In this Lithium-ion Bull (Forest Hills) article, Howard Klein covers the latest developments in the lithium space, from company to market news.

January 22 — Blind Faith Journey. Featuring Dire Straits & Moody Blues

I start today with a reminder of the strongly positive short (6-12 months), medium (1-4 years) and long (5-10 years) term lithium thematic:

2018 – “The Song Remains the Same” implies we get both the good – secular up Mega Trend; along with the inevitable pullbacks, triggered repeatedly and predictably by “oversupply fears”.

Coming back to Led Zeppelin’s Houses of the Holy. Side 1, Song 3. The End of the Lithium-ion Bull is…

Over the Hills & Far Away: https://www.youtube.com/watch?v=60iwmyhV8pQ

“Many have I loved, and many times been bitten

Many times I’ve gazed along the open road

Many dreams come true, and some have silver linings

I live for my dream, and a pocket full of gold

Mellow is the man who knows what he’s been missing

Many, many men can’t see the open road”

Mellow is the Aging Skeptic who knows what he’s been missing. It’s not too late, it’s early.

I live for my dream, and a pocket full of lithium (cash machines).

Remember: this is a Marathon, not a Sprint. A long-term Journey:

Don’t Stop Believing: https://www.youtube.com/watch?v=VcjzHMhBtf0

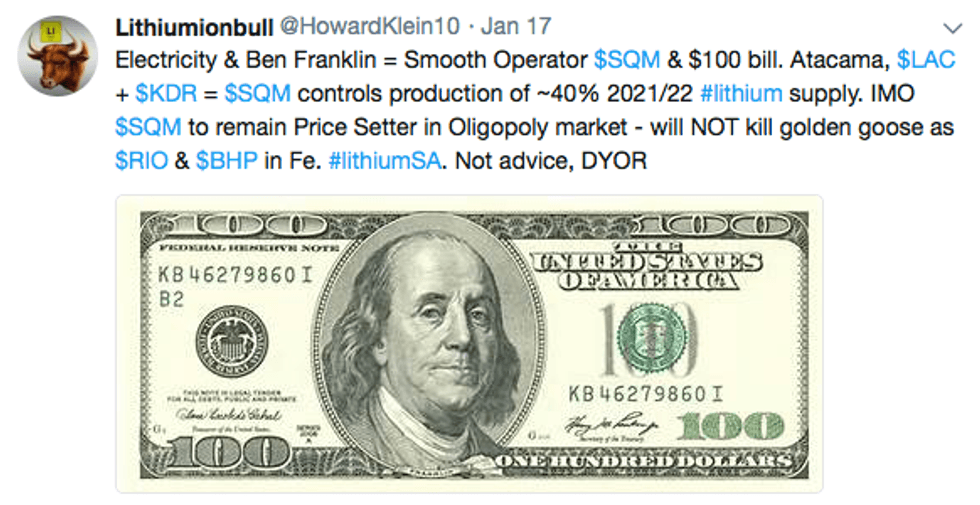

In September, I referenced via an automobile metaphor, Steve Winwood’s Traffic – Feelin’ Alright to describe how SQM made us all feel after their Investor Day.

Though “I Can’t Find My Way Home,” resonated last week, I say, Chillax. Have Winwood Blind Faith:

https://www.youtube.com/watch?v=IN1J5sMv28Q&list=PLIjkHGKwbuLkz49fpdJ-LfEoW95arp7s-

And Think: Vuja De, Tipping Point, Maturing on Optimism, Euphoria Coming

And Practice: Yoga, TM

Tree Pose: Sun Rising on 2018 #Lithium

The Empire Strikes Back?

I was sitting with the CEO of a lithium producer when SQM/CORFO news first hit via a Rosskill-buzz Tweet about 216,000 tons, quoting CORFO’s Eduardo Bitran.

First instinct was bleak:

Star (Alliance) Wars: The (Chilean) Empire Strikes Back

Empire Strikes Back – Original Trailer: https://www.youtube.com/watch?v=JNwNXF9Y6kY

I have since connected with 10+ fund managers in Australia, New York and Canada deeply invested and knowledgeable about the lithium space, an equal number of CEOs of lithium producers and advanced developers, several technical advisors who know brines intimately, and several bulge bracket and boutique sell-side advisors, to corroborate views.

A part of me wants to thank with all my heart all those research analysts that seem to be in competition with each other to be “The First” to call a “Lithium Top”. You constantly keep creating dip buy opportunities, while delaying financings, thus keeping supply tighter and lithium prices higher for longer.

Morgan Stanley. “Significant Li price downside risk”

HSBC. “Open the Floodgates”

CORFO surely deserves a Victory Lap. More on that later.

But I can’t help but think the non-political, Oligopolistic portion of the SQM brain, was not unhappy for this misperception to spread as a means to slow down or thwart the most advanced projects currently in market seeking full funding.

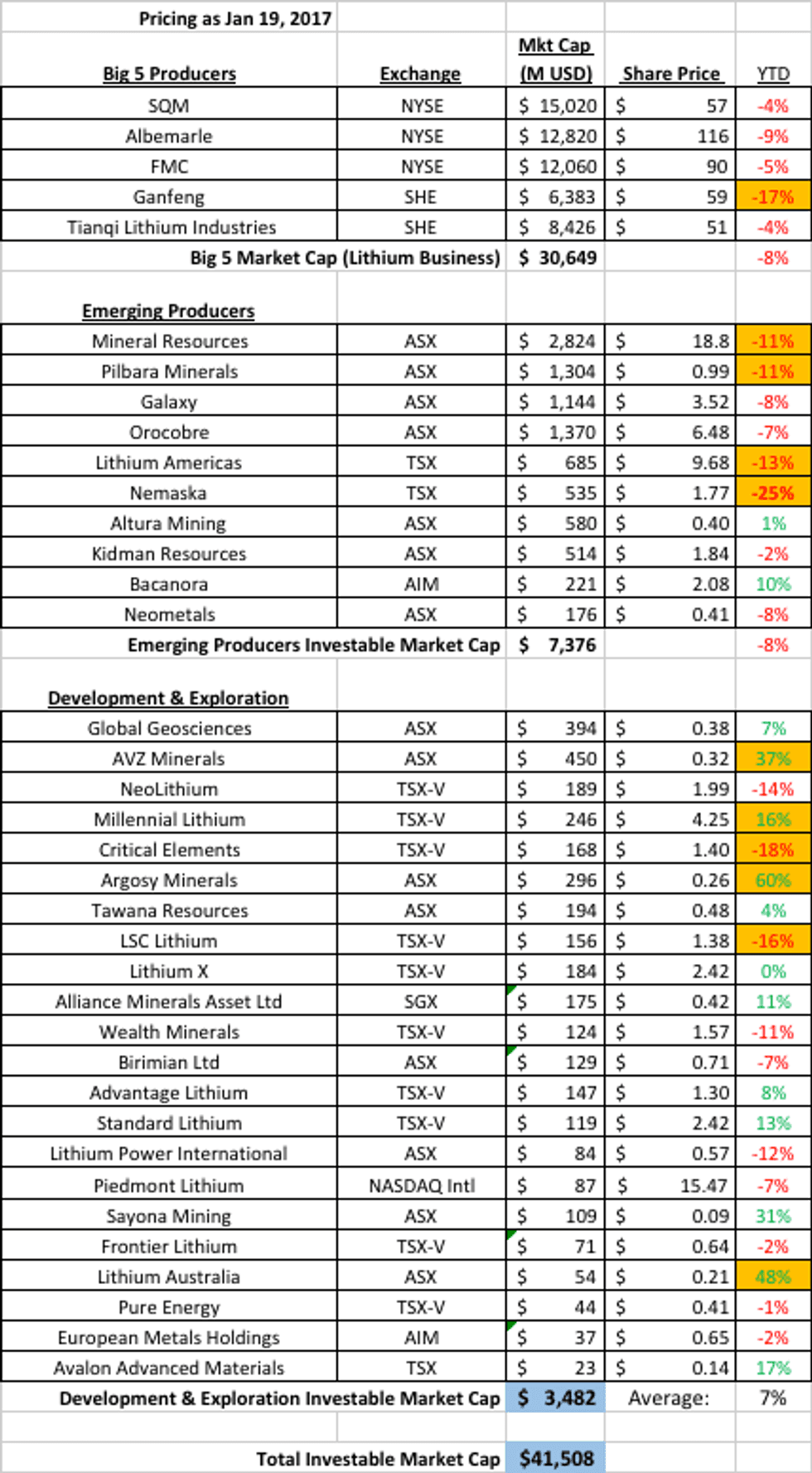

Among the Emerging Producers, Nemaska has been hit the hardest YTD (see below).

A senior executive from a prominent development project in Argentina emailed me:

“…We are not concerned and it’s a long term ramp up. They have essentially two mines in Atacama, a potash mine and a lithium mine. The brine they are reinjecting back is the high sulphate content one from the potash mine, which is extremely hard to process for lithium. They can’t triple their volume without severely affecting grade, flow rates and water balance. Also remember that ALB is trying to do the same from the same Salar.”

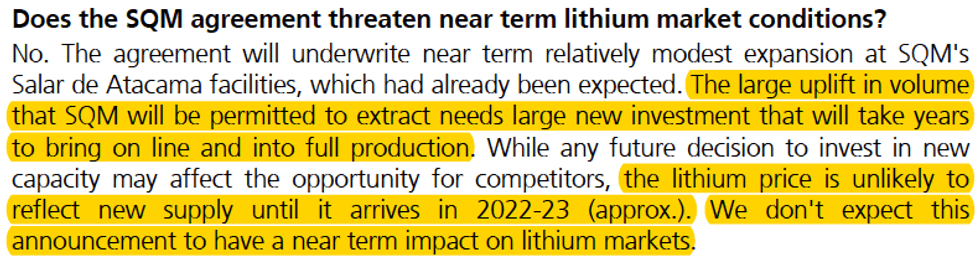

Congratulations UBS for getting it right…

And Cormark…

Bottoms Up!

The hard work and key differentiator at this stage of the lithium cycle is to have a true, proprietary supply model and realistic assessments of which new project may come on line and in what time frame. Very few banks allocate commitment to do this work properly – analysts’ coverage universe is too large and they must spend a lot of their time not doing actual research. No one making an “oversupply” call has done a credible, rigorous, convincing bottom- up analysis. Joe Lowry continues to do the best work on supply and has been the best price forecaster: $12-15/kg the “new normal” for several more years. I have been working with partners to create our own supply model.

I expect traditional investment bank research quality to deteriorate further now that MiFiD II has been introduced in Europe and is likely coming to the US. Fund managers now have to pay hard dollars for virtually everything brokers provide: conferences, 1×1 meetings, phone access to analysts. They will clearly pay for less of it and pass the “savings” to the investors in their funds. Active mutual funds, also under pricing pressure from the shift to passive management, will increasingly benchmark hug.

A series of new disruptions are occurring on a global basis. Artificial Intelligence, Big Data, Robotics, Electric Vehicle, Energy Storage, Blockchain. Each containing a distinct niche or niches. High growth, but still opaque.

This may sound contrarian in these days of all passive and ETFs all the time, but a confluence of factors are pointing toward a return to early hedge fund days – modest size AUM, thematic specialists, taking advantage of information asymmetries. Superior and super-normal risk-adjusted returns are available for those possessing an “edge”.

#callme

Air Supply

New nickname for sell-side fear-mongers writing lithium Short Stories.

Air Supply is anyone who hasn’t done the bottom up work but makes bold claims. This often manifests itself in textbook commodity economic theory we learned in business school: “…commodities always revert to mean and marginal cost of production….Lithium price is way above incentive price so entrants will quickly come in and meet demand… Lithium, of course, is not rare…It will all “End in Tears”…

Yeah, yeah. Eventually. In 8 -10 years, maybe. Lithium carbonate and hydroxide are Special. Specialty Chemicals. 10-20X EBITDA. The lithium supply chain is global and dozens of new, very large customers who have never thought about lithium are getting their heads around how to get a predictable, long-term source of supply. Lithium isn’t easy or super quick to produce. Production is not super scaleable.

James Bond Robert Friedland likes to talk about DRC copper and Clean TeQ’s clean and green cobalt/nickel sulphate at Project Sunrise in New South Wales. At Mines & Money London he commented about “Revenge of the Miners” given demand from EV revolution. His comments are even more applicable for those with quality lithium assets that can be put into production within 7-10 years, preferably sooner. All such issuers are currently inundated with strategic interest from massive companies from the US, Europe, Korea, Japan and China. Desperate for supply. Less sensitive on price, more concerned about security.

I see the lithium industry evolving in some ways like the copper industry, not so much iron ore. Economies of scale matter less in lithium compared to iron ore – $300-500M can build a highly profitable medium-scale lithium cash machine worth $1.5-$2B+. The top 4 companies probably will evolve to hold 50- 60% market share with another dozen or so other projects of scale held by another 10-15 companies. Just a guess.

New age, clean and green Dr. Lithium – the chemical with the PhD — may displace or at least be seen as comparable to old fogie Dr. Copper, the metal with the PhD, as a leading indicator of economic growth.

Meantime, whenever you hear Big Bank shouting “Oversupply,” think Air Supply.

No self-respecting Joe Battery Pack investor who is serious about making money in Lithium Rock and

Brine can tolerate listening to this type of music:

I’m all out of Love: https://www.youtube.com/watch?v=JWdZEumNRmI

Making Love Out of Nothing at All: https://www.youtube.com/watch?v=ogoIxkPjRts

Mr. Market Year-to-Date

While lower quality/higher risk lithium developers will almost certainly experience over the next 2-4 years: Dire Straits – Money for Nothing: https://www.youtube.com/watch?v=lAD6Obi7Cag

I have high confidence that in 2018/19 high quality assets and credible management teams look soon at

Royalty King CORFO news as another in a long line of: Sultans of Swing: https://www.youtube.com/watch?v=Il8ZC3O64AU

Or Psychodelic Moody Blues: Ride my See-saw: https://www.youtube.com/watch?v=Qggtp3Ffvwo&t=1s

Perhaps we will see increased prescriptions/demand for #lithium’s medicinal attributes ☺

I will restrict my comments in this issue to SQM and its partners Kidman and Lithium Americas.

Top Shelf Lithium Americas

In recognition of their new Big Boy status on the NYSE from this coming Thursday, LAC announced what is quite standard for NYSE-listed companies: a “shelf registration” for USD 500M in debt, equity or other securities that they can tap into OVER 25 MONTHS. What other Emerging Producer has such financial flexibility to tap US capital markets?

LAC is now filing according to greater and deeper corporate US disclosure rules, which, I assume, would implicitly lead to conservativeness in providing guidance: be extra careful to under-promise and over-deliver. To wit, LAC’s Operational Update included a vague “2020” start-up at Cauchari, when all prior guidance from SQM and LAC was 2H 2019.

In the context of Air Supply music driving us crazy last week Mr. Market inserted AC/DC Highway to Hell batteries inside Stairway to Heaven LAC mis- interpreting the shelf to mean some sort of immediate/dilutive equity raise. My gut tells me LAC may use this shelf some time for high yield debt to replace Ganfeng/Bangchak loan. Argentina is a bit of a darling with Wall Street debt investors and given Macri’s foreign investor charm offensive and accelerating GDP growth, I expect to see lots of USA capital deployed to Argentina.

Meantime:

- Cormark re-iterated LAC as their Top Lithium Pick and CAD 13.25 target

- Canaccord upgraded LAC from Hold to Spec Buy, $11 target.

- National Bank Financial also upgraded from Neutral to Outperform with a $12.5 target

Kidman Resources

In July, I said, Eyes Wide Shut

In September, I said, Who’s Next? Bargain

In December, I said, Long Live Rock

Today, in the face of another KDR collapse upon SQM news, I ask The WHO’s most famous question.

Who Are You? https://www.youtube.com/watch?v=PdLIerfXuZ4

Answer: an equal partner to what could be the lowest cost, longest lived miner and refiner of lithium hydroxide on the planet. In five-years-time, if not sooner, Mt. Holland may be considered SQM’s “flagship asset”.

Kidman has fallen in sympathy with LAC and in tandem with most every ASX Emerging Producer.

With the political/CORFO deal behind SQM, I suspect we’ll begin to hear more re-affirmation of their pedal-to-the-medal focus on advancing Mt. Holland, for anyone paranoid there might be a delay.

Blue Ocean Securities’ Steuart McIntyre just published a timely audio slide presentation re-iterating Kidman as their “Preferred Institutional Lithium Exposure”

https://www.blueoceanequities.com.au/kdr/

One more from The WHO.

I, Lithium-ion Bull:

Won’t Get Fooled Again (Live from Forest Hills!): https://www.youtube.com/watch?v=9CqPMbRqVNg

Will you?

Royalty King CORFO

I think it’s very fair to conclude that as far as lithium is concerned, Chile now has more Sovereign risk than Argentina and Australia.

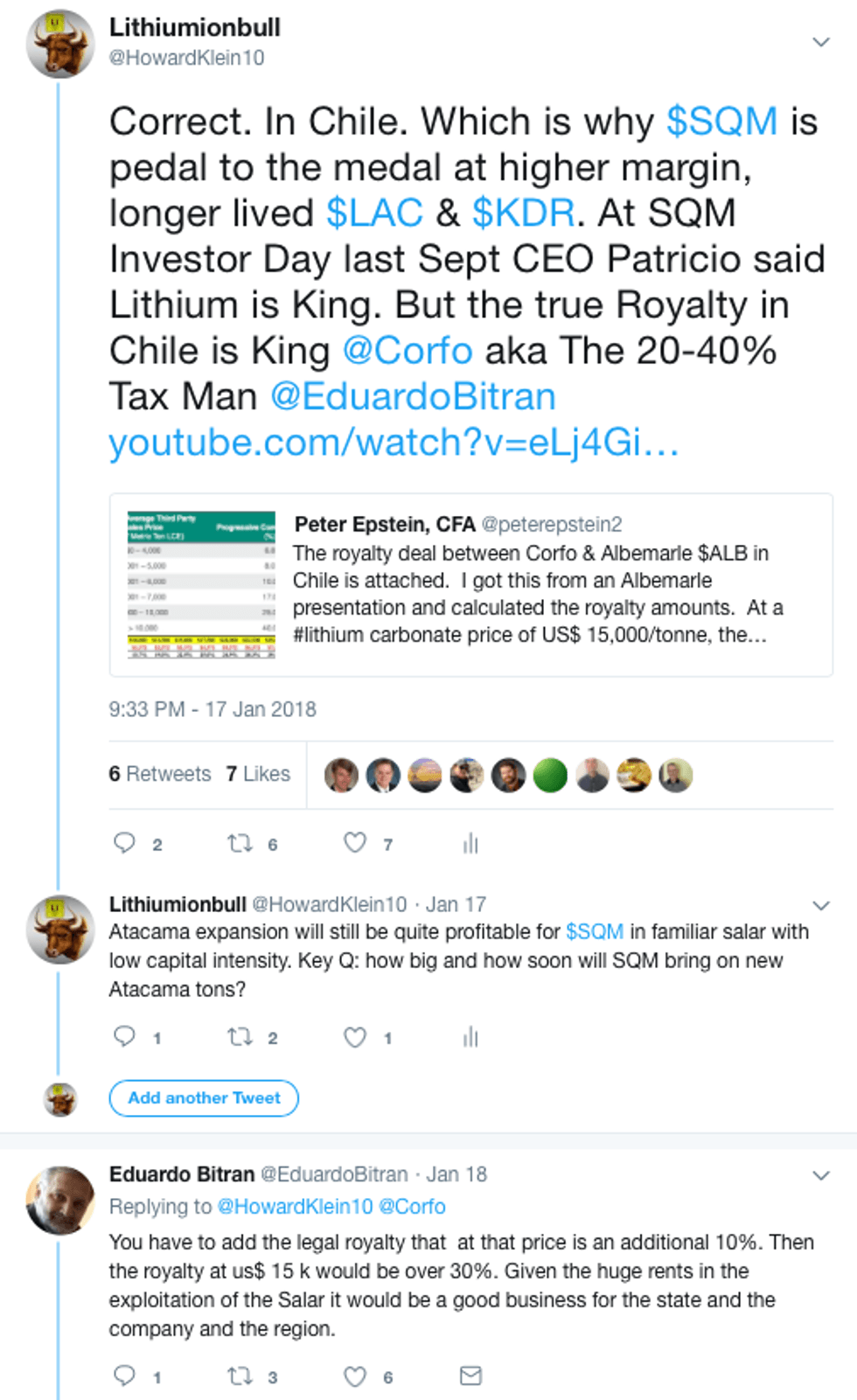

I was a bit surprised at how much Smooth Operator SQM seems to have had to capitulate, but I wonder if this deal will be further re- negotiated in a few years if Pinera delivers more bread to Chileans. I realized who won this latest round of negotiations when I was honored to be put among that small coterie of lithium commentators to receive a tweet reply from The Tax Man.

@EduardoBitran was further getting busy with @globallithium on Twitter on Saturday. Feel free to look it up.

Good or Bad for SQM?

I’m implicitly biased to believe the above tweet written before CORFO news hit. Fast forward to 2018 September Investor Day and/or their 25th NYSE Anniversary Bell Ringing, I anticipate SQM will talk ebulliently about progress at all three of their lithium operations, while continuing to show high lithium prices and forecast tight markets. But I’m a bit cautious about the heavy hand of Chile in the Atacama, which will reduce SQM’s earnings immediately via new royalty.

SQM has spoken before about having a “responsibility to its customers” to grow to meet their needs. SQM is making good on that responsibility through aggressive, but prudent growth, with Tier One assets diversified by country and product mix. I believe Mr. Market has not yet been pricing in what will be the key growth drivers and news flow for SQM over the coming years: Cauchari – the next big new brine being put into production; lowest AISC lithium carbonate. Mt Holland – perhaps the largest, lowest AISC, longest lived lithium hydroxide producer globally, located in a super low sovereign risk jurisdiction.

Mine Life. Mine Death.

Cauchari has a 40+ year mine life and SQM and LAC equally own the asset. Mt. Holland has a 50+ year mine life and SQM and KDR equally own the asset. Ownership is an important concept.

SQM owns nothing in Atacama. And the new agreement foreshadows a possibility that SQM will sell its lithium facilities to CORFO. It has only a 12-year lease with a put option to sell to CORFO “the facilities that are necessary to increase the additional production and operation capacity related to the increased lithium quota. The exercise price of this option is the replacement value of the facilities including depreciation.” Ownership is an important concept.

A good friend characterized it well – SQM is a Contract Miner on behalf of the people of Chile. Now paying 3-8X more in taxes than previously for the privilege to administer “The People’s Lithium”.

I would put a 30-50% probability today that the SQM/CORFO deal will be re-negotiate at some stage. But, immediate term, the deal should be considered the “base case scenario” for SQM’s flagship Atacama assets. Which means, Atacama, despite having the world’s lowest cash operating costs, now is the second or third lowest compared to Cauchari and Mt. Holland on the much more important AISC – all-in-sustaining-cost. 2030 “concession” means Atacama – Short Live Brine – has a 12-year Mine Death.

My friend Isuru Seneviratne of Radiant Value Management shared with me his view:

The terms of SQM’s settlement are pretty rough. CORFO forced SQM to acknowledge that the concession runs out in 2030 (irrespective of how much lithium is produced between now and then), and agree on:

- returning all assets to CORFO at end of concession

- granting a purchase option for the water rights acquired by SQM Salar (Atacama solar evaporation site) and production facilities (Carmen chemical processing plant).

This incentivizes SQM to keep pushing hard into Australia and Argentina, even as they negotiate extending the concession with Chile’s new government.

At first glance, SQM’s EBITDA fell from ~$1bn to ~$700m in 2018 and ~$800m in 2019. We are modeling Atacama capacity expansion of 43kta by 2021 (with utilization to follow). SQM has the ability to greatly increase debt from the current levels, so I doubt they will be capital constrained executing their growth plans across Chile, Argentina and Australia. But the massive dividend of 2016 will likely not be repeated.

With the changes in SQM’s corporate governance structure – and the stepping down of Julio Ponce – perhaps we will see some new approaches from SQM in terms of their financing strategy. They may lever up. Change dividend policy. If the Nutrien 32% block is sold to another strategic, SQM’s financial management and push for geographic diversification will likely increase.

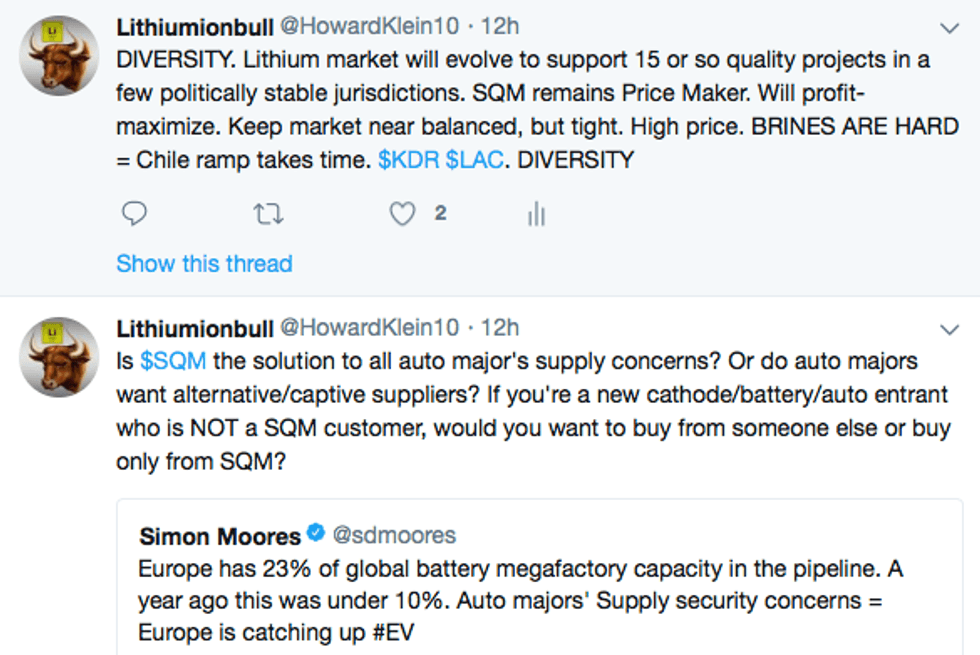

DIVERSITY was a subject of one of my Tweets referring to a Simon Moores’ comment on the enormous expansion of European auto majors worried about securing supply:

Don’t Forget Demand

In the wake of the SQM paranoia, it’s easy to forget that Ford announced $11B in EV investments, up from $4.5B, that Infiniti is another car company going all electric and probably another dozen relevant DEMAND data points that are coming so frequently it’s almost impossible to keep track.

Meanwhile, more proof from China on the Old Normal Synchronized Global Growth.

I shared some Must See TV as well from “I ain’t talking about rich, I’m talking about WEALTH” BlackRock.

Evy ‘my next car will be electric’ Hambro sounds an awful lot like Lithium-ion Bull:

On #lithium & battery materials:

“Fundamentally bullish…Structural (10-yr) demand that doesn’t exist in other commodities… Space Rocket junior lithium and battery materials investments in 2017…One up 1800%! …My Next Car will be Electric”.

Broader #commodities thematic: Bull Run in 2018 due to:

- Synchronized Global Growth;

- Six years under-investment in mining;

- Explosive Price Response;

- Robust Margins and Cash flow;

- Large PE discount to market

Disclaimer: Lithium-ion Bull (Forest Hills) is a periodic publication, written through my advisory firm RK Equity Advisors, LLC. I may act, or may have acted in the past, as a financial advisor, or capital raiser for certain of the companies mentioned herein and may receive, or may have received, remuneration for services from those companies. I, RK Equity as well as their respective partners, directors, shareholders, and employees may hold stock, options or warrants in issuers mentioned herein and may make purchases and/or sales from time to time, subject, of course, to restricted periods in which we may possess material, non-public information. The information contained herein is not financial advice and whether in part or in its entirety, neither constitutes an offer nor makes any recommendation to buy or sell any securities.