Cobalt Outlook 2021: Demand to Rise, Higher Price Environment Ahead

After a year full of uncertainty, what is the cobalt outlook for 2021? Analysts share their thoughts.

Click here to read the latest cobalt outlook.

This time last year, cobalt market watchers were expecting demand from the electric vehicle (EV) sector to pick up, but 2020 was overshadowed by the coronavirus pandemic.

Cobalt, a key element in lithium-ion batteries, experienced supply chain challenges, with lockdowns and containment measures testing its resilience.

With the new year now in full swing, the Investing News Network (INN) reached out to cobalt experts to get more insight about the cobalt outlook for 2021.

Cobalt trends 2020: The year in review

Uncertainty at all levels spiked in 2020 as COVID-19 hit the world during the first few months of the year.

“COVID-19 certainly threw a lot of surprises at the cobalt market in 2020,” George Heppel of CRU Group told INN. He added that the superalloy market was the main area impacted.

“Demand for cobalt metal in Europe and the US collapsed in Q2 in response to the widespread grounding of aircraft fleets, and this has had a major impact on regional arbitrages for cobalt metal.”

This was balanced out somewhat by lower supply due to mine disruptions in Madagascar, Morocco and Canada, which put a limit to price falls, he explained.

“Elsewhere, we saw a spike in cobalt hydroxide payables out of the Democratic Republic of Congo (DRC) as COVID-19-related disruption in South Africa caused a bottleneck in shipping from the DRC to China, but the effect of this was limited,” Heppel added.

Speaking about surprises in the cobalt space in 2020, aside from COVID-19, Caspar Rawles of Benchmark Mineral Intelligence said price resilience in the face of such uncertainty was unexpected, particularly during the first half of the year, when EV sales were so heavily impacted by the virus.

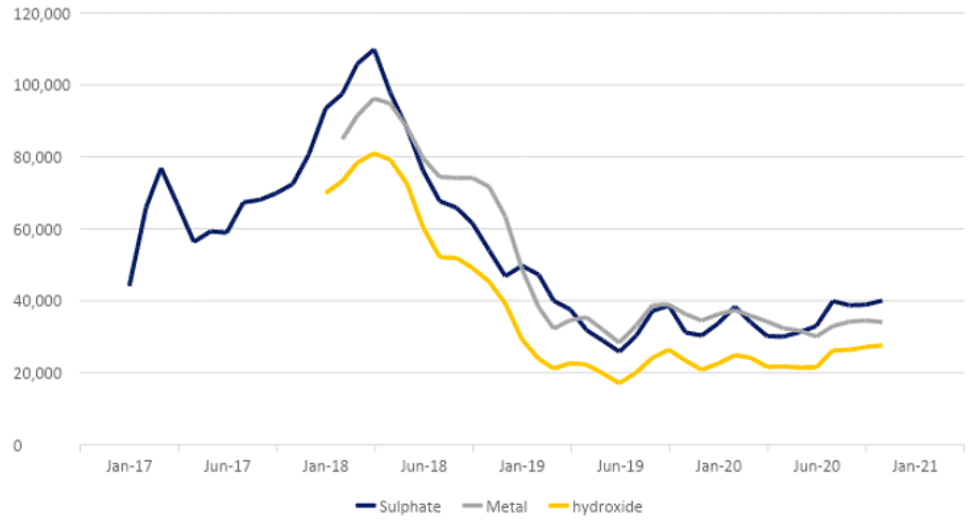

2020 cobalt price performance. Chart via Benchmark Mineral Intelligence.

“The market was supported by high consumer electronics demand as people upgraded or purchased new devices for home working,” he told INN. “But as we moved into H2 and EV sales began to recover post-stimulus efforts, this really showed where the market mindset is at with reference to 2021 demand and the tightening supply outlook.”

Aside from COVID-19, the biggest cobalt news story of the year for Heppel was the DRC government’s formation of Enterprise Generale Cobalt, a government body whose aim is to give the state more power over the artisanal mining sector.

“Should this business model be successful, it could prove to be a reliable, consistent source of cobalt units in the future,” he said.

Cobalt outlook 2021: Supply and demand

Demand for cobalt is mainly driven by the EV sector, which had a strong finish in Q4 2020.

Roskill expects global EV sales for the year to increase by 10 to 15 percent year-on-year, with Europe being the largest-growing EV market globally.

“Such rapid demand growth in Europe has mainly been supported by massive fiscal incentives implemented by various countries across the continent, such as Germany and France,” Ying Lu of Roskill explained to INN via email.

For cobalt, Benchmark Mineral Intelligence expects demand to continue to rise into 2021.

“(This) not only as EV sales continue to surge, but due to a number of reasons,” Rawles said. “We are continuing to see a delay in the shift to high-nickel (less cobalt-intense) cathodes, which adds to the demand outlook.”

Additionally, the firm expects to see further growth from the consumer/portable electronics industry, not just linked to the virus, but also to the ongoing rollout of 5G devices.

“On top of battery demand, assuming the vaccine programs continue to move from strength to strength, we could also start to see some improving demand from the aviation sector in H2 2021,” Rawles said.

Across all end markets, Benchmark Mineral Intelligence forecasts that cobalt demand will increase by 15 to 20 percent year-on-year, with the majority of this driven by the battery sector.

Commenting on demand, Heppel of CRU said the biggest COVID-19-related impact on cobalt this year was the “green recovery” policy drive seen in many western countries in response to the recession.

“This has given a tremendous kickstart to the European EV market, which looks poised to overtake China in terms of annual sales next year. Although some of these policies will be scaled back in the coming years, we believe that the decline in the average price of EVs will mostly make up for the subsidy decline.”

Elsewhere, the other key growth market is China, which CRU believes will return to growth in 2021 after several years of stagnant EV sales.

In 2020, the supply side of the cobalt market was less resilient to COVID-19 impacts compared with the demand side.

Last year saw the temporary shutdown and suspension of a number of operations in Africa in H1. During that time, only 30 to 40 percent of refining capacity in China was operational, according to Roskill.

“Consequently, both mined and refined cobalt supply fell in 2020, marking the first decrease in global production since 2016,” Lu said.

Moving to 2021, Roskill is expecting production of cobalt feedstocks to increase back to pre-COVID-19 levels, should several projects in the DRC continue to ramp up output as scheduled.

“This could largely offset the output loss from Mutanda should the mine remain closed in 2021,” Lu said. “Projects at earlier stages may, however, face further delays given the macroeconomic situation remains uncertain.”

Speaking about supply, Rawles said growth will be needed next year if supply and demand have any chance of being roughly balanced.

“There are a number of ramping projects in the DRC, including Phase 2 at Eurasian Resources Group’s RTR operation and China Nonferrous Metal Mining (Group)’s Deziwa, on top of the restart of Ambatovy in Madagascar,” he said. “In percentage terms, we see supply growth slightly below demand, tightening the market on 2020 levels.”

For Heppel, supply growth looks healthy for now, with CRU expecting cobalt mined supply to grow by 13 percent in 2021.

Cobalt outlook 2021: Supply chains and responsible sourcing

One trend that has gathered pace in the last year has been the localization of supply chains, which Rawles believes is generally good for the industry.

The expert welcomes scrutiny of cobalt and the battery supply chain, not just from the DRC/artisanal perspective, but also in terms of wider environmental, social and governance concerns.

“Not only will this accelerate the move to a truly sustainable future, (but) it will also increase understanding of cobalt in the global community, which I think today has been misrepresented,” he said. “Of course, the changes will bring about challenges and take some time to implement, but we are starting to see real change, particularly in the DRC, which is positive news for the industry.”

The DRC’s dominance of the cobalt-mining sector will mean that it will always be challenging to localize supply of mined material; the DRC is to cobalt as oil is to Saudi Arabia, Heppel explained.

“However, this doesn’t mean there aren’t still localization opportunities,” he commented to INN. “The other behemoth of the cobalt world is China, which is responsible for around 90 percent of all cobalt chemical refining worldwide.”

Heppel expects to begin to see more announcements of localized cobalt refinery capacity in 2021.

Looking back at how responsible sourcing of cobalt has evolved, Rawles said that there has now been a realization that the way forward is to work with the artisanal supply chain to ensure safe practices from a human rights and safety perspective, and also an environmental viewpoint.

“This has been a big shift that has taken some time for downstream companies to be able to accept, but we are now starting to see this message more and more from major supply chain players,” he said.

For Heppel, the main barrier to responsible sourcing of cobalt is the lack of a universally recognized authority or auditing body that can approve mining and refinery sites.

“Right now, the market relies almost entirely on self-reported internal auditing as opposed to a dedicated third party for checking sourcing,” he said.

Cobalt outlook 2021: What’s ahead for prices

Looking at what’s ahead for prices, Benchmark Mineral Intelligence doesn’t expect average prices to surge in 2021, but anticipates a higher price environment moving through the year.

“Indicators in the market today are that prices are to drift higher as we move into the new year; demand is going from strength to strength in the battery supply chain, and we have started to see some speculators return to the market,” Rawles said.

Meanwhile, Roskill anticipates tightness in cobalt feedstocks to continue in 2021, particularly in the spot market given that a large portion of crude cobalt hydroxide production has already been locked into long-term contracts.

“Payables for spot cargos would be likely to remain above 75 percent of the underlying metal price over the year,” Lu said. “This would, in turn, support prices for chemicals, for instance, battery-grade cobalt sulfate and oxides.”

On the metal side, Lu said the space might see the divergence in China and Europe/US prices continue, at least in Q1 2021, “given demand from traditional metal applications are still clouded with uncertainty, with Europe now back to new lockdowns.”

Overall, underpinned by a positive demand outlook and tight raw material supply, Roskill believes the average benchmark cobalt metal price could pass US$18 per pound in 2021 from below US$16 in 2020.

One of the trends seen in cobalt has been long-term contracts to secure supply of the battery metal.

For Rawles, it is likely the space will see more contracts of this nature, particularly as more automakers move towards direct-sourcing strategies.

“Longer-term contracts should be beneficial for the supply chain, potentially to stabilize volatility and decrease security of supply concerns,” he said.

For the head of price assessment at Benchmark Mineral Intelligence, a key challenge that may start to become more common is a lack of longer-term material availability.

“Any buyers that are late to lock in these deals may struggle to find the material they need. During contract negotiation this year there were fewer contracts concluded for a number of reasons, but partly due to longer-term deals keeping supply out of the market for a number of years,” he said.

For his part, CRU’s Heppel believes there will always be appetite for long-term deals for both buyers and sellers of cobalt.

“For buyers, it’s the only way to truly minimize long-term supply risk, and for sellers the incentive is that it guarantees stable demand of units,” he said. “The cobalt price cycle of 2016 to 2018 accelerated the plans of many end users to lower their cobalt usage, and the major cobalt producers are therefore keen to avoid another shortage that might lower long-term cobalt demand.”

Cobalt outlook 2021: Key factors to watch

After a year full of uncertainty, it is hard to predict what could happen next in the space, but there are a number of factors that investors interested in cobalt should keep an eye out for.

“Demand is the key one,” Rawles said. “Continue to watch European and Chinese sales, but with the (Joe) Biden administration in the US from January we also are expecting to see more EV/energy storage positive strategies, which would likely see a further acceleration of global demand.”

In the near term, the impacts of the virus and further waves of infections could be a catalyst.

“For cobalt, South Africa is a key region to watch on the supply side, and the last lockdown had a major impact on logistics of cobalt raw materials reaching refiners — whilst at this point another lockdown of that nature seems unlikely, it would have an immediate implication for already stretched supply chains,” Rawles explained to INN.

For his part, Heppel continues to believe that there is strong market potential for lithium-iron-phosphate (LFP) batteries in markets outside of China, most notably Europe.

“It will take many years for it so begin to gain market share due to intellectual property considerations, but 2021 might be the year where we begin to see hints of the development of an LFP supply chain outside of China — which would have major implications for long-term demand for nickel and cobalt, albeit not for a few years,” he said.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.