Barksdale Resources Corp. ("Barksdale" or the "Company") (TSXV:BRO) (OTCQX:BRKCF) is pleased to announce completion of the Phase I, 5,000-meter drilling program at the Cerro Verde zone, San Javier project Sonora, Mexico as well as the latest assay results from 16 additional drill holes. Importantly, all 36 drill holes from the current program have intersected various concentrations of visually apparent copper mineralization and each of the 16 drill holes discussed in this press release have assay-confirmed intercepts of copper mineralization above a 0.20% copper cut-off grade. These latest results continue to confirm continuity of drilled mineralization, as well as expansion of the oxide copper footprint

Drilling Highlights:

- Barksdale's inaugural 5,000m drilling program at Cerro Verde has successfully concluded with all 36 holes encountering copper mineralization (assay confirmed and visually estimated from core logging).

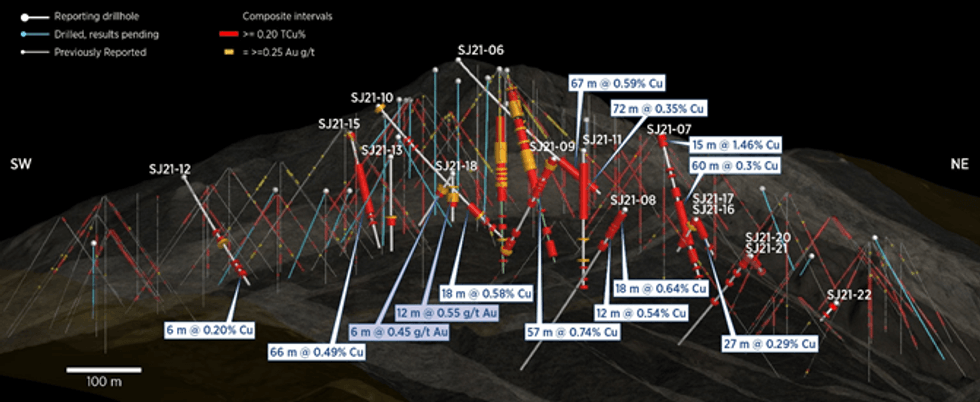

- Drilling has continued to confirm and expand the footprint of the Cerro Verde zone with key results including significant near-surface oxide mineralization including 57m grading 0.74% copper from surface (SJ21-09), which included a 15m intercept of 1.74% copper from 12-27m. Additional shallow oxide intercepts include 15m grading 1.47% copper from surface (SJ21-07), and 66m grading 0.49% copper (SJ21-15).

- Step-outs from the Cerro Verde footprint of mineralization include 12m grading 0.85% copper from 6-18m and 12m grading 0.54% copper from 33-45 (both from SJ21-08) as well as 12m of 0.45% copper from 30-42m (SJ21-18).

Rick Trotman, President and CEO of Barksdale commented: "This is a great follow-up to the initial holes that we announced in mid-October. Not only has the team demonstrated the robust nature of the supergene copper zone but we are now starting to see the results of some of the step out holes that show that Cerro Verde's footprint still has room to grow. With 15 drill holes still at the assay laboratory, including our last batch of samples which was submitted during the first week of December, we anticipate additional results to be announced during January and potentially into early February."

Geology Discussion

Iron oxide copper gold deposits ("IOCG deposits") are generally recognized as containing significant amounts of iron oxide minerals, such as magnetite and various forms of hematite. The San Javier deposit is classified as an IOCG due to the occurrence of large amounts of hematite, specularite and goethite associated with the copper ± gold mineralization, as well as its lack of porphyry-style veining. Mineralization at San Javier was likely originally deposited as sulfide minerals, principally chalcopyrite with lesser amounts of pyrite. As the deposit was exposed to oxide weathering, primary sulfides precipitated secondary (oxide) copper mineral suite consisting of malachite, azurite, chrysocolla and tenorite. In San Javier drill core these minerals are often seen as fracture coatings and breccia-fillings. Typically, as weathering progressed, acidic fluids that were generated from sulfide oxidation, then further leached and mobilized the copper until it encountered ground water. At this point leached copper participated to form zones of enriched secondary sulfide copper mineralization. At San Javier the predominant secondary sulfide mineral encountered in drill core to date is chalcocite. This suite of primary oxide and secondary sulfide copper minerals can generally be processed using industry standard heap-leach techniques.

The San Javier deposit is complex due to post-mineral faulting including numerous low-angle faults found within the deposit area. From drill evidence, the amount of displacement along these low-angle faults suggests that mineralization in the Cerro Verde zone has likely been subjected to post-mineral displacements, where blocks of mineralization have been separated from their original point of deposition. Barksdale believes that continued geologic mapping and evaluation of the surrounding district may find additional blocks of mineralization that were originally part of the same mineralizing system but subsequently were dismembered and transported by faulting.

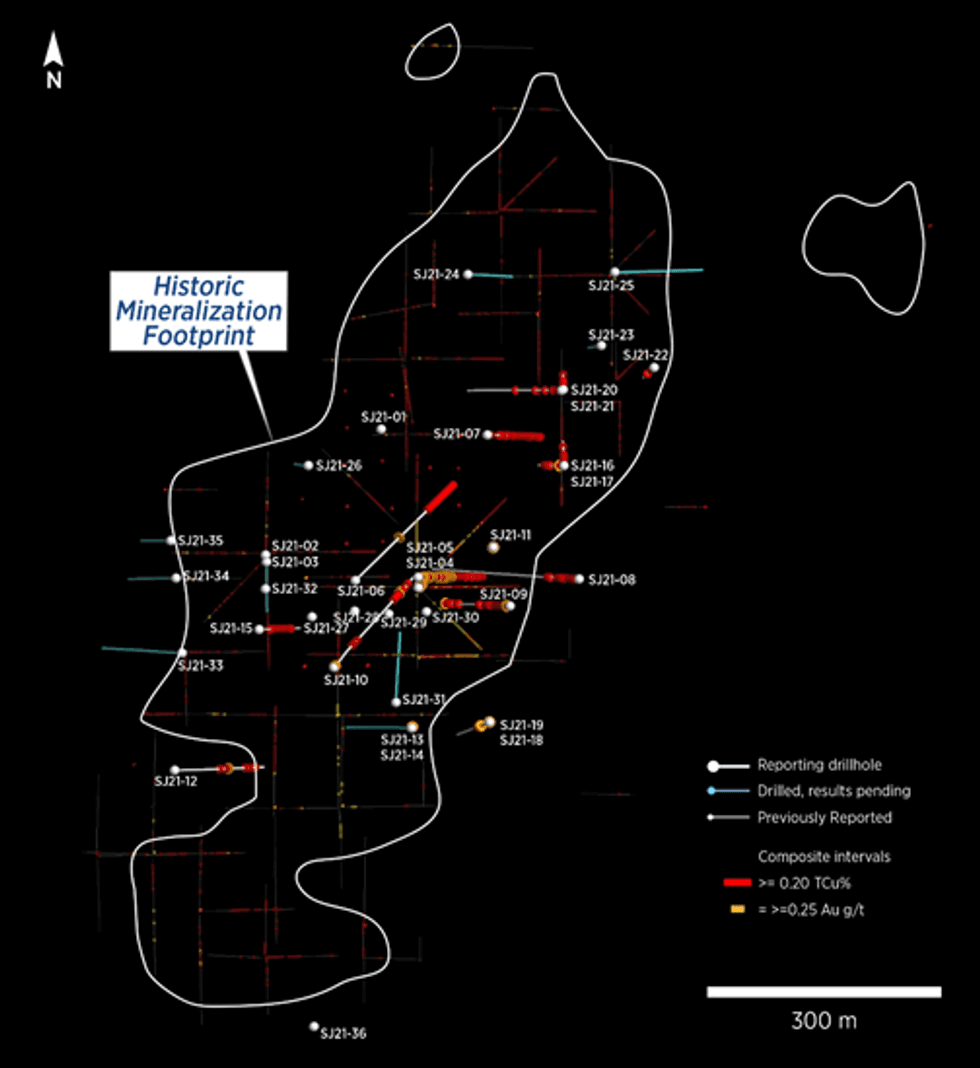

Figure 1. Plan view of the Cerro Verde zone showing the historic mineralization footprint relative to recently completed drilling by Barksdale. The zone remains open in multiple directions.

Based on assay data and visual copper estimates from drill core, the 2021 drilling has successfully extended mineralization laterally from previous known drilling and indicates that the Cerro Verde mineralized zone remains open particularly to the south, west, and northeast (see Figure 1). At depth, drilling has frequently encountered a sharp boundary between zones of secondary sulfide copper mineralization (chalcocite) and primary copper mineralization (dominantly chalcopyrite), again, indicating the presence of post-mineral faulting. Additionally, the primary copper mineralization zones typically exhibit weak propylitic alteration with disseminated chalcopyrite, suggesting that these zones are distal to the core of the IOCG mineralizing system.

Figure 2. Three-dimensional view of the Cerro Verde zone highlighting select drill intercepts.

Table 1. Significant Drill Hole Results (Copper above 0.20%). True widths vary between 60-100% and average 80%.

| From | To | Interval | Cu | Au | Type of |

|---|---|---|---|---|---|---|

Hole | (m) | (m) | (m) | (%) | (g/t) | Mineralization |

| SJ21-06 | 183.0 | 250.0 | 67.0 | 0.59% | 0.02 | Oxide |

| SJ21-07 | 0.0 | 15.0 | 15.0 | 1.47% | 0.04 | Oxide |

45.0 | 48.0 | 3.0 | 0.68% | 0.02 | Enriched | |

54.0 | 57.0 | 3.0 | 0.25% | 0.01 | Oxide | |

72.0 | 84.0 | 12.0 | 0.54% | 0.01 | Enriched/Primary | |

90.0 | 150.0 | 60.0 | 0.30% | 0.03 | Primary | |

156.0 | 183.0 | 27.0 | 0.36% | 0.02 | Primary | |

192.0 | 195.0 | 3.0 | 0.32% | 0.00 | Primary | |

| SJ21-08 | 6.0 | 24.0 | 18.0 | 0.64% | 0.03 | Oxide / Enriched |

27.0 | 30.0 | 3.0 | 0.29% | 0.02 | Primary | |

| 33.0 | 45.0 | 12.0 | 0.54% | 0.03 | Enriched / Primary |

| 57.0 | 66.0 | 9.0 | 0.26% | 0.04 | Primary |

| SJ21-09 | 0.0 | 57.0 | 57.0 | 0.74% | 0.08 | Oxide |

| including | 12.0 | 27.0 | 15.0 | 1.75% | 0.03 | Oxide / Enriched |

66.0 | 72.0 | 6.0 | 0.39% | 0.01 | Primary | |

114.0 | 120.0 | 6.0 | 0.25% | 0.03 | Primary | |

129.0 | 132.0 | 3.0 | 0.22% | 0.10 | Primary | |

135.0 | 150.0 | 15.0 | 0.32% | 0.14 | Enriched / Primary | |

| SJ21-10 | 54.0 | 57.0 | 3.0 | 0.26% | 0.04 | Enriched |

60.0 | 63.0 | 3.0 | 0.26% | 0.03 | Enriched | |

69.0 | 72.0 | 3.0 | 0.36% | 0.02 | Enriched | |

171.0 | 216.0 | 45.0 | 0.52% | 0.09 | Oxide /Enriched | |

| SJ21-11 | 15.0 | 87.0 | 72.0 | 0.36% | 0.01 | Enriched / Primary |

147.0 | 150.0 | 3.0 | 0.21% | 0.02 | Enriched | |

162.0 | 165.0 | 3.0 | 0.20% | 0.06 | Primary | |

171.0 | 175.5 | 4.5 | 0.33% | 0.02 | Primary | |

| SJ21-12 | 90.0 | 93.0 | 3.0 | 0.21% | 0.02 | Oxide |

102.0 | 105.0 | 3.0 | 0.21% | 0.03 | Primary | |

150.0 | 153.0 | 3.0 | 0.22% | 0.06 | Enriched | |

159.0 | 165.0 | 6.0 | 0.20% | 0.04 | Oxide | |

| SJ21-13 | 75.0 | 87.0 | 12.0 | 0.32% | 0.14 | Oxide/Enriched |

| SJ21-15 | 0.0 | 6.0 | 6.0 | 0.30% | 0.03 | Oxide |

42.0 | 108.0 | 66.0 | 0.49% | 0.01 | Oxide | |

120.0 | 123.0 | 3.0 | 0.22% | 0.06 | Enriched | |

| SJ21-16 | 0.0 | 6.0 | 6.0 | 0.38% | 0.03 | Oxide / Primary |

9.0 | 12.0 | 3.0 | 0.25% | 0.74 | Primary | |

27.0 | 30.0 | 3.0 | 0.20% | 0.00 | Primary | |

33.0 | 42.0 | 9.0 | 0.36% | 0.03 | Primary | |

| SJ21-17 | 0.0 | 27.0 | 27.0 | 0.29% | 0.04 | Oxide / Primary |

42.0 | 45.0 | 3.0 | 0.27% | 0.01 | Primary | |

| SJ21-18 | 30.0 | 42.0 | 12.0 | 0.45% | 0.23 | Enriched/ Primary |

| SJ21-19 | 6.0 | 7.5 | 1.5 | 0.22% | 0.07 | Primary |

24.0 | 33.0 | 9.0 | 0.63% | 0.23 | Oxide / Enriched | |

| SJ21-20 | 0.0 | 12.0 | 12.0 | 0.24% | 0.02 | Oxide |

15.0 | 18.0 | 3.0 | 0.20% | 0.01 | Primary | |

30.0 | 33.0 | 3.0 | 0.28% | 0.01 | Primary | |

48.0 | 51.0 | 3.0 | 0.20% | 0.02 | Primary | |

84.0 | 87.0 | 3.0 | 0.34% | 0.01 | Primary | |

| SJ21-21 | 3.0 | 18.0 | 15.0 | 0.32% | 0.04 | Oxide / Enriched |

27.0 | 30.0 | 3.0 | 0.47% | 0.04 | Primary | |

| SJ21-22 | 3.0 | 9.0 | 6.0 | 0.22% | 0.01 | Oxide / Primary |

18.0 | 21.0 | 3.0 | 0.21% | 0.03 | Enriched |

Resource Calculation and Economic Studies

The Company has completed logging and sampling 36 drill holes from the recently completed 5,000m drilling program and is presently working to complete an updated geologic model in early Q1 2022. Once the remainder of the assay results have been received and incorporated into the model, Barksdale will be able to calculate an initial resource for the Cerro Verde zone. The Company is looking to complete a resource calculation during the first quarter of 2022. In total, there are over 100 historic and new drill holes that define a zone of copper mineralization that has a footprint of approximately 1.2km long by 350m wide, which is exposed at surface on the eastern hillside at the Cerro Verde.

Based on the results from the planned resource calculation and ongoing metallurgical program (detailed in the next section), Barksdale would be in a position to undertake a preliminary economic assessment ("PEA") at the Cerro Verde zone in the first half of 2022. The Company is currently soliciting and reviewing bids from various leading technical consulting firms that would complete the PEA as well as the resource calculation, with oversight provided by Andrew Pooler, Barksdale's SVP of Project Development. Mr. Pooler has overseen the delivery of dozens of economic and technical studies during his career and has built and/or been responsible for the production performance of open pit and underground mines in North, Central and South America with both heap leach and mill recovery circuits.

Metallurgical Program

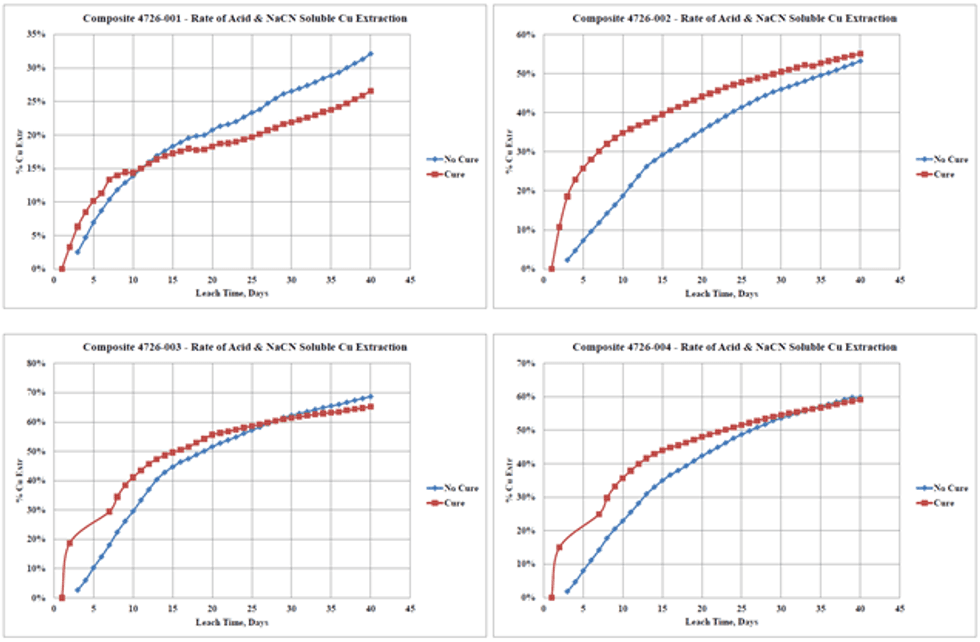

Barksdale currently has eight metallurgical column tests ongoing with McClelland Laboratories in Sparks, Nevada that represent material from four composite samples. Each composite has been crushed to 80% passing 25mm (1 inch) and each composite has two tests. For each composite, one column is tested using an acid agglomeration cure and the other column is tested without an acid agglomeration cure. The raffinate used for the tests contains 5 grams per liter of sulfuric acid with an irrigation rate of 6 liters/hour/m2. The column tests will provide Barksdale with metallurgical recovery data with respect to how well the copper mineralization, both oxide and sulfide, respond to heap leach processing.

The table below highlights the parameters of the ongoing tests and initial results:

Table 2. Metallurgical Program Data

Test # | Composite # | Total Cu (%) | Acid Soluble Cu (%) | NaCN Soluble Copper (%) | Cu Extracted (%) at 40-Days | Acid & NaCN Soluble Cu Extracted (%) at 40-Days |

1 | 4726-001 | 0.416% | 0.077% | 0.147% | 17% | 32% |

2 (cure) | 4726-001 | 0.416% | 0.077% | 0.147% | 14% | 27% |

3 | 4726-002 | 0.601% | 0.531% | 0.051% | 52% | 53% |

4 (cure) | 4726-002 | 0.601% | 0.531% | 0.051% | 53% | 55% |

5 | 4726-003 | 0.388% | 0.352% | 0.013% | 65% | 69% |

6 (cure) | 4726-003 | 0.388% | 0.352% | 0.013% | 61% | 65% |

7 | 4726-004 | 0.640% | 0.519% | 0.012% | 50% | 60% |

8 (cure) | 4726-004 | 0.640% | 0.519% | 0.012% | 49% | 60% |

The tests are designed with a 90-day leach cycle and will conclude in late January. Based on preliminary data collected after 40 days of irrigation, copper extraction is performing very well and the impact of the acid agglomeration cure on recovery is negligible, suggesting that not only is the mineralization amenable to cost-effective heap leaching processing, but a lower capital heap leach design (with no agglomeration equipment) could be achieved.

Figure 3. Copper recovery curves from the ongoing metallurgical column testing. The graphs highlight copper extraction rates versus time under irrigation with sulfuric acid.

Following completion of the 90-day irrigation cycle, the columns will be disassembled, and the residual material will be assayed. The breakdown process is estimated to take approximately 30-days. Results of the final metallurgical recovery data will be announced once completed.

Quality Assurance and Quality Control

Drilling was completed using HQ size diamond drill core and core was logged by geologic consultants engaged by the Company. Drill holes were logged and marked for sampling prior to being sawn in half using a diamond blade saw, with one half of the sawn core being placed in a cloth sample bag, with a unique sample tag, while the second half was returned to the wooden core box for storage on site. Sample assays are being performed by Skyline Assayers & Laboratories, which is an accredited laboratory (ISO 9001). Core samples are analyzed for total copper, acid soluble copper, cyanide soluble cooper, as well as well as a multi element ICP Analysis.

The analytical work has been and is subject to a QA/QC program that includes certified reference standards from OREAS North America. These standards are of similar composition to the rock types at San Javier. Several different standards are included in each batch of samples submitted to the lab. These controls are tracked to ensure the integrity of the assay data. Results are all within acceptable limits.

Table 3. Drill Hole Information

Hole | Easting | Northing | Elevation | Depth | Azimuth | Dip | Status |

SJ21-01 | 623292 | 3160798 | 942 | 100 | 0 | -90 | Met Hole |

SJ21-02 | 623138 | 3160631 | 967 | 100 | 0 | -90 | Met Hole |

SJ21-03 | 623140 | 3160622 | 967 | 90 | 180 | -45 | Met Hole |

SJ21-04 | 623341 | 3160588 | 1007 | 61 | 0 | -90 | Met / HQ Hole (HQ announced) |

SJ21-04 | 623341 | 3160602 | 1007 | 201 | 0 | -90 | Previously Announced |

SJ21-05 | 623258 | 3160598 | 1006 | 260 | 90 | -72 | Announced in This Release |

SJ21-06 | 623258 | 3160602 | 1019 | 250 | 45 | -50 | Announced in This Release |

SJ21-07 | 623432 | 3160791 | 922 | 200 | 90 | -70 | Announced in This Release |

SJ21-08 | 623554 | 3160599 | 829 | 285 | 270 | -50 | Announced in This Release |

SJ21-09 | 623462 | 3160563 | 893 | 150 | 270 | -55 | Announced in This Release |

SJ21-10 | 623229 | 3160482 | 960 | 231 | 45 | -50 | Announced in This Release |

SJ21-11 | 623440 | 3160641 | 903 | 176 | 0 | -90 | Announced in This Release |

SJ21-12 | 623016 | 3160344 | 869 | 180 | 90 | -51 | Announced in This Release |

SJ21-13 | 623332 | 3160401 | 896 | 120 | 0 | -90 | Announced in This Release |

SJ21-14 | 623331 | 3160401 | 896 | 140 | 270 | -55 | Assays Pending |

SJ21-15 | 623129 | 3160534 | 924 | 155 | 90 | -59 | Announced in This Release |

SJ21-16 | 623529 | 3160750 | 815 | 53 | 270 | -51 | Announced in This Release |

SJ21-17 | 623529 | 3160750 | 815 | 55 | 0 | -55 | Announced in This Release |

SJ21-18 | 623435 | 3160408 | 875 | 60 | 0 | -90 | Announced in This Release |

SJ21-19 | 623435 | 3160408 | 875 | 80 | 245 | -55 | Announced in This Release |

SJ21-20 | 623533 | 3160852 | 768 | 170 | 270 | -45 | Announced in This Release |

SJ21-21 | 623533 | 3160852 | 768 | 30 | 0 | -45 | Announced in This Release |

SJ21-22 | 623655 | 3160882 | 709 | 30 | 225 | -50 | Announced in This Release |

SJ21-23 | 623584 | 3160911 | 768 | 30 | 260 | -55 | Assays Pending |

SJ21-24 | 623406 | 3161005 | 853 | 120 | 90 | -64 | Assays Pending |

SJ21-25 | 623602 | 3161009 | 791 | 195 | 90 | -55 | Assays Pending |

SJ21-26 | 623195 | 3160750 | 962 | 120 | 270 | -80 | Assays Pending |

SJ21-27 | 623200 | 3160549 | 968 | 63 | 0 | -90 | Assays Pending |

SJ21-28 | 623257 | 3160557 | 1006 | 185 | 0 | -90 | Assays Pending |

SJ21-29 | 623302 | 3160553 | 992 | 140 | 0 | -90 | Assays Pending |

SJ21-30 | 623352 | 3160556 | 996 | 185 | 0 | -90 | Assays Pending |

SJ21-31 | 623311 | 3160435 | 921 | 147 | 0 | -50 | Assays Pending |

SJ21-32 | 623138 | 3160586 | 947 | 167 | 0 | -90 | Assays Pending |

SJ21-33 | 623025 | 3160500 | 852 | 165 | 270 | -60 | Assays Pending |

SJ21-34 | 623017 | 3160600 | 850 | 130 | 270 | -60 | Assays Pending |

SJ21-35 | 623010 | 3160650 | 850 | 84 | 270 | -60 | Assays Pending |

SJ21-36 | 623200 | 3160000 | 788 | 95 | 0 | -90 | Assays Pending |

Scientific and technical information in this news release has been reviewed and approved by Lewis Teal, Senior Consultant to the Company and a ‘Qualified Person' as defined under Canadian National Instrument 43-101. The discussion related to the metallurgical program has been reviewed and approved by Steve Dixon, a Consultant to the Company and a ‘Qualified Person' as defined under Canadian National Instrument 43-101.

Barksdale Resources Corp. is a base metal exploration company headquartered in Vancouver, B.C. that is focused on the acquisition, exploration and advancement of highly prospective base metal projects in North America. Barksdale is currently advancing the Sunnyside copper-zinc-lead-silver and San Antonio copper projects, both of which are in the Patagonia mining district of southern Arizona, as well as the San Javier copper-gold project in central Sonora, Mexico.

ON BEHALF OF Barksdale Resources CORP

Rick Trotman

President, CEO and Director

Rick@barksdaleresources.com

Terri Anne Welyki

Vice President of Communications

778-238-2333

TerriAnne@barksdaleresources.com

For more information please phone 778-238-2333, email info@barksdaleresources.com or visit www.BarksdaleResources.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes "forward-looking information" under applicable securities legislation including, but not limited to, the ability of Barksdale to verify or replace historic estimates at San Javier as current resources, the proposed technical and drill program at San Javier and the timing thereof, the prospective deposits, targets and mineralization at San Javier and the anticipated receipt and timing of necessary governmental or third party approvals and permits. Such forward-looking information reflects management's current beliefs and is based on a number of estimates and assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Readers are cautioned that such forward-looking information is neither a promise nor guarantee, and is subject to known and unknown risks and uncertainties including, but not limited to, delays in obtaining governmental or third party approvals and permits, actual results of exploration activities, unanticipated geologic formations, structures and characteristics, environmental risks, future prices of base and other metals, operating risks, accidents, labor issues, and other risks in the mining industry as well as general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets and lack of available capital. There are no assurances that the Company will obtain the necessary permits for and successfully complete the proposed technical and drill program at San Javier as currently contemplated or at all. In addition, there is uncertainty about the spread of COVID-19 and variants of concern and the impact they will have on the Company's operations, supply chains, ability to access mineral properties, conduct due diligence or procure equipment, contractors and other personnel on a timely basis or at all and economic activity in general. All forward-looking information contained in this news release is qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR at www.sedar.com. Accordingly, readers should not place undue reliance on forward-looking information. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

SOURCE: Barksdale Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/678010/Barksdale-Intercepts-15m-of-174-Copper-15m-of-146-Copper-and-67m-of-059-Copper-at-San-Javier-in-Sonora-Mexico