Phosphate Outlook 2022: Geopolitics to be a Key Market Mover

The phosphate space was impacted by US duties, changing weather patterns and supply disruptions in 2021. How will the market perform in 2022?

Click here to read the previous phosphate outlook.

Phosphate is an important component of fertilizers, making it essential to the agriculture industry.

Prices for phosphate moved higher in 2021, driven in part by a US countervailing duty on phosphate imports from Morocco and Russia. The market was also impacted by lingering transport issues, higher energy prices and strong grower sentiment. In H2, prices reached heights unseen since 2008 as supply challenges mounted.

As 2022 starts, the Investing News Network (INN) takes a look at what experts expect for phosphate going forward.

Phosphate trends 2021: Tight supply catalyzes prices

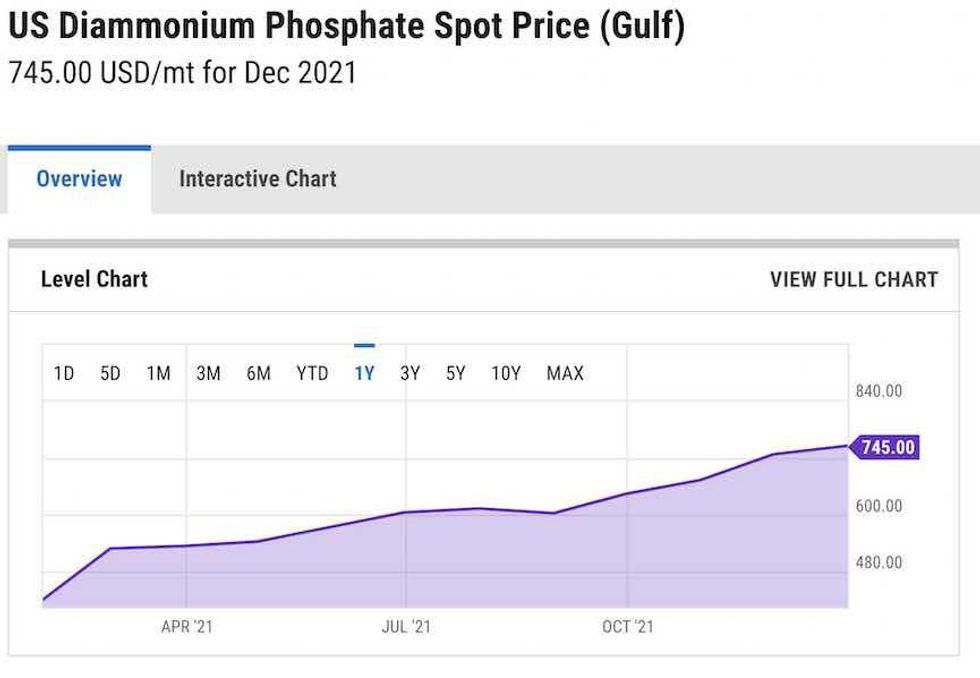

Prices for US diammonium phosphate (DAP) started 2021 at US$421 per metric tonne (MT), and by December various tailwinds had pushed values 76 percent higher to US$745, a 13 year high.

2021 spot price performance for US diammonium phosphate.

Chart via YCharts.

"In early October, prices reached levels unseen since the global financial crisis in 2008,” the World Bank’s Commodity Markets Outlook reads. “Prices have been supported by strong demand in Brazil and the United States, especially for maize and soybeans, both of which are phosphate-intensive crops.”

Similarly, prices for Morocco phosphate rock climbed from US$83.33 on December 31, 2020, to end 2021 at US$176.67 — a 112 percent increase.

Supply quickly became the primary value driver early in 2021 after prices entered the year still elevated from 2020. Higher commodity prices enticed farmers to bulk up crops, which weighed further on the tightening market.

In March, the US International Trade Commission ruled that the domestic industry was being “materially injured by reason of imports of phosphate fertilizers from Morocco and Russia that the US Department of Commerce has determined are subsidized by the governments of those countries.”

The ruling, and the subsequent tax on phosphate from those nations, pushed prices even higher; by mid-March, values were up 26 percent from the start of the quarter.

“US authorities in March 2021 decided to impose 20 percent duties on Moroccan phosphate imports, and duties ranging from about 10 to 47 percent on Russian phosphate imports,” Glen Kurokawa of CRU Group told INN.

“The determination was appealed to the US Court of International Trade, which should render a decision in 2022,” he added. “Moroccan and Russian phosphate exports to the US remain extremely low and nearly non-existent.”

Morocco and the Western Sahara region rank second in terms of annual phosphate output, producing 37 million MT in 2020. Russia is the fourth largest phosphate producer with a tally of 13 million MT the same year.

By June, US DAP was selling for US$604.75 as farming input, energy and freight transport costs all rose, creating a precarious position for some farmers as profit margins became increasingly stretched.

Some lingering logistical challenges related to the pandemic also weighed on the space during H1.

“There appear to have been a few delays when the Suez was blocked earlier this year,” said Kurokawa, who is a senior analyst at CRU. “We have not heard about significant problems with deliveries in general. However, freight prices rose significantly due to undersupply and high demand, but are declining as China reduces exports.”

Another factor that weighed on the market in 2021 was China’s decision to suspend phosphate exports until June 2022. As the top-producing country, China puts out 90 million MT annually for 30 percent of global supply.

There has been speculation that the nation halted exports to build domestic stores of phosphate to ensure future food supply. China has made drastic export reductions to its phosphate shipments in the past.

This was most notable in 2008 ahead of the Beijing Summer Olympic Games. Coincidentally, the country is set to host the Winter Olympic Games in the same city in 2022.

In September 2021, the phosphate sector was faced with another challenge when leading American producer Mosaic (NYSE:MOS) announced its production and operations had been negatively affected by Hurricane Ida.

The storm, which hit Louisiana in late August, was the second most damaging and intense hurricane to make landfall, registering as a category five. The estimated cost for damages is US$75 billion.

“In the third quarter, relative to historical averages, production is expected to be down by approximately 300,000 tonnes,” a September statement from Mosaic reads. “Fourth quarter operating rates are expected to improve sequentially, but production may still be down from historical averages.”

Despite the production disruption, the company reported Q3 revenues of US$3.4 billion, a 44 percent year-over-year increase. Mosaic credited stronger pricing for offsetting the volume decline.

Phosphate outlook 2022: Crop prices to remain elevated

After trending higher through 2021, prices for phosphate have continued their upward trajectory in January 2022. Downstream costs pushed DAP prices to US$863 mid-month, with continued growth forecast in the near term.

“Demand in China is strong and feed demand continues to increase in response to the country’s rebuilding of its hog herd population following the culling of large numbers to control the African swine fever outbreak,” the World Bank report states. “Rising raw material costs — particularly phosphoric rock, ammonia, and sulfur — have also contributed to the price surge.”

2022 is anticipated to bring continued rising food prices due to inflation, farmer overhead and higher energy and transport costs. US farmers are also expected to plant more crops this year, requiring more fertilizer.

“Crop prices remain high, pushing up phosphate prices,” Kurokawa said. “Input costs, such as for nitrogen (which relies on natural gas) and sulfur are high, and also support high phosphate prices.”

As the world continues to deal with and recover from COVID-19, food supply chains have been stretched thin, making 2022 crops valuable and important, and in turn increasing the need for fertilizers for those crops.

“India has raised phosphate subsidies to record levels,” the senior analyst at CRU explained to INN. “China, which is one of the biggest phosphate exporters, has nearly stopped exports so that it can provide for its own farmers. This has pushed prices up further.”

Kurokawa continued, “High prices are prompting comparisons to 2008, as well as questions about if and when the prices will decline. There has also been some excitement lately about rapidly growing phosphate demand in electric vehicle (EV) batteries, though the market is very small and largely confined to China.”

While lithium-iron-phosphate (LFP) batteries make up only a small percentage of the specialty phosphate market, they are forecast to see continued growth. It's worth noting that LFP technology isn’t new — it is one of the original battery formulas — but it was phased out in the early 2000s due to lack of efficiency.

“Recent progress in LFP battery technology, however, has increased its adoption prospects. The most advanced LFP batteries are comparable and sometimes arguably better than other battery technologies,” Kurokawa wrote in an October report. “LFP batteries are cheaper and contain neither nickel nor cobalt, both of which are limited in reserves, have volatile and high prices, and can involve ESG issues. Iron and phosphate are used to produce LFP, and both are abundant. LFP batteries are also more durable, allowing more charging cycles.”

Tesla (NASDAQ:TSLA), one the world’s leading manufacturers of electric vehicles, uses LFP batteries in some of its models, and that percentage could grow as demand for EVs trends higher into the decade.

Climate change is another factor that will likely impact future demand and supply fundamentals.

In Canada, the government has proposed on-farm emissions reductions of 30 percent to aid in greenhouse gas production, a move Fertilizer Canada says will cost the country more than C$48 million over the next eight years.

On the other hand, the cost of weather alterations driven by climate change is also likely to have a secondary impact to the sector, including events like Hurricane Ida in Louisiana.

“Effects are more likely to be indirect," Kurokawa said. “To the extent weather is affected by climate change, this affects agricultural planting conditions and prices, which in turn affects phosphate demand.”

Kurokawa mentioned the frequency and duration of ENSO (El Niño-Southern Oscillation) activity as an example of how climate change is weighing on the sector.

“Climate change policies may lead to increasingly higher production and other costs in the future,” he said. “There is more discussion in the phosphate market about environmental concerns other than climate change, such as local environmental effects from phosphate mining and gypsum by-production.”

Phosphate outlook: Precarious supply a potential growth catalyst

Looking ahead, the phosphate market is expected to climb to US$90.25 billion by 2028, registering an annual compound growth rate of 5 percent between 2022 and 2028. Contributing to this uptick will be increasing pressures on global food supply, rising populations, inflation and downstream costs.

In 2021, US phosphate imports increased by 1.3 million MT, 57 percent higher than 2020's intake.

“Following a nearly doubling in 2021, DAP prices are expected to experience a modest increase in 2022 on expectations of continued tight supply,” the World Bank's market report notes.

For Kurokawa, China’s next moves will be pivotal to phosphate price performance this year.

”Phosphate prices may be pressured when China returns to exporting phosphate and several phosphate projects commission in 2022,” he said. “If the US appellate court significantly alters the countervailing duties, this will likely disrupt phosphate trade again.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Phosphate-mining Stocks to Watch | INN ›

- Fertilizers: The Difference Between Potash and Phosphate | INN ›

- phosphate stocks | INN ›

- 10 Top Phosphate Countries by Production | INN ›

- Josh Linville: Fertilizer Market in Uncharted Waters as Prices Soar | INN ›

- Potash and Phosphate Price Update: H1 2022 in Review ›