Aurora Cannabis Stumbles Following Fiscal 2019 Results

Aurora originally anticipated net revenues between C$100 million and C$107 million for its Q4, but missed the low end by 1 percent and the high end by 8 percent.

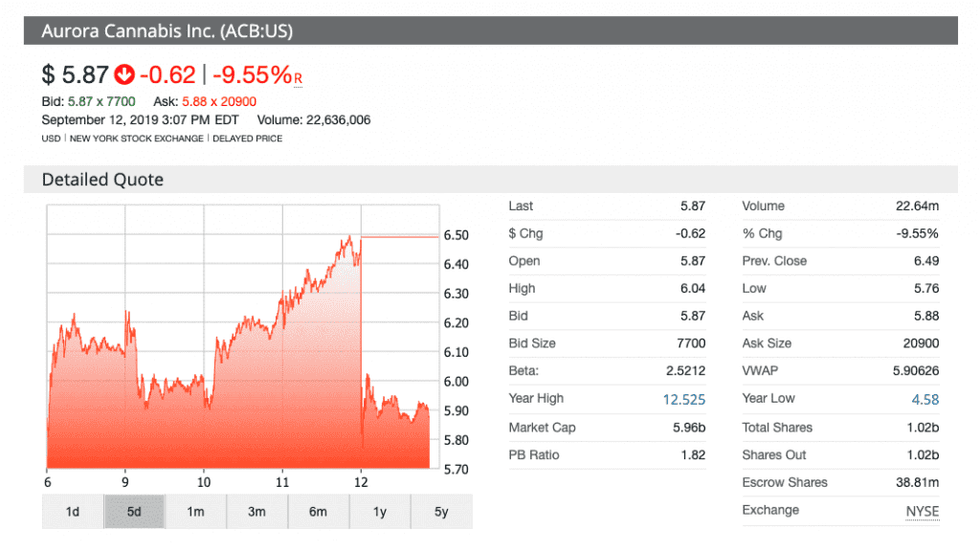

Aurora Cannabis’ (NYSE:ACB,TSX:ACB) shares were rocked on Thursday (September 12) after the company released the report for its fiscal Q4 and fiscal 2019 after trading hours on Wednesday (September 11).

In Toronto, Aurora closed at a price of C$8.51 per share on Wednesday and dropped to C$7.76 when markets opened in Toronto on Thursday, a decrease of almost 9 percent in value. As of 3:19 p.m., shares of the firm in New York sharply declined over 9 percent for the day, representing a price point of US$5.88.

Despite a net revenue of C$98.9 million for the most recent quarter, representing an increase of 52 percent over its fiscal Q3, the cannabis firm missed the goals it laid out in a guidance it released in August.

The company originally anticipated net revenues between C$100 million and C$107 million for the operating quarter, missing the low end of its target by 1 percent and the high end by 8 percent.

Net revenues for the entire fiscal 2019 year for Aurora came in at C$247.9 million, up almost 350 percent from its fiscal 2018 year.

The company sold 36,628 kilograms of the 57,442 kilograms of cannabis it produced over the course of the fiscal year.

During a call with investors, Aurora’s chief corporate officer Cam Battley said the net revenues were not reflective of the core cannabis revenues, which came in at the top of its guidance projection at C$94.6 million where the guidance had anticipated revenues between C$90 million and C$95 million.

Battley chalked up the difference in amounts to the company’s ancillary cannabis items, which were “more variable” than cannabis products when it came to sales. He added the performance of Aurora’s non-cannabis units managed under separate governance structures were less visible to the company.

“We required a lot from our ancillary companies and operations, specifically with respect to our analytical testing and our patient counselling, and we can’t record revenue internally for intra-company transfers,” said Battley.

While the firm may have missed its financial target, the Q4 report highlighted that the company had grown its patient base to over 84,000 patients and had C$29.7 million in medical cannabis revenue.

Aurora reported a significant decrease in the selling price of cannabis in its Q4, down to C$5.32 from C$6.40 reported in Q3 2019, representing a drop of almost 17 percent, due to an increase in sales volume in both consumer and wholesale markets.

The company reported it had increased its production yield to 29,034 kilograms of flower in Q4, up from 15,590 kilograms in Q3 of 2019. The company attributed this to upping production at two of its facilities in Ontario.

Aurora’s recent selling of its remaining shares of The Green Organic Dutchman (TSX:TGOD,OTCQX:TGODF) added C$86.5 million in gross proceeds to the company, representing a 50 percent internal return rate, according to the earnings report.

Battley also mentioned the company is currently producing vape pens, mints, gummies and chocolates ahead of the legalization of edible marijuana products later this year in Canada — the so-called Cannabis 2.0, which is set to arrive on October 17.

The company sees the new wave of cannabis legalization as a boon for the market and expects to have its lineup of products ready by December this year, which is the earliest ingestible products will be available to consumers, according to Health Canada.

Aurora CEO Terry Booth said during the call the company is now looking to expand its footprint in the US on a state-by-state basis, citing the farm bill that was passed last year — which descheduled hemp and its derivatives — as a driver for the growth of the CBD market in the country.

“As part of the US market strategy, the company is considering its stakeholders and how various state and federal regulations will affect its business prospects,” the company said in the press release.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.