Battery Grade Lithium Carbonate with 99.9 Percent Purity Produced from Kachi

Very low impurities confirmed from Kachi Brines lithium carbonate produced using Lilac direct extraction process

Highlights:

- Groundbreaking results confirm that very high purity lithium carbonate with very low impurities produced from Lilac Solutions ion exchange pilot plant with brines from Lake’s Kachi Lithium Brine Project, Argentina.

- Lithium carbonate with 99.9% purity produced with very low impurities, such as iron and boron.

- Focus now on producing larger volume samples of battery grade lithium carbonate specifically for potential downstream off-takers in discussions with LKE.

Lithium explorer and developer Lake Resources NL (ASX:LKE) is pleased to announce a major step forward, confirming that battery grade lithium carbonate with 99.9% purity has been produced with very low impurities from Lake’s Kachi Lithium Brine Project using Lilac Solutions’ disruptive technology in California.

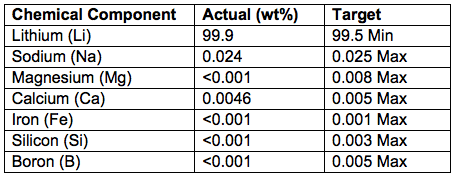

Lithium carbonate with 99.9% purity exceeds the industry standard specifications for battery-grade purity (>99.5 wt%). A significant outcome was that very low impurities were produced with results of iron (Fe) <0.001wt% and boron (B) <0.001wt%. Demonstrating low impurity levels has been a key focus of the company in this process and a high priority in recent downstream discussions with battery/cathode producers.

Samples are being produced from the first pilot plant modules using Lilac Solutions’ direct extraction ion exchange process, a result of over nine months of testing to optimise the process for Kachi brine samples. The information is being used in the Kachi Pre-Feasibility Study (PFS) which will be reported on shortly.

Larger samples of battery grade lithium product will be produced for potential downstream off-takers from the 20,000 litres of Kachi brine samples recently shipped from Argentina. This follows discussions with potential off-takers and other international development partners who are extremely interested in the low impurities of material produced by the direct extraction technology and are seeking confirmation of its potential.

Welcoming the results, Lake’s Managing Director Steve Promnitz said: “This is potentially groundbreaking for the industry that we have demonstrated that a high purity battery grade lithium carbonate can be produced using brines from Kachi after 9 months of detailed test work. The critical development is the confirmation of very low levels of impurities which no doubt will be welcomed by potential off-takers.

“We are now focused on delivering greater volumes of battery grade lithium carbonate from Kachi brines and the pilot plant modules which will form the basis for more active engagement with potential off-takers increasingly focused on sustainability. With the Kachi PFS nearing completion, we are confident we can generate the right product at the right time, delivering consistently high quality, low impurity products that meet the needs of global buyers. Whilst we had anticipated releasing the PFS in late 2019, the study has been only slightly delayed awaiting additional engineering studies. We now anticipate the release date to be within the next month.”

Lake aims to produce at Kachi a high quality, low impurity product capable of attracting premium pricing. Lab testing has shown that lithium concentrations of 30-60,000 mg/L lithium can be produced from brines of ~300 mg/L lithium in a few hours using the Lilac process.

Significantly, Lilac’s direct extraction process offers a sustainable solution for Lake Resources when extracting lithium from brine as processed brine is returned to the aquifer once the lithium has been extracted removing the need for traditional evaporation ponds. This addresses increasing interest from electric vehicle makers (OEM’s) and battery makers to demonstrate they have access to a sustainable scalable supply chain for raw materials.

Figure 1: Lithium carbonate product with 99.9% purity and low impurities from the Kachi Lithium Brine Project using Lilac’s direct extraction ion exchange process.

Table 1: Specifications of lithium carbonate product with 99.9% purity. Very low impurities in Iron (Fe) and Boron (B) from the Kachi Lithium Brine Project using Lilac’s direct extraction ion exchange process.

About Lake Resources NL (ASX:LKE)

Lake Resources NL (ASX:LKE, Lake) is a lithium exploration and development company focused on developing its three lithium brine projects and hard rock project in Argentina, all owned 100%. The leases are in a prime location among the lithium sector’s largest players within the Lithium Triangle, where half of the world’s lithium is produced at the lowest cost. Lake holds one of the largest lithium tenement packages in Argentina (~200,000Ha) secured in 2016 prior to a significant ‘rush’ by major companies. The large holdings provide the potential to provide consistent security of supply, scalable as required, which is demanded by battery makers and electric vehicle manufacturers.

The Kachi project covers 70,000 ha over a salt lake south of FMC/Livent’s lithium operation and near Albemarle’s Antofalla project in Catamarca Province. Drilling at Kachi has confirmed a large lithium brine bearing basin over 20km long, 15km wide and 400m to 800m deep. Drilling over Kachi (currently 16 drill holes, 3100m) has produced a maiden indicated and inferred resource of 4.4 Mt LCE (Indicated 1.0Mt and Inferred 3.4Mt) (refer ASX announcement 27 November 2018).

A direct extraction technique is being tested in partnership with Lilac Solutions, which has shown 80-90% recoveries and lithium brine concentrations 30-60,000 mg/L lithium. Battery grade lithium carbonate has been produced from Kachi brine samples with very low impurities (Fe, B, with <0.001 wt%). Phase 1 Engineering Study results have shown operating costs forecast in the lowest cost quartile (refer ASX announcement 10 December 2018). Test results have been incorporated into a Pre-Feasibility Study (PFS) aimed to be released soon. The Lilac process is being trialed with a pilot plant in California which will then be transported to site to produce larger battery grade lithium samples. Discussions are advanced with downstream entities, mainly battery/cathode makers, as well as financiers, to jointly develop the project.

The Olaroz-Cauchari and Paso brine projects are located adjacent to major world class brine projects either in production or being developed in the highly prospective Jujuy Province. The Olaroz-Cauchari project is located in the same basin as Orocobre’s Olaroz lithium production and adjoins the Ganfeng Lithium/Lithium Americas Cauchari project, with high grade lithium (600 mg/L) with high flow rates drilled immediately across the lease boundary.

The Cauchari project has shown lithium brines over 506m interval with high grades averaging 493 mg/L lithium (117-460m) and high flow rates, with up to 540 mg/L lithium. These results are similar to lithium brines in adjoining pre-production areas under development and infer an extension and continuity of these brines into Lake’s leases (refer ASX announcements 28 May, 12 June 2019).

Significant corporate transactions continue in adjacent leases with development of Ganfeng Lithium/Lithium Americas Cauchari project with Ganfeng announcing a US$237 million for 37% of the Cauchari project previously held by SQM, followed by a further US$160 million to increase Ganfeng’s equity position to 50% on 1 April 2019, together with a resource that had doubled to be the largest on the planet. Ganfeng then announced a 10 year lithium supply agreement with Volkswagen on 5 April 2019. Nearby projects of Lithium X were acquired via a takeover offer of C$265 million completed March 2018. The northern half of Galaxy’s Sal de Vida resource was purchased for US$280 million by POSCO in June-Dec 2018. LSC Lithium was acquired in Jan-Mar 2019 for C$111 million by a mid-tier oil & gas company with a resource size half of Kachi. These transactions imply an acquisition cost of US$55-110 million per 1 million tonnes of lithium carbonate equivalent (LCE) in resources.

For more information on Lake, please visit https://www.lakeresources.com.au/home/

Click here to connect with Lake Resources NL (ASX:LKE) for an Investor Presentation