Extensive exploration leading to gold resource growth.

Overview

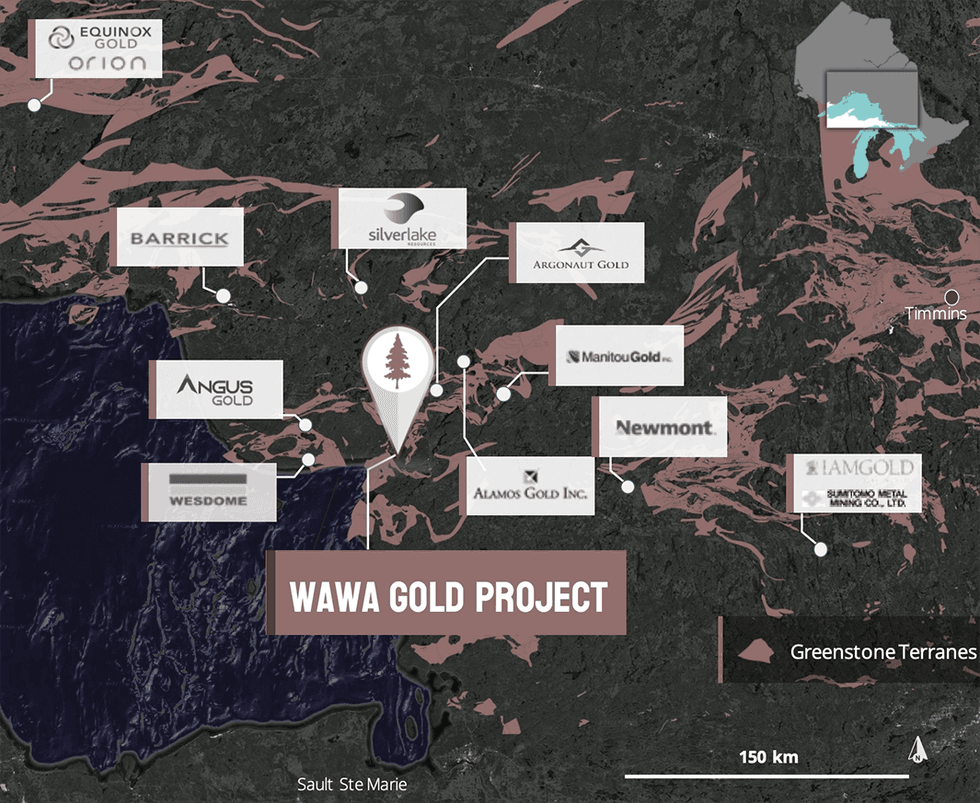

Red Pine Exploration Inc. (TSXV:RPX) is a gold exploration company focused on identifying, acquiring and developing prospective properties in Ontario, Canada. Red Pine is currently developing its 100-percent-owned flagship Wawa gold project, located near Wawa, Ontario. The project sits within a mining-friendly jurisdiction that hosts properties owned by Argonaut Gold (TSX:AR) and Alamos Gold (TSX:AGI), as well as Newmont (NYSE:NEM; TSX:NGT) and Barrick Gold (NYSE:GOLD; TSX:ABX). The project is also supported by established infrastructure as well as a receptive and skilled community.

Led by an experienced management and technical team, the company's flagship Wawa gold project is located 2 kms southeast of the Municipality of Wawa, in Northern Ontario. The property, covering 7,031 hectares, hosted several former mines with a combined historic production of 120,000 oz gold.

Since becoming involved in the property in 2014, Red Pine has developed two resource estimates for the property. The two mineral deposits, Surluga and Minto Mine South, are a currently estimated NI 43-101 resource of 1.30 million tonnes @ 5.47 g/t gold for 230,000 ounces in the indicated category and 2.716 million tonnes @ 5.39 g/t gold for 471,000 ounces in the inferred category. Both deposits remain open in all directions, providing the company with expansion potential, and more than 95 percent of the contained ounces at both deposits are located between surface and a depth of 350 meters.

In addition to the two deposits already defined on the property, Red Pine believes the Wawa gold project has the potential to host six additional deposits and has generated a pipeline of several high-priority targets that, combined, could contain up to 3 Moz gold. The majority of the targets rest within the six-kilometer Wawa Gold Corridor, a gold mineralization zone that could be the controlling mineralization structure for the property.

Red Pine’s 2022 exploration program has more than the planned 25,000 meters. Red Pine also intersected high-grade mineralization up to 325 meters away from the current resource boundary in the Surluga North area. The company continues to expand the footprint of mineralization outside the current resource of the Surluga Deposit confirming the presence of both high-grade mineralization and multiple gold zones in a newly identified large intrusion-related gold system (IRGS) west of the Jubilee Shear Zone. The mineralization associated with the IGRS west of the Jubilee Shear Zone can be traced over one kilometer.

Company Highlights

- 100 percent Wawa Gold project ownership

- The Wawa project hosts eight known gold deposits, two of which have NI 43-101 resources.

- Surluga and Minto Mine South mineral deposits currently have an estimated NI 43-101 resource of 1.30 million tonnes @ 5.47 g/t gold for 230,000 ounces in the indicated category and 2.716 million tonnes @ 5.39 g/t gold for 471,000 ounces in the inferred category.

- Resource principally located between the surface and 300 meters vertical depth

- Discovery of higher-grade mineralization in the Jubilee Shear Zone (host of the Surluga deposit) down plunge of the existing resource

- Preliminary drilling identified five high-grade gold exploration targets that could grow the current resource: Hornblende, Minto B, Grace/Nyman, Minto Mine South and Parkhill # 4 shear zones

- Potential for additional high-grade gold targets in the extension of the Jubilee Shear Zone, south of the Parkhill Fault

- Strategic partner Alamos Gold (TSX:AGI) holds 19.3 percent of outstanding shares of Red Pine, and recently committed capital in its latest $20M financing.

- Strong management team with vast experience developing projects in Canada.

- Management and insiders hold 2 percent of company shares.

- Fully funded drill program of up to 25,000 meters

- Newly identified large intrusion-related gold system (IRGS) west of the Jubilee Shear Zone from the company's 2022 exploration program.

Get access to more exclusive Gold Investing Stock profiles here