Bitcoin: A Price History of the First Cryptocurrency

Overview

The cryptocurrency market is expected to grow at a compound annual growth rate of 30 percent from 2019 to 2026 and reach a market capitalization of US$5.2 billion by 2026. Because of the growth opportunities available, the overall crypto global population has more than doubled from 100 million in January 2021 to more than 200 million in May 2021, as per reports. To further fuel this growth, users will need platforms that they can trust without a shadow of a doubt. According to KPMG, one of the key factors that will be critical in the growth of the crypto economy are "trust agents" like regulators, auditors, academic institutions, consortiums, and trading platforms.

CoinSmart Financial is a leading Canadian-headquartered cryptocurrency asset trading platform dedicated to providing customers with an intuitive trading platform for buying and selling digital assets, like Bitcoin and Ethereum, combined with the seamless ability to on-ramp and off-ramp fiat. Clients' security and protection is the company's primary focus.

The company is registered as a money services business with financial regulators in Canada (through FINTRAC) and in the United States (through FinCEN). In addition, the company is registered with the Ontario Securities Commission as a restricted securities dealer in Ontario and all other Canadian jurisdictions.

In 2022, CoinSmart’s wholly owned operating subsidiary Simply Digital Technologies Inc. was acquired by Coinsquare Ltd., a Canadian crypto asset trading platform. The acquisition positions Coinsquare as one of Canada's largest crypto asset trading platforms and allows CoinSmart to hold approximately 12 percent ownership in Coinsquare on a pro-forma basis.

CoinSmart is registered with the Financial Intelligence Unit of Estonia for providing a virtual currency service and offers crypto asset trading services to select European countries and other markets. The company further builds on its mission to make cryptocurrency accessible by providing educational resources tailored to every level of cryptocurrency customer and unparalleled 24/7 omni-channel customer success/support. Offering instant verification, industry leading cold wallet storage, advanced charting with order book functionality and over-the-counter premium services. The company ensures every client's needs are met with the highest level of quality and care.

Website | LinkedIn | Twitter | Instagram

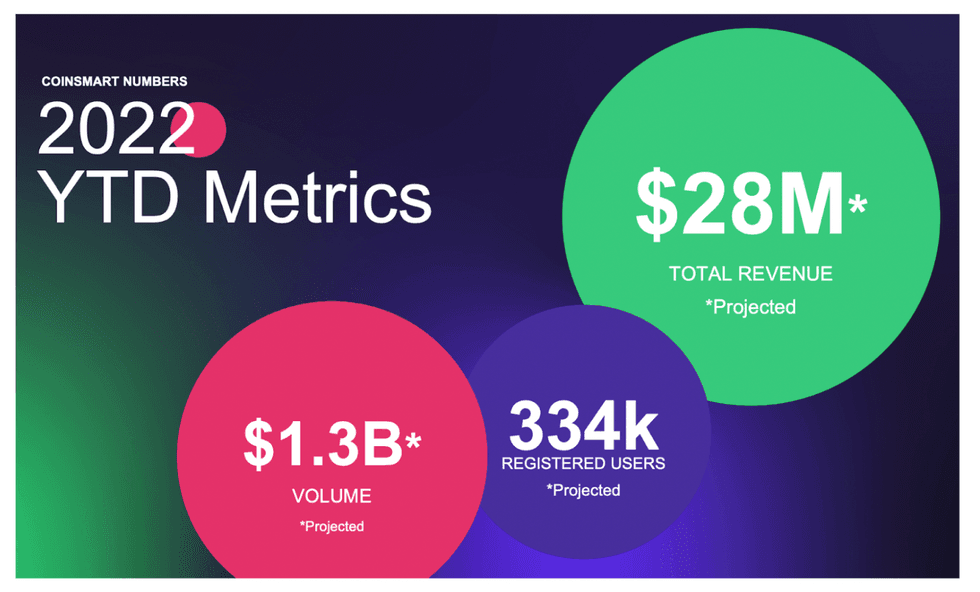

CoinSmart In Numbers

- Projected total revenue of $28 million for 2022 from $16.7 million in 2021

- Projected 334,000 registered users by December 31, 2022 compared to 182,000 in the same period last year.

- $1.3 billion worth of trading volume projected for 2022

- More than $1.5 billion worth of trading volume in four years

- $705 lifetime value

- $105 cost to acquire

- Customer satisfaction rate of 99.8 percent

NOTE: All the $ values are in CAD.

Strict Commitment To Transparency And Ethical Business Practices

CoinSmart obtained its Canadian FINTRAC license in 2018 before it was even required for virtual currency businesses. It is currently one of only two crypto platforms registered as a Marketplace with the Ontario Securities Commission.

The company has also acquired licenses and approvals for each jurisdiction it operates in, including the US and Estonia. The company is currently in the process of obtaining licenses and approvals for future geographic expansion in the European Union, Australia and Latin America.

As a publicly-traded company, CoinSmart is required to legally disclose the following information (not exhaustive):

- Annual audited financials and quarterly reporting from a tier 1 accounting firm

- Instances of insider trading

- Ownership changes

- Public filings for mergers and acquisitions.

In September 2022, CoinSmart, through its wholly-owned operating subsidiary Simply Digital Technologies Inc., was acquired by Coinsquare Ltd., a Canadian crypto asset trading platform. Under the purchase agreement, CoinSmart will hold approximately 12 percent ownership in Coinsquare.

Company Highlights

- CoinSmart is a Canadian cryptocurrency trading platform focused on building trust with users by delivering a safe, secure and intuitive platform for trading digital assets.

- The company is one of the first Canadian trading platforms to be compliant with the Financial Transactions and Report Analysis Centre of Canada (FINTRAC) and is committed to the safety and security of its users through strict compliance with regulations.

- The company has a strong user base and a high customer satisfaction rate of 99.8 percent. CoinSmart's revenue has grown tenfold in the first three years since its launch in 2018, and is projecting $1.3 billion in revenue for 2022.

- CoinSmart is led by an experienced management team with a strong history of success in online business, mergers and acquisitions, and exit strategies.

- In 2022, CoinSmart’s wholly owned operating subsidiary Simply Digital Technologies was acquired by CoinSquare, a Canadian crypto asset trading platform.

Get access to more exclusive Blockchain Investing Stock profiles here