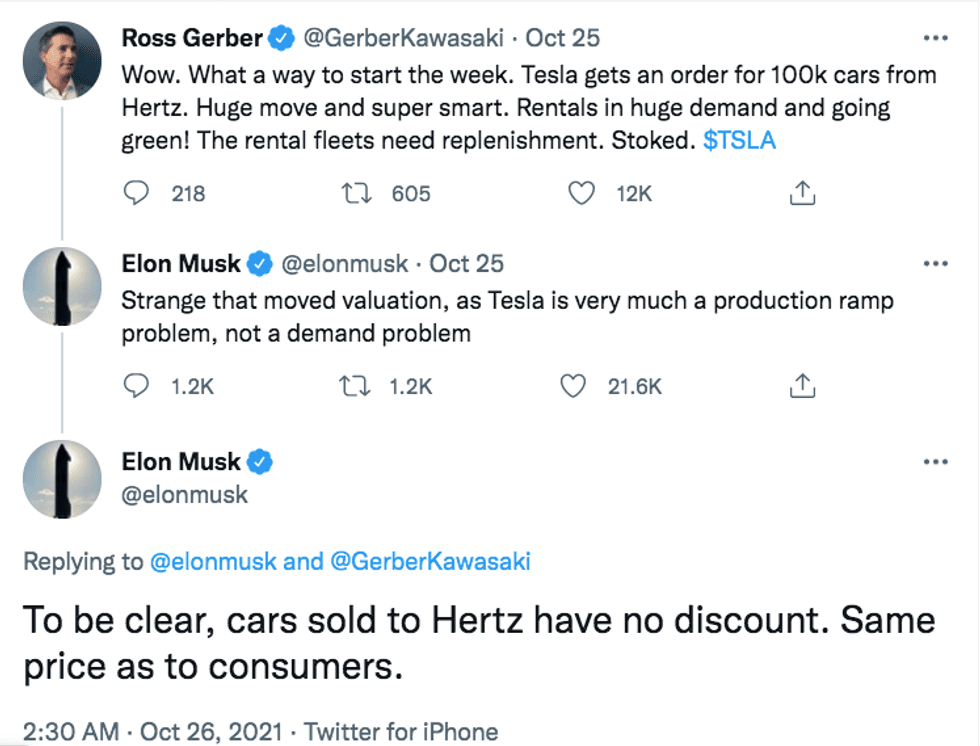

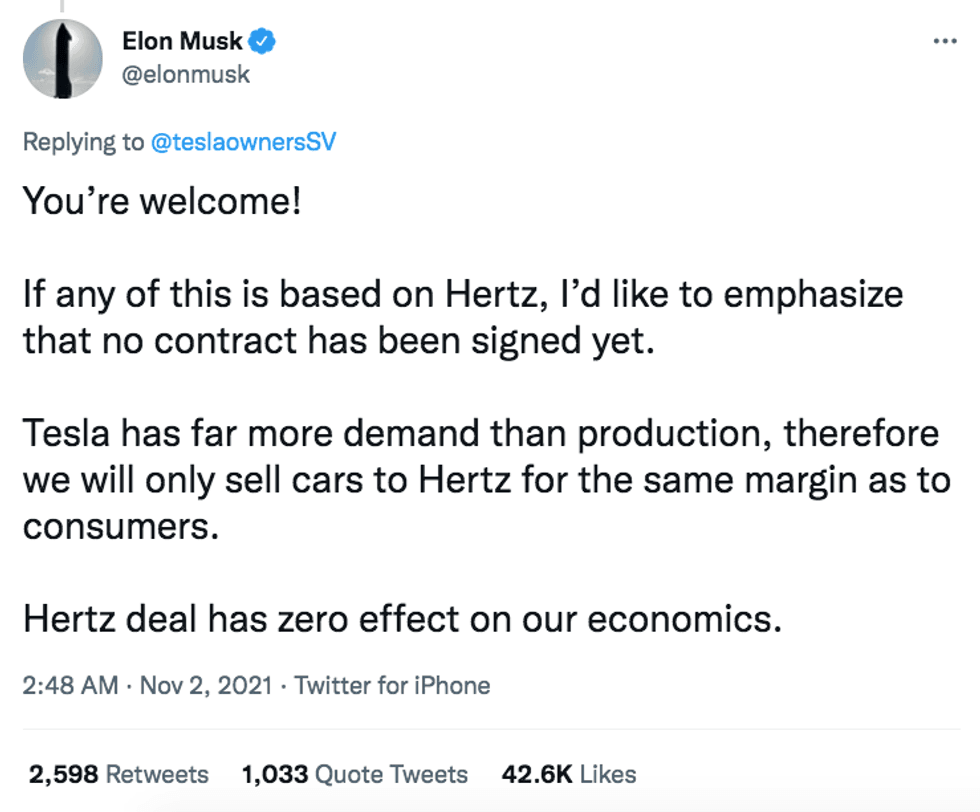

Musk, who is now three times richer than Warren Buffet, confirmed that Hertz paid full price for the electric cars made by Tesla, which has faced production ramp-up delays for some time. Tesla shares surged from a US$909.68 closing price on October 22 to US$1,018.43 by October 26, touching a high of US$1213.86 on November 3.

As candid as ever, Musk questioned such a big move in his company's valuation on Twitter (NYSE:TWTR), saying, "Tesla is very much a production ramp problem, not a demand problem."

In its third quarter report, released on October 20, Tesla shared better-than-expected results, posting record revenue for the fifth consecutive quarter. Even so, the company corroborated Musk's statement, saying that its factories will need time to ramp up due to global supply chain constraints.

Prices for key commodities used in electric car batteries have been on an uptrend in the past year, and that's part of why there's an uncertain environment with respect to cost structure.

Tesla Chief Financial Officer Zachary Kirkhorn said during a conference call that Q4 production will depend heavily on availability of parts, but "we are driving for continued growth."

As mentioned, Hertz is not receiving any discount; its order is expected to be delivered by the end of 2022, highlighting the global upswing in electric vehicle (EV) demand, a trend expected to continue into the next decade.

"Electric vehicles are now mainstream, and we've only just begun to see rising global demand and interest," said Mark Fields, Hertz's interim chief executive, formerly of Ford Motor Company (NYSE:F). In September, Tesla's Model 3 became Europe's best-selling car — the first EV to top the general model rankings, according to JATO.

There's growing evidence that EVs are going mainstream, with demand not being a current issue for Tesla.

Meanwhile, constraints in supply chains and a greater push for localization continue to mount. Tesla Senior Vice President Drew Baglino told investors that the company's goal is to "localize all key parts of the vehicles on the continent, if not closer," and not just at the end assembly level, "but as far upstream" as possible.

Looking at some of the production ramp-up issues Tesla and other EV makers could face, raw materials supply is an aspect to watch out for. That said, according to Caspar Rawles, chief data officer at Benchmark Mineral Intelligence, Tesla is one of the few automakers that has secured battery raw materials directly at the mine/refiner level, and for that reason it's in a strong position on raw material sourcing.

"While I suspect that in the medium term Tesla has secured enough raw materials for its forecasted demand, longer term there is likely to still be work to do across the spectrum of battery minerals," he said.

Tesla secured a lithium deal with top producer Ganfeng Lithium (OTC Pink:GNENF,SZSE:002460) on November 1; it will see the Chinese company supply battery-grade lithium hydroxide to the US carmaker starting next year for three years. Lithium hydroxide prices are up 91 percent this year, as per Benchmark Mineral Intelligence data.

"The reality is that Tesla is not demand constrained at the moment, but cell (and chip) constrained, so the company will likely look to increase its raw material supply irrespective of orders like the one from Hertz."

An interesting point to consider for battery metals investors is the type of batteries Tesla will be using going forward, which will determine the raw materials supply it will need to secure longer term.

Most carmakers use nickel-cobalt-manganese or nickel-cobalt-aluminum cathodes for their cars, but Tesla is turning to a cheaper alternative, lithium-iron-phosphate (LFP), for some of its models. Last week, the company announced it is moving to use LFP cathodes for its standard Model 3 and Model Y cars across global markets.

"In reality it will likely be a mix of both LFP and nickel-based chemistries for extended-range versions," Rawles told the Investing News Network. "At this point it is hard to tell the exact mix, but if it is based on regional sales in the US and Europe, it would likely be 20 to 30 percent standard-range models."

Tesla has been using LFP batteries in China for some time, supplied by Contemporary Amperex Technology (SZSE:300750), the world's largest battery maker.

Switching to LFP cathodes globally would not take long to implement, Rawles explained, saying that retooling production lines to use prismatic LFP cells in packs would be one of the key changes.

"It is important to remember that all standard-range Model 3s and Ys produced in China use LFP, with Giga Shanghai producing all Tesla vehicles delivered into Europe currently," Rawles said. "As such, this change only really impacts US production, where LFP cells will need to be shipped to the US for vehicle production."

LFP cathodes do not use cobalt or nickel, which together with lithium have seen prices increase in the past year.

Even though Tesla's news will have some impact, Rawles doesn't think investors should be worried. Tesla has publicly stated it will need increasing volumes of cobalt going forward, and Musk has been public about the company's concerns over the security of nickel supply in the medium to long term.

"While the production mix will alter slightly for where it is today, volume of sales at Tesla will see increasing volumes of both metals needed — this is true not only of Tesla, but the EV industry globally," he said.

Don't forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.