Canopy Growth Will Take Goldcorp’s S&P/TSX 60 Index Spot

S&P Dow Jones Indices confirmed Canopy will replace Goldcorp in the large-cap index “prior to the open of trading on Thursday, April 18.”

Marijuana firm Canopy Growth (NYSE:CGC,TSX:WEED) will become the first cannabis company to join the S&P/TSX 60 Index (TSX:TX60) when it replaces a legacy gold company.

On Thursday (April 11), S&P Dow Jones Indices confirmed the C$19 billion Canadian cannabis company will be added to the large-cap index, taking the spot of Goldcorp (NYSE:GG,TSX:G).

The holding for the gold company in the index will be reassigned since the firm is set to be acquired by Newmont Mining (NYSE:NEM) in a deal worth US$10 billion.

Canopy’s inclusion will take place before trading opens on Thursday, April 18.

According to the index operators, the S&P/TSX 60 “addresses the needs of investment managers who require a portfolio index of the large-cap market segment of the Canadian equity market.”

In addition to the swap between firms, Goldcorp will also be dropped from the S&P/TSX Composite Index.

Shares of Canopy quickly rose during Friday’s (April 12) trading session. In Toronto, the company was up 4.81 percent at 2:17 p.m. EDT, while in New York shares of the firm rose 4.22 percent.

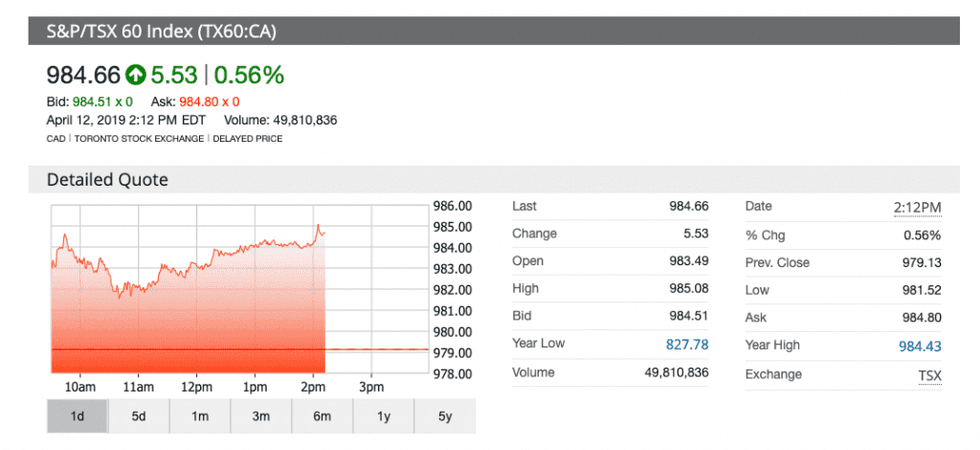

The S&P/TSX 60 Index was also up on Friday with a marginal rise of 0.59 percent.

Bruce Linton, co-CEO of Canopy, said in a press release that the inclusion marks another “major accomplishment” for the company.

Canopy has marijuana operations in Canada, Latin America and Europe. The company has also announced expansion plans to the US to produce hemp and sell derivative products.

The Canadian Press reported that the resulting entity from the Goldcorp acquisition is set to pursue a new listing on the Toronto Stock Exchange.

On Thursday, shareholders of Newmont approved the issuance of common shares in relation to the acquisition offer for Goldcorp. However, the acquisition closing date has not been indicated.

“We thank Newmont’s shareholders for their overwhelming support for this compelling value creation opportunity as we build the world’s leading gold company,” Gary Goldberg, CEO of Newmont, said in a press release.

The Financial Post reported that Newmont’s acquisition of Goldcorp will create the world’s largest gold miner, and that the new company could produce 6 to 7 million ounces of gold per year over the next 10 years.

Some of the top stocks by weight in the index include Canadian banks Royal Bank of Canada (NYSE:RY,TSX:RY), Toronto-Dominion Bank (NYSE:TD,TSX:TD) and energy firm Enbridge (NYSE:ENB,TSX:ENB).

The index holds a total of only 60 constituents; these inclusions are meant to be seen as long positions.

Don’t forget to follow us @INN_Resource and @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.