Drill Tracker Weekly: Sama Drills Near-surface, High-grade Nickel Sulfides at Samapleu

Sama Resources announced initial results from an infill drill program at its Samapleu nickel-copper sulfide project in Cote d’Ivoire.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

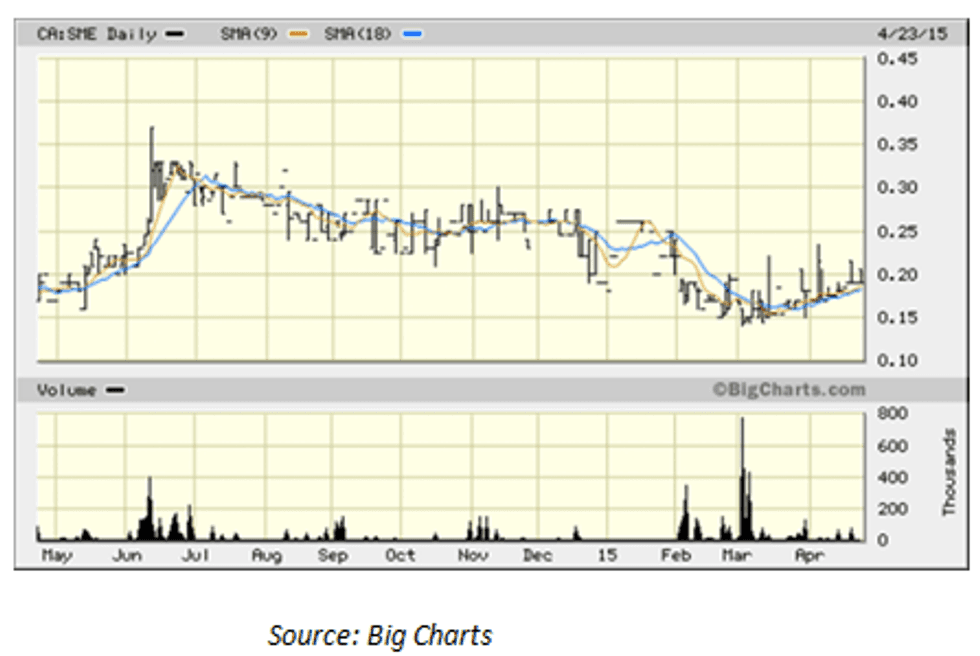

Sama Resources (TSXV:SME)

Price: $1.19

Market cap: $18 million

Cash estimate: $1.3 million

Project: Samapleu

Country: Cote d’Ivoire

Ownership: 66.6 percent

Resources: 12.4 MT @ 0.24% Ni, 0.20% Cu, 0.02% Co, 0.11 g/t Pt, 0.29 g/t Pd

Project status: Advanced exploration

- Sama Resources announced initial results from its 3-4,000 metre infill drill program on its 66.6% owned Samapleu nickel-copper sulphide project in Cote d’Ivoire. Sama Resources is 15% owned by MMG (China Minmetals) and 13% by the IFC (International Finance Corporation). Sama holds a 66.6% interest in the project with Société pour le Dévelopement Minier de Côte d’Ivoire (SOMEDI) holding the remaining 33.3%

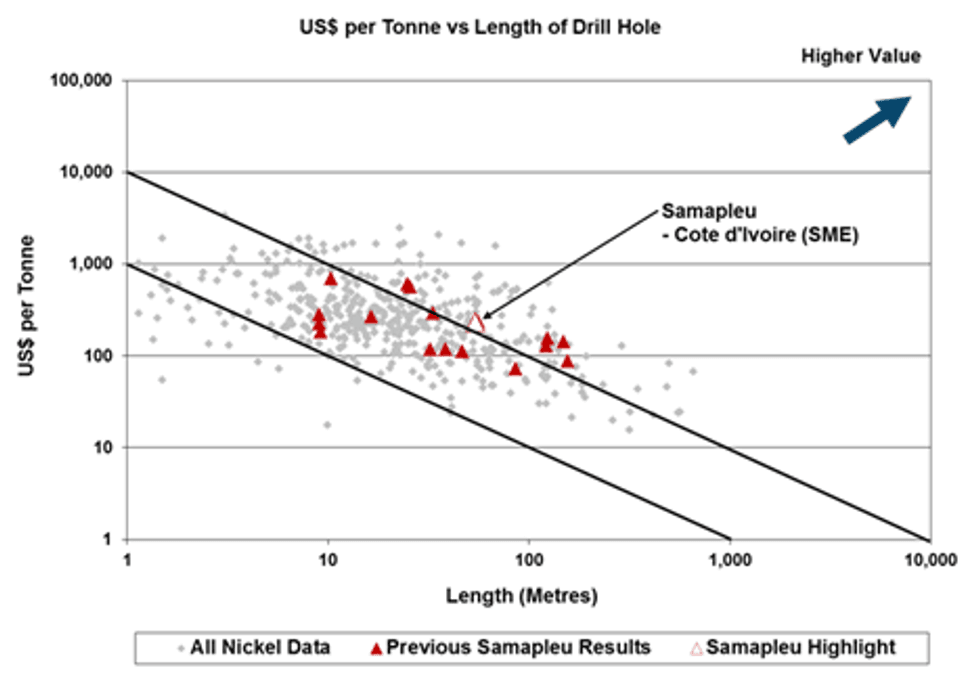

- Infill drilling intersected near surface mineralization at a depth of 15.0 metres grading 0.96% Ni, 0.76% Cu, 0.04% Co, 0.09 g/t Pt, 0.74 g/t Pd over 53.90 including two higher grade intervals separated by 2.35 metres of below cut-of material. Assuming zero grades for 2.35 metres interval gives a calculated and diluted grade of 3.15% Ni, 1.87% Cu, 0.11% Co, 0.017 g/t Pt and 2.25 g/t Pd over a drill interval of 10.35 metres. The Company reports that the drill orientation was designed to produce a near to true width interval.

- The deposit is believed to be a relatively small pipe-like feeder dyke to the Yacauba layered igneous complex within the centre of a 125 kilometre long mineral long mineralized zone extending across the border between Guinea and Cote d’Ivoire. The Company has a number of other targets in the area including the Yepleu and Bounta prospects.

- The 2012 resource estimate outlines a small, low grade deposit totalling 12.4 million tonnes grading 0.24% Ni, 0.22% Cu, 0.015% Co, 0.107 g/t Pt, 0.298 g/t Pd, 0.035 g/t Au and 0.010% Rh. The resource estimate was calculated using a 0.1% Ni cut-off grade. Preliminary metallurgical testwork indicates 75% recovery for nickel and 89% for Cu producing a low grade 18.5% Ni+Cu concentrate with a precious metal by-product. Precious metal recoveries are low at 48% Pd, 31% Pt and 30% Au.

Discovery history: First drilling conducted by SODEMI in 1982. Landon Capital (Sama) signed a joint venture with SODEMI in January 2009.

Current drilling: 54 metres @ 0.96% Ni, 0.76% Cu, 0.04% Co, 0.09 g/t Pt, 0.74 g/t Pd, including 2.90 metres @ 4.45% Ni, 2.20% Cu, 0.16% Co, 0.01 g/t Pt, 3.08 g/t Pd and 5.10 metres @ 3.87% Ni, 2.56% Cu, 0.14% Co, 0.03 g/t Pt, 2.83 g/t Pd.

Risks Analysis

Data contained in DRILL TRACKER WEEKLY is based on early stage exploration activity. The results are obtained at the very early stages of exploration and therefore, individual results may not be reproducible with additional trenching or drilling, nor may the results ultimately lead to the discovery of an economic deposit. Delineation of a resource body requires an extensive data gathering exercise according to guidelines set out in National Instrument 43-101 before investors can be reliably assured of a competent body of mineralization that may be of economic interest. DRILL TRACKER WEEKLY is designed to highlight individual trench or drill results, which stand out as being materially anomalous and are particularly worth of note – a type of early warning flag for a particular property that warrants further attention. Hence, DRILL TRACKER WEEKLY does not provide a recommendation to buy, sell or hold a specific equity – it is an information reference source to help quantify the meaning and relevance of early stage exploration results.

Relevant Disclosures Applicable to: Drill Tracker Weekly

1. The research analyst or a member of the analyst’s household owns and/or has options to acquire shares of the subject issuer. At the date of this release, Wayne Hewgill, owns no shares in any companies in this report.

Analyst Certification

I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. This report makes no recommendations to buy, sell or hold. Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.