Deep-South Discloses a Preliminary Economic Assessment, NPV: CA $ 895 Million, Pre-Tax IRR: 30.4% at a Price of Copper of US $ 3.00 Per Lbs, on The Haib Copper Project in Namibia

Deep-South Resources Inc. (“Deep-South” or “the Company”) (TSX-V: DSM) today announced that it has received the results of a Preliminary Economic Assessment (“PEA”) from Mineral Engineering and Technical Services of Australia (“METS”) on its Haib Copper project in Namibia.

Deep-South Resources Inc. (“Deep-South” or “the Company”) (TSXV:DSM) today announced that it has received the results of a Preliminary Economic Assessment (“PEA”) from Mineral Engineering and Technical Services of Australia (“METS”) on its Haib Copper project in Namibia.

Highlights of PEA

Four recovery options were considered for economic evaluation. The best economic outcome is derived by using option 3 which combines an initial ore sorter upgrade with subsequent heap leaching of the upgraded material. All financial metrics are based on the recent 43-101 indicated resource estimation of 456.9 MT @ 0.31% Cu. The salient features of this option are as follows:

Table 1: Option 3 financial metrics

| Financial Metric | $3.00/lb Cu Price | $3.30/lb Cu Price | $3.60/lb Cu Price |

| CAPEX | US$191.8M | US$191.8M | US$191.8M |

| Total Operating Expense1 | US$1.41/lb CuEq | US$1.42/lb CuEq | US$1.43/lb CuEq |

| NPV7.5%, pre-tax | US$716.2M (CA$895.3M) | US$883.1M (CA$1,103.9M) | US$1,049.3M (CA$1,311.6.1M) |

| IRRpre-tax | 30.4% | 34.9% | 39.2% |

| Payback Period pre-tax | 4.2 years | 3.6 years | 3.3 years |

| NPV7.5%, post-tax | US$463.1M (CA$578.9M) | US$567.4M (CA$709.3M) | US$671.3M (CA$839.1M) |

| IRRpost-tax | 23.0% | 26.1% | 29.1% |

| Payback Periodpost-tax | 5.7 years | 4.9 years | 4.4 years |

| Throughput (Mtpa) | 8.5 | 8.5 | 8.5 |

| Annual production lbs / CuEq | 47 million | 47 million | 47 million |

| Strip ratio | 2:1 | 2:1 | 2:1 |

| LOM | 55 years | 55 years | 55 years |

1Variable due to change in absolute royalty payment due to increased revenue

The PEA focuses on the potential of heap leaching treatment. Several opportunities are identified in the PEA that could significantly enhance the economic return outlined in the report, including more assays of the molybdenum to be included in future resources estimation, sorting technologies enhancing the recovery processing performance and reduced power costs. The PEA recommends these opportunities be pursued and to proceed with a pre-feasibility study (“PFS”).

“By going with heap leach treatment and sorting technologies, we have been able to provide low capital cost and operating costs and, equally as important, reduce the environmental footprint of the project,” said Pierre Leveille, President & CEO of Deep-South. “The PEA proposes a robust economic return that we expect to enhance during the PFS stage.”

Four recovery options were considered for economic evaluation:

Option 1: Ore sorter upgrading, dense media upgrading, flotation and heap leaching of the tails.

Option 2: Two-stage dense media upgrading, flotation and heap leaching of the tails.

Option 3: Ore sorter upgrading and heap leaching of the upgraded material.

Option 4: Whole ore heap leaching.

Table 2: Economic summary for the 4 recovery options

| Financial Metric | Option 1 | Option 2 | Option 3 | Option 4 |

| Throughput (Mtpa) | 8.5 | |||

| Copper Recovery (%) | 77.1 | 82.1 | 73.2 | 80.0 |

| CAPEX

($M) | US$221.2 | US$250.1 | US$191.8 | US$220.3 |

| Total Operating Expense

($/lb CuEq) | US$1.46 | US$1.47 | US$1.41 | US$1.37 |

| NPV7.5%, pre-tax ($M) | US$645.1

(CA$817.6) | US$662.6

(CA$828.3) | US$716.2

(CA$895.3) | US$794.1

(CA$992.6) |

| IRR pre-tax (%) | 25.9% | 24.4% | 30.4% | 29.7% |

| Payback Period pre-tax | 5.0 years | 5.3 years | 4.2 years | 4.3 years |

| NPV 7.5%, post-tax ($M) | US$421.0

(CA$526.3) | US$434.3

(CA$542.9) | US$463.1

(CA$578.9) | US$514.1

(CA$642.6) |

| IRR post-tax (%) | 20.0% | 19.0% | 23.0% | 22.6% |

| Payback Period post-tax | 6.7 years | 7.1 years | 5.7 years | 5.8 years |

Options 3 & 4 have shown better economic figures, despite option 3 having a relatively low copper recovery compared to the other options as the use of ore sorting technology has the benefit of reducing the downstream capital requirements. Those two options will be the object of further testwork and a Pre-Feasibility Study (“PFS”).

Option 3 is the case presented in this press release.

Economic Opportunity

METS believes a ramp up to 20 Mtpa as the project is nearing positive cash flow will increase the financial viability. METS have developed a scenario which focuses on option 3 – the best economic option in terms of IRR – in assessing the impact of increasing the scale of the project. The assessment looks at beginning the project at 20 Mtpa, however it is recommended to stage the expansion over a number of years (e.g. start at 8.5 Mtpa, increase to 10 Mtpa and then increase to 20 Mtpa for instance). The following table outlines the key economic outcomes for the larger throughput scenario (using the base case figures – e.g. $3.00/lb copper price).

Table 3: Option 3 at an increased 20 Mtpa throughput

| Financial Metric | 8.5 Mtpa Scenario

($3.00/lb Cu) | 20 Mtpa Scenario

($3.00/lb Cu) |

| CAPEX | US$191.8M | US$320.5M |

| NPV7.5%, post-tax | US$463.1

(CA$578.9) | US$854.9M

(CA$1,061.9M) |

| IRR post-tax | 23.0% | 28.6% |

| Payback Period post-tax | 5.7 years | 4.5 years |

| LOM | 55 years | 24 years |

A throughput optimisation study should be performed once a final process design has been selected.

Recovery Method

For the recovery of copper from the Haib deposit, heap leaching was considered for all options. The primary reasons for the selection of heap leaching is the low grade nature of the deposit and the vast scale of the orebody. Previous work conducted on the Haib project suggests that a conventional crush-grind-float and sale of copper concentrate is not economically feasible due to the low grade and hardness of the ore – requiring a significant amount of energy for grinding. The low costs associated with heap leaching compared to a whole ore flotation circuit is believed to improve the viability of the project. Heap leaching is traditionally performed on oxide material, although there has been increasing development in the application to acid insoluble sulfides.

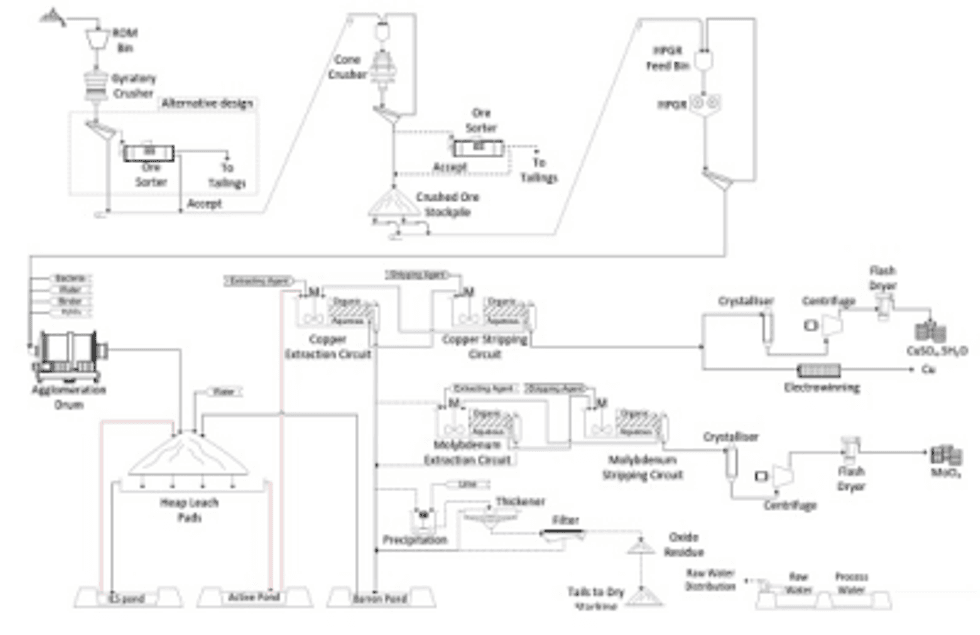

Previous sighter amenability testwork, carried out by Mintek, METS and SGS South Africa, suggests the Haib material can extract high amounts of copper, up to 95.2% via a bacterial assisted leaching, although additional testwork is required to determine the optimal operating parameters. Given these results there is no reason to suggest the chalcopyrite in the Haib deposit will not be amenable to bacterial assisted heap leaching. The system design proposed will use 3 crushers and an ore sorting system (either on the primary crushed product or the secondary crushed product depending on the technology selected) that will provide higher grade ore to the heaps. The primary crusher will reduce the rock to 127 mm (gyratory crusher), the secondary crusher to 32 mm (cone crusher) and the tertiary crusher to 5 mm (HPGR). The process is designed for a 90% availability, processing over 23,000 tonnes of ore per day (at the 8.5 Mtpa scenario) at a strip ratio of waste:ore of 2:1.

Haib Copper flow sheet diagram:

Click Image To View Full Size

Molybdenum recovery has been considered for the flowsheet design, although no operating expense, capital expense or revenue has been considered for the economic analysis. The economics of the molybdenum will be assessed once it is included in the indicated resource.

An indicated resource of 456.9 Mt at 0.31% copper at an annual throughput of 8.5 Mtpa would correspond to a 55 year project life. Due to the long project life, it is suggested to start at 8.5 Mtpa and operate at this throughput for approximately 3 years and then execute staged expansions to eventually ramp up to 20 Mtpa, ultimately shortening the project life. As the resource expands and the inferred resource progresses towards measured, then additional expansion to possibly 40+ Mtpa should be assessed. All flowsheets, mass balances, design criteria and equipment lists are based on an 8.5 Mtpa throughput; although financial components have been scaled to provide estimates for the higher throughput scenario.

The PEA technical report will be filed on SEDAR at www.sedar.com and on the Deep-South website at www.deepsouthresources.com shortly after the issuance of this news release.

Geology & Mineralization

The Haib deposit is located within part of the Namaqua-Natal Province called the Richtersveld geological sub-province which is further subdivided into a volcano-sedimentary sequence (locally, the Haib Subgroup), the Orange River Group and the intrusive Vioolsdrift suite which are closely related in space and time.

The principal mineralised hosts at the Haib are a Quartz Feldspar Porphyry (QFP) and a Feldspar Porphyry (FP).

The Haib deposit is in essence a very large volume of rock containing copper mineralization. The grade is variable from higher grade in the three core zones progressively dropping towards the margin of the deposit.

The principal sulphides within the Haib body are pyrite and chalcopyrite with minor molybdenite, bornite, digenite, chalcocite and covellite.

Mineral Resources

The mineral resources for the Haib Copper Project were estimated by Dean Richards of Obsidian Consulting Services, supervidsed by Peter Walker of P & E Walker Consultancy, both independent Qualified Persons as defined by NI 43-101 and were reported in a news release dated January 16, 2018 but are summarized below for convenience. Readers should review that news release for additional information or read the full report that can be viewed on our web site at: www.deepsouthresources.com or on the SEDAR web site at: www.sedar.com.

Table 4: Classified mineral resources of the Haib Project at a 0.25% Cu cut-off grade

| Resource Class | xMillion Tonnes | Cu(%) | Contained Cu x billion lbs |

| Indicated | 456.9 | 0.31 | 3.12 |

| Inferred | 342.4 | 0.29 | 2.19 |

Notes:

1- Dean Richards of Obsidian Consulting Services, a Member of the Geological Society of South Africa and Professional Natural Scientist (Pr. Sci. Nat) with the South African Council for Natural Scientific Professions (SACNASP), estimated the Mineral Resources under the supervision of Peter Walker of P & E Walker Consultancy, both of whom are the Qualified Persons for the Mineral Resource Estimates. The effective date of the estimate is January 15, 2018. Mineral Resources are estimated using the CIM Definition Standards for Mineral Resources and Reserves (2014).

2- Reported Mineral Resources contain no allowances for hanging wall or footwall contact boundary loss and dilution. No mining recovery has been applied.

Rounding as required by reporting guidelines may result in apparent differences between tonnes, grade and contained metal content.

Table 5: Haib copper indicated mineral resources, sensitivity cases

| %Cu Cut-off | xMillion Tonnes | Cu(%) | Contained Cu x billion lbs |

| 0.20% | 904.8 | 0.27 | 5.39 |

| 0.25% | 456.9 | 0.31 | 3.12 |

| 0.30% | 219.8 | 0.36 | 1.74 |

Table 6: Haib copper inferred mineral resources, sensitivity cases

| %Cu Cut-off | xMillion Tonnes | Cu(%) | Contained Cu x billion lbs |

| 0.20% | 686.2 | 0.26 | 3.93 |

| 0.25% | 342.4 | 0.29 | 2.19 |

| 0.30% | 109.8 | 0.34 | 0.82 |

This Haib Copper Mineral Resource has been defined by diamond core drilling covering a total surface area of some 2.6 square kilometres.

The mineral resource classification is closely related to data proximity. Topographic elevations within the mineral resource area vary from 320m to 640m above mean sea level and average 480m above mean sea level.

Indicated resources are constrained between the variable topographic surface and a horizontal level which is 75m above mean sea level and within which the majority of the drill and assay data are constrained. Inferred resources are laterally constrained by the last line of drill holes and extend vertically from the horizontal surfaces defined by the +75m and -350m above mean sea level ( a block of 425m thickness) within which there is a lesser data set derived from drilling.

Mineralization is open near surface and at depth to at least 800 metres deep. The Mineral Resource estimate is based on the results from approximately 66,500 metres of drilling in 196 holes. The most recent drilling data comes from Teck Resources drilling programs totalling 14,500 metres (2010 & 2014) and from re-assaying a part of the 164 historical drill cores which are well preserved on site. Indicated Resources are defined by a drill grid of 150 metres by 150 metres, while Inferred Resources are defined by a drill grid of 300 metres by 150 metres.

The Haib Copper exploration licence provides significant potential for resource expansion, since there is known, but poorly drilled and assayed, mineralisation beyond the drill grid boundaries and below the main mineralised body (which covers some 2 square kilometres of surface area), where a few drillholes from 75m above mean sea level to -350m above mean sea level (i.e. a thickness of 425m) have shown that mineralisation is present. The deepest drillhole did not pass out of mineralised material. In addition, there are 5 satellite mineralised target areas surrounding the main Haib porphyry body which still require further evaluation.

Mineral Resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. These mineral resource estimates ar based on Indicated Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. However, there is no certainty that these indicated mineral resources will be converted to measured categories through further drilling, or into mineral reserves, once economic considerations are applied. There is no certainty that the preliminary economic assessment will be realized.

Mineralogy

The Haib Copper Deposit is a large sulphide ore deposit. Copper is mainly present as a sulphide in the form of chalcopyrite. Copper is also present as oxides (chrysocolla, plancheite, malachite and azurite), occurring as intrusions in shear zones.

Initial testwork results showed that the Haib mineralisation is a competent quartz feldspar porphyry rock.

It can be seen that the main ore is copper with only an accessory amount of molybdenum present. The chalcopyrite also occurs as occasional coarse irregular grains from 0.1 mm to 0.35 mm.

Mining Methods

Considering the Haib copper deposit characteristics, the suitable mine design is based on an open pit method. As the deposit is basically composed of hard rock material, the mining operations will involve drill and blast of all excavated material, which will be segregated by cut-off grade.

The mining fleet considered being suitable for the Haib project would most likely consist of between 80 t and 120 t sized hydraulic excavators, off highway dump trucks with a capacity of between 65 t to 90 t, supported by standard open-cut drilling and auxiliary equipment.

Tailings disposal

Option 1 and 2 will generate approximately 250 ktpa tonnes per annum of tailings from the flotation circuit. Due to environmental and water recovery considerations the tailings will undergo dry staking. All options include dry stacking of the iron oxide waste from the iron removal stage (250-500 ktpa depending on the process option). The remaining waste will either be from the ore sorter rejects or from the heap leach pads (~8 Mtpa) and will be coarse rock material. The heaps will remain in place and undergo periodic washing to ensure copper extraction is maximised. Washing will be stopped once the ore is considered ‘spent’. The ore sorter rejects and the spent ore can be disposed of in a manner that produces a suitably stable landform.

Environmental considerations

In terms of environmental aspects, dry stack facilities offer a number of advantages to other surface tailings storage options – some of these include:

- –Reduced water requirements, principally achieved by recycling process water and near elimination of water losses through seepage and/or evaporation;

- –Groundwater contamination through seepage is virtually eliminated;

- –Significant safety improvement with the risk of catastrophic dam failure and tailings runout being eliminated;

- –Easier to close and rehabilitate.

Waste rock storage

It is suggested to consider stockpiling the low-grade ore to process it at the end of mine life, in case the copper price increase considerable by the end of the mine life and/or a new mineral processing technology be created or developed.

Capital Cost

Direct capital costs were estimated at US $ 139.6 million, including off-site infrastructure. Indirect costs and a 10% contingency were estimated at US $ 52.2 million, which bring the initial capital cost to a total of US $ 191.8 million.

Table 7: Capital cost breakdown

| Cost (US$M) | Option 3 |

| Crushing & HPGR | 56.2 |

| Agglomeration & Heap Leaching | 12.4 |

| Copper Recovery | 32.1 |

| Iron Removal | 1.8 |

| Water | 2.8 |

| Reagents | 1.6 |

| Services | 2.0 |

| Sulphuric Acid Production | 22.0 |

| Supporting Infrastructure | 2.8 |

| First Fill | 6.0 |

| Working Capital | 14.0 |

| Insurance | 3.3 |

| EPCM | 14.0 |

| Contingency | 14.0 |

| Commissioning | 2.8 |

| Accommodation & Temp Services | 2.8 |

| Spares & Tools | 1.5 |

| Total (US$M) | 191.8 |

Operating Costs

Total operating costs, including capital leases as an operating expense, are estimated in the PEA as US $ 7.79 per tonne of ore processed, broken down as follows:

Table 8: Option 3 operating cost breakdown

| Area | Annual Cost

(‘000 USD) | Unit Cost

(USD/t ROM) | Unit Cost

(USD/lb CuEq) |

| Mining | 19,210 | 2.26 | 0.41 |

| Processing | 38,696 | 4.55 | 0.82 |

| Product Freight | 2,109 | 0.25 | 0.04 |

| Wharfage & Shiploading | 234 | 0.03 | 0.00 |

| Administration | 1,700 | 0.20 | 0.04 |

| Royalty | 4,224 | 0.50 | 0.09 |

| Total | 66,173 | 7.79 | 1.41 |

Note: Mineral Resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. These mineral resource estimates are based on Indicated Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. However, there is no certainty that these indicated mineral resources will be converted to measured categories through further drilling, or into mineral reserves, once economic considerations are applied. There is no certainty that the preliminary economic assessment will be realized.

Sulphur Burning Plant

The design for each option as it stands involves the burning of sulphur to produce sulphuric acid.

There are several possibilities for sulphuric acid sourcing, including purchasing from smelters within Namibia.

Buying in sulphuric acid at the start of the project life and building a sulphur burning plant once the project is cash flow positive may provide a better economic scenario.

This will allow for the sulphur burning plant capital to be deferred and the payback period to be shortened.

Risks

Aside from the usual risk associated with the advancement of a mineral project towards a production decision, such as metal prices, resource continuity, mineability, construction risk, capital and operating cost risk, the principal risk related to the Haib Copper Project is the confirmation of the heap leaching recovery and sorting technologies used in the PEA, which were based on preliminary testwork completed by University of Witwaterstrand, Mintek, METS and SGS South Africa. Additional testwork is required to confirm and potentially enhance the overall recovery performance of the project.

The major risks identified are detailed in the below list:

1- Insufficient metallurgical testwork has been undertaken.

Sampling of diamond core, ore sorting testwork, comminution, HPGR, heap leach tests are required;

2- Trade off studies are required regarding purchasing sulphur and making acid on site or purchasing sulphuric acid;

3- The optimum port and infrastructure needs further study work;

4- Specific mineralization sorting testwork success will be critical;

5- Variability within the deposit and;

6- Optimised transport routes.

Opportunities

Solar Energy: Given the semi-arid climate of Namibia, a solar energy farm may be an option for reducing the unit cost of power. This will also have positive social impacts for the project, which is expected to have a long life.

Project Expansion:

The resource tonnage allows for possible multiple expansion stages to be executed should the project proceed to once in production. A staged approach is recommended in order to de-risk the project by projecting that the project achieves positive cash flow prior to plant expansions.

Way Forward

The results from the PEA have been promising, going forward METS recommends Deep-South Resources move to conduct a Pre-Feasibility Study (PFS) as the next phase of the project.

Management hopes the outcomes of a Pre-Feasibility Study for the Haib Project will support the following:

- –An assessment of the likely technical and economic viability of the opportunity within a +/- 25% level of accuracy;

- –Optimization of the different mining, process, location and project configurations to determine and recommend the preferred optimum to be engineered during the Pre-Feasibility Study;

- –Evaluation of the project at different capacities;

- –Determination of any fatal flaws in the opportunity;

- –Development of the risk profile of the opportunity in relation to the key business drivers;

- –Determination of the nature and extent of the Work Plan to complete further geological, mining, metallurgical, environmental and marketing work needed to be completed or undertaken during the Feasibility Study;

- –An estimate of the costs, schedule and resources required to complete the Feasibility Study. In addition, an overall project schedule shall be prepared to indicate the overall timing of project implementation, commissioning and start-up, and ramp-up to full production;

- –Identify resources (internal and external) and services required to undertake further work on the opportunity;

- –If a Pilot plant is required, it will be implemented during this stage;

- –Upgrade the mineral resource (if required);

- –Stakeholder considerations and plans;

- –Risk assessment further refined and mitigation plans established and;

- –Environmental assessment to prepare an environmental impact study.

Quality Control and Assurance and data verification

The independent qualified persons for the Haib Copper PEA are Mr. Damian Connelly of Mineral Engineering and Technical Services, Mr. Peter Walker of P & E Walker Consultancy and Mr. Dean Richards of Obsidian Consulting Services.

Obsidian Consulting Services conducted a review of the QA/QC programme implemented by Teck using the certificates of analysis received from Acme Labs and provided by Teck. This review compared the results of field duplicates, blanks as well as the various standards utilised with respect to Cu and Mo.

The design of Teck’s drilling programme, quality assurance / quality control programme and the interpretation of results were under the control of Teck’s geological staff. The QA/QC programme is consistent with industry best practices. Drill core is logged and cut onsite, with half-core samples prepared at Analytical Laboratory Services, Windhoek, Namibia. Prepared samples are shipped to Acme Analytical Laboratories, Vancouver, Canada for appropriate base metal assaying and gold fire assaying techniques. All analytical batches contain appropriate blind standards, duplicates and blanks inserted at regular intervals to independently assess analytical accuracy and precision.

Mr. Walker and Mr. Richards reviewed the sample chain-of-custody, quality-assurance and quality-control (QA/QC) procedures, and the accreditations of analytical laboratories used by Teck. The QPs are of the opinion that the procedures and QA/QC are acceptable to support Mineral Resource estimation.

Mr. Walker also audited the assay database, core logging and geological interpretations and found no material issues with the data as a result of these audits.

In the opinion of the QPs, the data verification programs undertaken on the geological and assay data collected from the Haib Copper support the geological interpretations and the analytical and database quality, and the data collected, can support Mineral Resource estimation.

Qualified Persons

Damian E.G. Connelly, BSc (Applied Science), FAusIMM, CP (Met), Director of Mineral Engineering Technical Services is the main author of the Preliinary Economic Assessment report and is responsible for the technical part of this press release and is the designated Qualified Person under the terms of National Instrument 43-101.

Peter Walker B.Sc. (Hons.) MBA Pr.Sci.Nat. of P & E Walker Consultancy is the main author of the 43-101 resource estimation report, and is a Qualified Person under the terms of National Instrument 43-101.

Mr. Dean Richards Pr.Sci.Nat. , MGSSA – BSc. (Hons.) Geology, of Obsidian Consulting Services is the contributing author of the 43-101 resource estimation report and is a Qualified Person under the Terms of the National Instrument 43-101.

About Deep-South Resources Inc.

Deep-South Resources Inc. is a mineral exploration company largely held by Namibian shareholders and Teck Resources Ltd, which holds about 35% of Deep-South share capital.

Deep-South is actively involved in the acquisition, exploration and development of major mineral properties. Deep-South currently holds 100% of the Haib Copper project in Namibia, one of the largest copper porphyries in Africa. Deep-South’s growth strategy is to focus on the exploration and development of quality assets, in significant mineralized trends, close to infrastructure, in politically stable countries.

More information is available by contacting Pierre Leveille, President & CEO at

+1-819-340-0140 or at: info@deepsouthresources.com or

Paradox Public Relations at +1-514-341-0408.

Cautionary statement on forward-looking information

Mineral Resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. These mineral resource estimates are based on Indicated Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves.. However, there is no certainty that these indicated mineral resources will be converted to measured categories through further drilling, or into mineral reserves, once economic considerations are applied. There is no certainty that the preliminary economic assessment will be realized.

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws.

Such statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of this release.

As well, all of the results of the 2018 Haib Copper preliminary economic assessment constitute forward-looking information, including estimates of internal rates of return, net present value, future production, estimates of cash cost, assumed long term price for copper of US$3.00 per pound, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, and estimates of capital and operating costs. Furthermore, with respect to this specific forward-looking information concerning the development of the Haib Copper Project, Deep-South Resources has based its assumptions and analysis on certain factors that are inherently uncertain. Uncertainties include among others: (i) the adequacy of infrastructure); (ii) unforeseen changes in geological characteristics; (iii) changes in the metallurgical characteristics of the mineralization; (iv) the ability to develop adequate processing capacity; (v) the price of copper; (vi) the availability of equipment and facilities necessary to complete development; (vii) the size of future processing plants and future mining rates, (viii) the cost of consumables and mining and processing equipment; (ix) unforeseen technological and engineering problems; (x) accidents or acts of sabotage or terrorism; (xi) currency fluctuations; (xii) changes in laws or regulations; (xiii) the availability and productivity of skilled labour; (xiv) the regulation of the mining industry by various governmental agencies; (xv) political factors, including political stability.

All such forward-looking information and statements are based on certain assumptions and analyses made by Deep-South’s management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believe are appropriate in the circumstances. These statements, however, are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information or statements including, but not limited to, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts to perform as agreed; social or labour unrest; changes in commodity prices, including the price of copper; unexpected failure or inadequacy of infrastructure, or delays in the development of infrastructure, the failure of exploration programs or other studies to deliver anticipated results or results that would justify and support continued studies, development or operations, and the results of economic studies and evaluations. Other important factors that could cause actual results to differ from these forward-looking statements also include those described under the heading “Risk Factors” in the company’s most recently filed MD&A filed by Deep-South. Readers are cautioned not to place undue reliance on forward-looking information or statements. The factors and assumptions used to develop the forward-looking information and statements, and the risks that could cause the actual results to differ materially are set forth in the “Risk Factors” section and elsewhere in the company’s most recent Management’s Discussion and Analysis report and Annual Information Form, available at www.sedar.com.

This news release also contains references to estimates of Mineral Resources. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral Resource estimates may have to be re-estimated based on, among other things: (i) fluctuations in copper prices or other mineral prices; (ii) results of drilling; (iii) results of metallurgical testing and other studies; (iv) changes to proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates; and (vi) the possible failure to receive required permits, approvals and licences, or changes to any such permits, approvals or licence.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

Click here to connect with Deep-South Resources (TSXV:DSM) for an Investor Presentation.

Source: www.thenewswire.com