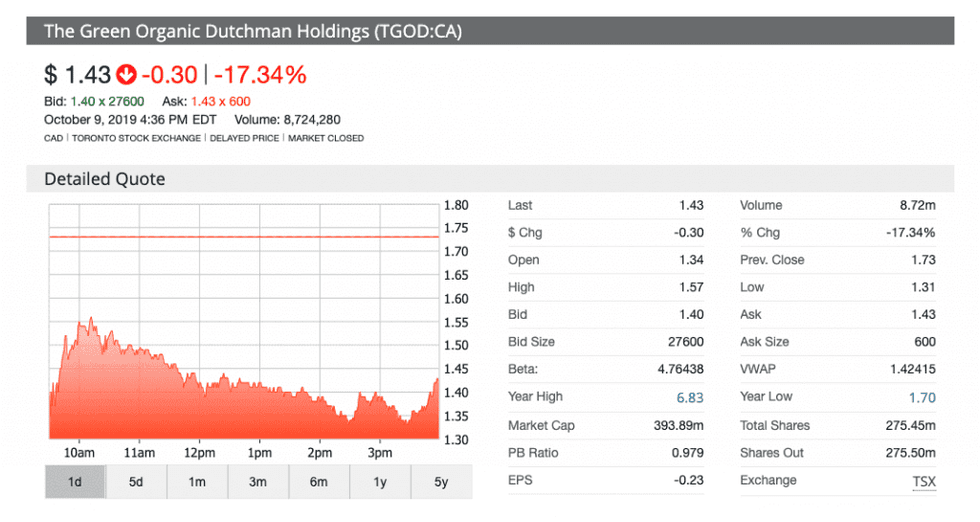

TGOD shares fell over 20 percent after the company said that, due to recent market conditions, financing sources “have been unavailable on acceptable terms within the timeframes required.”

Shares of The Green Organic Dutchman (TGOD) (TSX:TGOD,OTCQX:TGODF) sank on Wednesday (October 9) after the company announced it is looking into alternative means of financing to complete two of its growing facilities.

The Ontario-based cannabis producer said it has been seeking funding from commercial banking facilities through equipment leasing. Due to recent market conditions, however, “those sources of financing have been unavailable on acceptable terms within the timeframes required.”

The company’s share price sank 22.5 percent to C$1.34 when the market opened on Wednesday from a closing price of C$1.73 on Tuesday (October 8).

The market conditions TGOD referred to have affected the entire cannabis sector in both Canada and the US. This past summer was defined by high investor expectations and disappointing results, industry scandals and growing concerns about the safety of vaping products.

Since May, the North American Marijuana Index has dropped in value by over 50 percent.

TGOD told investors it may readjust the construction schedule for its upcoming facilities in Ancaster, Ontario, and Valleyfield, Quebec, if it can’t secure the necessary funding, and warned that there isn’t a guarantee the review will help find any new money.

Construction at Ancaster is “largely” complete, TGOD told investors, and the facility has all of the licensing from Health Canada necessary to grow cannabis. Any funds the firm does come into will be used to accelerate commercial production to boost revenues.

TGOD CEO Brian Athaide told BNN Bloomberg that the company is looking for C$160 million in bridge financing to finish off the facilities.

Athaide added that the company’s financial woes started after two asset-backed loans TGOD originally had in place fell through. This came after the company’s bank decided to wait to finance the deal until after TGOD was operational and had begun profiting from cannabis sales.

TGOD recently entered the recreational cannabis market with its first shipment of product to the Ontario Cannabis Store in August of this year.

Athaide said he hopes to secure a loan with a non-traditional lender, and added that the company expects to be cash flow positive by mid-2020, allowing it to refinance its loans.

The cannabis producer has had its share of struggles recently. In September, Aurora Cannabis (NYSE:ACB,TSX:ACB) sold off C$86.5 million worth of its remaining shares of TGOD.

The sale boded well for Aurora, boosting its share price, while TGOD shares took a hit after the news.

The company is debt free and has C$56.7 million in cash available in Canada, C$40.2 million of which is restricted cash set aside for capital expenditures. In August, TGOD reported C$2.9 million in revenue for the second quarter of this year, as well as a net loss of C$16.6 million due to setting up product commercialization in Canada and internationally.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.