Molybdenum Outlook 2022: Uncertain Demand, Declining Supply to Support Prices

Interested in molybdenum investing? Learn more here about the molybdenum outlook for 2022, as well as 2021's trends.

Click here to read the previous molybdenum outlook.

2020 hit the molybdenum market hard as oil prices crashed, but the metal turned to the upside in 2021.

After stabilizing for most of the first half of the year, molybdenum prices jumped in mid-2021 to remain steady above U$18 per pound by the end of the 12 month period.

With 2022 now in swing, investors interested in the industrial metal are wondering about the molybdenum outlook. Here the Investing News Network (INN) looks back at the main trends in the sector and what’s ahead.

Molybdenum trends 2021: The year in review

Molybdenum prices kicked off 2021 on an upward trend as optimism surrounding the demand outlook for industrial metals supported prices.

By the second half of the year, prices had rallied, reaching their highest point of the year at above US$20.

“Molybdenum prices soared, supported by a robust global economic recovery and strong steel demand — the metal is mainly used as an input for different types of steel,” FocusEconomics analysts said in their June report, adding that the metal was up more than 50 percent year-to-date.

In August, molybdenum prices lost some ground as steel prices fell on the back of signs that China might slow down the pace of its planned output curbs.

“Prices for molybdenum lost further ground in recent weeks, likely due to downbeat steel output in top-producer China — with alloying being a main end-use — while concerns over the pandemic’s development globally will have added an extra burden on prices,” the latest report from FocusEconomics states.

Even so, molybdenum prices are up more than 100 percent since the beginning of last year.

According to the International Molybdenum Association, in Q3 2021 global production of molybdenum fell by 1 percent compared to the previous quarter to hit 141.7 million pounds, and 6 percent from Q3 2020.

Meanwhile, global use of molybdenum in Q3 2021 fell 15 percent to 144.6 million pounds when compared to the previous quarter, although this was a 5 percent increase versus the same quarter in the previous year.

Molybdenum outlook 2022: What’s ahead for supply, demand and prices

It's important for molybdenum investors to remember that the market is driven by what happens in the steel and oil and gas sectors, with the latter being a traditional consumer of high-molybdenum steel for pipelines.

“Decarbonization of the economies might reduce molybdenum demand in the long run, but for now the demand is strong, particularly from the liquefied natural gas terminals,” Andrew Zemek of CPM Group told INN. “Activity in the oil and gas sector picked up in 2021 due to higher oil prices, but it is far from historical levels.”

If demand is driven by steel, oil and gas, output on the other hand is dictated by what happens in copper, as more than 80 percent of molybdenum production comes from copper mines.

“What drives production decisions in these mines is the situation in the copper market, not in the molybdenum market,” Zemek said. “They will produce molybdenum regardless of the price as long as it is profitable to produce copper.” That’s why there seems to be a disconnect between prices and production of the industrial metal.

“In 2021, prices rallied by 78 percent and the supply response was to reduce production by nearly 6 percent,” the CPM special advisor noted.

Even though these particular aspects of the molybdenum market make it difficult to make forecasts, there are some trends that the sector will continue to see moving forward.

CPM Group, which publishes a quarterly molybdenum report, is expecting production to continue to decline or remain flat. “This is to a large extent driven by the prolonged period of low prices in the past and a lack of investment, a lack of exploration and a lack of new projects,” Zemek said.

In terms of demand, the stainless steel sector is growing faster than crude steel, which in turn is positive for molybdenum. After the strong steel demand increase in the first half of 2021, which came as economies recovered from COVID-19, the third quarter saw the steel sector starting to flatten and then fall.

“Where steel production is going remains a big question mark,” Zemek said. “We think it will probably still grow in 2022, but not too much, probably about 3 percent.”

All in all, CPM expects molybdenum prices to remain high compared to historical levels.

“There's no doubt there is a decrease on the supply side,” Zemek said. "The question is how much of a decrease would be on the demand side. For the time being, we think we are heading for a deficit for at least three or four years in the molybdenum market.”

Looking further ahead, one trend investors should keep an eye out for is demand from the renewables sector. Molybdenum and copper are used in more than eight clean energy generation and storage technologies, and molybdenum is required for a range of low-carbon technologies, especially wind and geothermal.

However, “Even if technological improvements, costs reductions, and deployment of new emerging technologies were to take place, these changes would have little impact on the overall demand for them,” says the World Bank in its Minerals for Climate Action report.

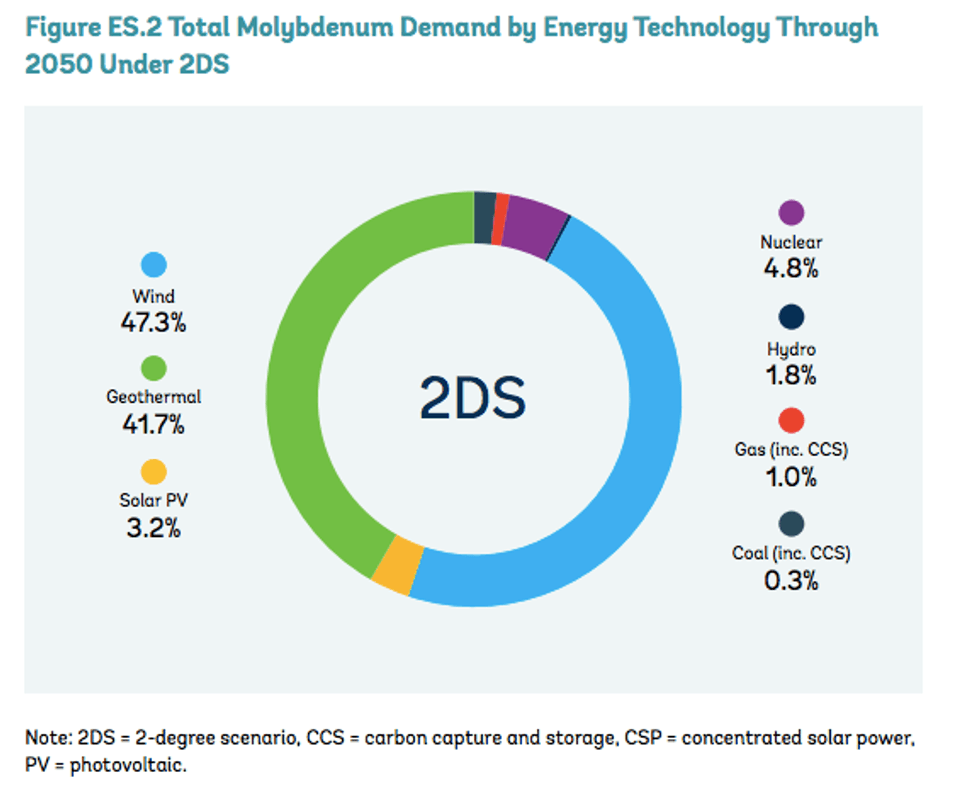

Total molybdenum demand by energy technology through 2050.

Chart via the World Bank.

“The greatest share of demand for molybdenum from electricity generation and energy storage technologies comes from wind (47.3 percent) and geothermal (41.7 percent), with all the other generation and energy storage technologies together accounting for only a small share (11 percent),” the World Bank’s report also states.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- 5 Major Molybdenum Uses | INN ›

- How to Invest in Molybdenum | INN ›

- Top Molybdenum Producers by Country | INN ›

- 5 Top Weekly TSXV Performers: Rising Molybdenum Price Benefits Explorers | INN ›