Here’s an overview of the main factors that impacted the copper market in Q1 2021, and what’s ahead for the rest of the year.

Click here to read the latest copper price update.

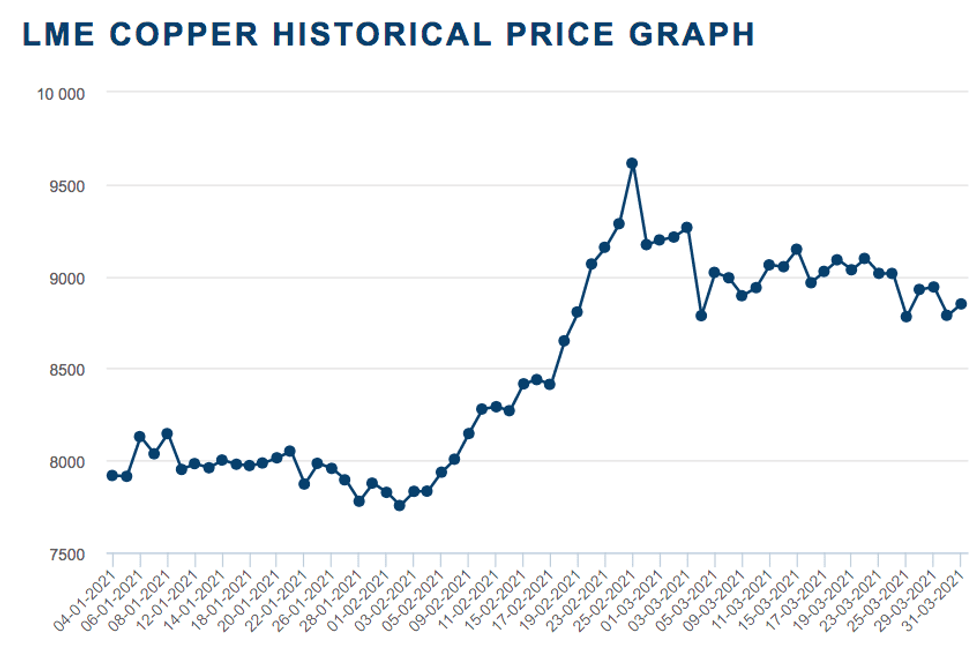

Copper prices increased more than 11 percent during Q1, hitting their highest level since 2011.

Demand expectations grew on the back of economic recovery from COVID-19, and as interest in the future of renewable energy and electric vehicles picked up pace.

With Q2 already in motion, the Investing News Network (INN) caught up with analysts, economists and experts alike to find out what’s ahead for copper supply, demand and prices.

Copper price update: Q1 overview

Copper started the year trading at US$7,918.50 per tonne, hitting its lowest level of the quarter on February 2 at US$7,755.50. Throughout the three month period, prices trended higher on anticipation of higher demand as economies opened up following strict lockdowns in 2020.

Q1 2021 copper price performance. Chart via the London Metal Exchange.

Copper’s price rally started in mid-February, and the red metal had jumped to a more than 10 year high by the end of the month. Its highest point of the quarter came on February 25, when the base metal was trading for US$9,614.50.

“Copper surged in early 2021 and outperformed consensus forecasts,” said Dan Smith of Commodity Market Analytics. “The main surprise was the strength of Organization for Economic Co-operation and Development manufacturing, with survey data pointing to rapid expansions in Europe and the US.”

Despite not being able to sustain its highest level, copper hovered around the US$9,000 mark for the rest of the period, ending the first three months of the year at U$8,850.50. That’s a more than 11 percent increase — a stellar quarter compared to Q1 2020, when the metal declined over 20 percent.

For Nick Pickens of Open Mineral, it is no surprise that copper prices have stopped rising and remain supported at around US$9,000, as the drivers haven’t changed.

“Healthy demand in China and government stimulus are supporting investor sentiment and hopes of a strong, green recovery. Meanwhile, the expected supply mine growth is stuttering,” he told INN.

Copper price update: Supply and demand dynamics

Chinese copper demand continued to grow in early 2021, helped by a strong rebound in industrial production and construction activity.

“However, domestic consumers are complaining about high prices and this is resulting in a reduction in local inventory levels,” Smith explained to INN. “The recovery in demand in Europe still looks reasonably strong, despite rising COVID-19 cases.”

Looking over to the supply side of the story, many copper producers are seeing rising COVID-19 cases, which is hampering output, particularly in Peru.

“Since the outright suspensions in Peru during the initial COVID-19 outbreak in Q2 2020, we have seen the mining industry rebound and manage production despite restrictions,” Pickens said. “There is a consensus view that mine production will rise this year, which would be the first time since 2018. And this increase could be anywhere up to 5 percent, even after allowing for disruption.”

According to the expert, this growth hinges on a relatively small group of large mines ramping up and rebounding from 2020 disruption — Grasberg, Cobre Panama, Cerro Verde and Las Bambas, with Spence and Kamoa-Kakula being the most significant new projects to start.

“However, so far in 2021, there has been no discernible impact, and certainly not on the concentrate market,” Pickens said. “On the contrary, disruptions to supply have been higher than average (albeit not as high as they could have been, given the global pandemic). So I think a recovery in mine supply is something to look for in Q2/Q3.”

When compared with Peru, Chile is performing much better, according to Smith, with its vaccination program progressing well. “But even there output is down in the early part of this year, reflecting structural problems and a lack of investment,” he said.

When looking at what’s happening in the scrap sector, the rebound in demand is straining the raw materials supply chain, resulting in very low treatment charges.

“While the rebound in China scrap imports is partly due to changes in government regulations, we expect imports to remain elevated through most of this year due to a lack of copper concentrate,” Smith said.

For Pickens, the strong prices globally have supported scrap availability, so consumers are now generally well covered. “In China, as import regulations continue to ease, we will likely see higher flows of material into the country, supplementing domestic supply,” he added.

Copper price update: What’s ahead?

Speaking about what could be ahead for prices, Smith said funds are targeting the previous high for copper, which was US$10,148, reached back in February 2011.

“The market is waiting for demand to catch up with bullish expectations, but momentum remains strong and this suggests another attempt to breach the record high will take place before too long,” he added.

As Q2 begins, investors should watch China, which is moving to tighten fiscal and monetary policy.

“Demand growth is likely to be disappointing as we enter the middle part of this year, which could set back bullish sentiment,” Smith said.

For FocusEconomics analysts, prices should fall from their near 10 year high as supply conditions improve, particularly in South America, where production levels should recuperate the losses sustained last year amid strikes and measures to contain the virus.

“That said, copper’s use in new technologies such as electric vehicles should support demand, moderating the decline in turn,” analysts added.

The firm’s panel projects that copper prices will average US$7,778 in Q4 2021 and US$7,497 in Q4 2022.

Looking further ahead, Gianni Kovacevic of CopperBank Resources (CSE:CBK,OTC Pink:CPPKF) told INN he sees a bright future as copper demand increases and supply struggles to keep up.

“Copper is going through a once-in-a-hundred-year pivot with this global transition to electrification,” he said. “The Green New Deal and on top of that the restimulation of the global economy, which is now well in excess of US$10 trillion dollars — they all help copper.”

Watch the entire interview with Kovacevic

In terms of what that could mean for prices, Kovacevic said that the current copper bull market is in seventh place compared to the last 10 copper bull markets.

“We’re (only) 10 months in. There’s also an unprecedented wave of new demand coming for copper — so this is interesting. Could this actually be the biggest bull market for copper in history? I think certainly it’s plausible,” said Kovacevic, who is also the author of “My Electrician Drives a Porsche?”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.