A look at what sent Proteostasis Therapeutics’ share price up 40 percent this week.

Investors might not yet be familiar with Proteostasis Therapeutics (NASDAQ:PTI) as the company only listed on the NASDAQ this year on February 11.

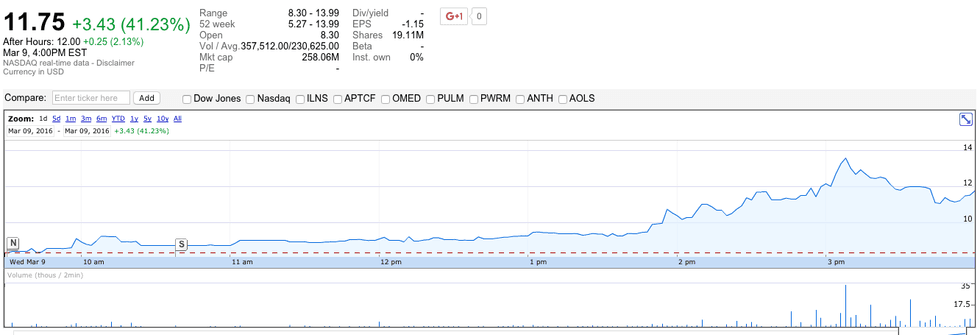

Since listing, the company has traded fairly flat, missing its expected price range by 30 percent at the low end and 40 percent at the high end. However, in the first half of this week, Proteostasis’ share price has risen by 107.6 percent. More impressively, it jumped more than 40 percent on Wednesday alone.

But what has accounted for the rise?

The fact that four analyst firms started covering the company this week appears to have led to the rise. Leerink Partners initiated coverage of the company on Monday, issuing an “outperform” rating and a price target of $13. Also issuing “outperform” ratings for the company were Baird, which set a $13 price target, and RBC Capital, whose price target is significantly more ambitious at $20.

Meanwhile, HC Wainwright’s Andrew Fein issued a “buy” rating with a price target of $15.

For investors wondering what has those analysts excited about the company, it’s worth getting a little background. Proteostasis is focused on developing novel therapies for cystic fibrosis (CF), a common genetic disorder that affects roughly 70,000 people worldwide. Although improvements in treatments have extended the life expectancy of individuals with CF, it remains an incurable disease.

The company has been working on developing novel therapies designed to pharmacologically control or rebalance an individual’s proteostasis network (PN). According to the company, disease, genetic mutation, environmental factors and aging can all cause the PN to become imbalanced.

Proteostasis’ lead candidate, PTI-428, received a fast track designation from the US Food and Drug Administration (FDA) in early February. PTI-428 is a novel and orally bioavailable CF transmembrane conductance regulator modulator that belongs to the amplifier class. Amplifiers, as the company notes, are CFTR modulators that selectively increase the amount of an immature form of CFTR protein, which in turn provides additional substrate for other CFTR modulators to act on.

The company has received FDA authorization to commence first-in-human studies for CF patients, which investors can expect to see happen sometime in the first quarter of 2016. Proteostasis’ goal with its Phase 1 clinical trial is to study safety, pharmacokinetics and preliminary phramacodynamics. The company’s final report is expected by the end of the year.

After its 41.23-percent increase on Wednesday, Proteostasis ended midweek trading at $11.75, up $3.42 for the day.

Securities Disclosure: I, Vivien Diniz, hold no direct investment interest in any company mentioned in this article.