What happened to cobalt in Q2 2019? Our cobalt market update outlines key market developments and explores what could happen moving forward.

Cobalt prices continued their downtrend in Q2, with oversupply worries impacting investor sentiment toward the sector.

However, demand for cobalt, a key metal in the lithium-ion batteries used to power electric vehicles (EVs), is still expected to surge in the long term. Many market participants continue to believe that demand will outstrip supply even if cobalt content in cathodes is reduced.

Read on to learn what happened in the cobalt market in Q2 2019, including the main supply and demand dynamics and what market participants are expecting for the rest of the year.

Cobalt market update: Price performance in Q2

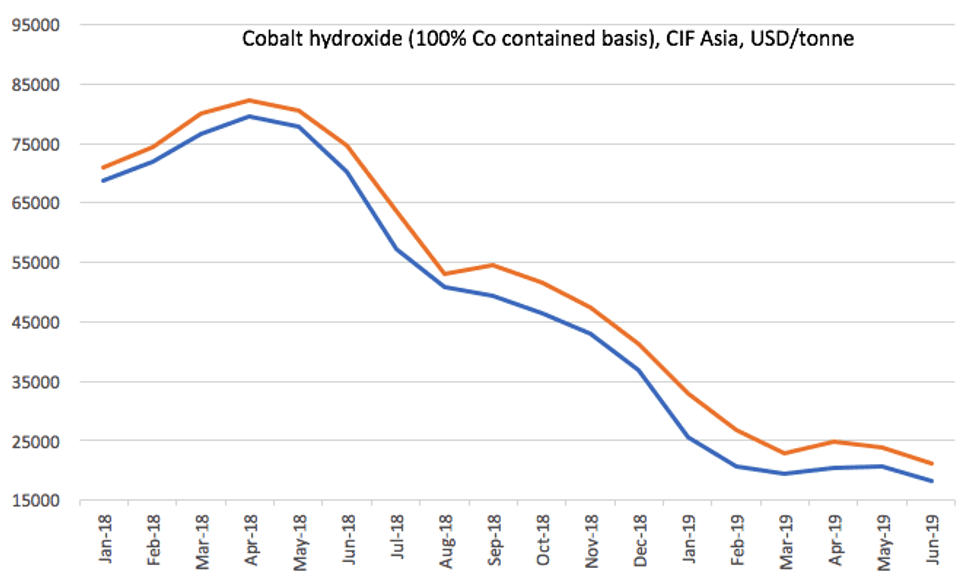

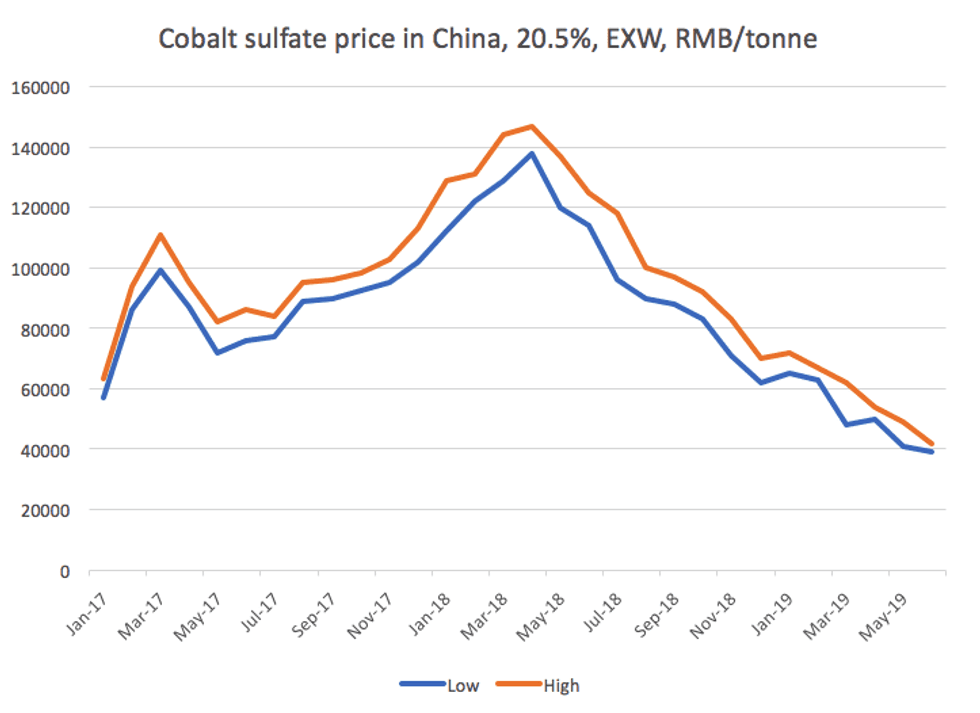

Cobalt metal prices made a slight rebound at the end of the first three months of the year and beginning of Q2, with some small recoveries in transacted prices for cobalt hydroxide. However, the second quarter of the year saw prices trend downward for most of the period.

“Ultimately prices fell to the lowest levels seen in some products for a number of years,” Benchmark Mineral Intelligence Senior Analyst Caspar Rawles told the Investing News Network (INN). “The Benchmark Minerals cobalt sulfate price fell on average by 26.4 percent over the space of the quarter.”

Negative sentiment continued to reign, especially in the battery sector, supported by oversupply in the cobalt hydroxide market.

“Refiners of battery chemicals feel availability of hydroxide and concentrate remains high and therefore are not prepared to pay the premium or high prices that we saw through 2017 and into 2018,” Rawles said.

In addition, after China reduced its subsidy policy, which came into full effect on June 25, the Chinese are fearing a dip in EV demand — fueling skepticism about the ramp up in production of EVs.

Chart via Benchmark Mineral Intelligence.

“I don’t think that we will see a significant recovery in prices in 2019 without a major supply shock as the market continues to be in oversupply with the production ramp ups happening in the Democratic Republic of Congo (DRC),” Rawles added.

Cobalt market update: Supply and demand

During the second quarter of the year, there were plenty of announcements impacting the cobalt space and its supply and demand dynamics.

Since the start of 2019, the development of supply chains for raw materials outside of China has been a main topic of discussion, with more and more battery plants either in production, under construction or being planned outside of Asia and in particular in Europe.

The Benchmark Minerals Megafactory Assessment is currently forecasting over 300 gigawatt hours of capacity in Europe by 2028, with a number of other plants expected to be publicly announced soon.

“These plants will need a supply of battery raw materials to feed them ― including cobalt,” Rawles said. “Refining capacity will need to be developed in the region in order to make the supply chain more efficient to help drive down costs.”

Mergers and acquisitions also took place in Q2, with Australian miner Jervois Mining (ASX:JRV) and Idaho-focused eCobalt Solutions (TSX:ECS,OTCQX:ECSIF) announcing plans to combine. The merger is facing opposition from some investors, including majority shareholder First Cobalt (TSXV:FCC,OTCQX:FTSSF), which has urged investors to vote against the transaction.

Looking ahead, the market might see further deals over the coming years, notably from the downstream battery supply chain investing in cobalt projects to secure output.

“With prices so low it presents a good opportunity for companies to invest in raw materials,” Rawles said. “Chinese companies are typically more aggressive on such strategies, so we might see deals involving Chinese entities first, but the whole supply chain is looking at the space.”

Another main topic of discussion in the market continued to be responsible sourcing and how to deal with artisanal mining.

In April, the London Metal Exchange (LME) launched an initiative to ban or delist brands that are not responsibly sourced by 2022. Under the new rules, all LME brands will, by the end of 2020, be assessed based on guidelines set by the Organization for Economic Co-operation and Development.

Near the end of June, illegal mining in the DRC made news headlines again after Kamoto Copper Company’s KOV mine collapse left dozens of miners dead in Southeast Congo. Kamoto Copper Company is 75 percent owned by Glencore’s (LSE:GLEN,OTC Pink:GLCNF) Katanga Mining (TSX:KAT,OTC Pink:KATFF).

Roskill estimates that 16,500 tonnes of cobalt was produced by artisanal miners in the DRC last year — roughly 15 percent of the country’s cobalt output.

For Rawles, the most promising path for the industry to address responsible sourcing appears to be the development of model artisanal mines like those being worked on by the Better Cobalt Initiative. These mines offer, among other things, safe working conditions, fair pay and legal mining concessions.

“It would not be correct to try and get rid of artisanal mining in the region as it offers a much-needed source of income for thousands of families,” Rawles said. “It is important for the supply chain to work with the artisanal mines and workers to make the production a sustainable source of cobalt.”

In terms of demand during the quarter, the conversation surrounding the potential reduction of cobalt in batteries continued to heat up.

In 2018, Korean battery makers SK Innovation (KRX:096770) and LG Chem (KRX:051910) announced that they are working on nickel-cobalt-manganese (NCM) 811 cathode/cells for EVs, but pushed back commercial production during the third quarter, highlighting the difficulties of using new chemistry for batteries.

Despite adoption being slower than expected, the move toward NCM 811, which requires less cobalt, is happening, with China’s CATL (SZSE:300750) beginning mass production of high-nickel cathodes in April and SK Innovation set to start production in Q3 of this year.

Furthermore, in Q2, Chinese battery maker SVOLT Energy Technology announced it is in the process of developing cobalt-free batteries in order to avoid concerns around sourcing the material.

“There are still risks in applying cobalt-free battery to EVs,” Professor Hu Guorong of Central South University in China said at a conference. “We need to develop cobalt-free battery in accordance to technology developments.”

Speaking with INN earlier this year, Jon Hykawy of Stormcrow Capital explained that cobalt is not really an energy booster in these batteries; it’s a safety mechanism, and that’s necessary.

The expert is bullish on cobalt in the long term, but supply is something to watch out for.

“For the next year to 18 months, I’d say we’re still in a situation where the supply is definitely higher than the demand that goes along with it,” he added.

Benchmark Mineral Intelligence forecasts total cobalt demand in 2019 to be 128,500 tonnes. And, despite the trend to move to lower cobalt content in cathodes, the firm still believes the impact of any changes in batteries is far outweighed by the growth in demand in the next five years.

Cobalt market update: What’s ahead?

As the third quarter of the year begins, there are key factors and announcements that could impact the cobalt market.

In terms of prices, Rawles expects to see further falls over the summer, although prices are already at very low levels.

“There is a chance that prices will recover slightly in late Q3 and into Q4 as this is generally a period of peak activity for the battery industry,” Rawles said. “A key factor will be to see how significantly the subsidy reduction impacts sales of EVs in China.”

“This will of course impact raw material demand, but also, importantly, it will have a heavy influence on sentiment within the industry — something which probably plays as significant a role on pricing in the cobalt market as supply and demand,” he said.

Another catalyst to keep an eye on is any major changes in supply from the DRC, but also refining, particularly in China.

“With prices as low as they are, we are starting to see it impact the supply side of the market in various ways with production slowing or stopping altogether in some cases,” Rawles added.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: First Cobalt is a client of the Investing News Network. This article is not paid-for content.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.