March 09, 2025

Impact Minerals Limited (ASX:IPT) is pleased to announce the acquisition of a large, 675 sq km landholding adjacent to its current land position surrounding one of the world’s greatest mines containing over 350 million tonnes of massive sulphide mineralisation, the Broken Hill silver-lead-zinc deposit in New South Wales.

- Impact to acquire a large tenement package from New Frontier Minerals Limited (ASX:NFM) adjoining its existing ground holding that almost completely surrounds the giant Broken Hill lead-zinc-silver mine in New South Wales.

- Impact’s ground now extends over 1,770 sq km and covers an area considered extremely prospective for large copper deposits following a novel exploration model that formed the basis of the company’s participation in the inaugural BHP Xplor program in 2023.

- Detailed mapping and sampling of 99 gabbro sills and other work completed during the Xplor program confirmed the copper potential with numerous areas for further exploration identified within the Broken Hill sequence. At least one such target lies within the newly acquired ground.

- Next steps will include ground geophysics to help identify targets for drilling.

- Terms of the acquisition are as follows: Impact to purchase BHA No 1 Pty Ltd, a wholly owned subsidiary of NFM, for $275,000 in Impact shares and subject to staged voluntary escrow over six months commencing one month after Completion.

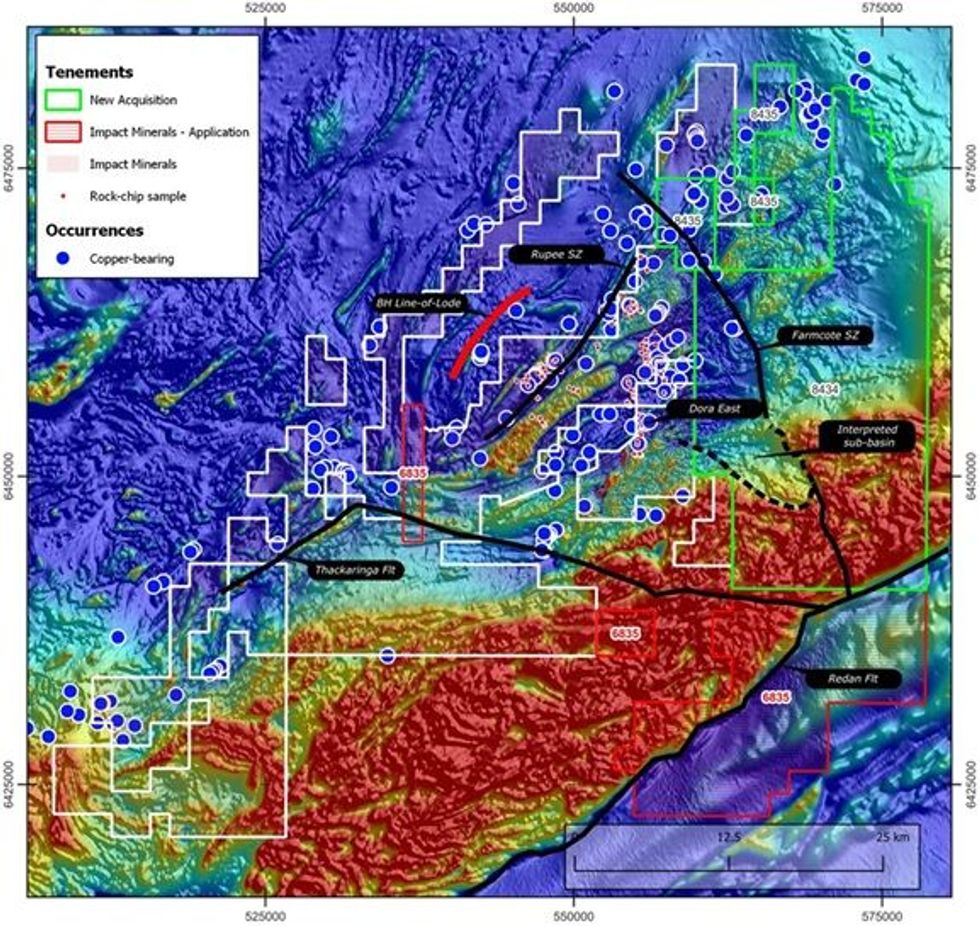

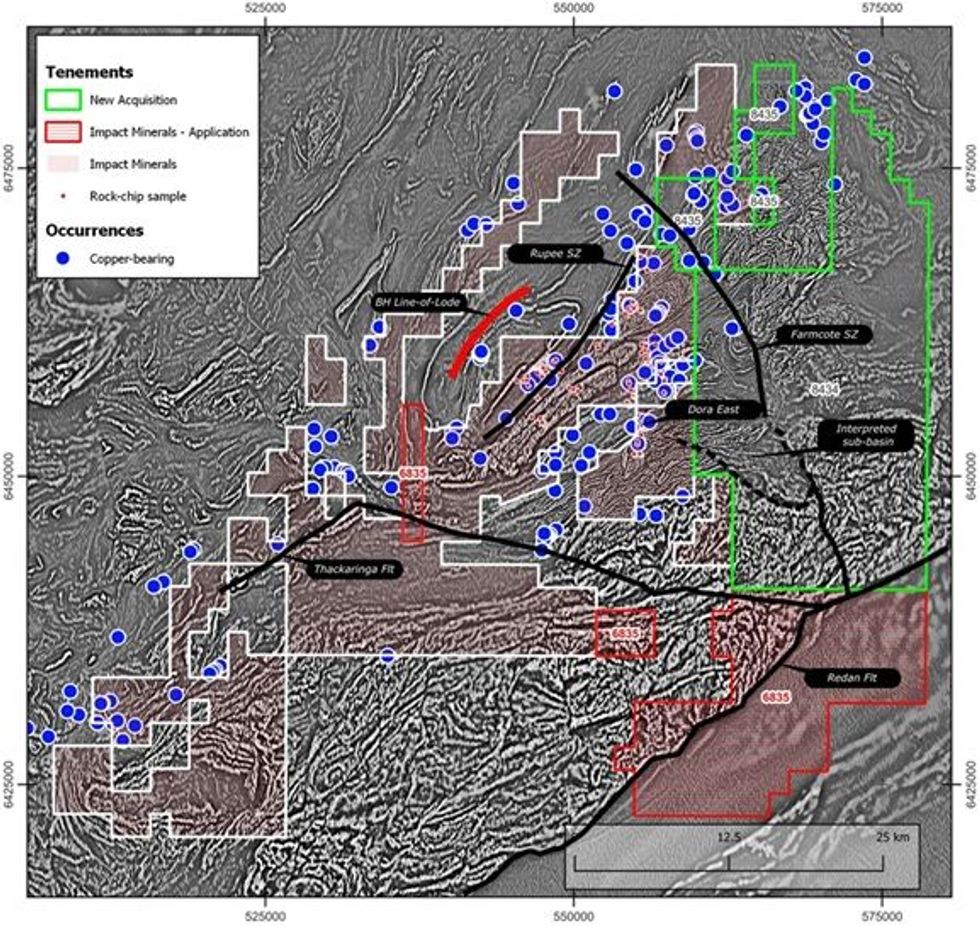

The acquisition builds on exploration and research completed as part of the BHP Xplor program, in which Impact participated in its inaugural year, and positions the company as one of the largest ground holders in the region, particularly to the south of Broken Hill. Impact now has 100% ownership of tenements covering 1,770 sq km and over 100 kilometres of strike (Figures 1 and 2; ASX Releases January 17, 2023, and February 16, 2023).

The Broken Hill region is currently experiencing a resurgence of interest in exploration. Broken Hill Mines (ASX: BHM, formerly Coolabah Metals Limited) recently purchased the privately owned Rasp Mine in Broken Hill and the nearby Pinnacles deposit. In addition, South32 Limited has entered a joint venture with a private company that owns a significant ground holding north of the Broken Hill mine. This interest is partly driven by a recent increase in silver prices and long-term demand trends for zinc and lead.

The Search for Copper at Broken Hill

Since the discovery of the giant Broken Hill deposit in 1883, most previous exploration has focused on silver-lead-zinc mineralisation. However, various styles of copper mineralisation are also known to occur throughout the region and have been the focus of some exploration and shallow drilling, though with limited success (Figures 1 and 2). Since copper mineralisation is commonly associated with, but peripheral to, numerous silver-lead-zinc deposits, many exploration geologists have asked, “Where is the large copper deposit at Broken Hill?”.

Impact became interested in the region's copper potential during exploration for silver-lead- zinc at the Dora East prospect, located about 30 km south of Broken Hill (Figures 1 and 2). Here, Impact discovered moderate widths of high-grade silver-lead-zinc mineralisation and narrow zones of high-grade copper-silver mineralisation (Figure 3 and ASX Releases December 8, 2015, and February 19 2016).

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

10h

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

15h

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00