Diamond Outlook 2022: Market Stronger After COVID Blow, Digital Sales Offer Support

What lies ahead for the diamond market? Experts share their thoughts on 2021 diamond trends and the 2022 diamond outlook.

Click here to read the previous diamond outlook.

The diamond market experienced a much-needed recovery in 2021 after the previous year’s massive COVID-19-related supply chain and retail disruptions.

Propelled by record highs in the equity markets, consumer sentiment was bolstered in the fourth quarter of last year, leading to the strongest holiday season for the jewelry sector in a decade.

According to MasterCard (NYSE:MA), US retail sales were up 8.5 percent from the previous year, and the jewelry segment saw a 32 percent year-over-year increase.

Diamond trends 2021: Market rebounds from pandemic blow

“2021 was an extremely strong year for the diamond industry — based on my estimates, global end-consumer diamond sales broke a record,” Paul Zimnisky, analyst and founder at Paul Zimnisky Diamond Analytics, told the Investing News Network (INN). “Consolidated rough diamond prices, according to the Zimnisky Global Rough Diamond Price Index, were up 28 percent.”

The 2021 diamond market recovery was also aided by a tightening in global supply. In January 2021, Rapaport, a diamond consultancy firm, noted that prices for polished diamonds had firmed in the closing months of 2020 as supply declined due to limitations on diamond manufacturing during India’s lockdowns.

“The industry began 2021 with a healthier supply-demand balance than it had at any stage in the past five years,” a press release from the outlet reads.

The ensuing stimulus and record-setting stock market highs then paved the way for growth across the jewelry sector, particularly in the diamond segment.

“After the initial consumer shock from COVID-19, global consumer demand for jewelry was revived, especially in the US and China. Since April 2020, sales have picked up in both consumer centers and hit record highs,” said Edahn Golan, founder of Edahn Golan Diamond Research and Data.

The heightened demand continued to improve over the course of the year, and was bolstered by a better-than-expected holiday season.

“December jewelry sales are currently expected to cross US$19 billion, double what was sold in December a decade ago,” said Golan. “For the entire 2021, I expect US jewelry sales to total US$94 billion to US$95.3 billion, up 51 to 53 percent compared to 2020.”

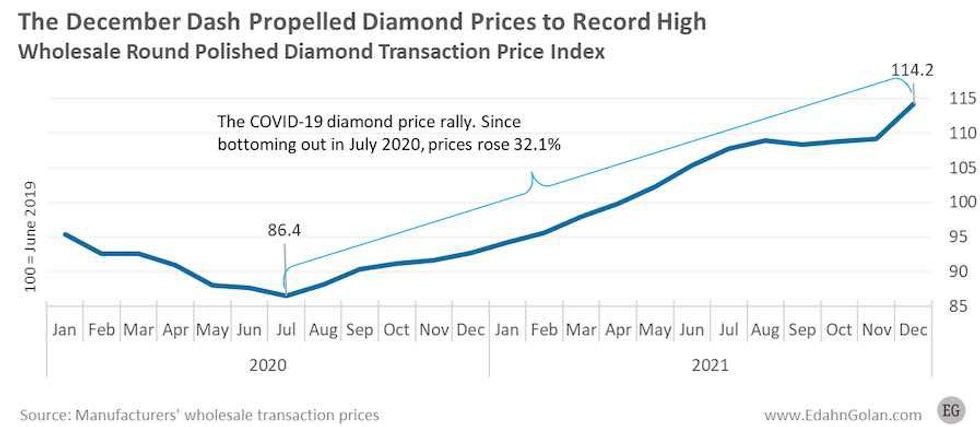

As the diamond researcher explained, prices for wholesale polished diamonds were up 32 percent between July 2020 and December 2021.

With 2020 surplus rough inventories from the mining sector drawn down over 2021, prices trended higher.

“The most significant impacts of pandemic-related supply chain disruptions in the diamond industry were felt in 2020,” Zimnisky said. “However, in 2021 the carryover from 2020 resulted in a relatively undersupplied market of rough and polished, which, combined with very strong demand, allowed for strong diamond price appreciation.”

Another factor that contributed to market growth was the strengthening of digital sales, as consumers decided to forgo the in-person shopping experience and purchase from home.

“After years of lagging behind most other consumer products, online jewelry sales picked up at once, and even small independents benefited from this surge in demand,” Golan said.

“As a result, retailers' inventories started to deplete, creating shortages and price increases during the year.”

As Rapaport’s Avi Krawitz noted during a December market presentation, the sector also saw what he described as the “emotional gifting” of diamond jewelry in 2021. “Some people wanted to express their love for loved ones through a gift, and what better gift than jewelry?” Krawitz said during the webinar. “There may be a conditioning of emotional gifting that people had during COVID, and that's continued.”

In fact, De Beers, one of the top diamond miners, reported rough diamond sales of US$4.82 billion in 2021, a 41 percent uptick from 2020’s US$2.81 billion. This trend (to a smaller extent) was echoed among many other miners.

Diamond trends 2021: Online sales strengthen

As mentioned above, an unintended by-product of 2020’s lockdowns was the strengthening of the diamond market's online presence.

“I think the pandemic has pressured the industry to innovate faster than it probably would have on that front,” Zimnisky said. “Many jewelers saw upwards of 20 to 25 percent of their sales occurring online.”

He continued, “While I don’t think that number is sustainable in the short to medium term, I do think online diamond sales will continue to be in the low double-digit percentage.”

Early adoption has proven to be crucial in capturing the growing market for digital diamond buyers.

Exploration and mining company Lucara Diamond (TSX:LUC,OTC Pink:LUCRF) saw triple-digit growth in 2021 on its digital sales platform, Clara Diamond Solutions, which the firm introduced in 2018.

“Clara platform transaction values totaled US$6.6 million in Q3 2021, a 136 percent increase from the US$2.8 million transacted in Q3 2020,” the company said. “Clara observed strong price increases continuing through the quarter and the number of buyers on the platform increased from 84 to 87 as of September 30, 2021.”

Diamond outlook 2022: Supply and demand trends

Heightened demand across the sector allowed all segments of the value chain to profit in 2021.

However, as Golan pointed out, the retail and manufacturing sides were first to benefit. “For awhile, manufacturers and wholesalers enjoyed improved cash flow and growing margins,” he said. “Polished diamond prices rose some 20 percent year-over-year, although some tapering off was identified in the last few months.”

Due to 2020’s production decline, which saw 111 million carats removed from the market, miners raised the value of goods in inventory.

“The scarcity, created by rising consumer consumption on one end and limited production on the other, led to continued rough diamond price hikes,” Golan said.

“The two main diamond miners, De Beers and Alrosa (MCX:ALRS), have increased prices of core rough diamond ranges by 28 to 30 percent during the past year. Clearly they closed the price gap between rough and polished diamonds to capture as much of the available income in the market.”

In 2021, De Beers’ per carat price rose 13 percent to US$135 with an average unit cost of US$59; that's compared to 2020's US$119 with an average unit price of US$62. The average price for rough diamonds across the sector climbed 23 percent for the year.

Before the pandemic reduced production by 20 percent, annual diamond output numbers had been declining at a yearly rate of 5 percent since peaking at 152 million carats in 2017.

This output decline has been further heightened by the closure of Australia's Argyle mine in 2020, which was the world’s premier source of pink diamonds, a factor Zimnisky believes has impacted the sector.

“I think this has been most evident in smaller goods in particular,” he commented to INN. “That smaller, lower-quality category has underperformed for years; however, small goods are finally having a moment, and I think the Argyle closure is a big part of that.”

Operated by Rio Tinto (ASX:RIO,LSE:RIO,NYSE:RIO), the mine opened in 1985, and has produced roughly 90 percent of the world’s pink and red diamonds, as well as a significant amount of small white diamonds.

With annual output declining, the Argyle closure and rising demand, future supply has become extremely important. In 2021, half a dozen mining companies made extensive capital expenditures on mine extension and new development projects. According to Zimnisky’s report, at least US$7 billion was invested in the space to expand some of the largest diamond mines well into 2030 and beyond.

The future could also contain more mergers and acquisitions.

In 2021, Rio Tinto became the sole owner of the Diavik diamond mine in Canada’s Northwest Territories. The mining major acquired the remaining 40 percent stake in the mine — which entered production in 2003 — from the now-insolvent Dominion Diamond Mines.

The Canadian mine produced 6.2 million carats of gems in 2020 and is expected to end production in 2025.

Diamond outlook 2022: Market drivers

Looking ahead, Zimnisky sees the US market continuing to be a key for overall sector growth. The diamond analyst noted that the American market comprises half of global sales, despite registering a moderate growth rate.

“In 2021, US diamond jewelry sales were up an estimated 35 to 45 percent versus 2020, and up perhaps an even more impressive 15 to 25 percent relative to 2019, the pre-pandemic proxy,” Zimnisky said.

He attributes this trend to “all of the moons aligning: significant economic stimulus, a slow return to experience spending and pent-up engagement and wedding jewelry demand coming out of 2020.”

Additionally, the trend of gifting jewelry to loved ones during times of crisis has been another catalyst to the improved market, although he did warn that some of this elevated spending may weaken in the months ahead as Omicron weighs on economic recovery.

“We may see some economic slowdown as governments around the world begin to rein in stimulus in 2022,” he said. “However, I think the diamond industry will be supported by continued pent-up wedding demand. Talk to anyone planning a wedding right now and you’ll know what I mean.”

For Golan, 2022 is a chance for the diamond sector to appeal to new demographics with targeted environmental, social, governance (ESG) strategies.

“An important trend we should expect to see is the swell in demand for ethically sourced components in jewelry, be it diamonds, gold or silver,” said the researcher. “I believe we are nearing a tipping point in that regard.”

As with digital purchasing, the diamond sector has an opportunity moving forward to broaden its horizons through enticing socially conscious shoppers.

“The jewelry industry at large will be tested on this and its ability to prove its good practices are essential,” Golan said. “It has good practices,” he added. “Now it needs to improve its ability to prove it.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Diamonds: A Beautiful Investment - Part 1 | INN ›

- Top Gem and Diamond Stocks | INN ›

- The Diamond Market Value Chain: Upstream, Middle Market and ... ›

- Cormac Kinney: Diamond Prices Rising, New Tech to Open Market for Investors | INN ›

- Chris Dessi: US$1.2 Trillion Diamond Market Ripe for Unlocking, Here's How to Do It | INN ›