July 22, 2024

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to advise that the non- renounceable rights issue (Entitlement Offer) announced on 21 June 2024 has raised $1.58 million (before costs).

- Non-renounceable rights issue raises $1.58 million

- Miramar receives JMEI Credit allocation of up to $450,000

- Preparing for maiden drilling programme at Bangemall Ni-Cu-Co-PGE Projects

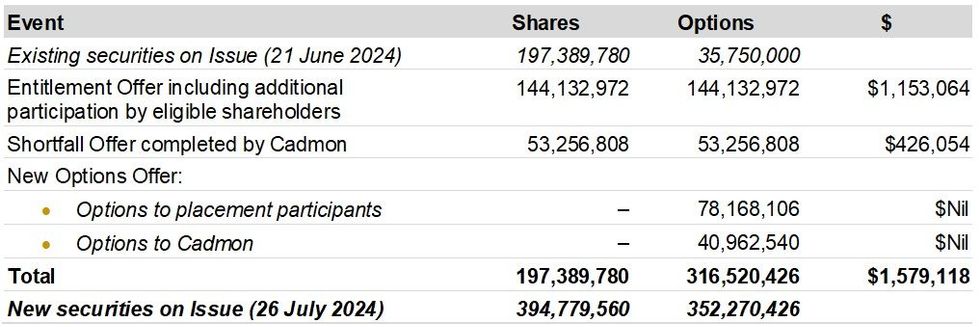

The Company will issue 197,389,780 Shares and 316,520,426 Options exercisable at $0.018 each expiring three (3) years from the issue date following the completion of the Entitlement Offer (Options). Subject to satisfying the Listing Rule requirements, the Options will be quoted under the ASX code M2ROA.

Separate to the Entitlement Offer, the Company will issue 119,130,646 Options applied for under new options offer pursuant to the Prospectus (New Options Offer).

Funds raised from the Entitlement Offer will primarily be used for upcoming exploration programmes at the Company’s 100%-owned Bangemall Ni-Cu-Co-PGE projects in the Gascoyne regions of WA, the 80%- owned Gidji JV Project near Kalgoorlie, and for other exploration and corporate activities.

Miramar’s Executive Chairman, Mr Allan Kelly, thanked existing and new shareholders who participated in the Entitlement Offer, supporting the Company’s exploration plans across its various projects.

The results of the Entitlement Offer and New Options Offer are set out below:

The Shares and Options are expected to be issued on Thursday, 26 July 2024, in accordance with the updated timetable.

Further details of the Entitlement Offer and New Options Offer can be found in the prospectus dated 21 June 2024.

JMEI Credits Granted

Miramar is pleased to announce that it has been advised by the Australian Taxation Office (ATO) that its JMEI application for the 2024/2025 financial year has been accepted and the Company has received an allocation of up to $450,000.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

11h

Faraday Copper Signs LOI to Acquire BHP’s San Manuel Property in Arizona

Faraday Copper (TSX:FDY,OTCQX:CPPKF) has signed a letter of intent (LOI) to acquire BHP's (ASX:BHP,NYSE:BHP,LSE:BHP) San Manuel property, which sits next to its Copper Creek project in Arizona. The company says the move will combine the two adjacent assets into a single US-focused copper... Keep Reading...

23 February

ASX Copper Mining Stocks: 5 Biggest Companies in 2026

Copper prices have been volatile throughout 2025 and into 2026, fueled by economic uncertainty from an ever-changing US trade policy and strong supply and demand fundamentals. The International Copper Study Group, the leading copper market watcher, reported an apparent refined copper surplus of... Keep Reading...

23 February

What Was the Highest Price for Copper?

Strong demand in the face of looming supply shortages has pushed copper to new heights in recent years.With a wide range of applications in nearly every sector, copper is by far the most industrious of the base metals. In fact, for decades, the copper price has been a key indicator of global... Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00