Altiplano Recommences Hugo Decline Development to Access Additional Cu-Au Mineralization at the Historic Farellon Mine, Chile

Altiplano Metals Inc. (TSXV:APN) is pleased to announce that management has recommenced advancement of the Hugo decline

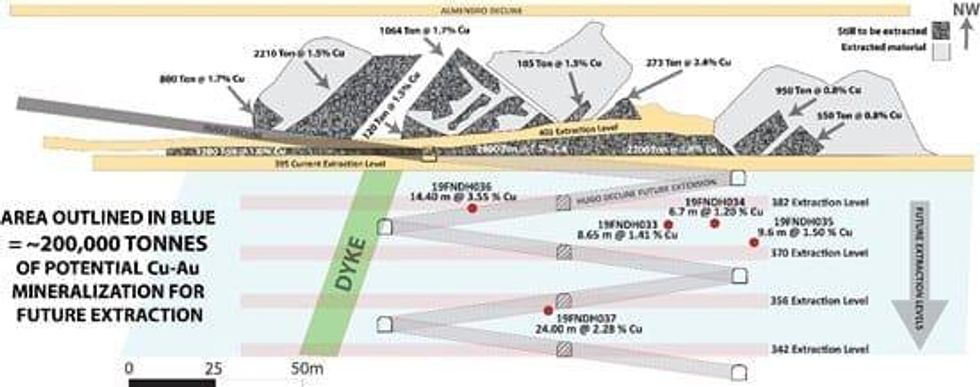

Altiplano Metals Inc. (TSXV:APN) (WKN:A2JNFG) (“Altiplano” or the “Company”) is pleased to announce that management has recommenced advancement of the Hugo decline which currently accesses the 401M and 395M underground extraction levels at the Company’s historic Farellon Copper-Gold Mine near La Serena, Chile. The advancement of the decline will continue over the next few months and will provide access to deeper parts of the Farellon Cu-Au vein system, which was intersected in 5 diamond drill holes completed in 2019 (see Table 1). This advancement will provide access for further bulk sampling of the Farellon mineralization below the 395M level (see Figure 1).

CEO Alastair McIntyre stated, “We are pleased to report the continuation of the Hugo decline which will facilitate continued evaluation of the Farellon Cu-Au vein system. We are excited to move the project forward as we work on this expansion and the development and building of the onsite processing facility.”

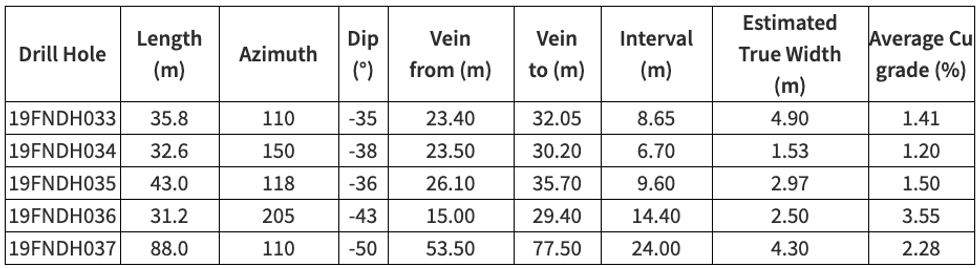

Table 1 – 2019 Drill Results

Over the next several months the company plans to advance the Hugo decline up to 53 m vertically below the 395M level. The decline extension will allow access to a potential 200,000 tonnes of Cu-Au mineralized material. Limited drilling completed in 2019 indicates that the vein system persists to depth with similar grades and widths as has been extracted over the last 15 months of bulk sampling. During this period Altiplano has extracted and processed 57,000 tonnes of mineralized material at an average grade of 1.75% Copper. This compares closely to the vein’s Inferred mineral resource, which was 278,360 tonnes at an average grade of 1.92% Copper (and 0.12 g/t Au) at a 1.0% Cu cut-off grade, as discussed in an independent Technical Report by APEX Geoscience Ltd. (Dufresne et al, 2018 – Link to associated press release). The Company plans to continue diamond drilling to provide additional information on the geometry of the vein system, as well as its resource potential, and to guide the Hugo exploratory drift advancement.

Figure 1: Simplified cross-section of the Farellon vein system showing the potential Cu resources below the 395M level. Based on the 2019 rate of extraction 200,000 tonnes may represent 3-4 years of future extraction.

Altiplano is utilizing information gained from past production records, ongoing diamond drill testing, and the current underground bulk sampling program itself, to estimate grades, widths and tonnages of the mineralization ahead of additional bulk sampling. The Company has not reported any Mineral Reserves for the project and no production decision has been made at this time. Should a production decision be made without completing a feasibility study demonstrating economic and technical viability, there would be increased uncertainty as well as economic and technical risks of failure associated with such a production decision.

John Williamson, P.Geol., Chairman of Altiplano, is the Qualified Person as defined in National Instrument 43-101 who has reviewed and approved the technical contents of this press release.

Altiplano Metals Inc. (TSXV: APN) is a mineral exploration company focused on evaluating and acquiring projects with significant potential for advancement from discovery through to production, in Canada and abroad. Management has a substantial record of success in capitalizing on opportunity, overcoming challenges and building shareholder value. Additional information concerning Altiplano can be found on its website at www.apnmetals.com.

ON BEHALF OF THE BOARD

/s/ “John Williamson”

Chairman

For further information, please contact:

Jeremy Yaseniuk, Director

jeremyy@apnmetals.com

Tel: (604) 773-1467

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the (TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts, that address exploration drilling, exploitation activities and events or developments that the Company expects are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability to obtain necessary permits, licenses and title and delays due to third party opposition, changes in government policies regarding mining and natural resource exploration and exploitation, and continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on the Company, investors should review the Company’s continuous disclosure filings that are available at www.sedar.com.