Legalization of marijuana is no doubt exciting for the industry–and investors–but it may not be as exciting as one may think.

Legalization of cannabis is no doubt a positive step forward in the rapidly growing industry, but its lower prices are garnering different reactions for the states that tax legal marijuana sales.

As reported by Bloomberg, marijuana prices are dropping as former illegal marijuana harvesters have started investing in pot factories. For example, marijuana prices in Colorado have allegedly dropped 48 percent since it was legalized in the US state in 2014, as per data from Cannabase.

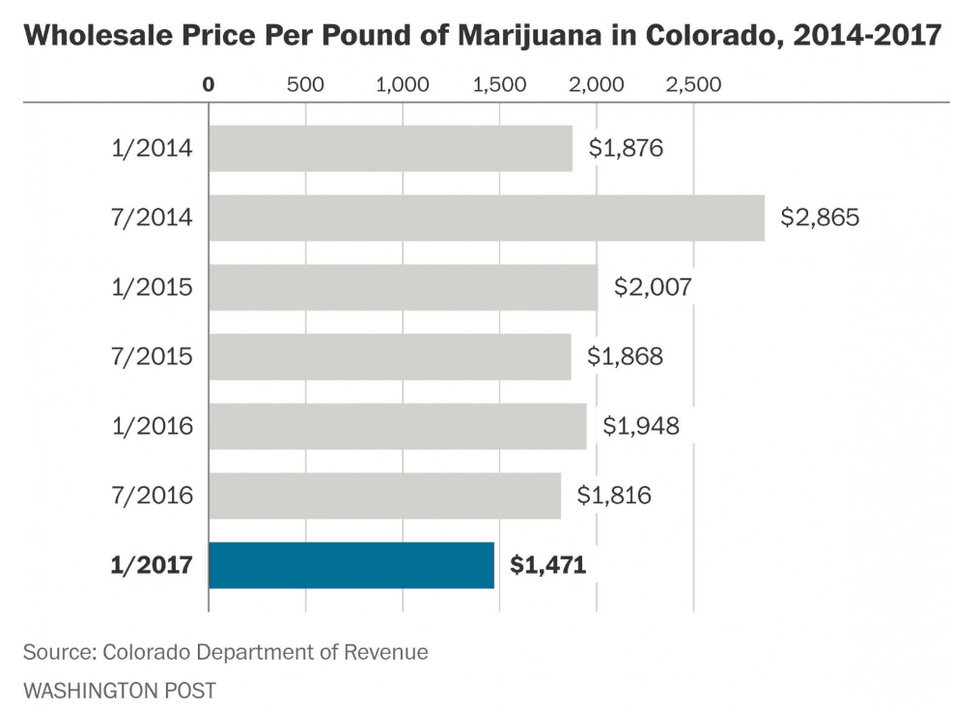

According to Colorado’s Department of Revenue, cannabis prices initially rose on supply shortages, then dropped as the industry started growing.

Below is a chart that is indicative of the wholesale cannabis price in Colorado from 2014 to 2017, as per The Washington Post.

Cannabis price slipping

As it can be seen, the Washington Post notes that wholesale prices in Colorado dropped 24.5 percent since 2016 alone to $1,471 per pound. Supply is also rapidly increasing as growers work to implement required technology.

Troy Dayton, chief executive officer at the Arcview Group suggested that investors and those interested in starting business in the sector “needs to be doing so with the understanding that the price is going to drop precipitously.”

“The agriculture technology space is already booming,” he said in the Bloomberg article. “Now they get to lay their hands on the cannabis industry.”

Similarly, Joe Caulkins, a drug policy expert at Carnegie Mellon University, said the price drop will likely continue. According to Vox.com, Caulkins suggested the cannabis price could potentially go as low as $30 per pound following the surgence in mass production.

With that in mind, retail marijuana prices are also falling–but not to the same extent as wholesale prices. Bloomberg noted that cannabis shops in Colorado made approximately $6.61 per gram in November 2016–a 25 percent drop from the first quarter in 2014–as per research from BDS Analytics.

Lower cannabis price: what it means for taxes

Of course, with lower marijuana prices comes tax implications that are less than ideal. As per the Washington Post, states including Colorado, Oregon, Washington, Nevada, Massachusetts and Maine tax cannabis as a percentage of its price. As such, the dropping price results in dropping tax revenue for each sale.

In Colorado, for example, the Washington Post writes that if the state wants to collect the same amount of revenue each year–when collected taxes for each unit sold are shrinking–there would be to have a massive increase in sales volume. The article goes on to suggest that unless the state’s consumption rises by a third in 2017, it will take in less marijuana tax revenue than the previous year.

As such, if wholesale prices continue dropping–as it appears to be the case suggested above–Colorado’s tax revenue for each unit of marijuana sold will only get lower in the following years.

Of course, only time will tell what implications lower marijuana prices will have, and what legalization on a federal platform will look like with Donald Trump as President. That said, investors in the cannabis sector will no doubt be following closely over the coming months to see what will transpire.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Jocelyn Aspa, hold no direct investment interest in any company mentioned in this article.