Shares of recently launched Columbia Care have been added to the new marijuana ETF focused on the US cannabis market.

A recently launched cannabis exchange-traded fund (ETF) focused on the US has added a C$1 billion company to its list of holdings.

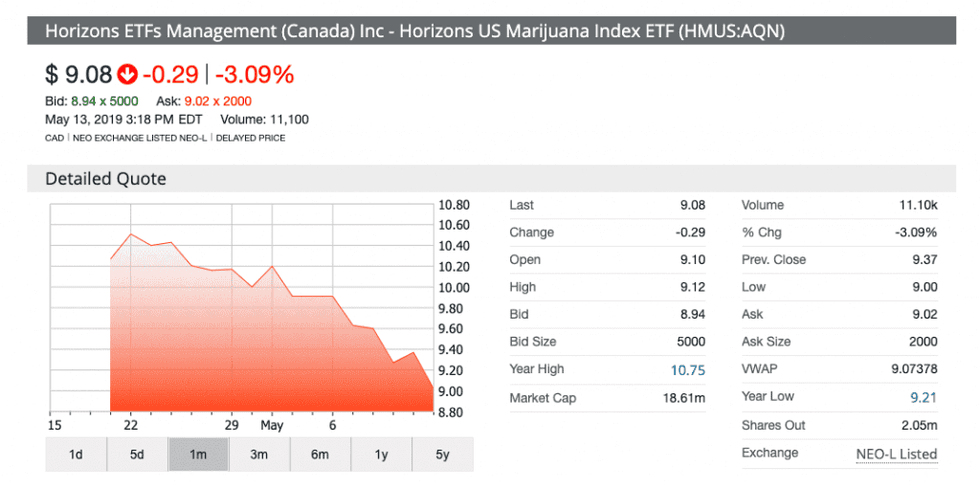

On Monday (May 13), Columbia Care (NEO:CCHW) was included in the Horizons US Marijuana Index ETF (NEO:HMUS), run by Horizons ETFs Management (Canada).

The medical marijuana company made its debut on the NEO Exchange in April, becoming the first company with an enterprise value of over C$1 billion to list on the exchange thanks to a merger with a special purpose acquisition corporation (SPAC).

According to Horizons ETFs, Columbia Care’s C$2 billion valuation makes the company eligible for a maximum weighting of 10 percent in the fund’s portfolio.

Normally, the Horizons US Marijuana Index ETF adds new stocks during a quarterly rebalancing done by Horizons ETFs. However, this addition was done via a “fast entry” rule.

The ETF launched in April, and Steve Hawkins, president and CEO of Horizons ETFs, said in a press release that he anticipates seeing investors gain interest in the US market as the country undergoes regulation changes for cannabis.

As of the Friday (May 10) trading session, Columbia Care was the fourth largest holding for the fund, coming behind Cresco Labs (CSE:CL,OTCQX:CRLBF), Charlotte’s Web (CSE:CWEB,OTCQX:CWBHF) and Curaleaf Holdings (CSE:CURA,OTCQX:CURLF).

Marijuana remains an illegal substance at a federal level in the US, despite legalization programs from several states opening the market to medical or recreational sales.

Columbia Care’s roadmap to its public debut

According to Nicholas Vita, vice chairman and CEO of Columbia Care, the firm is focused on solving “some of the world’s most challenging unmet medical and health needs through the use of our proprietary portfolio of consistently dosed, pharmaceutical-quality cannabis-based medicines.”

Columbia Care reached the NEO Exchange after completing a merger with a public entity created by financial institution Canaccord Genuity (TSX:CF,OTC Pink:CCORF) and designed as a SPAC.

“In this particular case we sold C$40 million of effective blind pool cash into a public vehicle and then we said look, if someone wants to go public they can just merge with our SPAC,” Canaccord’s president and CEO, Dan Daviau, told the Financial Post.

During its Q1 financial results release last Wednesday (May 8), Columbia Care posted revenues of US$12.9 million. The company earned US$39.3 million in revenue during 2018.

Vita said that thanks to its public debut, the company will be able to accelerate its roadmap of operations in the US.

The executive added that the public launch will also aid in the launch of the company’s hemp-derived cannabidiol products into “traditional consumer retail channels.”

SPAC debuts in the cannabis market gain momentum

During the Vancouver edition of the Arcview Investor Forum in April, Jonathan Sandelman, CEO of Cannabis Strategies Acquisition (NEO:CSA.A), said that SPACs are very transparent, which will be a big attraction point for investors.

“Its mission is to be very much like a private equity firm, but with daily liquidity, with the optionality not given to a private equity manager but to the investor,” Sandelman said.

The SPAC executive said his firm has already acquired five marijuana companies in the US.

On Monday, Mercer Park Brand Acquisition (NEO:BRND.U) started trading, adding another cannabis SPAC company to the NEO Exchange’s listings.

The firm raised US$402 million as part of its initial public offering. According to the NEO Exchange, Mercer Park will focus on acquiring companies with a value between US$300 million and US$800 million.

This is the fourth cannabis-focused SPAC to list on NEO, following $CSA.A, $CGGZ.UN, and Canaccord Genuity Growth Corp, which recently completed its qualifying transaction resulting in Columbia Care $CCHW on NEO.

— NEO Exchange (@NEO_Exchange) May 13, 2019

Anna Serin, director of listings development with the Canadian Securities Exchange, told the audience at the Arcview Investor Forum the exchange is getting ready to begin offering SPACs amongst its cannabis listings in the near future.

“With a SPAC, you’re investing in a management team who’s going to go out and acquire assets … in the future,” she said.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.