Nevsun Says Not So Fast: Board Rejects Hostile Lundin Bid

Nevsun has advised shareholders to take no action in regards to the C$4.75-per-share offer, revealing that there are alternatives on the table being explored.

The leadership of Nevsun Resources (TSX:NSU) has come back with a verdict on the July 26 hostile takeover bid from compatriot Lundin Mining (TSX:LUN), rejecting the C$4.75-per-share offer and taking the opportunity to announce a full strategic review.

“Nevsun’s board recommends that shareholders REJECT the hostile bid and DO NOT TENDER YOUR SHARES,” the company stresses in its Thursday (August 9) release, saying that the grass might be greener for shareholders if they wait.

“Tendering Nevsun shares to Lundin’s opportunistic hostile bid before the board and its advisors have had the opportunity to fully explore all available strategic alternatives to maximize shareholder value may preclude the emergence of a superior alternative transaction.”

The C$1.4-billion price tag Lundin slapped on Nevsun just doesn’t cut it, according to the board.

The company again revisited its talking points from last month, saying that the offer “fails to recognize the fundamental and strategic value” of Nevsun and its assets, and accusing Lundin of offering an inadequate premium for the shares given the work recently done furthering the Timok project.

Additionally, the company has taken umbrage at the fact that the offer is beneath the one announced in May, claiming that it is “lower in value than other alternatives which are expected to emerge.”

Nevsun did not name any other alternatives, but said that there are four attractive proposals on the table as a result of a review of financing opportunities to support the development of its prized Timok copper-gold project in Serbia.

“This process culminated on August 7, 2018 with four proposals being received from major and mid-tier mining and smelting companies indicating their willingness to purchase up to a 19.9 percent equity interest in Nevsun along with various proposals for partnering to develop the Timok project.

“Three of these proposals to acquire a non-controlling interest in Nevsun are at a premium to the price per Nevsun share offered in the hostile bid for full control of Nevsun,” states the company.

Nevsun said its board is evaluating the alternate offers, and reminded shareholders that as the bid is open until November 9, 2018, they have plenty of time to wait for more information.

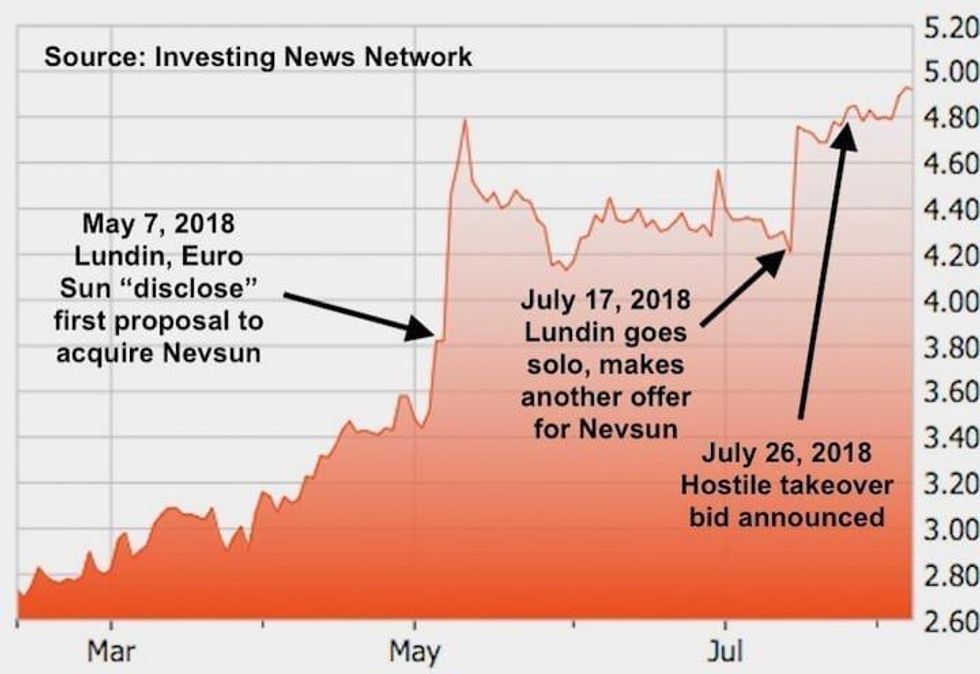

Clearly not in a waiting mood, in its message to Nevsun’s shareholders, Lundin claims credit for Nevsun’s boost in share value over the past few months, saying that the offer is an 82-percent premium on the company’s share price in February of this year, before Lundin approached Nevsun.

It also says the offer is a 33-percent premium on Nevsun’s share price prior to the announcement of the previous proposal in April, before Lundin and its former partner Euro Sun Mining (TSX:ESM) disclosed the negotiations in a bid to encourage shareholders to put pressure on Nevsun’s leadership.

Below: Nevsun’s share price in 2018.

“If the Offer is not successful and no competing transaction is made, Lundin believes it is highly likely the trading price of Nevsun shares will decline to significantly lower levels,” the company warns Nevsun shareholders on its website, also saying that in its own view, Timok requires US$700 million in pre-operational expenditures — a goal it paints itself alone as capable of achieving.

“While Nevsun has not formalized any plans yet to fund significant upfront and ongoing Timok costs, and the reinvestment plans needed to keep the Bisha mine open, it is very likely that Nevsun will require multiple phases of financing in the form of equity, stream/royalty and/or debt in markets which carry financing risks and likely significant dilution to Shareholders — all against a background of execution risk for such a large and complex asset.”

Nevsun says that the Timok upper zone will have a mine life of 10 years, producing over 1.7 billion pounds of payable copper.

In Toronto, Nevsun was trading at C$4.92 as of 12:00 p.m. EST on Thursday, down 0.81 percent. Lundin on the other hand was up 1.39 percent at C$6.90.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Scott Tibballs, hold no direct investment interest in any company mentioned in this article.