Overview:

The electrification revolution has prompted world governments to evaluate and strengthen domestic supply chains for the critical minerals clean technologies require. Lithium is one of the essential entries on the global critical minerals lists, yet countries like the United States are still facing a supply crunch that threatens to undermine its goal to develop a domestic supply chain of battery materials. China controls more than 75 percent of battery cell production, at least 70 percent of processed energy material production, and more than 60 percent of energy materials refinement.

A lithium-brine operation in Nevada is currently the only domestic lithium production operation in the United States. In an effort to boost production, President Biden announced new initiatives to update outdated mining laws, prioritize the federal critical minerals list, and strengthen stockpiling of critical minerals. Creating a domestic supply chain of lithium, alongside other critical minerals, is considered a significant yet feasible undertaking with the US Department of Energy’s Li-Bridge project that aims to develop a strategy for a more sustainable lithium battery supply chain. It’s clear that lithium operations within the United States will have the full support of federal and state governments as the country moves to build a domestic supply of critical minerals.

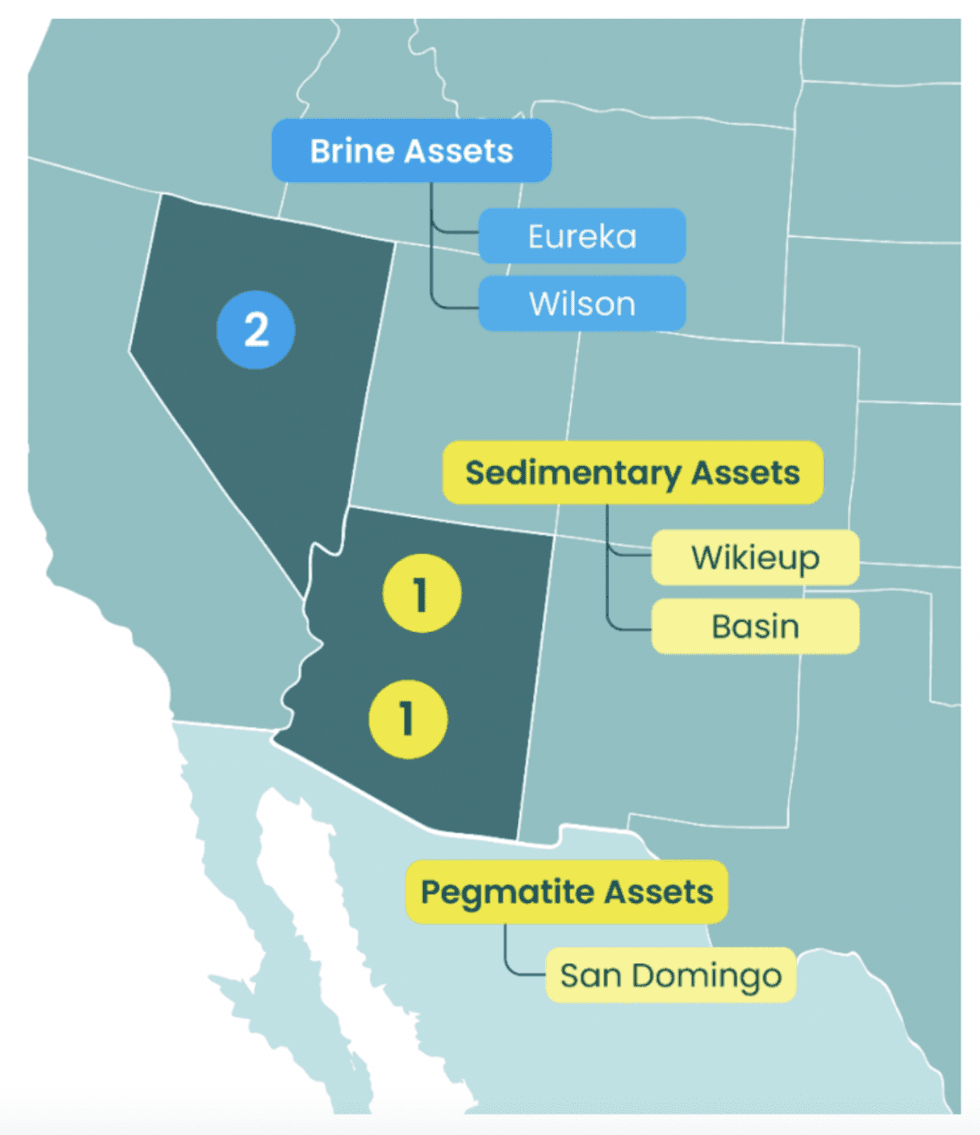

Bradda Head Lithium (AIM:BHL,TSXV:BHLI, OTCQB:BHLIF) is an exploration and development mining company with lithium assets in Arizona and Nevada in the United States, both Tier-1 mining jurisdictions. The company’s 100-percent-owned assets include all three types of lithium deposits and are near highly prolific operations. Bradda Head’s presence within the US and its potential to serve the growing demand for lithium creates significant opportunity for the company to become a major supplier of low-carbon lithium.

The company’s assets span all three types of lithium deposits: brine, clay (sedimentary) and hard rock (pegmatite). This project diversity gives Bradda Head a unique position with the capability to benefit from the strengths of each deposit type.

The San Domingo project in Arizona, one of the company’s flagship assets, will shortly be undergoing its second exploratory drilling program. The first 7,300-meter program demonstrated the presence of lithium-bearing minerals in roughly 60 percent of its drill holes, and the best intercept was 31.85 meters @ 1.60 percent lithium oxide. Bradda Head has been planning this follow-up program based on recent structural mapping, soil geochemistry and geophysical data to identify areas likely to contain lithium-bearing pegmatites, from the c.1,500 outcropping pegmatites it has in its 23-square-kilometer pegmatite district. The company’s additional assets in Arizona and nearby Nevada create additional opportunities for discovery and development. The Basin project in Arizona is Bradda’s flagship clay asset, and whilst only a small portion of it has been drilled, the project has an indicated and inferred JORC-compliant resource of 305 kt of lithium carbonate equivalent (LCE) with further resource growth expected this year.

Bradda Head places a strong emphasis on maintaining a positive ESG rating. The company is pursuing sustainable practices at every stage of its projects, is sensitive to cultural issues of Indigenous communities, and works with experts to minimize water usage throughout its operations.

An experienced management and exploration team lead the company toward fully developing its assets. The team has a strong track record of discoveries and executing multi-million-dollar deals. Ian Stalker (non-executive chairman), Charles FitzRoy (CEO), and Joey Wilkins (chief operating officer) have all played pivotal roles in the successful development and acquisition of past projects.

Company Highlights

- Bradda Head Lithium is an exploration and development mining company with 100-percent-owned assets in Arizona and Nevada, both Tier-1 mining jurisdictions.

- The company’s presence within the United States allows them to serve the growing need for domestic lithium as clean technologies become more prominent and significant to the country’s future goals.

- The company’s asset portfolio includes all three types of lithium deposits: brine, clay (sedimentary) and hard rock (pegmatite), allowing the company to benefit from the strengths of each deposit type.

- Bradda Head’s operations are in existing mining areas and near known deposits, enhancing the potential for significant discovery.

- One of the company’s flagship assets, the San Domingo project in Arizona, is currently undergoing exploratory drilling, and assays will be made available soon.

- Bradda Head is committed to maintaining a solid ESG rating throughout the exploration and development of its assets, prioritizing sustainability and cultural sensitivity at every step.

- An experienced management team with a track record of success leads the company toward its goals of fully developing its assets and serving the emerging domestic lithium supply chain.

Get access to more exclusive Lithium Investing Stock profiles here