Curaleaf Jumps After Reporting US$55 Million in Q2 Revenue

Curaleaf has credited its expansion across the US for the increased revenue. The MSO posted a net loss of US$24.4 million for the quarter.

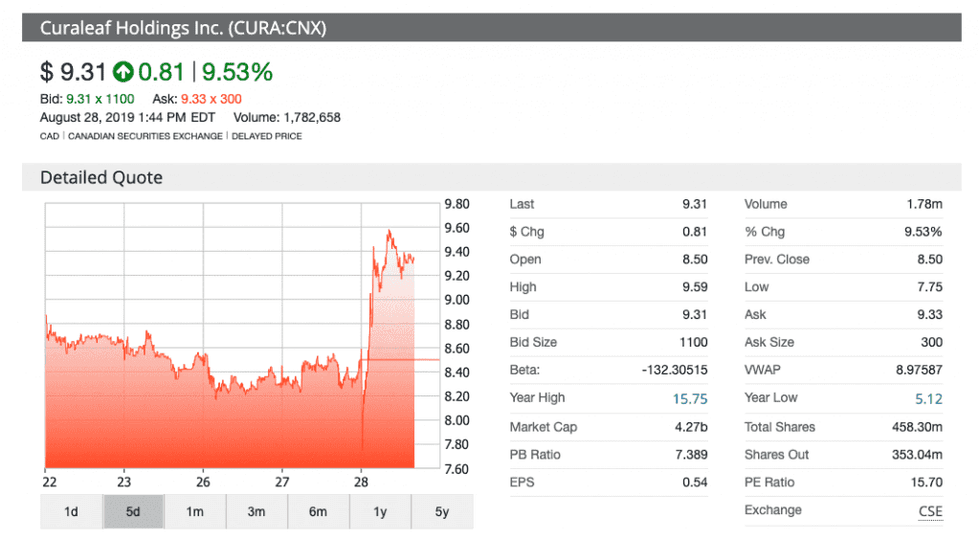

Shares of Curaleaf Holdings (CSE:CURA,OTCQX:CURLF) rose as the multi-state operator (MSO) reported revenue of US$55.1 million for the Q2 period on Wednesday (August 28).

Curaleaf opened the trading session at a price of C$8.50 per share and, as of 1:40 p.m. EDT, prices were sitting at C$9.31, representing an almost 9 percent value increase.

The results, which were released after trading hours on Tuesday (August 27), delighted investors as revenue jumped 35 percent from Q1 to reach US$40.7 million. The company said the increase is the result of its expanding footprint and improved operating margins.

The MSO has continued its expansion in the US with costly planned acquisitions in key states.

During an earnings call with investors, Curaleaf CEO Joseph Lusardi said that, following the planned purchase of Illinois-based GR Companies (Grassroots) and the Select brand of adult-use cannabis products, the US cannabis firm will operate in 19 states in total.

Curaleaf made one of the biggest moves in the US cannabis space last month when it confirmed its planned acquisition of Grassroots in a cash and stock deal priced at US$875 million.

According to the MSO, once the transaction is completed, Curaleaf will be the world’s largest cannabis company by revenue and the largest in the US across key operating metrics.

Boris Jordan, the company’s chairman, said Curaleaf expects pro forma revenue of over US$1 billion by the fiscal 2020 year due in part to its recent purchases and expansion plans.

Despite the rosy outlook for the company’s revenues, its net loss grew from Q1 2019. Losses in the second quarter totaled US$24.4 million, a 281 percent increase from Q2 2018. Curaleaf has attributed the losses partly to acquisition costs and a US$5.8 million depreciation.

During the conference call, Curaleaf CFO Neil Davidson said the company is focusing its expansion efforts on the key states of Arizona, Florida, New Jersey and New York, where medical programs and discussion around legalizing adult-use consumption are developing quickly.

The MSO’s home state of Massachusetts continues to be the largest market for Curaleaf. The company cultivates almost 39,000 pounds of flowers in the eastern state.

Florida was also a driver of growth for the MSO, said Lusardi. Curaleaf has 25 stores across the state — which has been hailed as a key state in the marijuana market — and recent upgrades to its facility in Florida have positioned the company to produce almost 100,000 pounds of flower yearly.

Curaleaf CEO addresses FDA remarks on CBD claims

In July, the MSO experienced a hiccup when it received a warning from the US Food and Drug Administration (FDA) for selling “unapproved” and “misbranded” cannabis products, while making unsubstantiated claims about the health benefits of hemp-derived cannabidiol (CBD).

Some of the products were not approved by the federal regulator and were found to be in violation of certain sections of the Federal Food, Drug and Cosmetic Act.

The federal regulator also flagged Curaleaf for claims across several of the company’s web pages about CBD’s ability to treat conditions such as chronic pain, ADHD and breast cancer.

Lusardi reassured investors that, upon receiving the letter from the FDA, the company quickly took action to address the concerns.

“The majority of the FDA concerns were focused around marketing of our CBD products and pointed to third-party content that was linked to our website. We have removed all such content,” said Lusardi.

Lusardi also told investors that, months prior to the FDA warning, Curaleaf completed an internal review of its products and discontinued sales of vape pens and soft-gel products. The company has also made changes to its product labeling and descriptions based on the review.

TipRanks analysts have the MSO listed as a “moderate buy” with a price target of C$12, which represents a 71 percent upside over the current share price.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.