- WORLD EDITIONAustraliaNorth AmericaWorld

Investor Insight

With its high-quality uranium assets in Tanzania, as well as a highly experienced corporate and in-country management team, Moab Minerals presents a compelling case for investors evaluating opportunities in the rapidly growing uranium market.

Overview

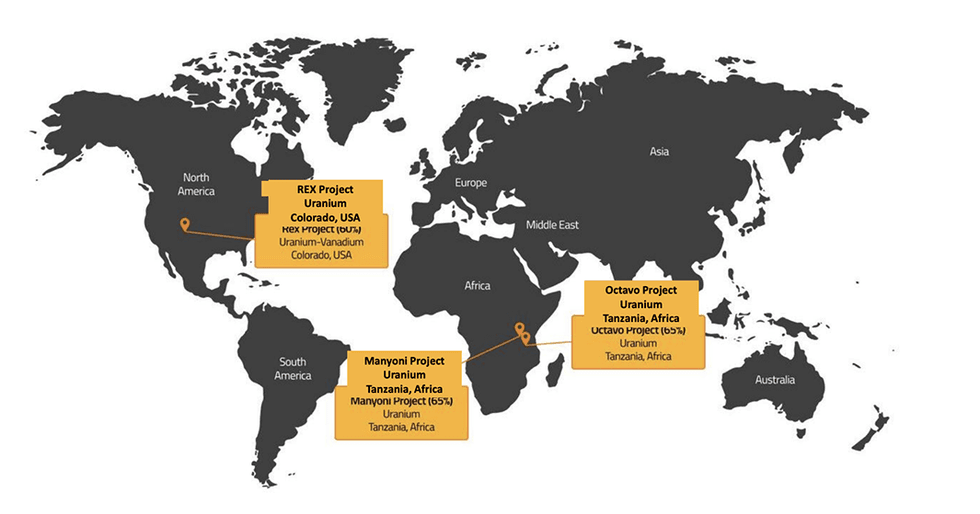

Moab Minerals (ASX:MOM) is an exploration company with the primary goal of developing its uranium assets in Tanzania. On the 8th July 2024 the company announced the acquisition of a majority stake in Katika Resources, a Tanzanian company, that holds the Manyoni and Octavo uranium projects. The Manyoni project was previously explored by Uranex Ltd from the early 2000’s until 2013. The Octavo uranium project is adjacent to Rosatom’s world class Nyota uranium deposit (Mkuju River project), which was formerly held by ASX listed Mantra Resources before the AU$1.02 billion takeover in 2011.

Tanzania is an emerging jurisdiction for large-scale uranium mining, with significant uranium deposits identified in recent years. Significant Tanzanian deposits include Namtumbo (Mkuju), Bahi, Galapo, Minjingu, Mbulu, Simanjiro, Lake Natron, Manyoni, Songea, Tunduru, Madaba and Nachingwea. Of these projects, Mkuju River is the largest, boasting a mineral resource of 8,500 tons U3O8 and, once operational, will be the country’s first operating uranium mine.

With a high-calibre team of highly experienced mining and business leaders with successful track records, and a Tanzanian based team of technical experts, Moab is well positioned to deliver on its commitment to expedite the exploration and development of its uranium projects in Tanzania.

Get access to more exclusive Uranium Investing Stock profiles here