The US Department of Energy’s report shows that wind energy prices are at significant lows compared to 2009.

The wind power sector in the US has been on a steady incline over the last four decades, but a new report shows that wind energy is now being sold at “record-low prices” for the first time in its history.

On August 8, the US Department of Energy (DOE) released its 2016 Wind Technologies Market Report that details a number of trends in the US wind power sector, including record low wind energy prices.

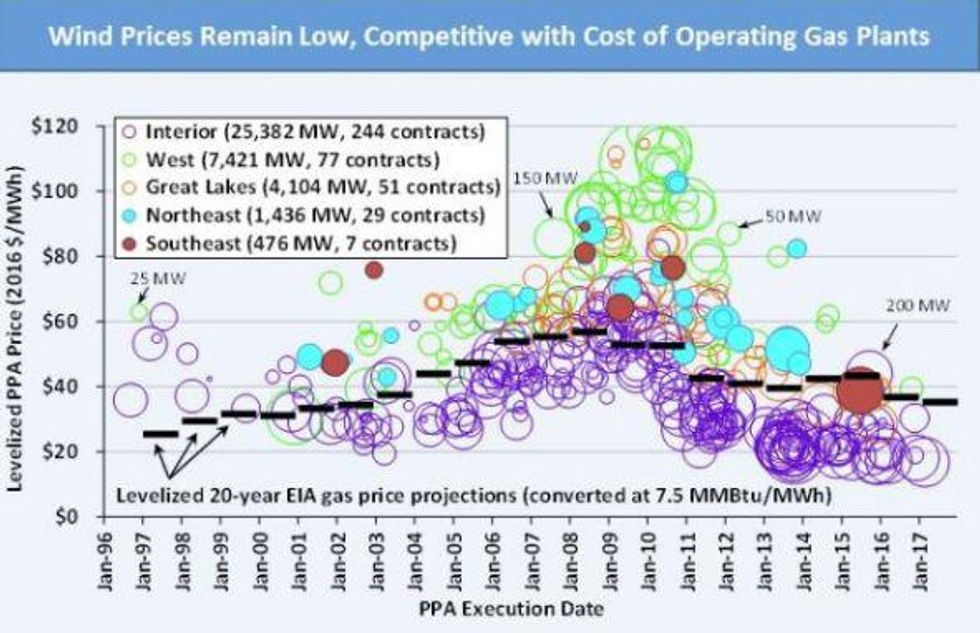

According to the report, the US national average price for wind power purchase agreements (PPAs) has dropped to $0.02 per kilowatt hour (kWh) compared to $0.07 per kWh in 2009.

That said, the report states the average is “dominated by projects that hail from the lowest-priced Interior region of the country,” including Texas, Iowa and Oklahoma.

“Today’s low PPA prices have been enabled by the combination of higher capacity factors, declining costs and record-low interest rates,” the report reads.

“Wind energy prices—particularly in the central United States, and supported by federal tax incentives—are at all-time lows, with utilities and corporate buyers selecting wind as the low-cost option,” Ryan Wiser, a Berkley Lab Senior Scientist and co-author of the report said.

The Wind Technologies Market Report also highlights that low prices have increased demand for wind energy from traditional electric utilities and from corporations, universities and municipalities.

The chart below details wind price trends in comparison with the cost of operating gas plants across the US between January 1996 and January 2017.

In addition to low cost wind energy, the cost of building wind turbines has also gotten much cheaper, which has led to a decline in project-level costs. For perspective, the average cost of a wind project in 2016 was $1,590/kW down $780/kW from 2009-2010.

With that in mind, nearly $13 billion was invested in new wind power plants in 2016, while 27 percent of all US power was generated by wind energy.

“In 2016, wind energy contributed 5.6 percent of the nation’s electricity supply, more than 10 percent of total electricity generation in 14 states, and 29 percent to 37 percent in three of those states,” a news release on the report indicates. Those three US states include Iowa, South Dakota and Kansas.

Looking ahead, it goes without saying that those numbers bode well for the growth of the wind energy sector. For example, the US Energy Information Administration estimates that wind capacity will increase to 88 GW by the end of 2017, up from 81 GW at the end of 2016. By the end of 2018, the agency estimates that number will rise to 102 GW. As a result, it won’t be surprising if costs continue trending lower.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Jocelyn Aspa, hold no direct investment interest in any company mentioned in this article.