Agriculture Market Forecast: Top Trends That Will Affect Potash and Phosphate in 2023

Fertilizer prices soared to new highs in 2022, putting pressure on farmers and food supply. Find out what's in store for the market in 2023.

Fertilizer prices surged to new heights in 2022, continuing a trend that began in 2021. The toll of war, rising gas costs, Chinese export issues and high crop prices pushed both phosphate and potash to record levels in April.

“Agricultural prices reached record highs in Q2 2022 as grain prices shot up in the aftermath of the war in Ukraine — both Russia and Ukraine are key global grain producers,” FocusEconomics' latest commodities outlook reads.

However, during the second half of 2022, demand destruction resulted in a 10 to 40 percent decline in consumption for both phosphate and potash, which pushed values lower.

A July agreement that ended Russia's blockade on Ukraine's agricultural exports also weakened prices, while an increase in production out of Canada eased some of the supply tension stemming from the war and Chinese shipment curtailments.

Experts polled by FocusEconomics anticipate that agriculture prices will "(trend downwards) in the quarters ahead amid softer demand, but remain above pre-pandemic levels.” Price support will come from factors such as lower Ukrainian grain output and high fertilizer prices, which "could dampen crop yields in 2023."

Demand is forecast to contract, but soil quality hasn't improved, which is likely to hinder crop yields. Smaller crop yields are likely to add to the mounting cost of food, driven higher in recent months by inflation.

How did phosphate perform in 2022?

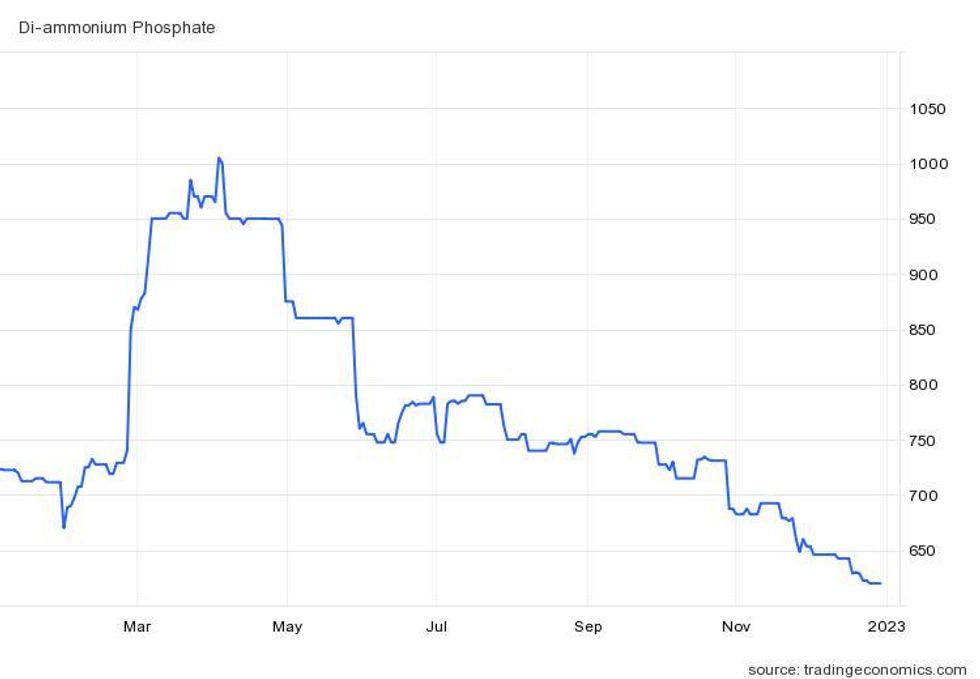

After rallying to an all-time high of more than US$1,000 per metric ton (MT) in April, phosphate prices came down significantly in the latter half of 2022, ultimately ending the year lower than they started.

The crop additive began the year at US$713, with values continuously moving higher through April, when concerns around Russian and Ukrainian grain and fertilizer exports reached a fever pitch.

The phosphate market was further impacted when China suspended exports through June to ensure enough domestic supply.

“Chinese fertilizer exports fell sharply in 2022 on government-imposed barriers. These barriers are set to remain in 2023, but as global and domestic prices move lower, we anticipate some relaxation,” an outlook report from CRU Group notes.

Diammonium phosphate's price performance in 2022.

Chart via TradingEconomics.

According to CRU, phosphate exports out of China topped 10.7 million MT in 2021, but contracted to 5.4 million MT in 2022. The consultancy expects some rebound in 2023, when shipments should tally 6.7 million MT. Annually, China is the top producer of phosphate, with output of 85 million MT in 2021. Russia ranks fourth, producing 14 million MT the same year.

By the end of June, phosphate prices had slipped back to the US$789 level.

The hidden costs of high fertilizer prices

Even though phosphate prices ended 2022 below their starting value, the true cost of the record-setting rise is yet to be felt.

The International Fertilizer Association estimates that 85 percent of the world’s soils are deficient in nitrogen, while 73 percent are deficient in phosphorus (phosphates) and 55 percent are deficient in potassium (potash).

These deficiencies make fertilizers essential to crop growth. But to counter broad-based increases in overhead costs, many farmers are opting to limit the amount of fertilizer they purchase and use. This is expected to impact soil health and crop yields.

“The fertilizer supply/price crisis is in many respects more concerning than direct food inflation because it could inhibit food production in the rest of the world that could eventually help take up the slack from stalled Russian and Ukrainian grain deliveries,” Maximo Torero, chief economist for the UN Food and Agriculture Organization, told Reuters.

He explained that this will have a knock-on effect that will ultimately drive up the cost of food. “High fertilizer prices could have farmers worldwide reducing planned harvests and the amount of land they are planting — with the risk of depressed yields in the 2022/23 crop season — adding to the shortage of imported grains and putting food security at even greater risk,” Torero said.

As the global food system slips into precarious territory, demand for wheat is expected to hit a fresh high in 2023.

“Recent increases in global wheat demand for food use have been fuelled mainly by growing populations and shifts in diets and incomes,” Economist Intelligence Unit members said. “Ongoing population growth across parts of Africa and Asia will underpin further expansion in 2022/23, where we forecast that food use will reach a record 546m tonnes.”

How did potash perform in 2022?

Potash faced similar hurdles to phosphate in 2022. The most prevalent was the market's exposure to Russian disruption.

“In terms of production capacity, potash is certainly the most exposed to disruption from both Russia and Belarus when compared to other major fertilizers,” Humphrey Knight, potash principal analyst at CRU, told INN.

Taking the second and third respective spots on the top potash producers list, Russia and Belarus produced a combined 17 million MT of potash in 2022. Canada was in first place with 14 million MT.

“Prior to 2022, the two countries accounted for around 40 percent of global supply. Although exports from both countries have faced disruption in 2022, particularly from Belarus, product has continued to flow to many downstream markets,” Knight said.

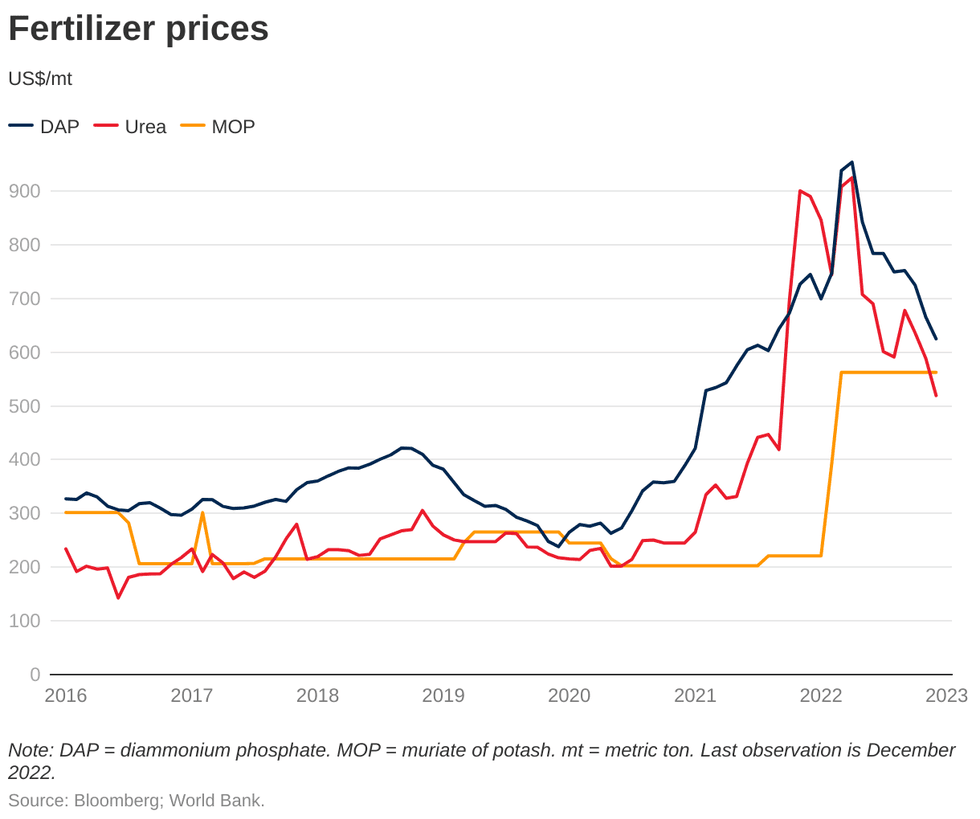

Muriate of potash (MOP) started 2022 at US$221 per MT, but the conflict in Ukraine and sanctions against Belarus drove prices to US$562 in March, the highest level since February 2009. MOP prices remained at that level for the rest of the year.

MOP is the most commonly used form of potash and is more affordable compared to sulfate of potash.

Price performance of diammonium phosphate, urea and MOP from 2016 to 2022.

Chart via Bloomberg and the World Bank.

Higher potash prices causing demand destruction

While phosphate moved lower during H2, potash remained elevated off of continued supply concerns. Fears that supply will be further depleted by Russia’s invasion of Ukraine heightened the impact of 2021 sanctions targeting Belarusian potash exports.

“The (Russian) trade sanctions have specified 'carve-outs' for the food and fertilizer sectors to avoid adverse effects on global food security,” a World Bank blog post reads. “These carve-outs have enabled Russia to continue exporting fertilizers. However, potash exports from Belarus have fallen by more than 50 percent due to the restriction on using EU territory for transit purposes.”

Picking up some of that slack is Canada, where the nation’s potash producers have started to ramp up output.

“Canada’s largest producers, Nutrien (TSX:NTR,NYSE:NTR) and Mosaic (NYSE:MOS), maintain plans to reactivate capacity the companies had previously idled, at least partly in response to the supply disruption in Russia and Belarus,” said Knight.

However, as Knight went on to explain, 10 months of persistently high prices have led to potash demand destruction.

“Mosaic recorded only a modest year-on-year increase in potash sales in the first nine months of 2022, and Nutrien saw potash sales decline over the period,” he said. “Despite the supply disruption, demand has been weak, and the Canadian producers have consequently not been able to take advantage of the supply gap.”

What factors will move the agriculture market in 2023?

Looking ahead, Knight expects 2022’s price surge to have lasting implications for farmers.

"Some spot prices hit record highs in 2022, and this has made potash affordability very unfavorable for consumers," he said. “Consequently, many have reduced potash consumption significantly and global demand has weakened.”

As farmers reduced their use of fertilizer, many began experimenting with nutrient efficiency and enhancing products. According to CRU, this is something that could happen more in the future.

“As capital markets tighten and fertilizer producers hold flush cash balances, 2023 could be the year to 'roll the dice' and acquire companies with patented new plant nutrition technologies,” the firm's outlook report reads.

Following 2022’s demand destruction, Knight believes the sector could recapture lost buying if prices retract.

“The potash market certainly remains exposed to further disruption to production into 2023, and could see supply tighten quickly if demand recovers rapidly from its current lull,” he said.

The principal analyst at CRU concluded, “However, a more gradual recovery in demand appears more likely (in 2023), meaning supply should remain adequate.”

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Fertilizers: The Difference Between Potash and Phosphate ›

- Potash and Phosphate Price Update: H1 2022 in Review ›