Investors who want to jump into to the rapidly growing lithium market have many options — here’s a look at three ways to gain exposure.

Navigating any industry from an investment perspective can be an arduous task, with investors not knowing where to start. This dilemma is why we, at The Lithium Spot, strive to do all of the heavy lifting for readers, presenting thorough, straightforward industry analysis. In this piece, we take a look at the investment options available to investors looking to participate in the rapidly growing lithium industry.

Miners

Over the better part of the last year and a half, the lithium miners have benefited the most from the lithium boom. A couple of reasons for this are the relative scarcity of large mining operations, along with the tight supply/demand picture, which has led to increasing market prices for lithium. As the electrification of the world’s vehicle fleet unfolds over the next few decades, lithium demand will continue to rapidly increase. And given the complexity of bringing new mining operations online, supply will struggle to keep up for at least the next few years, leading to stable or higher market prices. Thus, miners that can provide a steady supply of lithium will see tremendous revenue growth and juicy margins, two conditions any investor should welcome.

Approximately 80 to 90 percent of world supply over the last few years has been dominated by five producers, giving the industry an oligopoly structure. These five producers are shown below along with their YTD performance:

Looking at the table above, any investor could throw a dart to randomly select a miner to invest in and yield almost a 50-percent return on the low end. Additionally, although these miners have experienced tremendous growth over the last few years, their dominance is likely to continue given the aforementioned struggle for new companies entering the market.

For investors willing to do a bit more research and take on more risk, there are quite a few junior miners looking to enter the market over the next few years that are notable. Lithium Americas (TSX:LAC) (+96 percent YTD), Pilbara Minerals (ASX:PLS) (+12 percent YTD) and Altura Mining (ASX:AJM) (+59 percent YTD) are just a few names that have funding and are looking to break into the market. These companies still have a long runway ahead as they construct and subsequently try to ramp up production. However, they possess a good combination of land resource, management and partnerships, allowing investors to rest a little easier.

Battery Makers

Like lithium miners, battery manufacturers have enjoyed a great run. Samsung SDI (KRX:006400), LG Chem (KRX:051910), L&F (KOSDAQ:066970) and others have ridden the electric vehicle and energy storage hype trains to massive YTD returns (all up >50 percent). Investing in battery manufacturers is great for those individuals who want to invest directly in the cause of the momentum in the lithium industry: batteries.

The issue here is that with ample competition in the market, it is a lot tougher to find the right battery manufacturers to invest in. Battery technology is relatively similar across the board, with differentiation coming in how each manufacturer packs its batteries. Creative designs leading to EV or energy storage batteries that pack more cells into smaller form factors (resulting in higher energy density) is the name of the game. However, as soon as new designs come into the market, customers have little incentive to not switch to the new product. There is a reason why battery manufacturers are not household brand names, while other electronic components manufacturers like Intel (NASDAQ:INTC), Qualcomm (NASDAQ:QCOM) and Texas Instruments (NASDAQ:TXN) are much more widely known given their competitive advantages and ability to lead their niches.

Passive Investment: LIT ETF

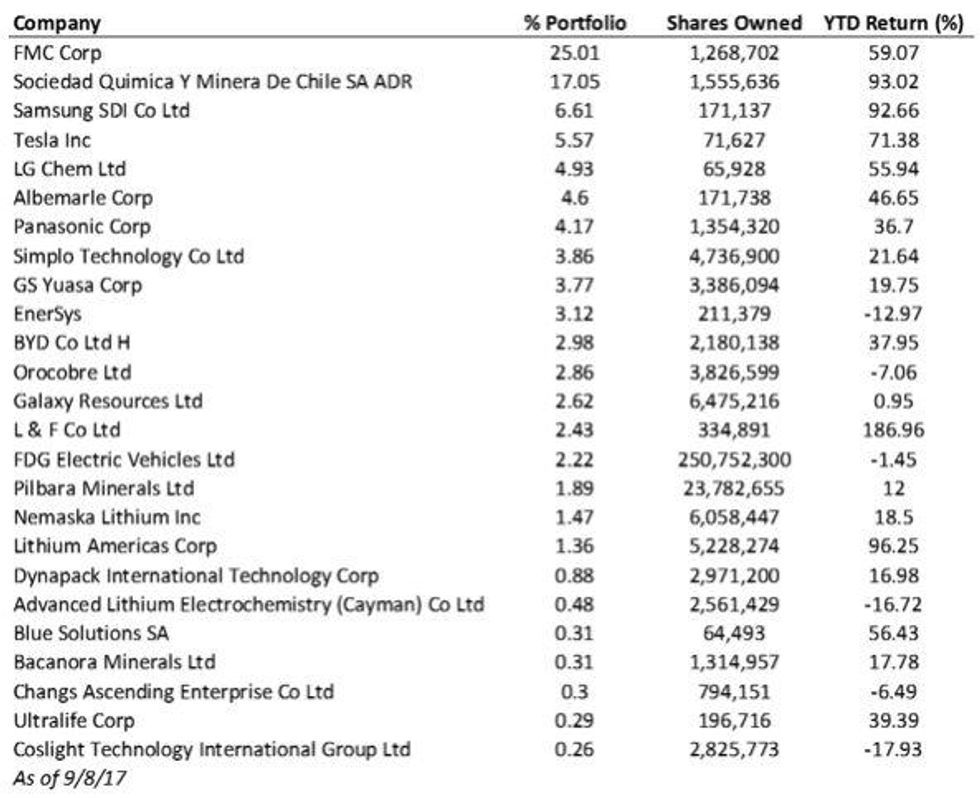

For those investors that aren’t stock pickers, don’t have the time to dig deep into individual companies or just can’t decide between miners, battery makers and EV manufacturers, Global X Funds’ LIT ETF (ARCA:LIT) is an good alternative. The fund tracks the Solactive Global Lithium Index and charges 76 basis points in fees. But compared to YTD performance of over 50 percent, that is negligible. Additionally, as of June 30, it had one- and five-year returns of 18.51 percent and 0.62 percent. Below, we show you the fund’s top 25 holdings, and their respective weightings. The table shows that by buying LIT, investors can get exposure to miners, battery producers and EV manufacturers. Or more simply put, LIT provides exposure to the three core industries participating in the lithium boom.

It should be noted that the Solactive Global Lithium Index’s top weighting, at 25 percent of the index, is FMC (NYSE:FMC), a company which derives only 11 percent of its revenue from lithium. Although the stock has performed very well over the last few years, FMC is probably not the best way to capture gains in the lithium boom. Yes, it is true that the company is part of the lithium oligopoly. It is also true that it will probably spin out the lithium business at some point over the next couple of years. But until then, or until Solactive changes its weightings, investors should be aware that a quarter of LIT’s assets are invested in a company whose primary focus is not the lithium business.

Deciding between LIT or individual lithium miners and battery producers goes back to the classic debate of passive versus active investing. In good years, which has been the case so far in 2017, taking a 50-percent return on a passively managed fund is probably a no-brainer. But looking forward, investors need to decide which side of the debate they see capturing the most gains. As we mentioned, we think the miners are poised to continue to benefit the most from the EV boom given the favorable supply/demand picture. And from a purely competitive standpoint, battery and automotive companies currently face a much stiffer landscape than do the miners. Thus, even if all three industries grow at the same rate, miners will be able to split their pot among fewer firms, making it easier for investors to choose the right companies and capture the most upside.

By Shrey Patel and Jonah Raskas of The Lithium Spot

About the authors — Jonah’s passion for the Lithium space is fueled around Market Research, valuation and of course, making some smart investments! His passion for Market Research started out early on his career when he worked in the White House’s SpeechWriting office. There, Jonah was tasked with researching for the President’s and Vice President’s speeches on a diverse set of topics ranging from Defense to Agriculture to Policy Announcements. Following that, Jonah’s career took a turn to Wall Street where he worked for two separate investments banks. It was there that he worked on the capital markets desk getting an up close sense of valuation and the market. He worked on many different offerings ranging from IPO’s to Secondary offerings as well as in depth analysis on a wide range of companies. Most recently, Jonah’s core strength of market research has helped him earn widespread praise from a variety of consulting and MBA internship opportunities. Having just completed his MBA at the Gabelli School of Business (summa cum laude) in Marketing & Accounting, Market Research is again at a focal point for his job in Brand Management for a Fortune 500 company.

Shrey’s interest in Lithium began when he was asked to cover the space during his time on the specialty chemicals team at GAMCO Investors. Interning for a well-respected analyst, and a famed value investor, he learned a tremendous amount while researching and writing an in-depth industry report on the rapidly emerging Lithium sector, and covering Albemarle Corporation. With an undergraduate background in Biomedical Engineering and Economics from UNC (University of National Champions!), and an MBA in Finance and Accounting from the Gabelli School of Business, Shrey approaches the industry from both a technical as well as a business perspective. This background also affords him the ability to get into the nitty-gritty fundamentals while maintaining a perspective on the broader, global interconnections of the industry and economy. Through his time on both the buy and the sell-sides, as well as his experience managing capital raised from friends and family, Shrey brings tremendous research and investing insight to the table.