Lead Price Forecast: Top Trends That Will Affect Lead in 2023

What’s the lead forecast for 2023? Read on to find out what analysts had to say about the market.

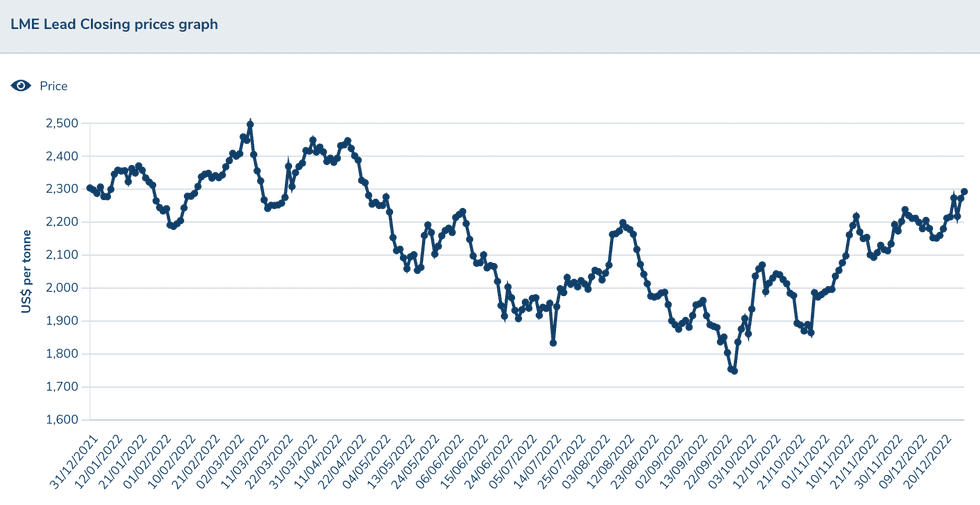

Global uncertainty once again dominated the lead market in 2022, with prices staying volatile throughout the year.

But even with frequent ups and downs, the metal almost broke the US$2,500 per metric ton (MT) level early in the year.

As 2023 kicks off, the Investing News Network is looking back at the main trends in the lead space in 2022 and what’s ahead for prices, supply and demand in the new year. Read on to learn what experts see coming.

How did lead perform in 2022?

Lead prices performed in a choppy fashion for most of 2022 after seeing high levels and instability in 2021. The base metal kicked off 2022 trading at US$2,337, climbing through the first quarter to begin Q2 at US$2,450.

Lead's price performance in 2022.

Chart via the London Metal Exchange.

Despite the outbreak of the Russia-Ukraine war, which brought uncertainty to the world markets due to strict economic sanctions on Russia, lead prices fell due to weaker consumption growth.

“The drop came amid reports of an increased supply of primary lead, which was somewhat tempered by tighter supply from secondary sources — smelters of scrap lead will face an increased cost following the recent imposition of a VAT in China,” analysts at FocusEconomics said back in April.

During the second quarter, lead prices fell sharply below the US$2,000 threshold and continued their decline in the third quarter to reach their lowest level of the year in September, when the metal was changing hands for US$1,737.50.

“Lead prices likely benefited over the last month from the easing of the global semiconductor shortage, which appears to have boosted car supply,” FocusEconomics analysts explained at the time. “That said, the broader demand backdrop was still downbeat due to rising interest rates around the world and stop-start Covid-19 restrictions in China.”

Increased volatility continued to take a hold of the lead market in the last quarter, but prices climbed to end the year at US$2,336.50 — almost neutral compared to their 2022 starting point.

"The global lead market was robust at the end of 2022, with a refined deficit in that year drawing down much of the stocks builtup in 2020 to 2021 and a shortfall in the concentrate market reversing any slight excess in 2021 following 2020’s large deficit," Wood Mackenzie analysts said in a recent report.

What factors will move the lead market in 2023?

As the new year begins, investors interested in the lead market should keep an eye on supply and demand dynamics, as well as other catalysts that could impact the sector moving forward.

After rising by 4.6 percent in 2021, global demand for refined lead metal is forecast to increase by 1.4 percent to 12.6 million MT in 2023, according to the International Lead and Zinc Study Group (ILZSG). “Measures implemented by the Chinese authorities to contain a resurgence in COVID-19 cases negatively impacted lead demand in the automotive sector,” the industry group said. “However, this was partially balanced by a rise in the exports of lead acid batteries.”

For Wood Mackenzie's analysts, the extent to which COVID-19 impacts the lead market in 2023 will likely stem from how well China can adjust to the ending of its zero-COVID policy.

"This is a key uncertainty in relation to lead consumption and wider economic growth," they said. "However, the weight of the replacement battery market and lead recycling means that the impact on lead’s supply-demand balance will likely be limited."

Even though the Russia-Ukraine war has had only a modest bearing on the lead market, higher power costs resulting from sanctions on Russia are something to follow in 2023. "Increased costs have made some smelters vulnerable, while they have also boosted interest in energy storage systems, which can employ lead batteries," Wood Mackenzie analysts said.

Another factor to watch is the lithium market, as activity there will determine the speed at which the world switches from lead-acid batteries to lithium-ion batteries.

"With the uptake of lithium-ion batteries as part of the energy transition still in its infancy, latent demand for lithium-ion batteries will often be running ahead of lithium raw material supplies," as per the firm. "Lithium chemical prices increased severalfold in 2022 and this has resulted in lead-acid batteries being used when lithium-ion batteries had been preferred."

Looking over to supply, world lead mine supply is forecast to remain more or less unchanged in 2022 at 4.56 million MT, the ILZSG says. In 2023, output is anticipated to rise by 2.7 percent to 4.68 million MT.

For its part, Wood Mackenzie expects global mine production in 2023 to be 12 percent less than it was 10 years ago. It will likely be at least 5 percent less than it was in 2019, but the firm forecasts that it will more than recover all that it lost in 2022.

"Abra is the most significant new mine in terms of scale of lead production, but also because it will not also produce zinc," analysts at the firm pointed out. Another to watch is Ozernoye in Russia. "A risk for lead mine supply in 2023 is that zinc prices weaken to extent that some mines become uneconomic and curtail output."

The ILZSG expects world refined lead supply to fall by 0.3 percent to 12.34 million MT in 2022, with a 1.8 percent rise to 12.56 million MT anticipated in 2023. “(We expect) that global demand for refined lead metal will exceed supply by 83,000 tonnes in 2022. In 2023, a smaller deficit of 42,000 tonnes is expected,” the group said.

Panelists recently polled by FocusEconomics see prices averaging US$2,014 in Q4 2023 and US$1,934 in Q4 2024.

“Potential supply disruptions and the availability of physical stocks are key factors to watch in terms of supply,” they said. “Meanwhile, the speed of China’s recovery from the current surge in Covid-19 cases, the pace of global monetary policy tightening and the scope of Chinese infrastructure spending are key factors to watch on the demand side.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.