As of 11:00 a.m. EST on Friday, gold was changing hands at $1,066.60. Silver was also up, while copper and oil were down.

The US Federal Reserve’s long-awaited December meeting took place this week, and as many expected, the central bank opted to raise interest rates.

The Fed hiked the target range of the federal funds rate to 0.25 to 0.5 percent, marking the first increase in nearly a decade. But while that’s an exciting development, Fed Chair Janet Yellen emphasized that any further moves from the Fed will be gradual. “It’s important not to overblow the significance of this first move,” she said.

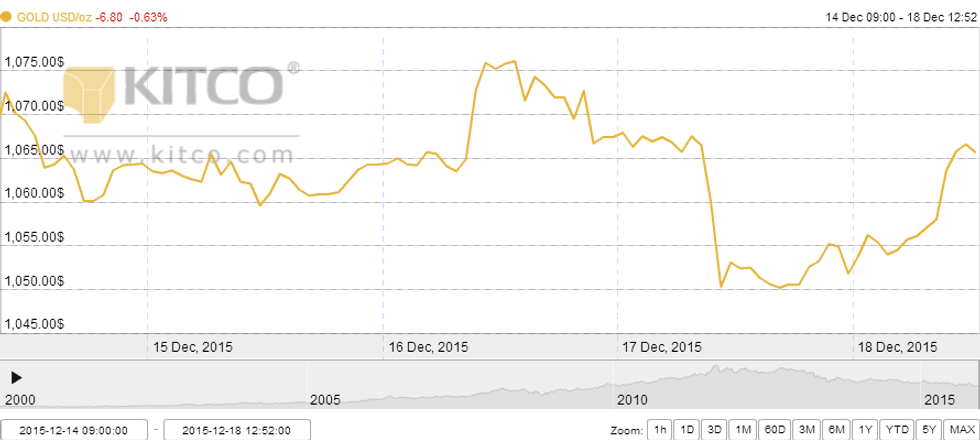

Gold-focused investors reacted fairly positively to that outcome. While the yellow metal took a steep drop Thursday in the wake of the Fed’s meeting, falling to its lowest level in six years (COMEX gold futures for February sank 2.5 percent, to $1,049.60 per ounce), it’s since recovered. As of 11:00 a.m. EST on Friday, it was changing hands at $1,066.60.

According to The Wall Street Journal, “[a] drop in the dollar Friday prompted some investors to unwind bets against gold before the weekend.” George Gero, senior vice president at RBC Capital Markets Global Futures, told the news outlet, “[t]here may be a temporary bottom in gold as people sit back and see how the dollar behaves over the next few days.”

Check out the below chart from Kitco for an overview of gold’s price action this week:

For its part, the silver price reacted much the same as the gold price to the Fed’s announcement. While it took a big drop on Thursday after the meeting, sinking to $13.69 per ounce, it’s since bounced back — as of 12:00 p.m. EST on Friday it was changing hands at $14.13.

On the base metals side, Reuters reported Friday that copper prices were up for the day, but nonetheless “were staring at their biggest weekly fall in a month as traders cut risk in the second last trading week before Christmas.” Specifically, three-month LME copper was up 0.3 percent, at $4,560.50 per tonne, with a weekly loss of 2 percent in the cards.

Finally, MarketWatch said that oil futures were able to get back above $35 per barrel on Friday. January West Texas Intermediate crude was up 0.9 percent, at $35.27, and February Brent crude was up the same amount, trading at $37.38. However, according to the news outlet, oil futures are still set to lose for the week.

And unfortunately, it doesn’t look like the coming weeks will bring much relief. “The predicted mild U.S. winter will do nothing to encourage the bulls or the gradual rate path of the U.S. economy that will see the U.S. dollar continue to appreciate,” Stuart Ive of OM Financial told the publication.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading:

Weekly Round-Up: Gold Holding Steady Ahead of Fed Meeting

Weekly Round-Up: Gold Price Up After Bumpy Week

Weekly Round-Up: Gold Price Hurt by Thin Trading

Weekly Round-Up: Gold Price Up After Hitting Lowest Since 2010

Weekly Round-Up: Gold Price Hurt by US Jobs Data