Drill Tracker Weekly: RTG Extends Magnetite Skarns to Depth at Mabilo

RTG Mining announced step-out drill results from its Mabilo project in the Philippines. The project was acquired through a June 2014 merger with Australia-based Sierra Mining. The drilling contractor, Galeo, has a right to earn a 42-percent interest in the project (to a depth of 200 meters), by providing US$4.25 million in exploration drilling and management services.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

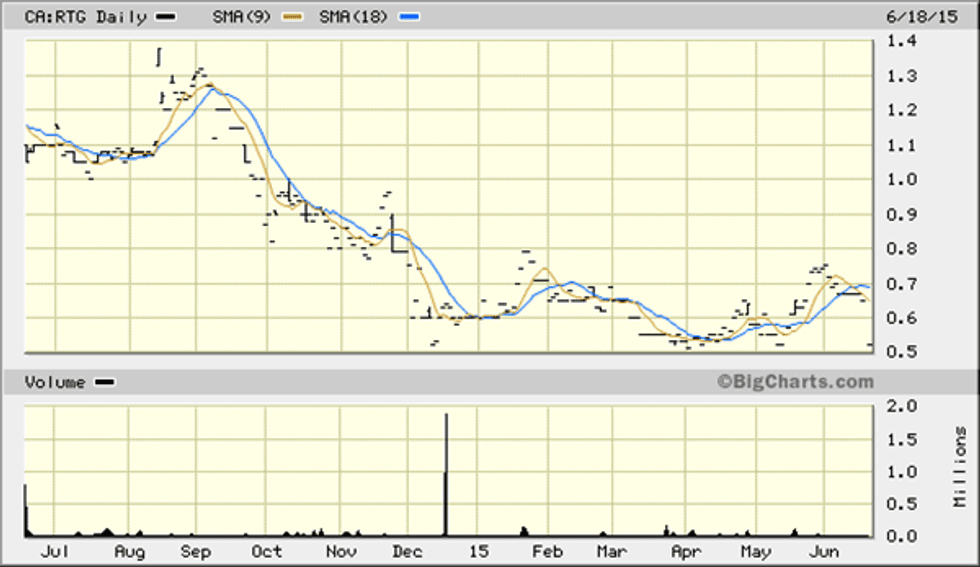

RTG Mining (TSX:RTG)

Price: $0.67

Market cap: $90 million

Cash estimate: AU$ 17 million

Project: Mabilo

Country: Philippines

Ownership: 58 percent (see text)

Resources: Indicated: 5.9 MT at 2.2g/t gold, 2.1 percent copper, 8.4 g/t silver and 49 percent iron

Project status: Resource definition

- RTG Mining announced step-out drilling results from its Mabilo Cu-Au-Fe project in the in Camarines Norte Province of the Philippines. The project was acquired through the June 2014 merger with Australian based Sierra Mining. The drilling contractor, Galeo, has a right to earn a 42% interest in the project (to a depth of 200 metres), by providing USD$4.25 million in exploration drilling and management services.

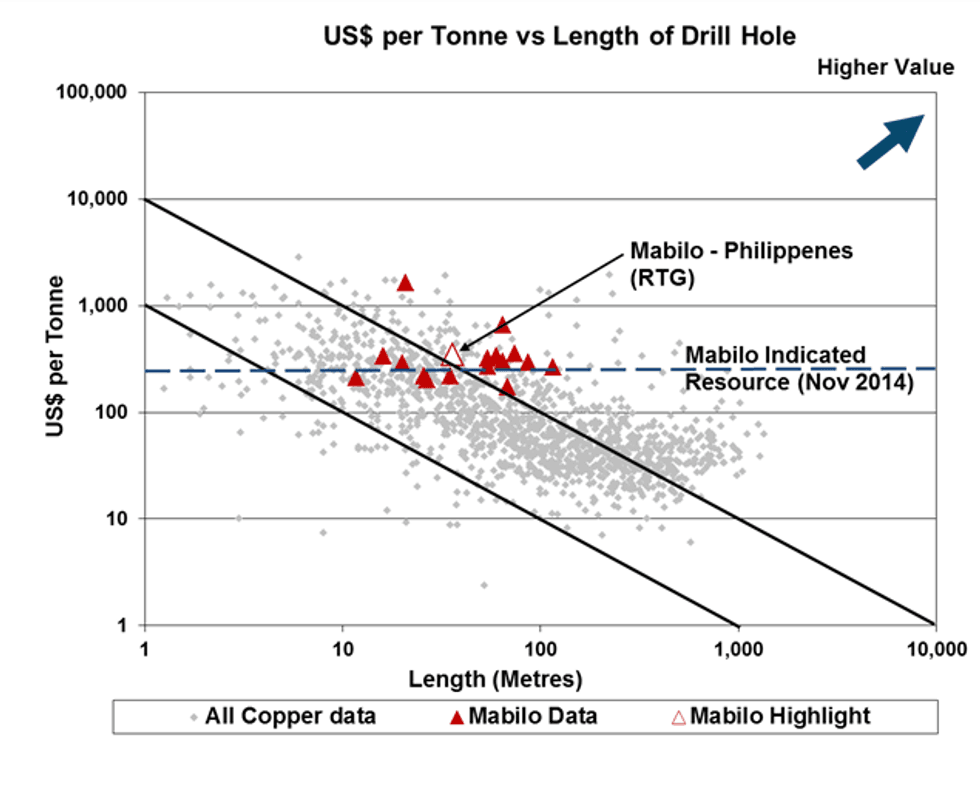

- Hole MDH-100 extended the magnetite skarn a further 30 metres along strike to the south with the highest grade interval in the primary mineralization to date. Including a high grade 1.0 metre interval of 24.59 g/t Au and 3.25% Cu the hole returned 36 metres averaging 3.34 g/t Au and 3.25% Cu starting at a depth of 282 metres. The most southerly interval encountered the first occurrence of high-grade secondary bornite after chalcopyrite possibly indicating a higher temperature environment.

- Mineralization in the main South Body occurs in two 45 degree dipping tabular bodies of skarn mineralization with an upper garnet rich body and a lower zone of massive magnetite skarn, with significant copper and gold associated with chalcopyrite and lesser bornite. In some areas the magnetite has been weathered to form a hematite skarn, with the copper remobilized forming high-grade supergene zones, dominated by chalcocite and massive native copper.

- On November 2014, the Company announced an initial NI 43-101 complaint (and JORC Code) indicated resource estimate of 5.9 MT at 2.2g/t Au, 2.1% Cu, 8.4 g/t Ag and 49% Fe with an additional inferred resource of 5.5 MT grading 1.7 g/t Au, 1.5% Cu, 12.9 g/t Ag and 39% Fe. The Indicated resource includes a near surface high-grade gold zone (340,000 t @ 3.2 g/t Au) as well as a supergene Chalcocite copper zone (101,000 t @ 24% Cu) that the Company believes may be able to provide early cash flow.

Discovery History Small scale artisanal miners exploited iron, copper and gold on the property

First drill hole (2012) – 66 meters at 2.1 g/t gold, 3.0 percent copper, 46.1 percent iron

Current Holes (South Mineralized Zone): 36 meters at 3.3 g/t gold, 3.25 percent copper including 1.0 meters at 24.59 g/t gold,

8.1 percent copper, 56 g/t silver

Risk Analysis

Data contained in DRILL TRACKER WEEKLY is based on early stage exploration activity. The results are obtained at the very early stages of exploration and therefore, individual results may not be reproducible with additional trenching or drilling, nor may the results ultimately lead to the discovery of an economic deposit. Delineation of a resource body requires an extensive data gathering exercise according to guidelines set out in National Instrument 43-101 before investors can be reliably assured of a competent body of mineralization that may be of economic interest. DRILL TRACKER WEEKLY is designed to highlight individual trench or drill results, which stand out as being materially anomalous and are particularly worth of note – a type of early warning flag for a particular property that warrants further attention. Hence, DRILL TRACKER WEEKLY does not provide a recommendation to buy, sell or hold a specific equity – it is an information reference source to help quantify the meaning and relevance of early stage exploration results.

Relevant Disclosures Applicable to: Drill Tracker Weekly

The research analyst or a member of the research analyst’s household owns and/or has options to acquire shares of the subject issuer. At the date of this release the author, Wayne Hewgill, owns shares in the following companies in this report: Fission Uranium Corporation (TSX:FCU)

Analyst Certification

I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. This report makes no recommendations to buy, sell or hold. Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.