Overview

At Tesla’s quarterly earnings call in late 2020, Chief Executive Elon Musk urged participants, “Well, I’d just like to re-emphasize, any mining companies out there, please mine more nickel.” During Tesla’s Battery Day event on September 22, 2020, Musk shared the company’s goal of implementing a vertically integrated battery supply model centered in North America in order to produce batteries with zero high-cost cobalt and more low-cost nickel.

On top of this, experts forecast that 2021 will be a big year for nickel as a recovery in China and speculated demand from the electric vehicle battery sector create a perfect storm.

Historically, the Sudbury region in Ontario has been where some of the most significant nickel deposits in the world have been discovered. The Sudbury Basin currently has 8 producing mines, and has produced over 11 million tonnes of nickel since production started over 125 years ago. The geological endowment of the Sudbury region, coupled with the city’s status as one of the global epicenters of historical nickel production, mean that most of the mining operations and prospective land packages in the region are almost exclusively owned and controlled by prominent global mining corporations such as Vale(NYSE:VALE), Glencore (LON:GLEN) and KGHM.

One exception to this, however, is Magna Mining (TSXV:NICU). Due to some prescient strategic thinking at a low point in the mining cycle in 2016, a group of Sudbury mining professionals acquired the past producing Shakespeare Mine and its surrounding property package, which is located approximately 60km from the city of Sudbury. In addition to the mine site, Magna’s property package today also includes over 180km² of prospective adjacent land, which has seen little exploration activity to date.

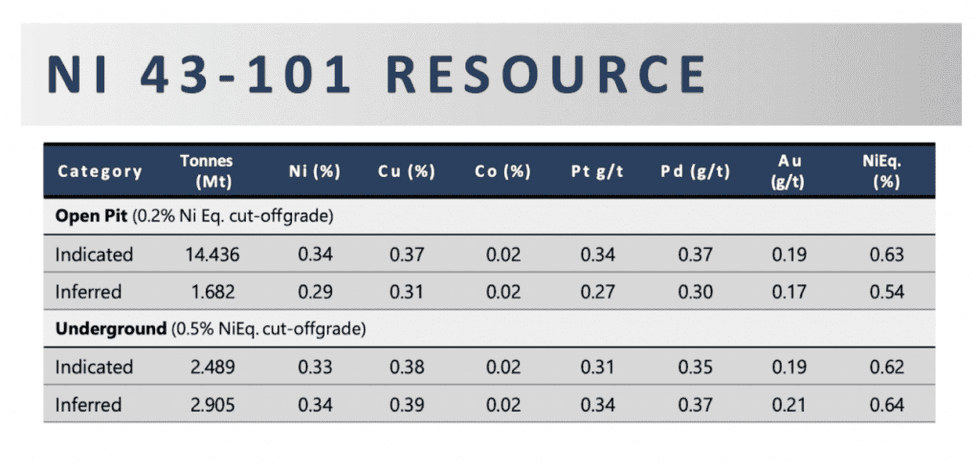

Magna Mining’s flagship project, the 100 percent owned Shakespeare Mine, also boasts an NI 43-101 resource, major permits required for the construction of an open pit mine, mill and tailing storage facility. The Shakespeare mine has an indicated open pit resource of 14.4 million tonnes at 0.34 percent nickel, 0.37 percent copper and 0.9g/t total precious metals (TPM).

Following a successful go-public transaction in May 2021, Magna Mining is planning an aggressive and exciting exploration program at Shakespeare, which will include multiple drill targets adjacent to the company’s existing deposit. The existing resource and permits at Shakespeare also offer the opportunity to bring the deposit back into production on an accelerated timeline, a unique advantage for a junior mining company.

A successful capital raise concurrent with the go-public transaction is facilitating this new expenditure at the Shakespeare project, reflecting the first significant expenditure in this part of the Sudbury region in over ten years. It’s a prospect which company CEO Jason Jessup is looking forward to: “We think that our company has the potential and the capacity to grow into a significant base metals company within 12 to 24 months, which is largely thanks to having many pieces of the puzzle, such as the existing resource and permits, already in place”

The team that has put this company together also possess the necessary skills sets to realize this vision. The management team, many of whom are Sudbury-based, brings over 80 years of combined experience in mining operations, geology, Sudbury-region exploration and capital markets, along with experience at working with many of the prior successful companies in the region such as Inco, FNX and Vale.

Company Highlights

- Magna Mining is a Sudbury-focused base metal exploration and development company.

- The flagship asset is the Shakespeare Mine, a past producing, Ni-Cu-PGM mine with major permits in place. The permits cover the construction of a 4,500 tonne per day mine, mill and tailings storage facility.

- The current deposit at Shakespeare hosts an NI 43-101 indicated open pit resource of 14.4 million tonnes.

- Throughout 2008 to 2012, the Shakespeare Mine processed over 480,000 tons of ore through a third-party mill at average grades of 0.33 percent nickel, 0.38 percent copper and 0.9g/t PGM + Au. This means that the metallurgy of the deposit is already well understood.

- The extensive Sudbury-region experience of Magna Mining’s management team should position the company well for both exploration and operational success.

- Overall, Magna Mining boasts many features which are rare to find in a junior mining company, including experienced local leadership and an advanced stage asset with major permits to go into production. Augmenting this is a large contiguous land package with significant exploration potential.

Get access to more exclusive Nickel Investing Stock profiles here