LiCo Energy Metals Inc. (TSXV:LIC) would like to provide its shareholders with additional information regarding the May 8, 2018 announcement of the signing of an option agreement for a 60% interest in the Teledyne and Glencore Bucke cobalt properties (the “Properties”) with Surge Exploration Inc.

LiCo Energy Metals Inc. (TSXV:LIC) would like to provide its shareholders with additional information regarding the May 8, 2018 announcement of the signing of an option agreement for a 60% interest in the Teledyne and Glencore Bucke cobalt properties (the “Properties”) with Surge Exploration Inc.

Since the completion of LiCo’s Phase 1 diamond drilling programs at the end of the 2017 calendar year, Company management has been reviewing various financing options that will allow it to continue to move forward its promising lithium projects in Nevada and Chile, as well as, its cobalt projects (Teledyne Cobalt and Glencore Bucke) in Canada.

The Company’s working capital, although sufficient to maintain operations, was inadequate to allow the Company to undertake five separate exploration programs in three countries on two different continents at the same time. Therefore, the Company sought various financing strategies that would allow it to continue to explore its properties and increase the value of its mineral assets for both calendar 2018 and 2019. The goal of each financing strategy was to provide the resources to fund the Company’s disclosed exploration programs, realizing that each of these strategies may either dilute the Company’s shareholders through a private placement, or in the alternative, reduce the Company’s interest in a single project going forward by entering into a property option agreement that funds the Company’s stated 2018 and 2019 exploration programs.

Given the continued softening / deterioration of junior mining equity financing markets and the relatively large number of Company common shares already issued and outstanding, management believed that seeking project specific option agreements would be the Company’s most readily available financing strategy option. On April 3, 2018 the Company announced the acceleration of payments for the Teledyne property in order to increase the property’s value with the aim of attracting further interest in the property. During this time, the Company received unsolicited expressions of interest for optioning and joint venturing its various mining assets. Each of these expressions of interest were deficient and ultimately rejected by management. At this point, LiCo was introduced to Surge Exploration Inc., through the common director. Surge Exploration Inc. had recently completed a financing and was looking for a suitable mining exploration project. After a due diligence period, an option agreement was successfully negotiated and ultimately signed by the respective company directors, with the common director abstaining from each vote. The agreement remains subject to TSX Venture Exchange approval.

This negotiated agreement not only provides LiCo with valuable cash (CAD $240,000) and equity consideration (1,000,000 common shares in a publicly traded company), but also completes the funding required for the Company’s 2018 and 2019 exploration programs on both the Teledyne and Glencore Bucke properties and funds 60% of all future expenditures on these properties. The stated goal of the 2018 and 2019 exploration programs are to define an underground cobalt resource on the property, which management believes is extremely valuable to both LiCo and its shareholders. It is this reason, along with the need for additional working capital and exploration funds, that management believes that LiCo shareholders will ultimately gain from the funding agreement and association with Surge Exploration Inc.

About LiCo Energy Metals: https://licoenergymetals.com/

LiCo Energy Metals Inc. is a Canadian based exploration company whose primary listing is on the TSX Venture Exchange. The Company’s focus is directed towards exploration for high value metals integral to the manufacture of lithium ion batteries.

Click Image To View Full Size

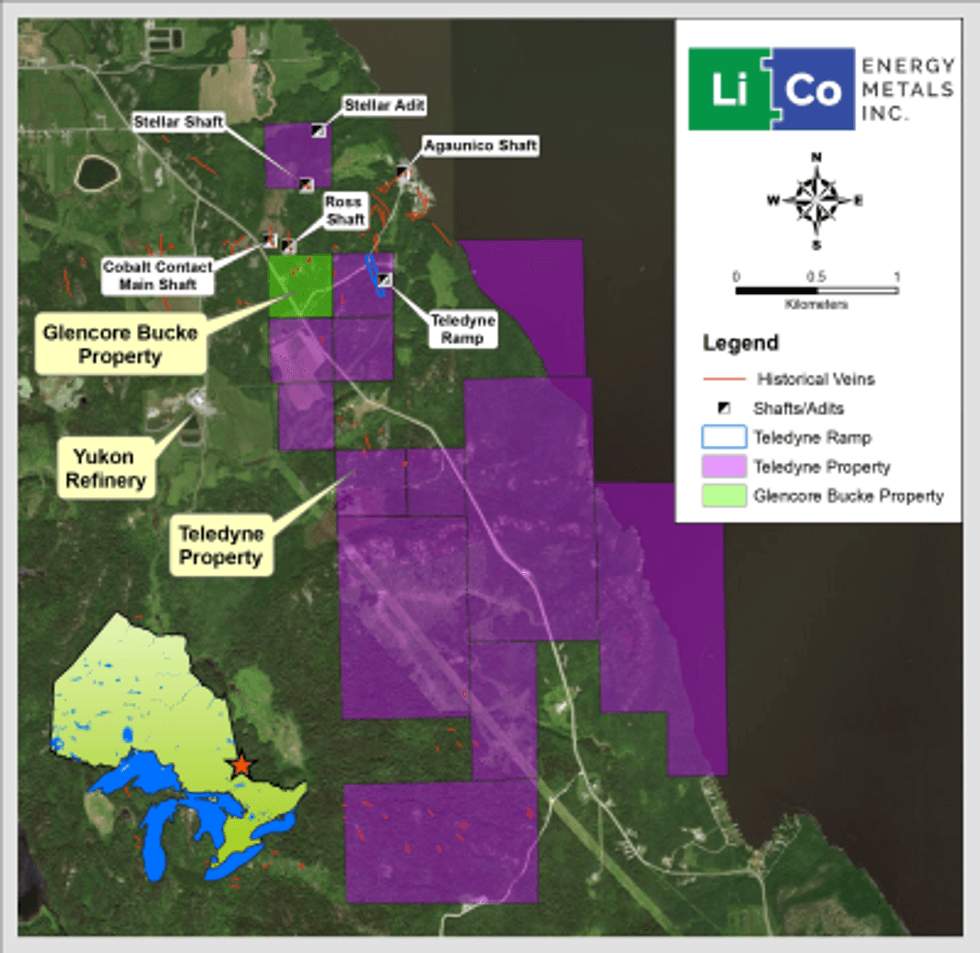

Glencore Bucke Cobalt Project (Cobalt, Ontario): The Company has purchased a 100% interest from Glencore Canada Corporation (subsidiary of Glencore plc) in the Glencore Bucke Property, situated in Bucke Township, 6 km east-northeast of Cobalt, Ontario, subject to a back-in provision, production royalty and off-take agreement. Strategically, the Glencore Bucke Property consists of 16.2 hectares and sits along the west boundary of LiCo’s Teledyne Cobalt Project. The Property covers the southern extension of the #3 vein that was historically mined on the neighbouring Cobalt Contact Property located to the north of the Glencore Bucke Property. Diamond drilling in 1981 on the Glencore Bucke Property delineated two zones of mineralization measuring 150 m and 70 m in length. During the fall of 2017, LiCo completed 21 diamond drill holes totaling 1,900 m. This drill program, along with the Phase 1 diamond drilling program completed on the Teledyne Cobalt Property, satisfied LiCo’s flow-through financing obligations. The exploration program at the Glencore Bucke Property also satisfied our contractual obligations to Glencore plc. whereby LiCo was to incur $250,000 of exploration expenditures on the Property within six months of the approval date (see News Release dated September 5th, 2017).

Ontario Teledyne Cobalt Project (Cobalt, Ontario):

The Company has recently exercised its option to earn 100% ownership, subject to a royalty, in the Teledyne Project located near Cobalt. Ontario. The Property adjoins the south and west boundaries of claims that hosted the Agaunico Mine. From 1905 through to 1961, the Agaunico Mine produced a total of 4,350,000 lbs. of cobalt and 980,000 oz. of silver. A significant portion of the cobalt that was produced at the Agaunico Mine located along structures that extended southward onto the Teledyne property. The Company completed a total of 11 diamond drill holes totaling 2,200 m in the fall of 2017. The drilling has confirmed cobalt mineralization present on the Property which is consistent with historical grades as reported historically by Cunningham-Dunlop (1979) and Bressee (1981), disclosed in earlier news releases. These reports are available in the public domain through MNDM’s AFRI database.

NI 43-101 Reports for both the Teledyne and Glencore Bucke Properties, are publicly available on www.SEDAR.com as well as the Company’s website. LiCo’s recently completed diamond drilling program (September to December 2017) consisted of both twinning and infill drilling of the historical drill holes located on both the Teledyne Cobalt and Glencore Bucke Properties.

Purickuta Lithium Project (Chile):

The Purickuta Project is located within Salar de Atacama, a salt flat encompassing 3,000 km2, being about 100 km long, 80 km wide and home to approximately 37% of the worlds Lithium production and Chile itself holds 53% of the world’s known lithium reserves (Source: Bloomberg Markets – June 23, 2017, “Lithium Squeeze Looms as Top Miner Front-Loads, Chile Says”). The property is 160 hectares large and is enveloped by a concession owned by Sociedad Quimica y Minera (“SQM”) and lies within a few kilometers of a property owned by CORFO (the Chilean Economic Development Agency) where its leases land to both SQM and Albermarle’s Rockwood Lithium Corp. (“Albermarle”) for lithium extraction. Together these two companies, SQM and Albermarle, have a combined annual production of over 62,000 tonnes of LCE (Lithium Carbonate Equivalent) making up 100% of Chile’s current lithium output. As reported in The Economist (June 15, 2017 – A battle for supremacy in the lithium triangle), the Salar de Atacama has the largest and highest quality proven reserves of lithium. The combination of the desert’s hot sun, scarce rainfall, and the mineral-rich brines make Chile’s production costs the world’s lowest. This together with a favourable investment climate, low levels of corruption, and the quality of its bureaucracy and courts makes Chile a favourable place to conduct business.

Dixie Valley Lithium Project (Nevada, USA):

The Company has an option to acquire a 100% interest, subject to a 3% NSR, on a large lithium exploration project at the Humboldt Salt Marsh in Dixie Valley, Nevada. Some important geological similarities exist between various lithium brines, notably geothermal activity, a dry climate, a closed basin, an aquifer, and tectonically driven subsistence exist at Dixie Valley along with Clayton Valley and various lithium bearing salars in Chile, Argentina and Bolivia.

Black Rock Desert Lithium Project (Nevada, USA):

The Company has entered into an option agreement whereby the Company may earn an undivided 100% interest, subject to a 3% NSR, in the Black Rock Desert Lithium Project in southwest Black Rock Desert, Washoe County, Nevada.

The technical content of this news release has been reviewed and approved Joerg Kleinboeck, P.Geo., an independent consulting geologist and a qualified person as defined in NI 43-101.

On Behalf of the Board of Directors

“Tim Fernback”

Tim Fernback, President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information:

This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to vary materially from forward-looking statements.

Click here to connect with LiCo Energy Metals Inc. (TSXV:LIC) and receive an Investors Presentation.