Blockchain Trends 2017: Initial Coin Offerings Dominate

While it’s hard to ignore that 2017 was an explosive year for cryptocurrencies, blockchain technology also slammed headlines throughout the year. Here’s a look back on blockchain trends of 2017.

We know that 2017 was the year bitcoin dominated headlines, but the digital currency would be nowhere without its supporting technology–blockchain.

Dubbed the Internet 2.0, blockchain has become much more than the technology behind cryptocurrencies. Putting it simply, 2017 undoubtedly was the year that set the wheels in motion for blockchain transforming not just the technology sector but its impact and use in other industries moving moving forward.

With that in mind, here the Investing News Network (INN) takes a look back at some of the biggest blockchain trends of 2017 with insight from analysts and companies in the space.

Blockchain trends 2017: ICOs at the forefront

Indeed, initial coin offerings (ICOs) were at the forefront of the blockchain sector in 2017, and overwhelmingly so.

Kevin Hobbs, CEO of Vanbex Group, expanded on that thought with INN, saying that ICOs were without a doubt the most important milestone of the industry last year.

“The really big story of 2017 is initial coin offerings,” he added, although he said that his expectations of the market were superseded as a result of the explosions in ICOs. “The benefits that blockchain managed to give to traditional investing changed that model, but I didn’t expect it to explode to where it is today.”

Similarly, experts at BIS Research told INN that while token sales began as early as 2013-2014, by November 2017 there were as many as 50 per month taking place.

“ICO funding [was expected to] cross $3 billion [in 2017] as compared to a meagre $220 million in 2016,” the firm said.

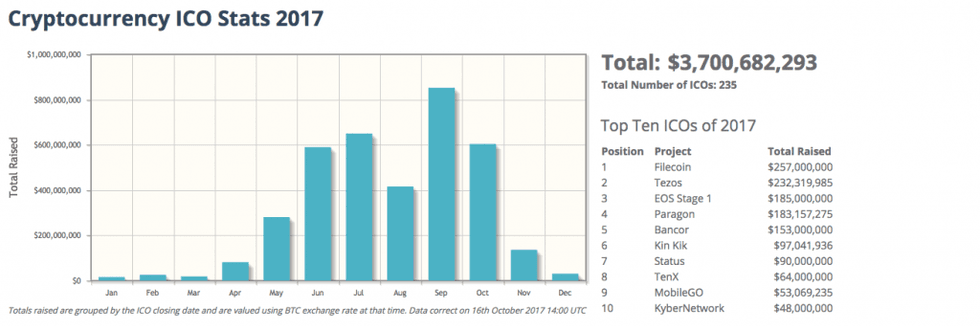

According to data from CoinSchedule, there was a staggering number of ICOs in 2017–235 total–that raised over $3.7 billion last year–just as BIS projected.

Much of that growth came in Q3 alone, according to Bitcoin Magazine, with more than $1.3 billion raised in related ventures.

“This is estimated to be five times more than all of the venture capital funding raised in the blockchain industry,” the outlet stated.

In terms of categories that dominated ICOS, infrastructure topped the list at 34.5 percent, followed by trading and investing, finance, payments, and data storage to round out the top five.

However, BIS Research claimed that the rise of ICOs also contributed to an increase in fraudulent offerings that resulted in regulators “stepping in and employing punitive measures.” For example, China, which is the world’s largest cryptocurrency market, halted all ICO operations within the country.

Blockchain trends 2017: Commercialization begins in the midst of uncertainty

ICOs weren’t the only components of the blockchain sector to make headlines in 2017.

Case in point, BIS Research told INN in an email that the implementation and commercialization really began taking flight in 2017, particularly in the financial services industry. That said, BIS Research stated that, overall, the technology “is not yet ready for widespread enterprise deployment, and must grapple various challenges before it can be rolled out on a wider scale.”

Still, that doesn’t mean there aren’t positives to be taken, particularly as blockchain technology is still in its very early days–meaning there’s plenty of room for growth.

“The sudden bout of interest from various federal governments, government agencies, and central banks has provided the technology the necessary impetus to hasten growth,” the research firm stated.

Similarly, research outlet PwC stated that uncertainty surrounding blockchain technology is “understandable,” although 2017 was without a doubt a transformative year for blockchain’s impact in the financial industry.

“In 2017, firms created plenty of functional, proof-of-concept projects using blockchain in applications such as internal payments, trade finance, and custody,” the firm stated. “Despite their potential, many of these projects aren’t yet ready for primetime. Still, leading firms are focusing their efforts in a few key areas where distributed ledger technology can solve practical issues.”

Blockchain trends 2017: Companies in focus

2017 was also the year a wide range of blockchain companies went public, or when companies turned their focus to the technology.

HashChain Technology Inc (TSXV:KASH) is one such company, which officially began trading on the TSX Venture exchange in December of last year. The company is the first publicly traded Canadian cryptocurrency mining company to file a final prospectus that supports a variety of mining operations across major cryptocurrencies.

Patrick Gray, CEO of HashChain, told INN via email that because the company was only incorporated mid-last year, “pulling everything together” in order to go public in such a short amount of time was a big milestone for the company in addition to achieving acceptance in the space. Gray said the company has also formed a partnership with High Standard Capital out of Vancouver.

“I knew that blockchain was the future but I didn’t anticipate how fast the space would grow in such a short period of time,” Gray added.

Other companies that made headlines in 2017 include HIVE Blockchain Technologies (TSXV:HIVE), another Canadian-based blockchain technology company that began trading under the symbol HIVE on the TSXV in September. Unlike HashChain, HIVE was a former mining company called Leeta Gold. Now that it has switched its focus to blockchain, HIVE is a cryptocurrency mining hashrate provider with facilities in places like Iceland.

Another company that turned its focus over to blockchain in 2017 is Riot Blockchain (NASDAQ:RIOT), formerly Bioptix and the first NASDAQ-listed pure play company focused on blockchain.

Blockchain trends 2017: Investor takeaway

Overall, 2017 set the stage in a big way for the future outlook for blockchain technology, and it’s clear the industry will only continue thriving from here on out–and in ways that have yet to be imagined.

With last year being the year of ICOs–and with more companies coming into focus or shifting their vision to blockchain technology–2018 will no doubt showcase that blockchain is more than just the technology behind mining cryptocurrencies.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Jocelyn Aspa, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: HashChain is a client of the Investing News Network. This article is not paid-for content.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.