Overview

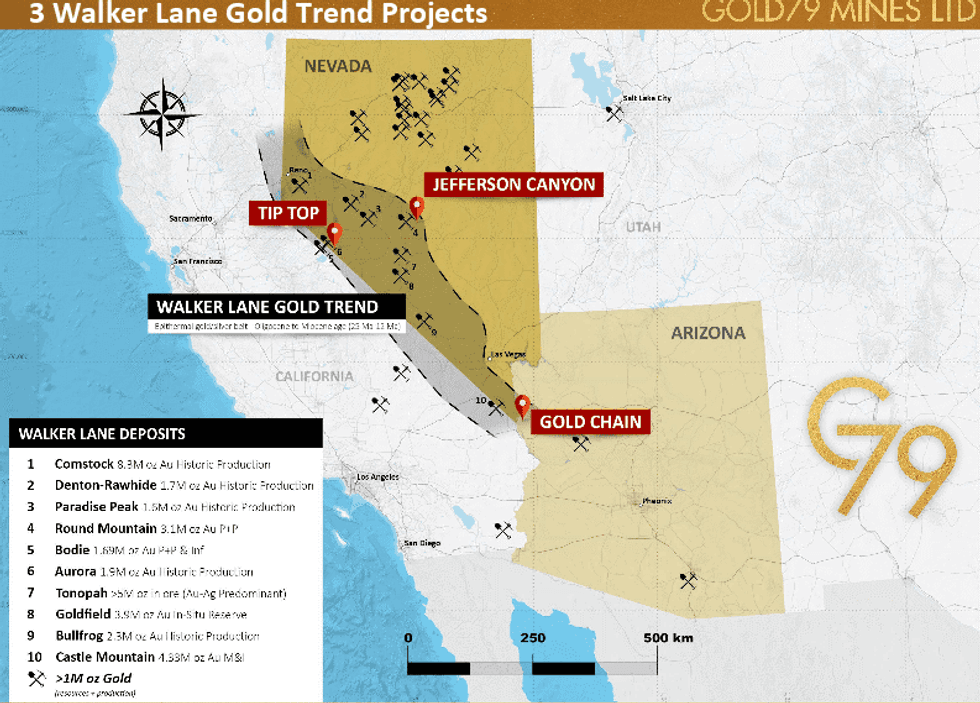

Gold79 Mines (TSXV:AUU) is a resource development company focused on gold exploration properties in Nevada and Arizona. The company owns a trio of properties located in the renowned Walker Lane gold trend, the Jefferson Canyon project, the Tip Top project and the Gold Chain project.

Nevada’s Walker Lane gold trend is home to a number of past-producing gold mines including the Comstock lode, the Denton-Rawhide mine and the Paradise Peak mine. Nevada is recognized as one of the world’s most productive gold regions and was ranked as the third-best jurisdiction in terms of investment attractiveness according to the Fraser Institute’s 2019 mining survey.

Gold79 Mines’ Jefferson Canyon gold project is an early-stage exploration project located on the north side of the Walker Lane gold trend. The project is located only seven kilometers away from Kinross Gold Corporation’s (TSX:K, NYSE:KGC) Round Mountain mine, which has produced approximately 15 million ounces of gold.

Gold79 Mines’ Gold Chain project was home to historical exploration and production, which the company intends to expand upon with further exploration. The property hosts oxidized conditions that extend at least 100 meters below the surface, which Gold79 Mines believes could be conducive to gold recovery by leaching.

Gold79 Mines’ Tip Top gold project is comprised of 22 unpatented mining claims totaling 173 hectares. The project contains several low-sulfidation oxide gold-silver epithermal veins with low base metal contents. Two of the veins on the Tip Top project historically produced 6,900 ounces of gold, with some silver production as well. While the project has sat dormant for more than 20 years, the property has excellent road access and benefits from strong regulatory support through Nevada’s mining-friendly state government.

Facing economic uncertainty moving forward due to the COVID-19 pandemic, a number of analysts and investment companies have recognized the potential for gold investment to remain strong as a common economic hedge. For example, Hong Kong investment firm CLSA projects the commodity is expected to outperform the S&P 500 Index in 2020, according to Forbes.Company Highlights

- Gold expected to outperform the S&P 500 Index in 2020, according to Hong Kong investment firm CLSA

- Nevada recognized as the third-most mining-friendly jurisdiction according to the 2019 Fraser Institute annual survey

- Jefferson Canyon, Tip Top and Gold Chain projects have seen limited modern exploration, offering potential upside

- Gold Chain, Jefferson Canyon and Tip Top projects are both located inside the Walker Lane gold trend

- Jefferson Canyon project is located only seven kilometers away from the Kinross Round Mountain mine, which has produced 15 million ounces of gold

- Strong management team brings years of experience in mineral exploration

- Gold79 Mines purchased the Sheep Trail Group of patented claims and reported 51.9 g/t gold from Initial Sampling.

Get access to more exclusive Gold Investing Stock profiles here