Cannabis Weekly Round-Up: Organigram Results Improve, Ascend Ready for Lawsuit

Catch up on the latest announcements in the cannabis investment market.

A Canadian cannabis producer beat estimates in its latest financial results, and experts believe it may be showing signs of achieving profitability.

Also this week, Ascend Wellness Holdings (AWH) (CSE:AAWH.U,OTCQX:AAWH) revealed it will be taking its dispute with MedMen Enterprises (CSE:MMEN,OTCQX:MMNFF) to court.

Keep reading to find out more cannabis highlights from the past five days.

Organigram posts encouraging results, stock drags through the week

As part of its financial report for its first fiscal quarter of 2022, Organigram Holdings (NASDAQ:OGI,TSX:OGI) posted its highest ever quarterly net revenue — US$30.4 million, up 22 percent from the previous quarter.

“Our record-breaking results in the first quarter of Fiscal 2022 are a testament to our successful strategy to create innovative, high-quality products that align with the evolving preferences of the various segments of cannabis consumers,” Beena Goldenberg, CEO of Organigram, told investors.

The company still reported a net loss line of C$1.3 million for the quarter; however, that was a much less severe loss than the C$34.3 million reported during the same period last year.

Raymond James analyst Rahul Sarugaser said in a note to clients that he is impressed at the company’s results, states a report from BNN Bloomberg. "For the first time in recent history, Organigram recorded cleanly positive gross margins, and executing on a multifaceted effort to widen margins in the near term, that the company believes will yield positive EBITDA by 3Q22," Sarugaser said.

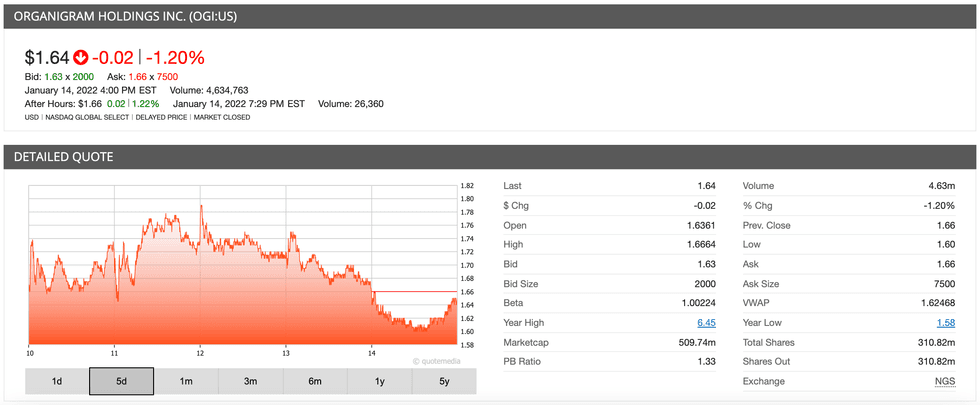

Organigram's share price, January 10 to 14, 2022.

Since issuing its financial results on Tuesday (January 11), shares of the company had dipped in value by 6.36 percent by the end of the week. As of Friday (January 14) at 4:00 p.m. EST, shares were priced at C$1.64.

Cannabis companies get set for lawsuit after dispute

Following a public back-and-forth between two US-based cannabis companies, one of the parties in the dispute is ready to take matters to court.

AWH told shareholders it has “filed a complaint commencing a lawsuit in the Commercial Division of the Supreme Court of the State of New York in New York County” against its former associate MedMen.

The dispute stems from the dissolution of a US$73 million investment deal in which AWH would be getting access to the coveted New York state cannabis market alongside MedMen.

AWH claims MedMen’s intention to cancel its commitment would go against guidelines from state regulators.

The company said the following on what it is attempting at the moment:

In addition, AWH has made an application for a preliminary injunction and temporary restraining order to maintain the status quo between the parties and to prevent any actions by the MedMen parties that would result in additional encumbrances on the equity or assets of MedMen NY, Inc.

Cannabis company news

- Delta 9 Cannabis (TSX:DN,OTCQX:DLTNF) issued financial guidance on its Q4 and year-end 2021 results as the company prepares to present its latest report to shareholders. The firm said it expects to achieve a net revenue line of between C$61.8 million and C$62.6 million.

- Avicanna (TSX:AVCN,OTCQX:AVCNF) confirmed a master supply agreement with Knop Laboratories, a Chilean pharmaceutical firm. As part of the deal, the Canadian firm will issue a “range of cannabinoid-based active pharmaceutical ingredients for the manufacturing, and commercialization of proprietary cannabinoid-based pharmaceutical products in Latin America.”

- Canntab Therapeutics (CSE:PILL,OTCQB:CTABF) notified investors of the successful delivery of two cannabis shipments, one in Ontario and the other in Australia. For the domestic market, the company delivered its first shipment of THC tablets to the Ontario Cannabis Store, whereas internally the company safely delivered its second shipment of THC and CBD tablets to Australia.

- Trees (NEO:TREE) announced the launch of its public stock on the NEO Exchange on Tuesday (January 11). “Investors in this segment have become increasingly discerning and we believe Trees will demonstrate — through sound execution and prudent management — an ability to grow and achieve scale by capitalizing on the extensive and accretive growth opportunities prevalent in the market today,” Trees CFO Jeff Holmgren said in a statement.

Don't forget to follow us @INN_Cannabis for real-time updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

- Invest in Cannabis: TSX Cannabis Stocks | INN ›

- Why Consider Investing in the Cannabis Industry? | INN ›

- Top Cannabis Stocks Year-to-Date | INN ›

- US Cannabis Stocks | INN ›

- Top Cannabis Stocks Year-to-Date | INN ›

- Top Cannabis Stocks Year-to-Date | INN ›