Nova Royalty: Leveraging the Green Energy Movement With Strategic Copper and Nickel Royalties

Nova Royalty Corp. (TSXV:NOVR,OTCQB:NOVRF) has launched its campaign on the Investing News Network.

Nova Royalty Corp. (TSXV:NOVR,OTCQB:NOVRF) is taking the course to become a leading royalty company in the transition to the future of sustainable energy. With a diversified portfolio of strategically important and scarce royalty assets operating out of mining-friendly and highly prospective jurisdictions, this company is one to consider.

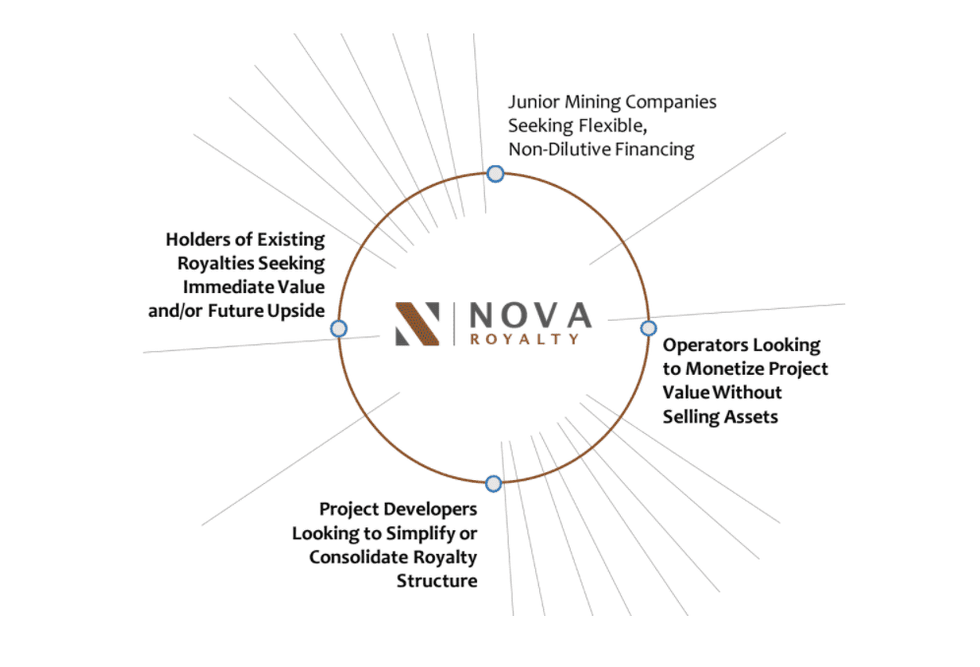

Nova Royalty has been acquiring royalties on copper and nickel in some of the world’s most strategic and prolific jurisdictions. The company’s royalty model offers direct exposure and optionality to commodity price appreciation and production increases while protecting investors from direct operating and exploration costs typically associated with a traditional mining business.

Nova Royalty’s Company Highlights

- Nova Royalty is a royalty company focused on leveraging the transition to green energy with direct investment in valuable copper and nickel assets, the building blocks for the energy transition.

- The company has a global investment portfolio with projects spanning strategic jurisdictions in Chile, Argentina, Canada and the US. The region that hosts the Dumont mining project in Quebec has the world’s largest emerging reserves of nickel.

- As a royalty company, Nova is exposed purely to revenues and is protected from any direct operating, carrying, exploration, or development costs. It offers optionality on copper/nickel price appreciation and production increase without additional costs.

- Strategic operators in Nova’s portfolio include First Quantum, Teck, Newmont, Waterton Global, Antofagasta, Rio Tinto and Transition Metals (TSXV:XTM). The company also has several other exploration royalties.