Overview

The Selwyn Basin in the Yukon remains a relatively underexplored and undervalued region with huge potential for gold deposits. Exploration companies looking to acquire and develop highly prospective projects in the region have the ability to leverage excellent discovery potential and exciting early-stage investment opportunities.

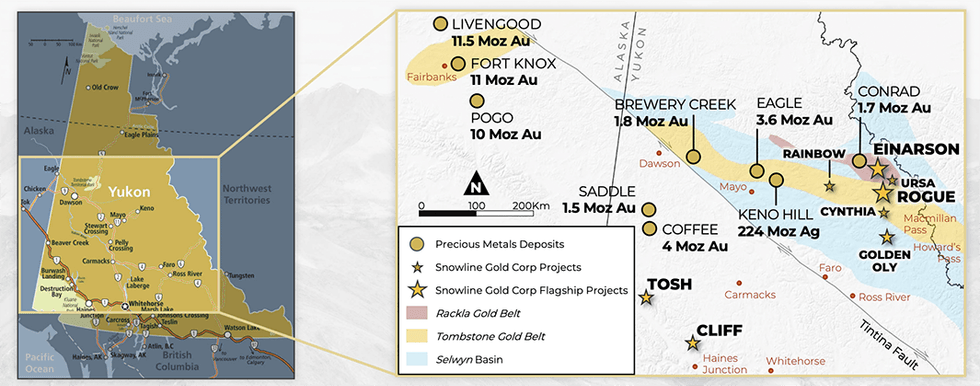

Snowline Gold (CSE:SGD) is a Yukon Territory focused gold exploration company with a seventeen-project portfolio covering >280,000 ha. The Company is exploring its flagship >137,000 ha Rogue and Einarson gold projects in the highly prospective yet underexplored Selwyn Basin. Snowline’s project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross’ Fort Knox mine, Newmont’s Coffee deposit, and Victoria Gold’s Eagle Mine. The Company’s first-mover land position and extensive database provide a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

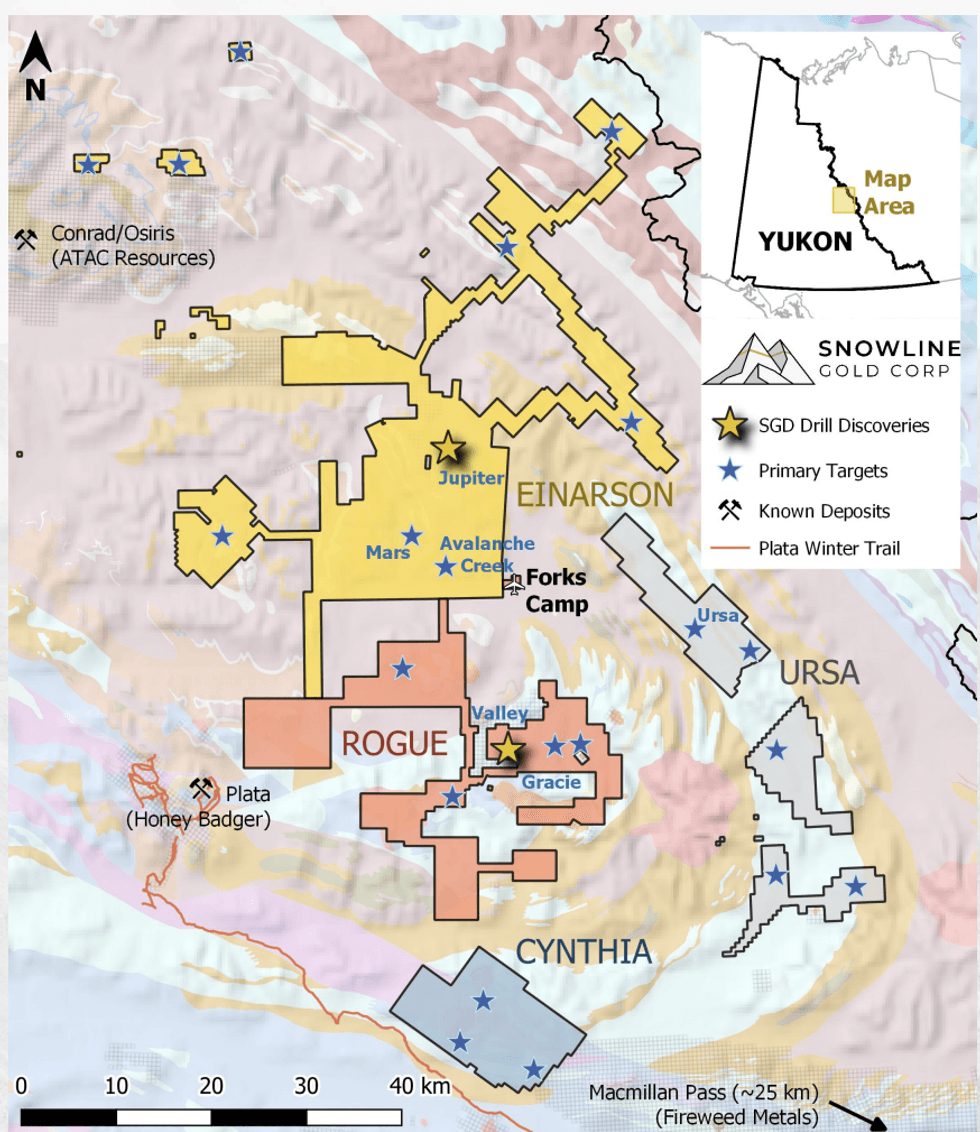

The Einarson property covers five primary target areas with high-grade surface grab samples and wide-scale gold anomalies in the soil. Additionally, the Rogue project hosts two prospective targets, which cover a newly discovered Tombstone series intrusion, and a potential buried intrusion with visible gold observed within its sulfide veining structures.

Snowline Gold leverages existing geological data from exploration work completed by the previous private operator. This data helps enable fast-tracked development and more rapid, low-cost entry to exploration.

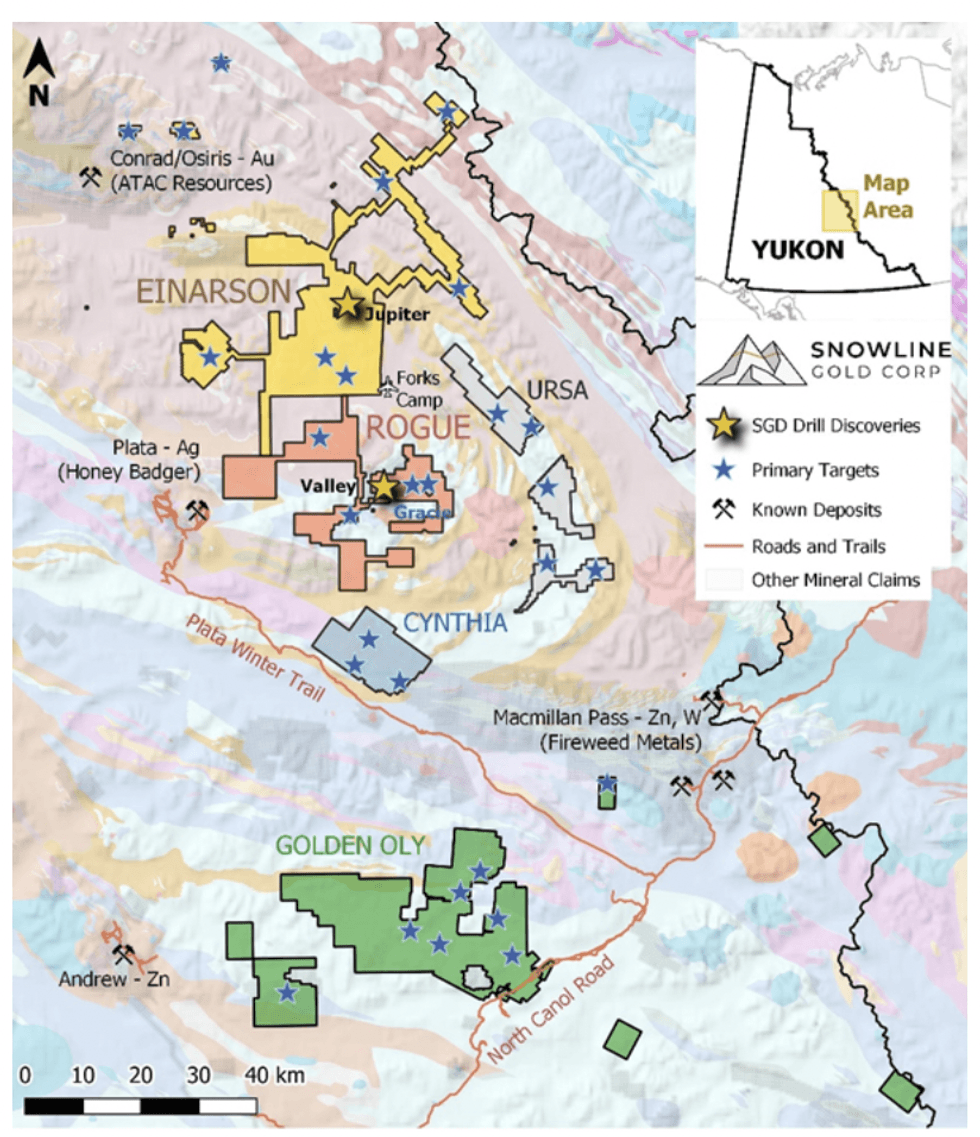

In 2022, Snowline Gold purchased a large portfolio in the Yukon Territory, the Golden Oly project, from StrikePoint Gold Inc. (TSXV:SKP), which comprises 10 gold properties in the Selwyn Basin.

Snowline Gold CEO Scott Berdahl said the Golden Oly project covers at least seven distinct reduced intrusion-related gold targets, with each target geologically similar to the company’s ongoing Valley discovery on the Rogue Project. “We have acquired not just the properties, but also extensive geochemical, geophysical and geological datasets which will accelerate our exploration efforts – all for roughly the cost of staking,” he said in a statement.

The company commenced its 2022 exploration and drilling program in June 2022. Phase 2 diamond drilling is underway at Rogue's Valley zone to test the extent of gold mineralization encountered by drilling in September 2021 within a soil and talus fine anomaly spanning roughly two kms.

The company’s solid share structure has a post-RTO total of over 89,197,000 shares and consists of several strategic shareholders, management and insiders. Snowline Gold has a committed 30 percent insider share position.

Company Highlights

- Snowline Gold is an emerging gold exploration company focused on the Yukon Territory in Canada. The company has a diverse asset portfolio of eight gold projects covering >280,000 hectares.

- The Company is exploring its flagship >137,000 ha Rogue and Einarson gold projects in the highly prospective yet underexplored Selwyn Basin.

- The Rogue and Einarson gold projects sit at the intersection of established mineral belts and host defined gold targets with high-grade potential at world-class scales.

- The company is led by a highly experienced exploration-focused management team

- Rogue’s Valley Zone is a newly discovered, bulk tonnage style, reduced intrusion-related gold system (RIRGS), with geological similarities to multi-million-ounce deposits currently in production like Kinross’s Fort Knox Mine in Alaska and Victoria Gold’s Eagle Mine in the Yukon. Early drill results demonstrate unusually high gold grades for such a system present near surface across intersections of hundreds of metres.

- Snowline Gold acquired the Golden Oly project comprised of ten gold properties in the Yukon's Selwyn Basin.

Get access to more exclusive Gold Investing Stock profiles here