Eurasian Resources Group CEO Benedikt Sobotka sees cobalt prices rising another 60 percent in the next 18 months.

Investors are closely watching the electric car revolution unfold. As demand for these vehicles rises, metals used in lithium-ion batteries are expected to see significant price increases.

Cobalt is one metal that is used in lithium-ion batteries, and recent comments from Eurasian Resources Group CEO Benedikt Sobotka indicate just how much demand there is for the metal.

“Demand is remarkably strong,” he said in a recent interview with Bloomberg. “People are inquiring about lifetime offtake contracts” for the company’s $1-billion Metalkol Roan tailings reclamation project in the Democratic Republic of Congo (DRC) for 2018 to 2019, he added. The project is expected to produce 14,000 tons of cobalt a year.

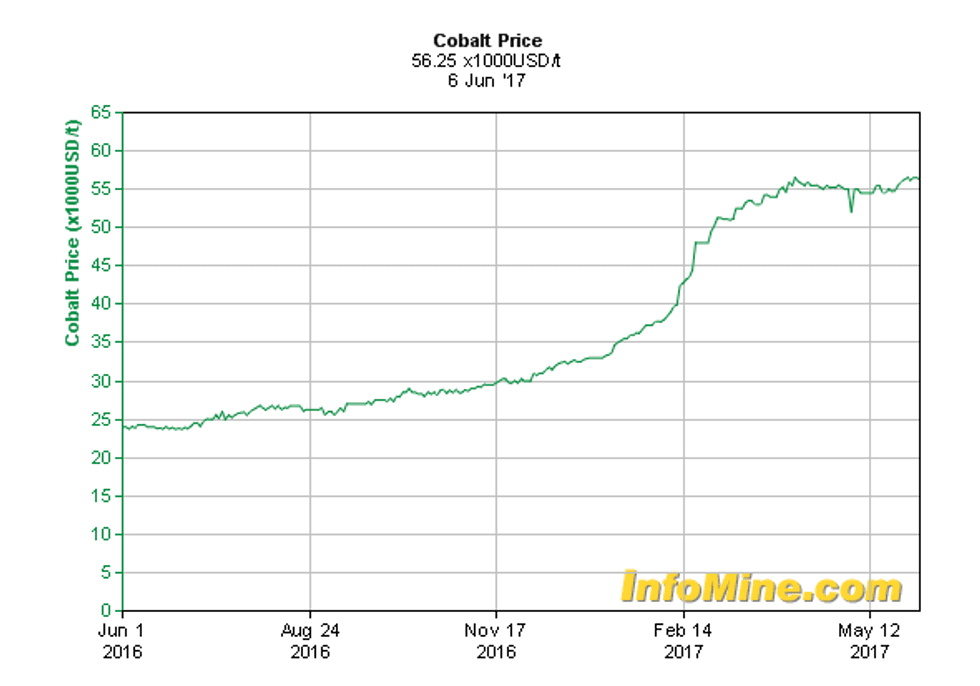

Cobalt prices have climbed 71 percent so far this year, and are currently sitting at $56,250 a ton. Sobotka believes they may rise another 60 percent to reach as much as $90,000 in the next 18 months or so.

Chart via InfoMine.

New supply is also due to come online at Glencore’s (LSE:GLEN) Katanga mine. When production restarts there later in 2017, the company is expected to become the world’s largest cobalt producer. However, there are still concerns that the cobalt market could fall into deficit in the next three years.

“In the next few years only five new cobalt mines are due to come online, and they will add about 50,000 tons of cobalt per year. That is certainly not enough to support the demand in the market,” Stephan Bogner of Rockstone Research said at this year’s International Metal Writers Conference.

Surging demand for electric vehicles is expected to push demand for lithium-ion batteries above 400 GWh by 2025, Benchmark Mineral Intelligence says. Lithium-ion batteries contain about 11 kilograms of cobalt, and demand for cobalt is expected to jump from 46,000 tonnes in 2016 to 76,000 tonnes by 2020.

There are also concerns about existing cobalt supply. The DRC is the world’s top cobalt producer, accounting for almost 60 percent of supply, but the country is politically unstable, and mining in the country is not always done ethically.

“Over the last 12 months the market participants have realized that there was a lot of dirty cobalt product that is produced using child labor in the DRC” and outdated technology, Sobotka said, adding, “[b]ig automotive corporations can’t just ignore this alarming problem anymore.”

Benchmark Mineral Intelligence analyst Caspar Rawles recently told the Investing News Network that while there are some cobalt projects in more stable jurisdictions that may ultimately help increase cobalt supply, it will not be possible to eliminate DRC cobalt. “There’s no lithium-ion industry without DRC cobalt,” he emphasized.

That said, he also believes that even with DRC cobalt the market is headed for a deficit. “The [cobalt] market’s going to be very tight certainly to 2020, and in about 2020 to 2021 that’s when we start seeing some deficit,” he said. And if that happens higher prices are almost a certainty.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.