July 16, 2024

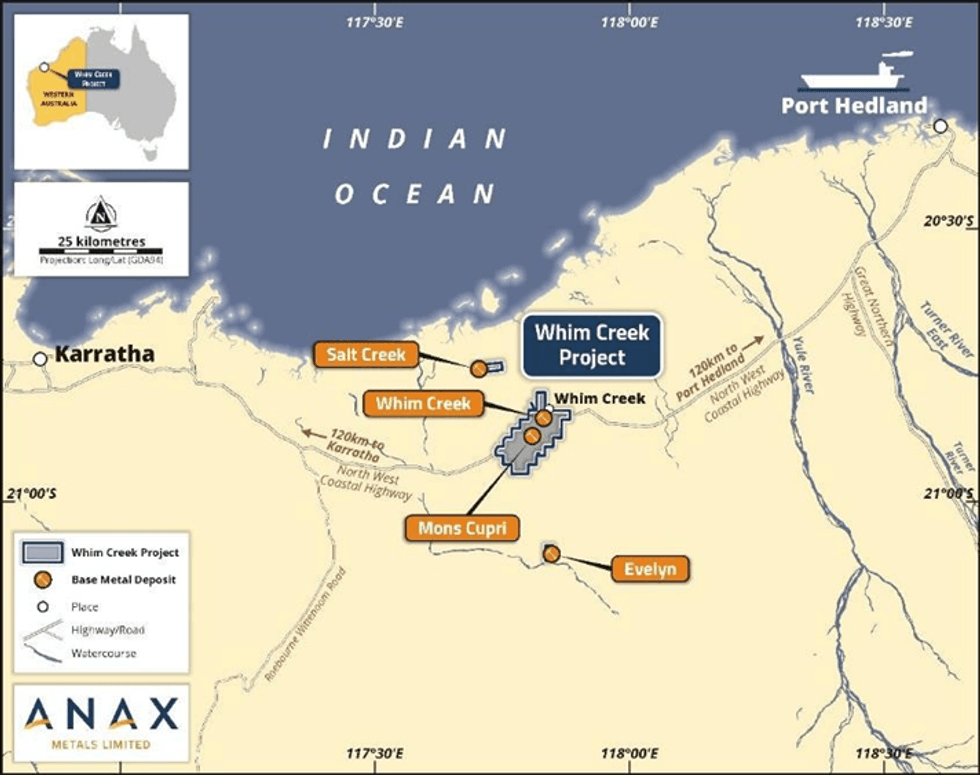

Anax Metals Limited (ASX: ANX, Anax, or the Company) is pleased to announce that a diamond drill rig has mobilised to Whim Creek to commence drilling at the Evelyn deposit, targeting high-grade copper mineralisation. Evelyn is located approximately 25km south of Whim Creek (Figure 1). Anax has an 80%joint venture interest in the Whim Creek Project, with Develop Global Limited (ASX: DVP) holding the remaining 20%.

- Diamond rig mobilised to Evelyn, targeting high-grade copper mineralisation

- First drilling at Evelyn since 2022 when RC hole 22AER005B intersected 13m @ 4.46% Cu, 3.10% Zn, 1.61 g/t Au and 45 g/t Ag1

- Programme to test for down-plunge extensions and increased drill density

- Up to 1,700m of extensional and resource drilling planned

Anax’s Managing Director, Geoff Laing, commented “We continue to focus on project growth through the planned extension drilling at our high-grade Evelyn deposit in parallel to the Pilbara consolidation program. Our strategy remains to position Anax to become a significant copper producer and key player in consolidating base metal production in the Pilbara.”

In mid-2022, the Company drilled two RC holes at Evelyn. The initial hole was abandoned due to excessive deviation and despite also experiencing substantial deviation, the second hole, 22AER005B, intersected 13m @ 4.46% Cu, 3.10% Zn, 45 g/t Ag and 1.61 g/t Au from 204m (Figure 2).1

The primary purpose of the programme will be to test for down-plunge extensions of high-grade copper below 22AER005B with a further two holes planned to increase drill density in the vicinity, which may allow for conversion from Inferred to Indicated Resources.

Diamond drilling will be used due to the excessive deviation experienced in the previous RC programme. The core holes will undergo geotechnical logging which will add to the existing geotechnical database and increase confidence in the geotechnical assessment. Mineralised intersections will also be retained for metallurgical variability testing.

Click here for the full ASX Release

This article includes content from Anax Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18h

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00