TerrAscend Shares Dip Following Q3 Financial Results

TerrAscend, a Canadian company seeking to become a multi-state operator in the US, reported C$1.8 million in revenue for Q3.

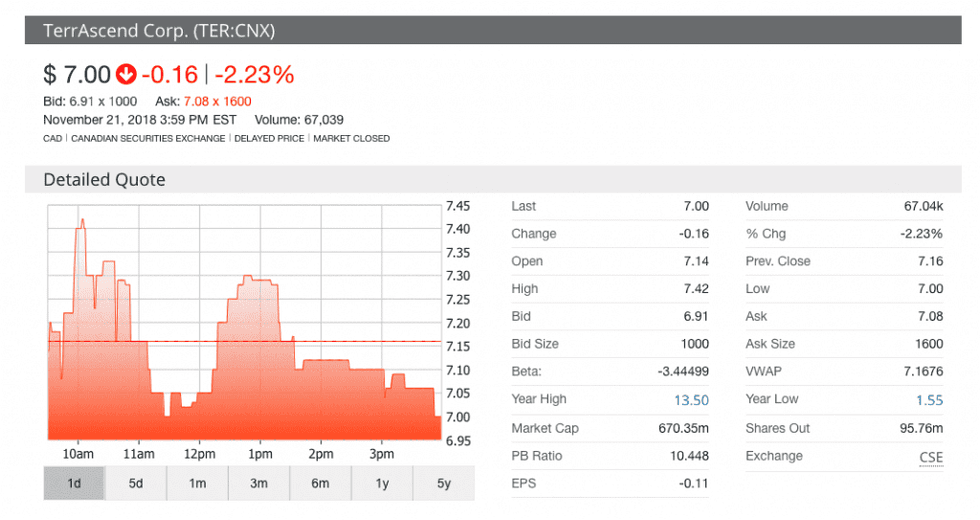

Shares of Canadian cannabis company TerrAscend (CSE:TER), which is also looking into US interests, were down following the launch of its Q3 financial report on Wednesday (November 21).

TerrAscend reported revenue of C$1.8 million as it followed through on supply deals for adult-use bulk product to Canadian provinces.

However, on Wednesday’s trading session, shares of the company were down 2.23 percent. The stock reached a high of C$7.42 during the day but ended up settling with a price of C$7.

At the end of the quarter, TerrAscend also reported a loss of C$2.8 million which represents a C$0.03 loss per share.

The company’s losses were dominated by its controlling interests. At the end of the quarter the company held a C$15.1 million cash and equivalents stash.

“TerrAscend’s goal is to become the leading multi-state operator in the US cannabis industry while continuing to capitalize on sizeable opportunities in Canada and the rest of the world,” Michael Nashat, TerrAscend’s president and CEO, said in a statement.

In October the company revealed its intentions to gain a presence in the fractured US cannabis market.

An estimate from Haywood Securities indicates the US cannabis market will be worth US$23 billion in 2025.

Launching a vertically integrated multi-state operator of cannabis assets in the US has become a popular play and has started to attract the attention of investors.

TerrAscend is in the unique position as itcounts with the backing from one of the biggest Canadian licensed producers (LPs) around.

Canopy Growth (NYSE:CGC,TSX:WEED) and its investment arm Canopy Rivers (TSXV:RIV) have made investments in TerrAscend that manoeuvre the regulations in place from the TMX Group.

Companies on the Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV) are not permitted to directly have assets in the US cannabis market due to the federal illegality of the drug.

However, the two investing companies shuffled the actual investment through a change in the shares being purchased.

As explained by Alan Brochstein, cannabis analyst with 420 Investor, Canopy Growth and Canopy Rivers swapped the equity stakes gained for “exchangeable shares” which don’t allow voting rights or dividends.

“In the future, if the rules for the TSX change, which could happen without full legalization, or if cannabis is legalized federally, then Canopy and Canopy Rivers will be able to convert their securities into common shares,” Brochstein wrote in his weekly column to investors.

In a previous statement Bruce Linton, acting CEO of Canopy Rivers and co-CEO of Canopy Growth, said the restructuring was done in order to “create long-term value for our shareholders as it positions the Company with optionality and conditional future exposure to a significant new market.”

According to the full financial report, neither of the companies TerrAscend has invested in for the US market — Well and Good and Neta NJ — will start operations until the reorganization with its key investees is complete.

Recreational market shows growth in report

Nashat said the company’s premium brand “Haven St.” has started to “resonate” with consumers in Canada.

The company started selling medical cannabis in April according to company documents.

Based on 11 reviews in the cannabis review site from Lift & Co. (TSXV:LIFT), the brand has a 4 star rating.

In Ontario, the brand counts with eight different products available on the OCS online store.

As of September 30, the company counted with 2,066 cannabis plants as its biological assets. The company reported owning C$4,742 worth of externally purchases cannabis oils.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.