Palladium Outlook 2021: Supply Constraints a Tailwind for Higher Value

Palladium prices climbed 18 percent over the course of the 2020. Read on to find out about the 2021 palladium outlook.

Click here to read the latest palladium outlook.

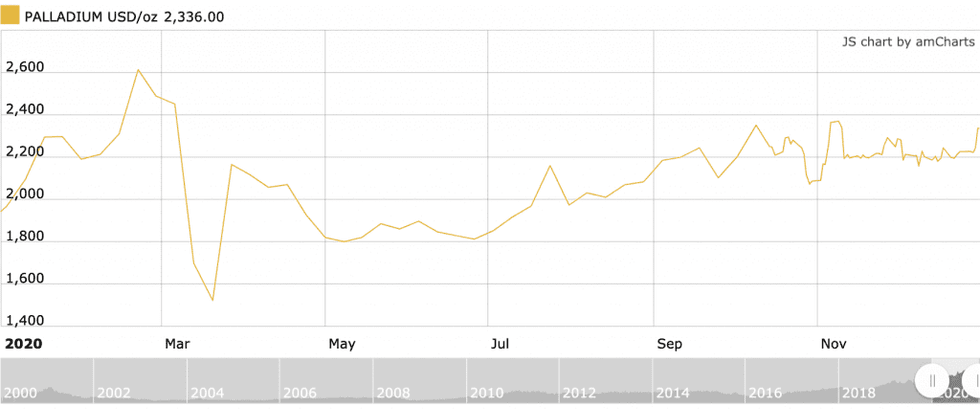

2020 saw palladium add 18 percent to its value, but that wasn’t the whole story. The effects of the coronavirus pandemic weighed heavily on precious metals early on, with palladium prices displaying volatility after the initial lockdowns imposed in March.

Palladium hit an all-time high in February, then sunk to a five month low 30 days later.

Although the COVID-19-facilitated drop was short-lived, the commodities market’s swan dive managed to shave 41 percent from palladium’s price, taking it from US$2,614 per ounce to US$1,522.

As gold and silver quickly rebounded, platinum and palladium also followed suit. The latter two benefited from a resurgence in safe haven investment allure, which precious metals are generally aided by.

2020 palladium price performance. Chart via Kitco.

But heightened interest from the investment segment did not combat supply disruptions.

“COVID-19 had an impact on both (platinum and palladium) prices. The impact was greater on platinum than on palladium in large part due to the disruption to South African mine supply,” CPM Group’s Rohit Savant explained to the Investing News Network (INN).

Palladium trends 2020: Sector performance tied to automotive demand

Palladium prices remained well off their February year-to-date high for much of 2020 due to a decline in demand from the automotive sector.

Roughly 80 percent of annual demand comes from auto manufacturing, while industrial demand accounts for 18 percent and the jewelry sector uses the remaining 2 percent.

According to an S&P Global report, auto sales around the world are expected to fall 20 percent for 2020. The decline is forecast to last an additional two years, with output at least 6 percent lower than 2019.

“We continue to believe that the Chinese market has the potential to resume moderate long-term growth, and project it will be the only region to recover to 2019 volumes by the end of 2022,” it states.

“In Europe and North America, sales showed signs of stabilizing in July and August, but we don’t expect these markets to fully recover their steep declines within the next two years.”

With palladium’s primary end-use segment significantly impacted, prices for the metal were also affected during 2020. “Platinum and palladium prices took a significant hit at the start of the pandemic, after growing robustly in the previous year on the back of tight supply and strong demand prospects” Steven Burke of FocusEconomics told INN.

“The drop in prices in late February and early March was predominantly driven by a stark fall in demand from the automotive sector. As lockdown measures weighed on the global economic outlook, vehicle demand took a massive hit.”

As demand contracted, a reduction in supply out of South Africa, a top producer of platinum-group metals (PGMs), worked to offset the automotive decline.

“Restrictions on South Africa’s mining sector to control the spread of the virus dragged heavily on supply, which, coupled with safe haven demand, helped prices to recover quickly in Q2,” said Burke. “In H2 2020, the ongoing rise in prices was mainly driven by recovering global economic activity — particularly out of China as car sales in the country were healthy.”

Palladium outlook 2021: Supply deficit to support higher prices in future

Palladium prices rose 18.6 percent for 2020, but the metal climbed more than 55 percent from its March low of US$1,522 to a high of US$2,370 in November. Forty-two percent of that recovery came just seven days following the metal’s mid-March dip.

“Palladium jumped really strong out of that March low, it was one of the first ones to break out,” commented Ralph Aldis of US Global Investors (NASDAQ:GROW). “I was kind of surprised, I didn’t expect it to come out as strong, but it did.”

The portfolio manager noted that all precious metals performed well in 2020, a trend he said indicates a broadening of the sector, which refers to growing interest from investors. In fact, palladium, platinum and silver all outperformed gold from their lowest points in March to their subsequent highs.

2020 wasn’t the first year that palladium made strong gains. In 2019, it added 46 percent to its value.

“Palladium has been in tight supply,” said Aldis, who went on to explain that production woes in Russia, another top PGMs producer, could add to that supply narrowness in the future.

“You have the issue in Russia with permafrost at the Norilsk Nickel (MCX:GMKN) facility. They may have some reduced output in the future, potentially,” said Aldis. “If something happens with their infrastructure, and they’re having to be rebuilt or shore up in some way, that could slow production.”

With output in Russia potentially being impacted down the road, and the disruption seen in 2020 out of South Africa, Aldis sees newly discovered deposits as a possible catalyst. He mentioned Chalice Gold Mines’ (ASX:CHN,OTCQB:CGMLF) Julimar project in Australia as particularly noteworthy.

“They have pulled out some fantastic holes — platinum palladium, nickel and copper; they’ve made a major discovery,” said Aldis. Calling the project a game changer, he noted that the perceived safeness of the jurisdiction also adds to its appeal. “So Australia I think could be disruptive to the South Africans and the Russians in terms of tough competition.”

Canada could also play a role in diversifying palladium supply. In 2019, sector major Impala Platinum (OTCQX:IMPUY,JSE:IMP) acquired the Lac des Iles mine in Northern Ontario, an area that is getting attention from the PGMs sector.

According to Aldis, Impala will need to ensure it has feedstock to last into the decade, making an adjacent deposit owned by junior Clean Air Metals (TSXV:AIR,OTCQB:CLRMF) especially interesting.

“In the future, (Lac des Iles) is going to need feedstock to replace its depleting ores, and Clean Air Metals is the closest deposit to that operation that would likely become the next feedstock,” he added.

Palladium outlook 2021: What investors can expect

Since the start of 2021, palladium has held above the US$2,200 mark, making it the most valuable of the four main precious metals. Prices spiked during the first week of the year, when values climbed to US$2,394, the highest since February 2020.

2021 palladium price performance. Chart via Kitco.

“Palladium prices are forecasted to rise during 2021 on an annual average basis; however, the gains in palladium prices are expected to be relatively lackluster compared to other metals in the complex,” said Savant, who is vice president of research at CPM Group.

He also cited several potential catalysts that could benefit or hinder the metal’s momentum.

“Much of palladium’s 2021 price forecast is pegged on a recovery in palladium fabrication demand,” he said. “The availability of vaccines and the large monetary and fiscal stimulus injected into the global economy is expected to support this expectation of growth in fabrication demand.”

Growth in demand is anticipated for the second half of the year, with prices rising in anticipation.

In terms of what price point to expect for the metal, FocusEconomics offered some insight. “Panelists see palladium prices falling slightly from their current level, but remaining extremely elevated by historical standards, averaging US$2,261 in Q4 2021,” said Burke.

Prices are likely to be slightly depressed as South African production returns to pre-pandemic levels. “That said, the ongoing recovery in global economic activity should support demand for vehicles — particularly for hybrids — and cap the overall fall in prices,” added Burke.

“A potentially faster-than-anticipated rollout of a vaccine is an upside risk, while the possible substitution of palladium for platinum in catalytic converters, given the elevated price disparity between the metals, is a downside risk,” he continued.

As vaccines are rolled out across Europe and North America, Africa is estimated to receive shipments in late summer, a factor that could result in further lockdowns and mining sector disruptions.

US Global Investors’ Aldis pointed out that South Africa controls 90 percent of the resource base in the PGMs space. “(Vaccine delivery) is going to impact probably every sector out there, because the rollout of the vaccine is going to be very problematic in countries where their healthcare infrastructure suffered from a lack of investment to some extent.”

Official numbers on just how impactful South African lockdowns have been on palladium supply are still being tallied, according to Savant, although a significant reduction is estimated.

Anglo American Platinum (Amplats) (LSE:AAL,OTC Pink:AGPPF), a South Africa-focused PGMs major, had to drastically reduce its guidance in 2020. Not only did government-imposed lockdowns weigh on output, but so did a fire at its smelter plant.

“(Amplats) curtailed guidance down to about 2.5 million ounces from 3.1 million to 3.3 million — that’s almost 600,000 ounces less production,” said Aldis. “It should tighten the market”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.